Printable 50 30 20 Rule

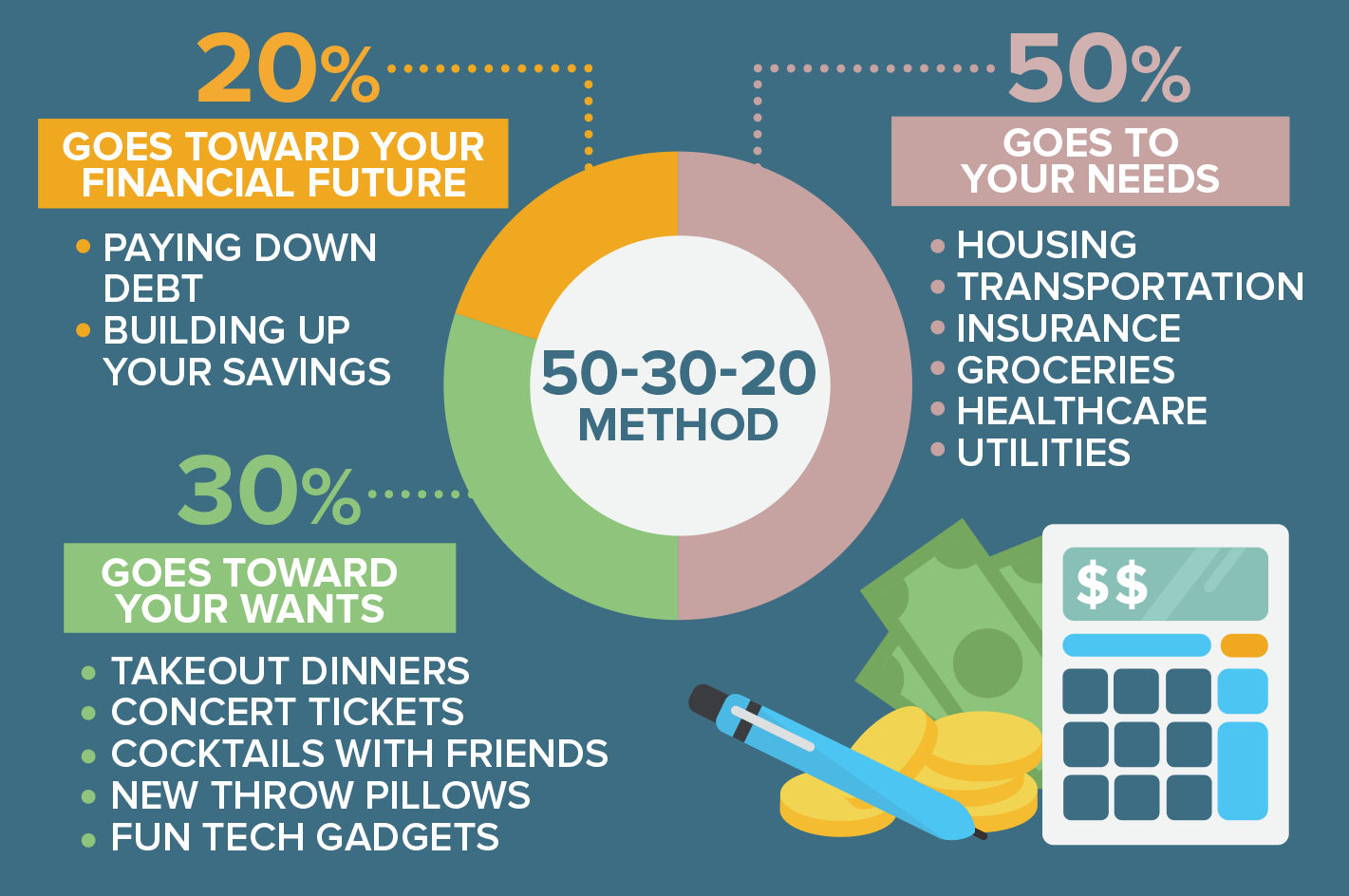

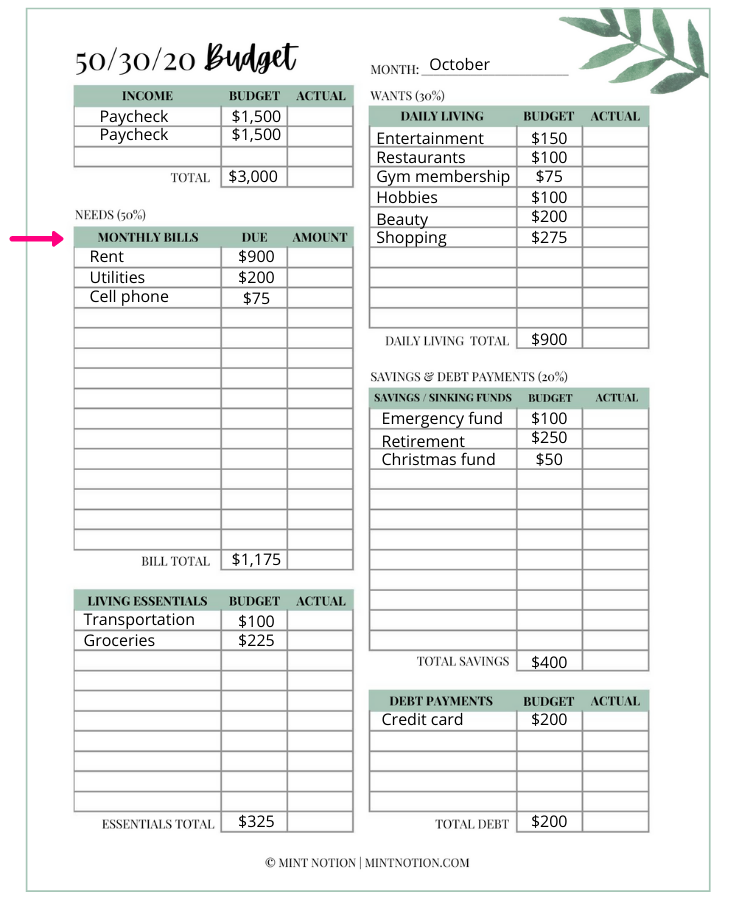

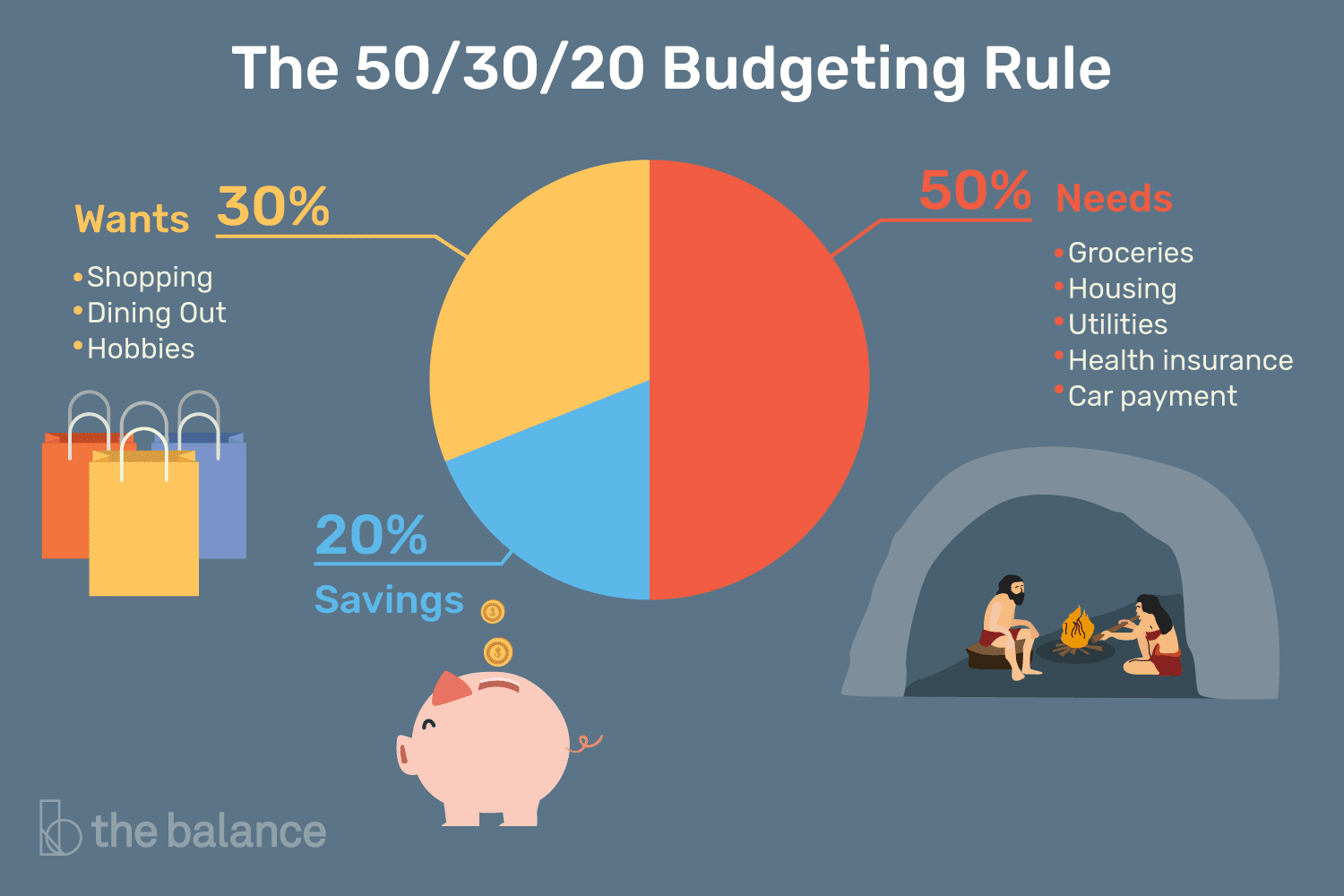

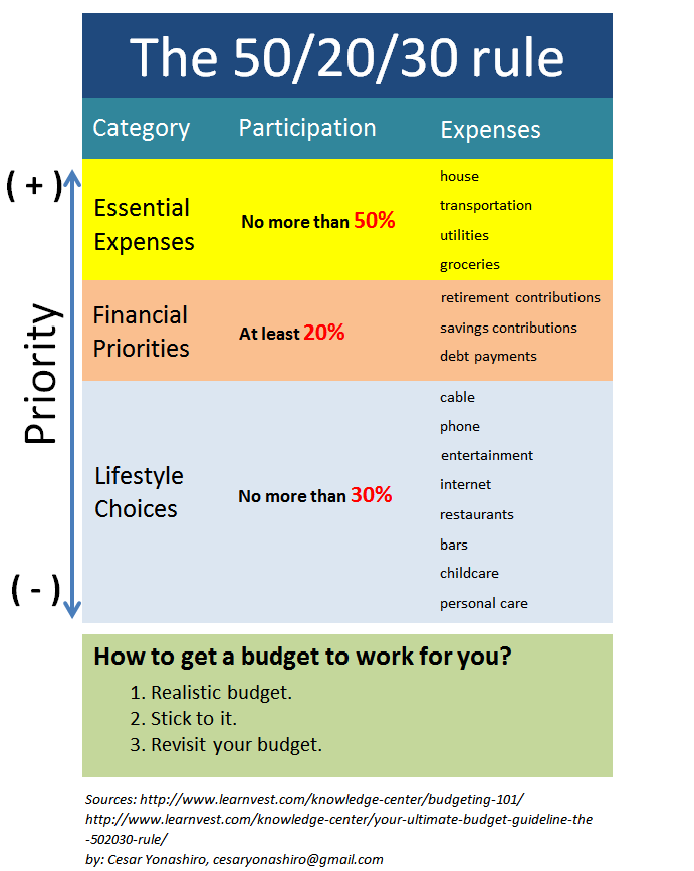

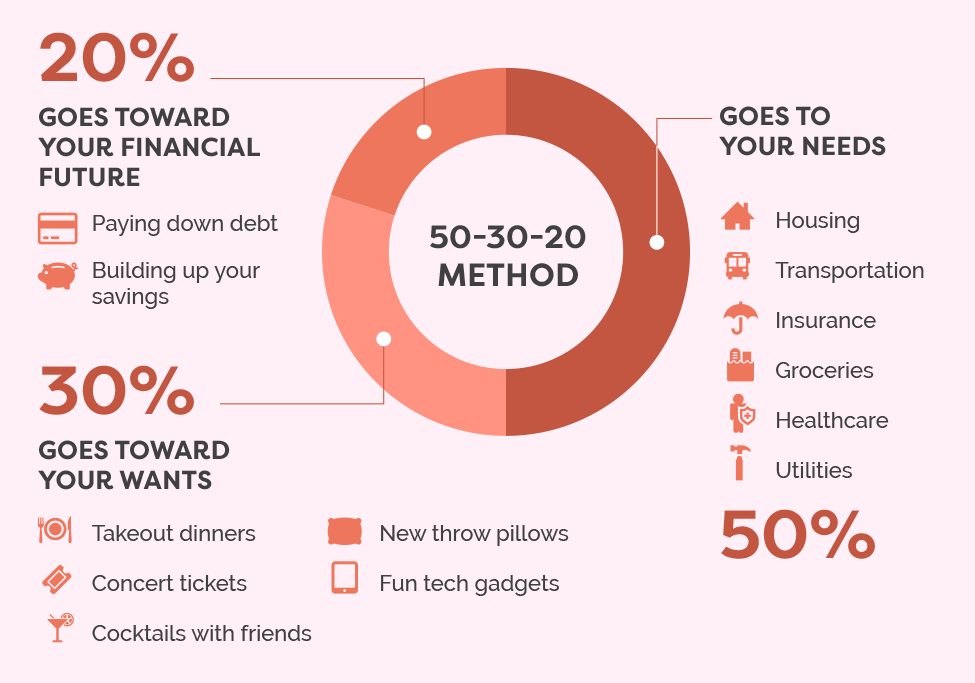

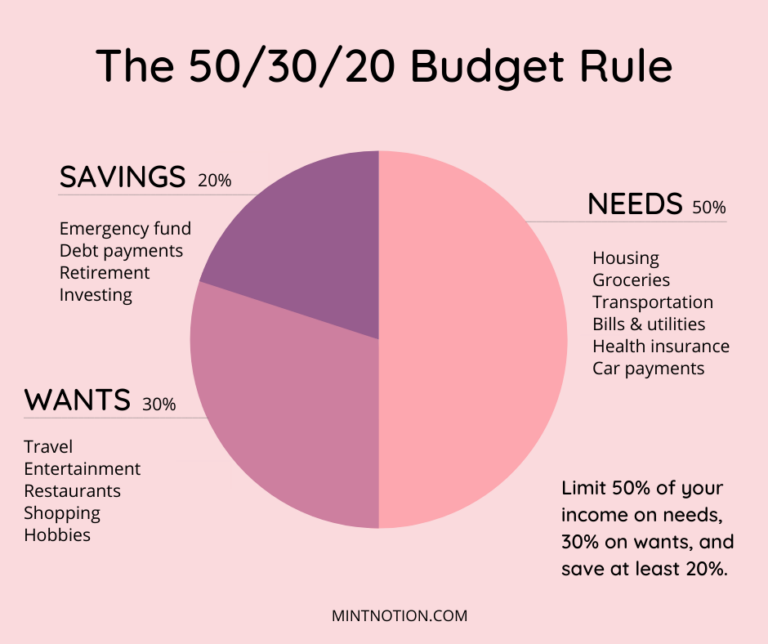

Printable 50 30 20 Rule - $4,000 x 50% = $2,000 for needs. 50/30/20 budget planner in pastel colors. To try this budgeting method out and get your free printable 50/30/20 budget template simply scroll through all the designs and layouts available below and then follow. Web the 50/30/20 budgeting rule is a popular method that helps you save, invest, and enjoy some of the finer things in life. Web one of the reasons the 50/30/20 budget is popular is because it allows for 30% of a consumer’s income to go toward discretionary spending. Here’s what her budget is going to look like: Needs are all your monthly expenses that are essential and must be paid, such as rent. Web for example 2, let’s consider jack’s take home salary of $60 000 per year and work out a 50 30 20 budget for it. Our spreadsheet is a great tool for keeping your finances on track. The recommended percentages are as follows: Here’s what her budget is going to look like: Web 50% of your monthly income what you should be spending on wants 30% of your monthly income savings and debt repayment 20% of your monthly income total monthly income monthly income x.5 monthly income x.6 monthly income x.7 monthly income x.8 monthly income x.9 monthly income x.1 monthly income x.2. To try this budgeting method out and get your free printable 50/30/20 budget template simply scroll through all the designs and layouts available below and then follow. Amount for wants:0.3 × $5 000 = $1 500. The last 30% of their paycheck goes. Breaking that down with the 50/30/20 rule, you’d have $2,509 to spend on needs. Web for example. Amount for needs:0.5 × $5 000 = $2 500. Needs are all your monthly expenses that are essential and must be paid, such as rent. Check out these cute printable 50/30/20 budget templates. Here’s what her budget is going to look like: Web this looks at median household income, which suggests that a growing cost of necessities and lack of. $4,000 x 20% = $800 for savings / debt payoff. 50/30/20 budget planner in pastel colors. Needs are all your monthly expenses that are essential and must be paid, such as rent. That's the front side of the puzzle with the picture on it. Web the 50/30/20 rule can be applied to any income level, helping you prioritize your spending. Amount for savings:0.2 × $5 000 = $1 000. Split your income between the 3 categories. Jack’s monthly income:$60 000 ÷ 12 = $5 000. 50% to needs, 30% to wants and. Twenty percent goes toward a savings account or into investing. The 50/30/20 budget is a good. You can then analyze this information further. Web that’s $2,400 total per month. Then, divide the money into 50% for needs, 30% for wants, and 20% for savings. Web the 50/30/20 budgeting rule divides your budget into 3 main categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. A plan like this helps simplify finances and is also easy to follow. Web that’s $2,400 total per month. Web for example 2, let’s consider jack’s take home salary of $60 000 per year and work out a 50 30 20 budget for it.. Web where 50% of their paycheck goes to essentials, including rent, groceries, transportation, etc. Amount for needs:0.5 × $5 000 = $2 500. Needs are all your monthly expenses that are essential and must be paid, such as rent. Here’s what her budget is going to look like: 50% for needs, 30% for wants, and 20% for debt/savings. Our spreadsheet is a great tool for keeping your finances on track. Twenty percent goes toward a savings account or into investing. By far the easiest way to implement the 50/30/20 budgeting rule is to use a spreadsheet that is set up to manage your budget in this way. If 50% does not cover your living expenses, which is unfortunately. Split your income between the 3 categories. It only requires you to track and divide your. $4,000 x 20% = $800 for savings / debt payoff. Web monthly 50/30/20 budget worksheet. 50% to needs, 30% to wants and. The recommended percentages are as follows: Web 50/30/20 budget spreadsheet: Pretty & practical 50/30/20 budget printable. Keep your monthly budget and. Check out these cute printable 50/30/20 budget templates. Web the 50/30/20 rule budget worksheet by financial stress is an expertly laid out 50/30/20 budget spreadsheet that can be used on a weekly basis to help take the stress out of budgeting. Web the 50/30/20 budgeting rule divides your budget into 3 main categories: It only requires you to track and divide your. Web that’s $2,400 total per month. That's the front side of the puzzle with the picture on it. $4,000 x 20% = $800 for savings / debt payoff. Web the 50/30/20 rule is pretty straightforward and uses your household’s income (net of tax) to determine how much money you can allot to each area in which you spend. Web the 50/20/30 rule is relatively easy but it may require work to discern between wants and needs, says chloe moore, cfp, founder of financial staples, a financial planning firm. Then, divide the money into 50% for needs, 30% for wants, and 20% for savings. 50/30/20 budget planner in pastel colors. 50/30/20 budget planner in pastel colors.

Enjoy Budgeting With the 503020 Rule Investdale

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Understanding the 50/30/20 Rule to Help You Save MagnifyMoney

The 50/30/20 Rule — A QuickStart Guide to Budgeting

The 50/30/20 Rule for Saving Money Saving money budget, Money

Economy and Finance Box How to budget your money. The 50/20/30 rule

How to Get Better at Budgeting — College Money Habits

The 50/30/20 Rule Detterbeck Wealth Management

503020 Budget Rule How to Make a Realistic Budget Mint Notion

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

A Plan Like This Helps Simplify Finances And Is Also Easy To Follow.

$74,580 Is The Median Household Annual Income.

Savings On Track And On Target.

Web The 50/30/20 Rule Can Be Applied To Any Income Level, Helping You Prioritize Your Spending And Savings Regardless Of Your Salary.

Related Post: