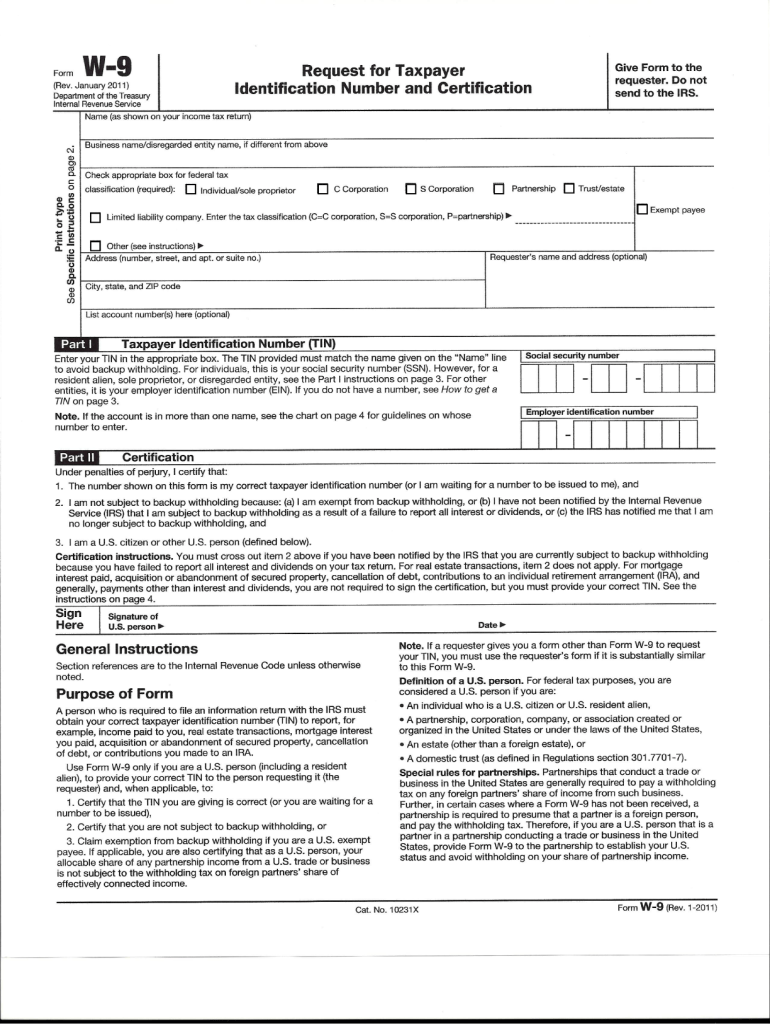

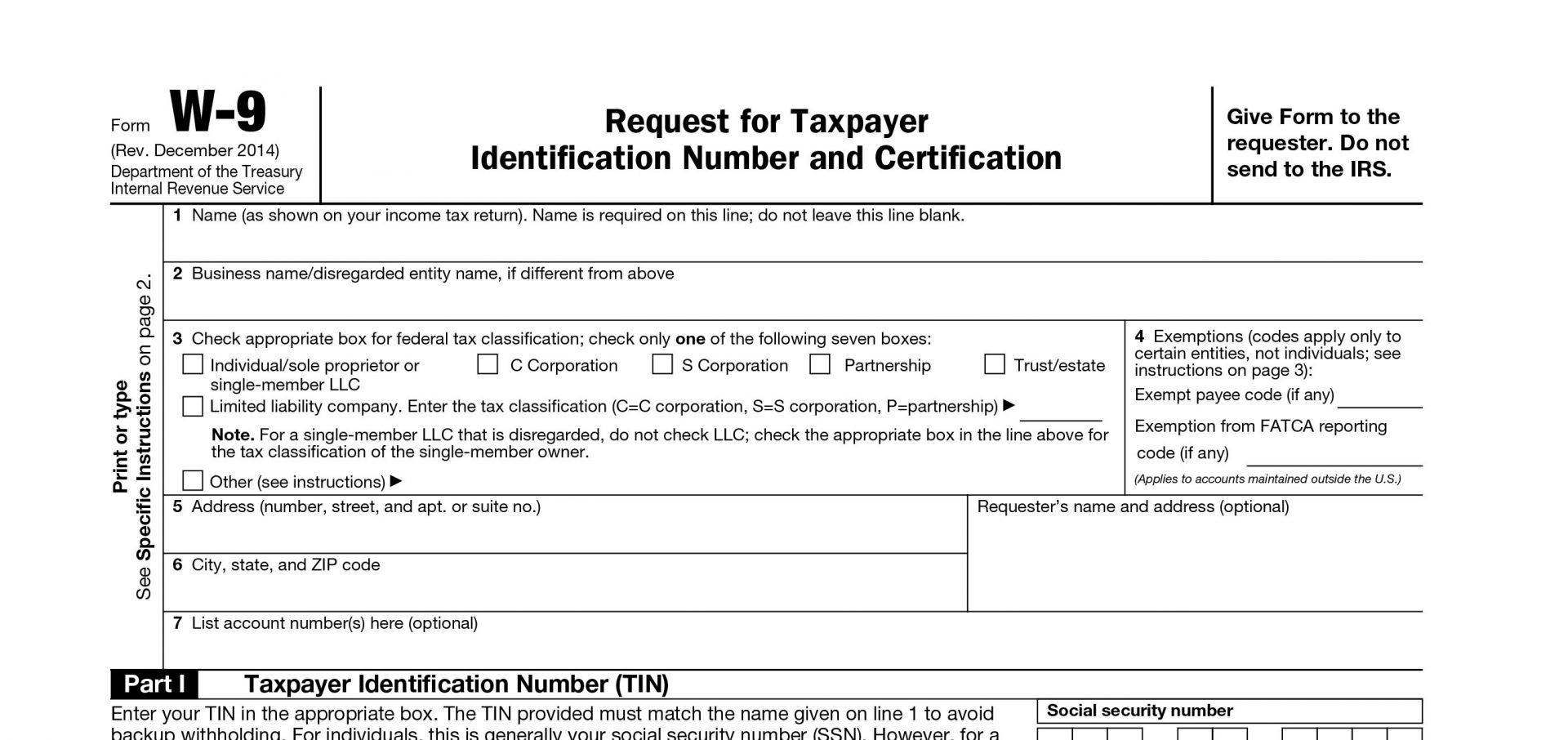

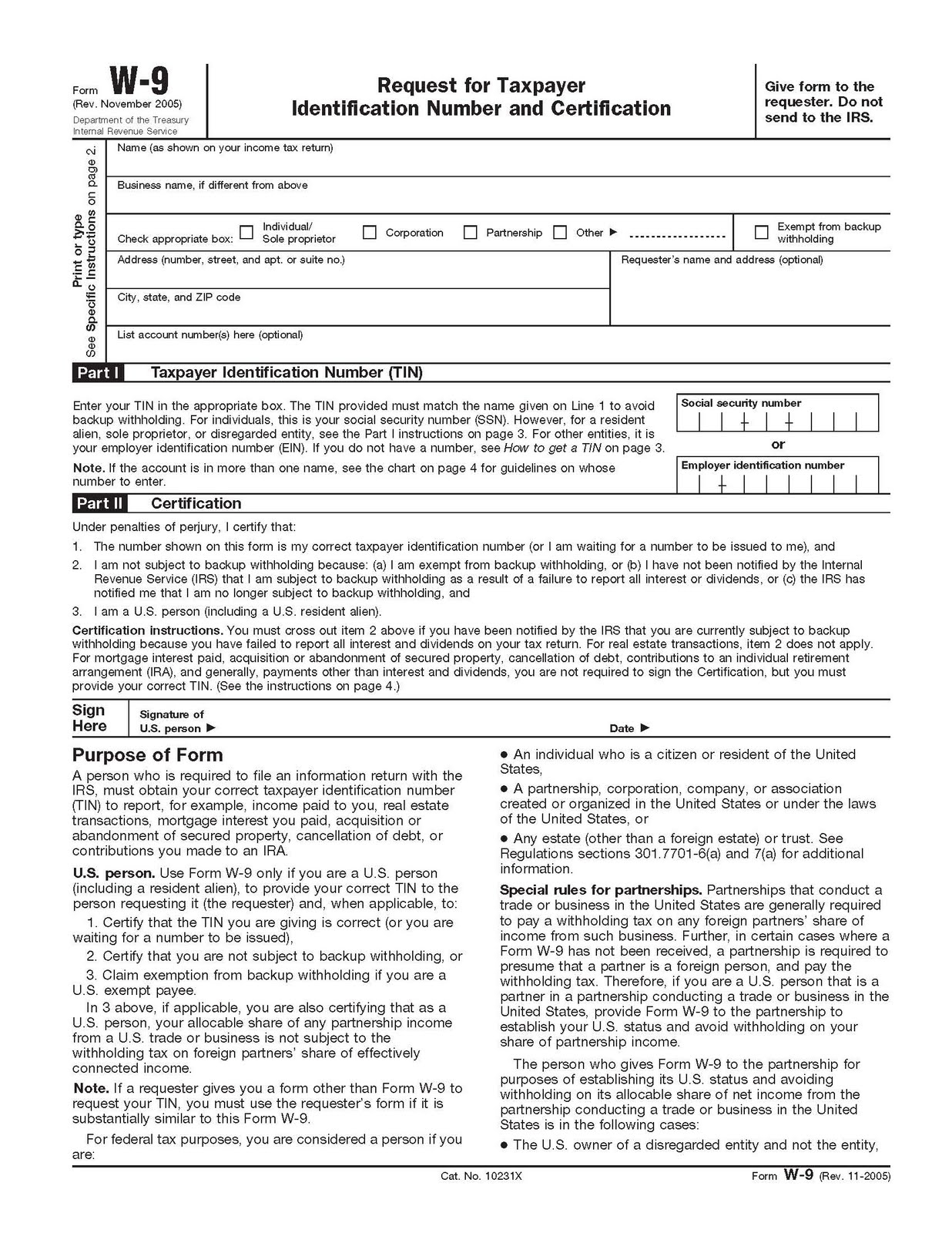

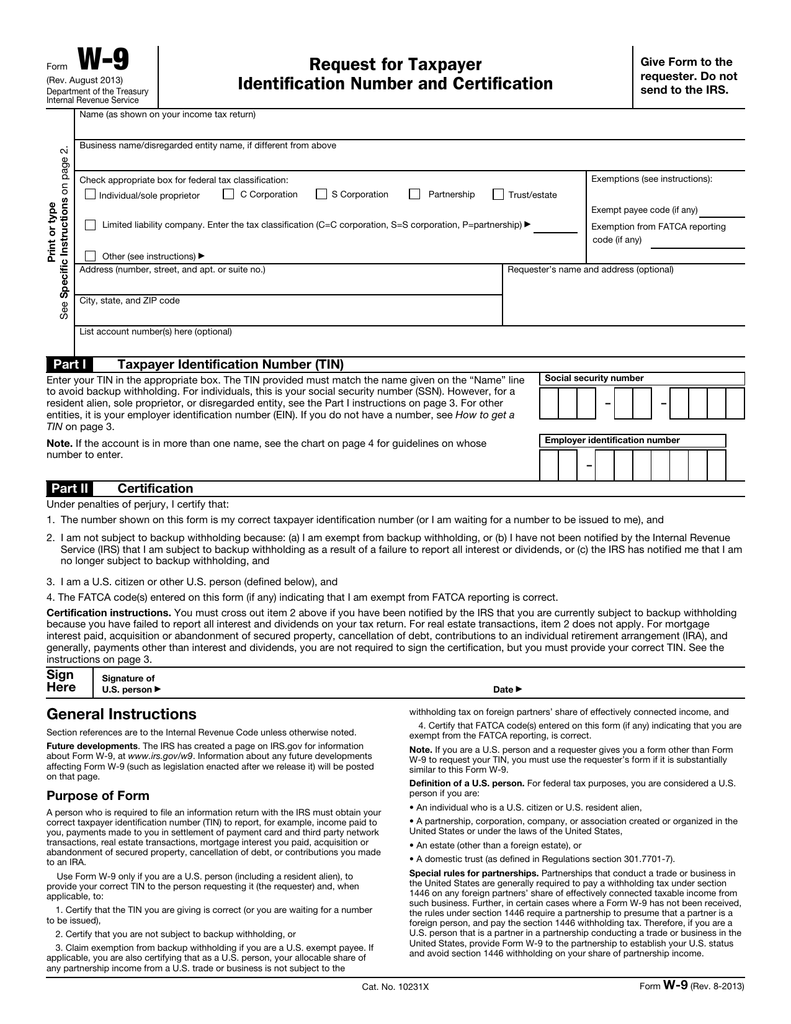

Printable Blank W 9 Form

Printable Blank W 9 Form - Web blank w 9 form 2024 printable. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. This form must be filled out in order. Claim exemption from backup withholding if you are a u.s. You must enter one of the following on this line; The adobe acrobat library contains Status and avoid section 1446 withholding on your share of partnership income. Form used to apply for a refund of the amount of tax withheld on the. 2024 irs w9 tax form. If an account holder fails to provide its tin, then the withholding rate is 30%. Status and avoid section 1446 withholding on your share of partnership income. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. See what is backup withholding, later. Person (including a resident alien), to provide your correct tin. Person (including a resident alien), to provide. The name should match the name on your tax return. You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise. 2024 irs w9 tax form. It is commonly required when making a payment and withholding taxes are not being deducted. Web 4.certify that fatca code(s). Web 2024 w 9 form printable. If you are running a sole proprietorship you would enter your name. If you are a u.s. If an account holder fails to provide its tin, then the withholding rate is 30%. Do not leave this line blank. September 13, 2022 by printw9. Do notleave this line blank. If you are running a sole proprietorship you would enter your name. Federal law requires that every employer* who recruits, refers for a fee, or hires an individual for employment in the u.s. For a joint account, only the person whose tin is shown in part i should sign (when. You must enter one of the following on this line; The adobe acrobat library contains Do notleave this line blank. To establish to the withholding agent that you are a u.s. The name should match the name on your tax return. Federal law requires that every employer* who recruits, refers for a fee, or hires an individual for employment in the u.s. Person (including a resident alien), to provide your correct tin. See what is backup withholding, later. Web to establish to the withholding agent that you are a u.s. Status and avoid section 1446 withholding on your share of partnership. See what is backup withholding, later. To establish to the withholding agent that you are a u.s. For the signature section, click “esign. You must enter one of the following on this line; Web 4.certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. You may be requested to sign by the withholding agent even if items 1, 3, and 5 below indicate otherwise. The name should match the name on your tax return. Web blank w 9 form 2021 printable irs calendar template printable, for tax year 2023, this tax filing application operates until october 15, 2024. You must enter one of the. Federal law requires that every employer* who recruits, refers for a fee, or hires an individual for employment in the u.s. See what is backup withholding, later. Web to establish to the withholding agent that you are a u.s. Failure to supply your tin, or supplying us with an incorrect tin,. Status and avoid section 1446 withholding on your share. Web blank w 9 form 2021 printable irs calendar template printable, for tax year 2023, this tax filing application operates until october 15, 2024. Federal law requires that every employer* who recruits, refers for a fee, or hires an individual for employment in the u.s. For a joint account, only the person whose tin is shown in part i should. The first arrows lead to a section asking your name and business name (if you have a business). Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. Do notleave this line blank. To clarify this point, the name on line 1 must match with the name the irs associates with your tin. Web blank w 9 form 2024 printable. You must enter one of the following on this line; Web 4.certify that fatca code(s) entered on this form (if any) indicating that you are exempt from the fatca reporting, is correct. This form must be filled out in order. It is commonly required when making a payment and withholding taxes are not being deducted. The name should match the name on your tax return. Person (including a resident alien), to provide your correct tin. For a joint account, only the person whose tin is shown in part i should sign (when required). You may be requested to sign by the withholding agent even if item 1, below, and items 4 and 5 on page 4 indicate otherwise. Request a copy or find a sample to meet your tax filing needs. If you are a u.s. The 2024 version replaces the version.

Non Fillable W9 Form Printable Forms Free Online

Printable W 9 Form Blank Fill Online, Printable, Fillable, Blank

Printable W 9 Form For Word Format Printable Forms Free Online

W9 Form 2019 Printable Irs W9 Tax Blank In Pdf Free Printable W9

Blank Printable W9 Form

W9 Form 2019 Printable IRS W9 Tax Blank in PDF

How to Submit Your W 9 Forms Pdf Free Job Application Form

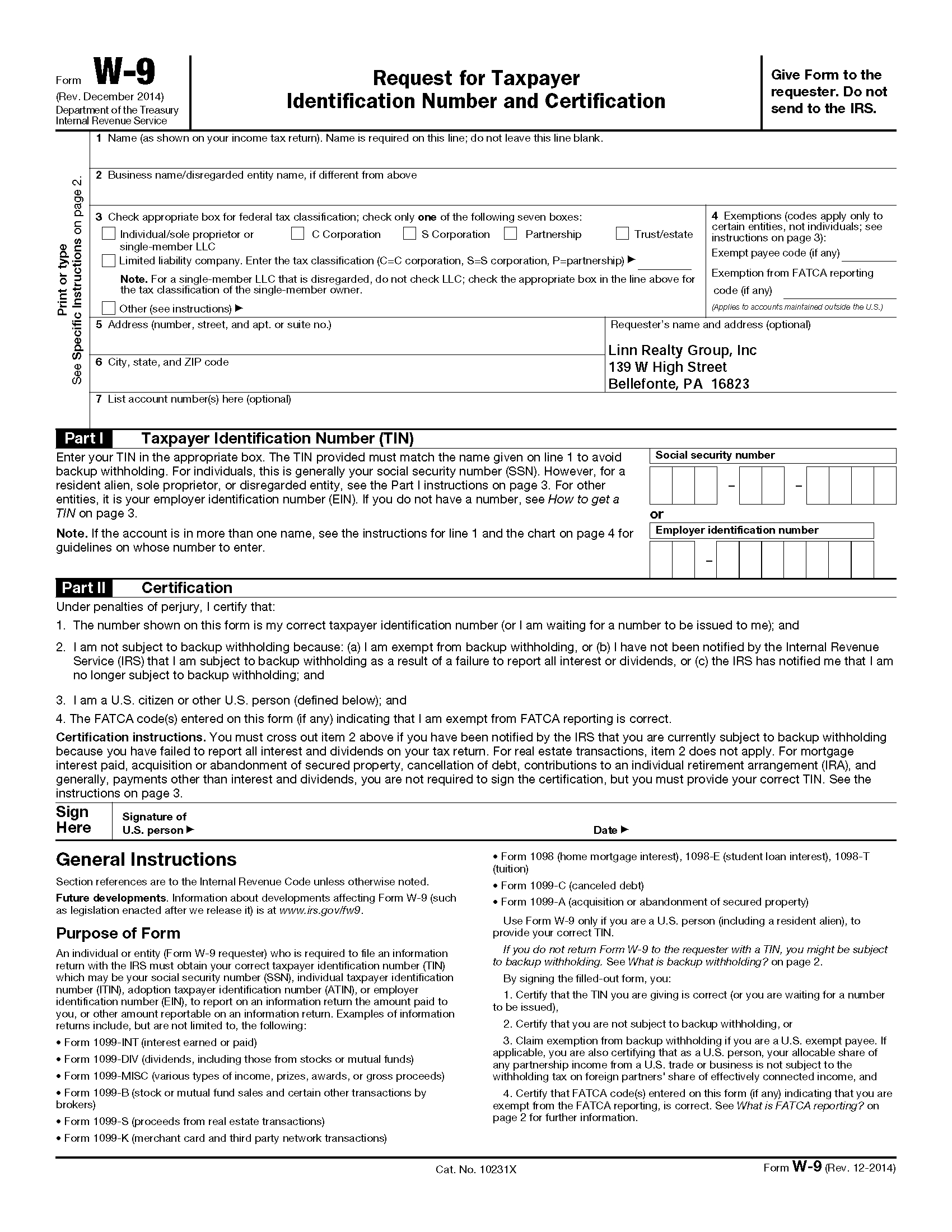

W9 Request for Taxpayer Identification Number and Certification

Blank 2020 W9 Form Example Calendar Printable

Blank W9 Form Stone Hill National

Web Download A Free W9 Form.

The Adobe Acrobat Library Contains

Person (Including A Resident Alien), To Provide Your Correct Tin.

Web Schedules For Form 1040.

Related Post: