Printable Form 1096

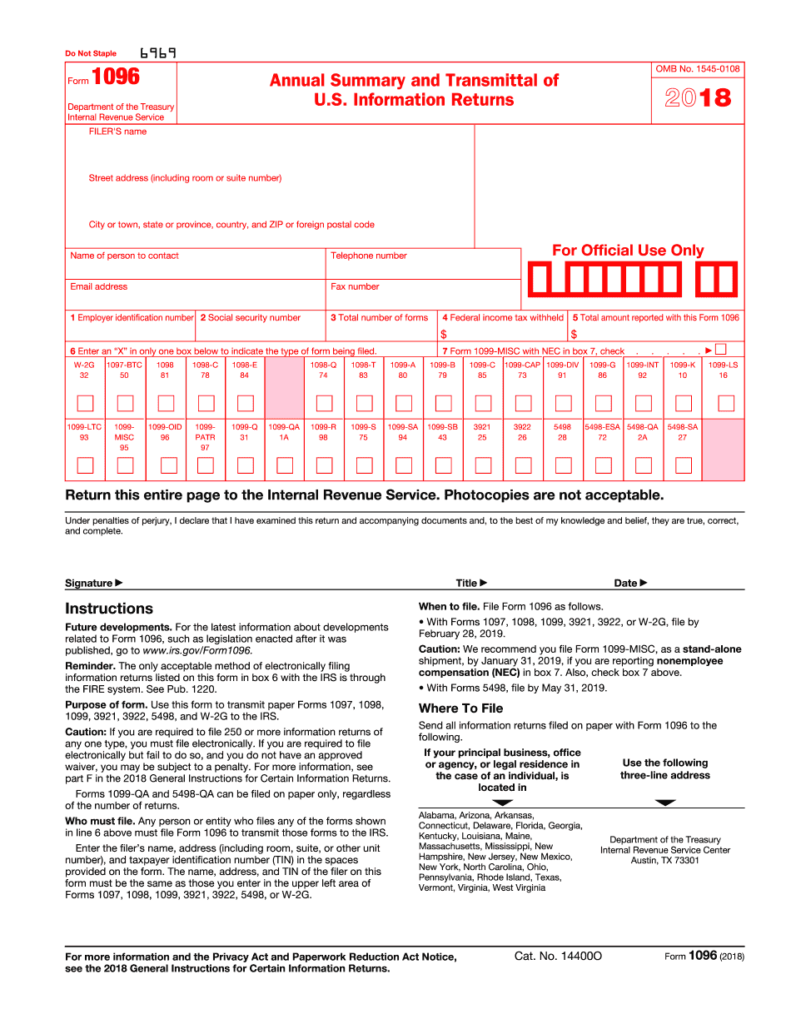

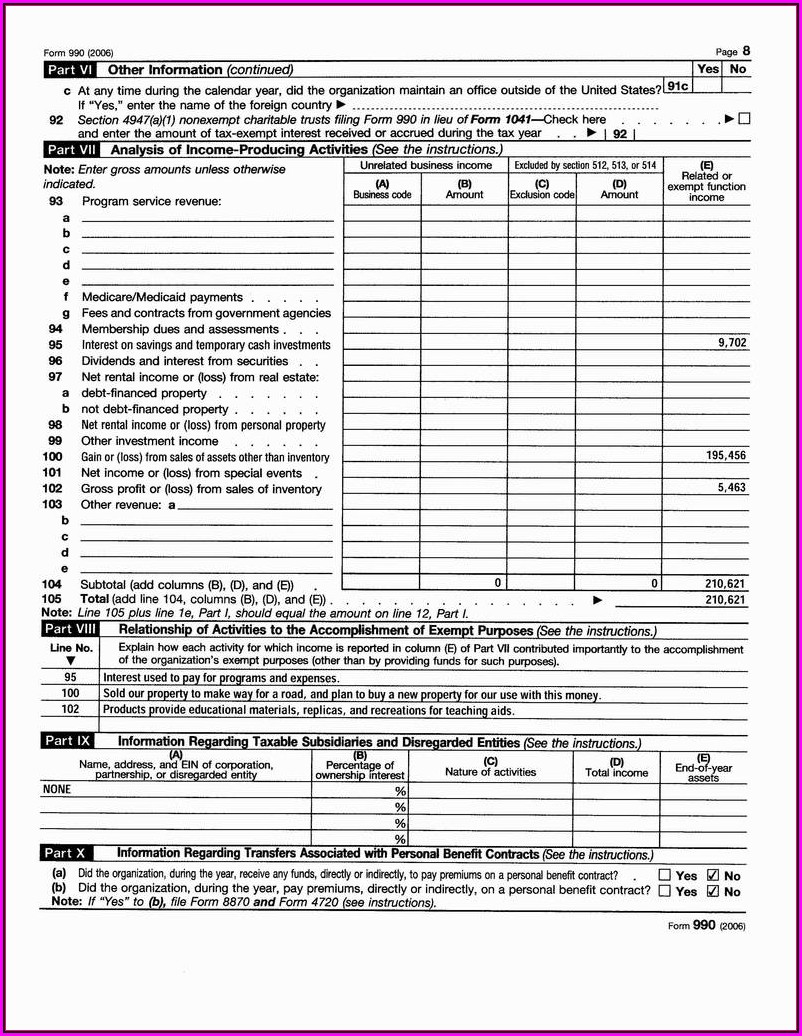

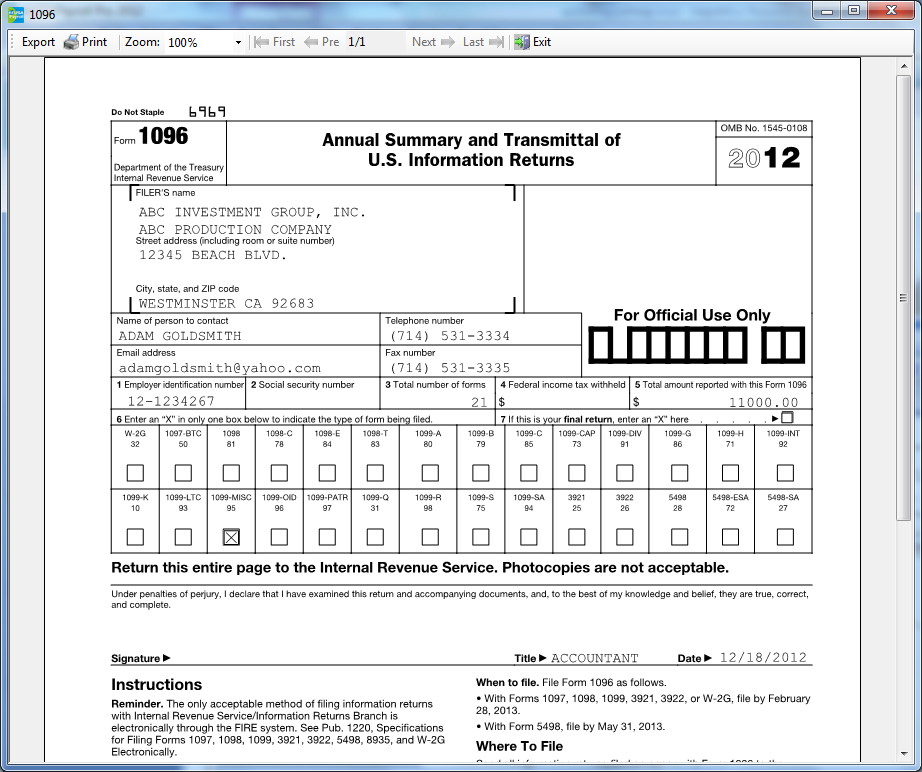

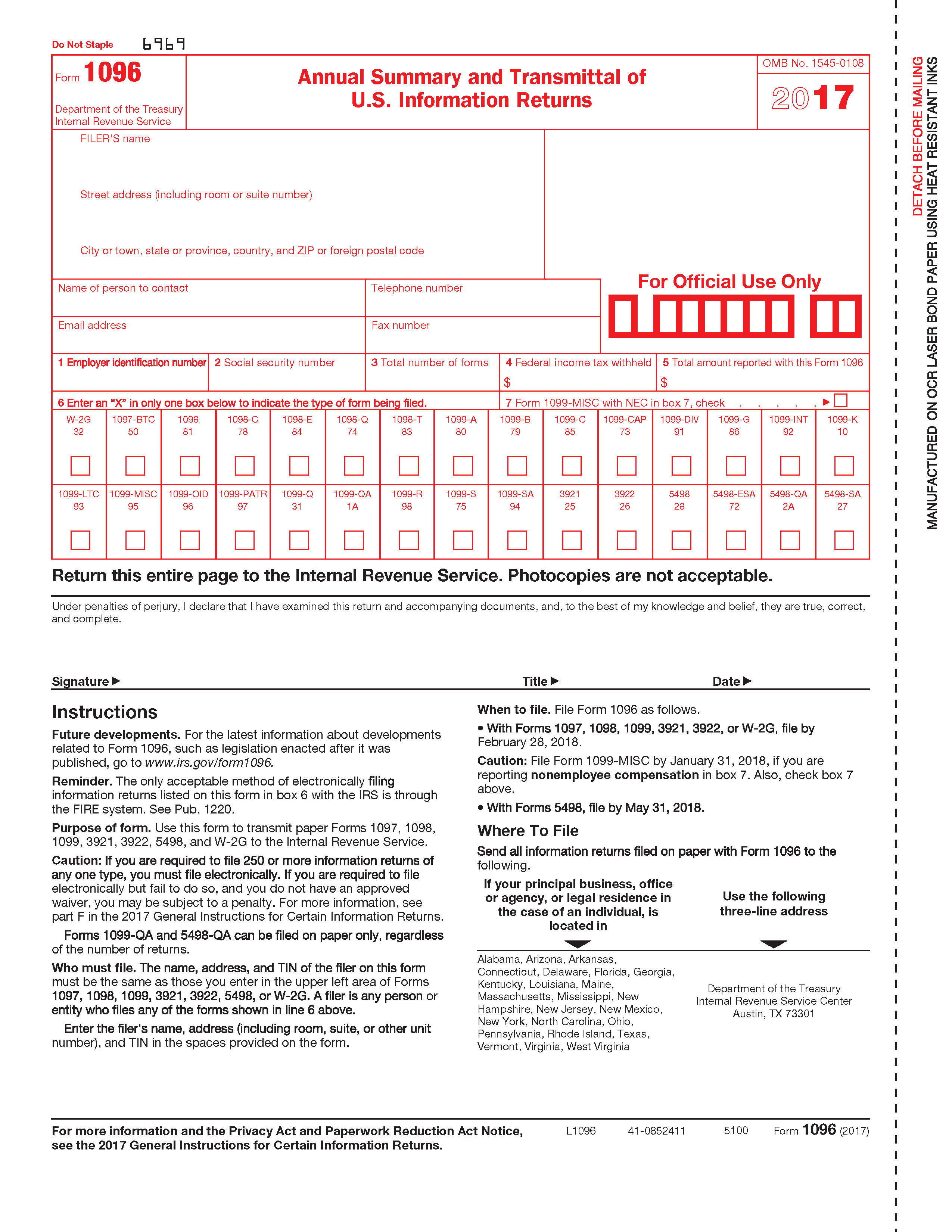

Printable Form 1096 - 2 what information is reported on form 1096? Form 1096, annual summary and transmittal of u.s. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Information returns, including recent updates, related forms and instructions on how to file. It appears in red, similar to the official irs form. Attention filers of form 1096: You don't need to submit form 1096 if you're filing electronically. Learn how to print 1099 and, if available, 1096 forms in quickbooks online, quickbooks contractor payments, or quickbooks desktop. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Web what is form 1096? Web irs form 1096, officially known as the annual summary and transmittal of u.s. Web from your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. Web print your 1099 and 1096 forms. Web form 1096 is the annual summary. Why do you need it? It appears in red, similar to the official irs form. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Learn about the purpose of this irs tax form, how to file, & who needs to file with block advisors. You don't need to submit form 1096 if you're filing electronically. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Information returns, is — as its official name implies — a summary document. Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not. Why do you need it?. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Explaining the basics of form 1096. The primary function of this form is to provide the irs with a quick overview of the information returns being submitted. Web form 1096, officially known as the annual summary and transmittal of u.s. Information returns, is — as its. It appears in red, similar to the official irs form. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. Web from your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. Web irs form 1096,. You also don't need to send 1096s to your contractors. Attention filers of form 1096: This form is provided for informational purposes only. Information returns, is — as its official name implies — a summary document. It appears in red, similar to the official irs form. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Like form 1099, it serves as a summary page for different irs tax forms. Web the official printed version of this irs form is scannable, but a copy, printed from this website, is not. It appears in red, similar. Do not print and file a form 1096 downloaded from this website; The official printed version of this irs form is scannable, but a copy, printed from this website, is not. This form is provided for informational purposes only. Information returns,” is a summary document used when filing certain irs information returns by mail. Form 1096 is only necessary if. This form is provided for informational purposes only. This form is provided for informational purposes only. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Attention filers of form. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. This form is provided for informational purposes only. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Do not print and file a form 1096 downloaded from this website; The purpose of form 1096 is to. If you are filing electronically, form 1096 isn't required by the irs. Form 1096 is only necessary if you are submitting paper forms, not if you are submitting your forms electronically. It appears in red, similar to the official irs form. Form 1096, annual summary and transmittal of u.s. Web form 1096, officially known as the annual summary and transmittal of u.s. The official printed version of this irs form is scannable, but a copy, printed from this website, is not. Web from your dashboard, go to “filings.” next, select the 1099s that you want to create a 1096 summary form for, such as the nec, misc, etc. Web irs form 1096, officially known as the “annual summary and transmittal of u.s. Information returns, including recent updates, related forms and instructions on how to file. Web what is form 1096? Information returns, is a summary document utilized when filing certain irs information returns by mail. Web irs form 1096, officially known as the annual summary and transmittal of u.s. The primary function of this form is to provide the irs with a quick overview of the information returns being submitted. You don't need to submit form 1096 if you're filing electronically. It serves as an accompanying cover sheet that provides the irs with a quick overview of the information returns you’re submitting. Attention filers of form 1096:

Fill Free fillable Form 1096 2019 Annual Summary and Transmittal of

Cómo llenar el Formulario 1096. Guía 2022 paso a paso

2018 2019 IRS Form 1096 Editable Online Blank In PDF Printable Form 2021

2019 1099MISC/1096 IRS Copy A Form Print Template for Word Etsy

Form 1096 Annual Summary and Transmittal of U.S. Information Returns

Tax Form 1096 Annual Summary & Transmittal Costco Checks

1096 template for preprinted forms 2018 Tracsc

Form 1096

1096 Annual Summary Transmittal Forms & Fulfillment

1096 IRS PDF Fillable Template 2023, USA Tax Form for 2023 Filing

2 What Information Is Reported On Form 1096?

Learn How To Print 1099 And, If Available, 1096 Forms In Quickbooks Online, Quickbooks Contractor Payments, Or Quickbooks Desktop.

Web Form 1096 Is Used When You're Submitting Paper 1099 Forms To The Irs.

Web Irs Form 1096, Annual Summary And Transmittal Of U.s.

Related Post: