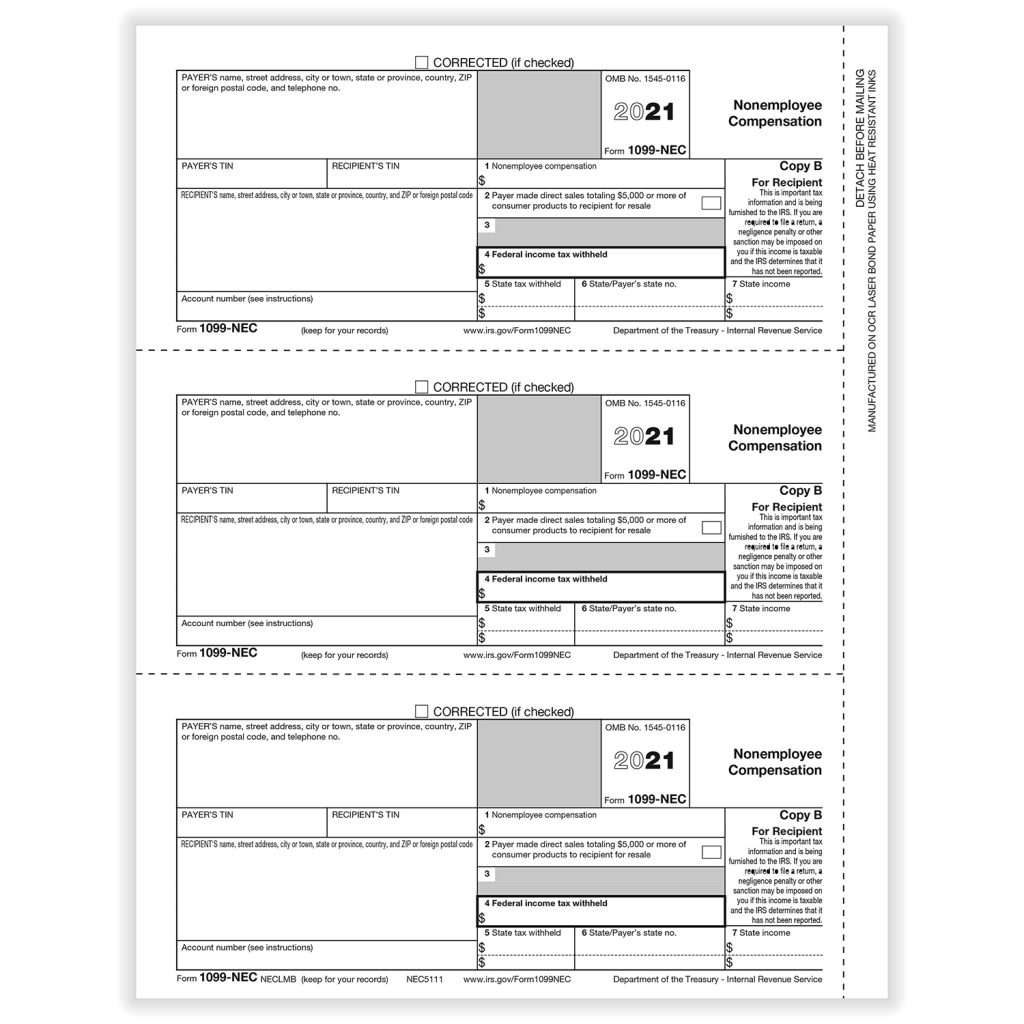

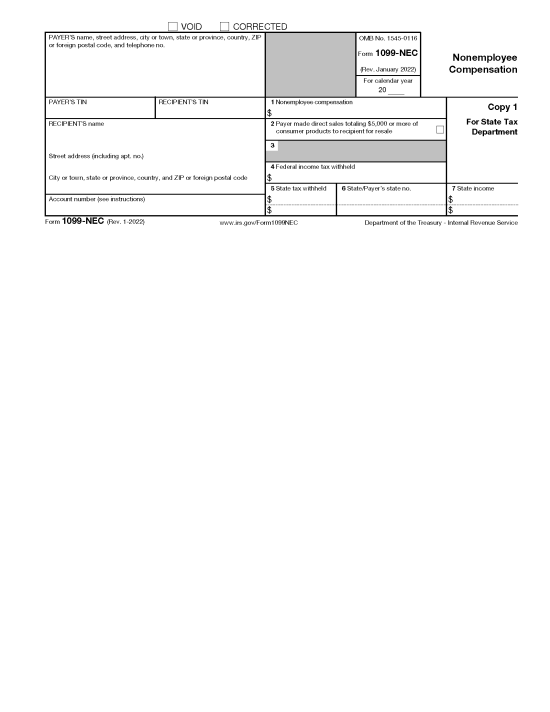

Printable Form 1099Nec

Printable Form 1099Nec - Web recipient’s taxpayer identification number (tin). Web the post draw for the 149th running of the preakness is set to take place monday at 5:30 p.m. Web updated november 27, 2023. The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. The green bay packers know their first opponent and location: Include your business name, address, and tin as well. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). The event will be streamed live on social media and youtube. Web what you need to know about form 1099nec hourly, inc., it is the deadline for filing with the irs and sending copies to your contractors. Mail the completed paper form to the irs at the address provided in the 1099 instructions. Quickbooks will print the year on the forms for you. The philadelphia eagles in brazil on friday night in week 1. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). However, the issuer has reported. Web recipient’s taxpayer identification number (tin). Fill out the recipient's name, address, tin, and compensation amount in the required boxes. The philadelphia eagles in brazil on friday night in week 1. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web updated november 27, 2023. The philadelphia eagles in brazil on friday night in week 1. For instance, if a business hires a freelance writer to create content and pays them more than $600 in a year, the business would report these payments on. Clarify your ira tax situation. Web the nfl will release the full 2024 regular season schedule on wednesday, may 15. It's. The nfl’s opener will be between the super bowl champion kansas city chiefs and baltimore ravens on thursday night in week 1. Web the 2024 ncaa softball tournament will begin on either thursday, may 16 or friday, may 17. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web the nfl will release the full 2024. The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. Web prices have surged so much in argentina that the government will print 10,000 peso notes. The green bay packers know their first opponent and location: Mail the completed paper form to. Return the dutch oven or skillet to medium heat and pour in 2 tablespoons of the reserved shallot oil. Persons with a hearing or speech disability with access to tty/tdd equipment can. Your name, address, tin, and the recipient’s details (name, address, tin). Web the 2024 ncaa softball tournament will begin on either thursday, may 16 or friday, may 17.. Web recipient’s taxpayer identification number (tin). Web what you need to know about form 1099nec hourly, inc., it is the deadline for filing with the irs and sending copies to your contractors. Clarify your ira tax situation. Web the nfl will release the full 2024 regular season schedule on wednesday, may 15. 1099 nec form 2020 printable fill out and. Add the garlic and cook, stirring, until fragrant and golden, 1 to 2 minutes. Clarify your ira tax situation. Mailing instructions can be found on the irs website. Next, enter the payment details in box 1, recording the total amount paid to the recipient during the tax. Your name, address, tin, and the recipient’s details (name, address, tin). Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. Persons with a hearing or speech disability with access to tty/tdd equipment can. Kansas city, missouri, or ogden, utah processing center. Web what you need to know about form 1099nec hourly, inc., it is the deadline for. Web updated november 27, 2023. The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. Web the nfl will release the full 2024 regular season schedule on wednesday, may 15. Give these forms to payees and report them to the irs by. For instance, if a business hires a freelance writer to create content and pays them more than $600 in a year, the business would report these payments on. Mail the completed paper form to the irs at the address provided in the 1099 instructions. Your name, address, tin, and the recipient’s details (name, address, tin). It will continue through the first week of june, ending either on thursday, june 6 or friday, june 7, depending onwhether the wcws championship series requires three games. Include your business name, address, and tin as well. However, the issuer has reported your. Persons with a hearing or speech disability with access to tty/tdd equipment can. Return the dutch oven or skillet to medium heat and pour in 2 tablespoons of the reserved shallot oil. If you made less than $600, you’ll still need to report your income on your taxes, unless you made under the minimum income to file taxes. It's a relatively new tax document, having been reintroduced in 2020. Two crossed lines that form an 'x'. Give these forms to payees and report them to the irs by january 31 of the year following the tax year being reported. The most important reason to file a form 8606 is to clarify your tax picture regarding iras and inherited iras, so that you don’t end up paying more. The event will be streamed live on social media and youtube. The philadelphia eagles in brazil on friday night in week 1. The nfl’s opener will be between the super bowl champion kansas city chiefs and baltimore ravens on thursday night in week 1.

1099 Nec Printable Forms Printable Forms Free Online

How to File Your Taxes if You Received a Form 1099NEC

1099 NEC Editable PDF Fillable Template 2022 With Print and Clear

Printable Form 1099 Nec

Fillable 1099nec Form 2023 Fillable Form 2023

![]()

Printable Form 1099nec

Free IRS 1099NEC Form (20212024) PDF eForms

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 1099NEC Non Employee Compensation

Irs 1099 Nec Form 2023 Printable Free

1099 Nec Form 2020 Printable Fill Out And Sign Printable Pdf Template, The Clock Starts Ticking On January 1, And Businesses Have.

These “Continuous Use” Forms No Longer Include The Tax Year.

Kansas City, Missouri, Or Ogden, Utah Processing Center.

Once You Find It, Scan For Part I:

Related Post: