Printable Irs Form 433 F

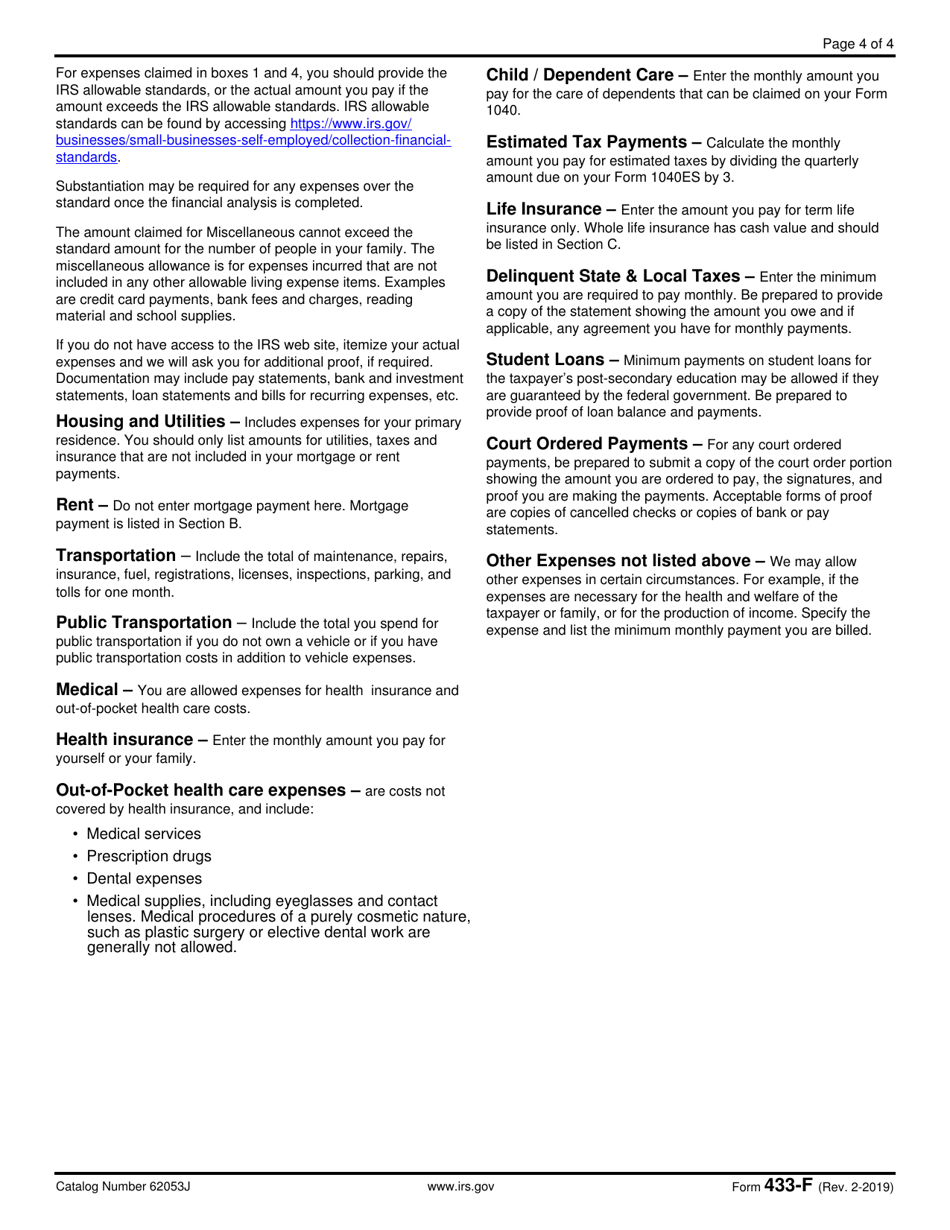

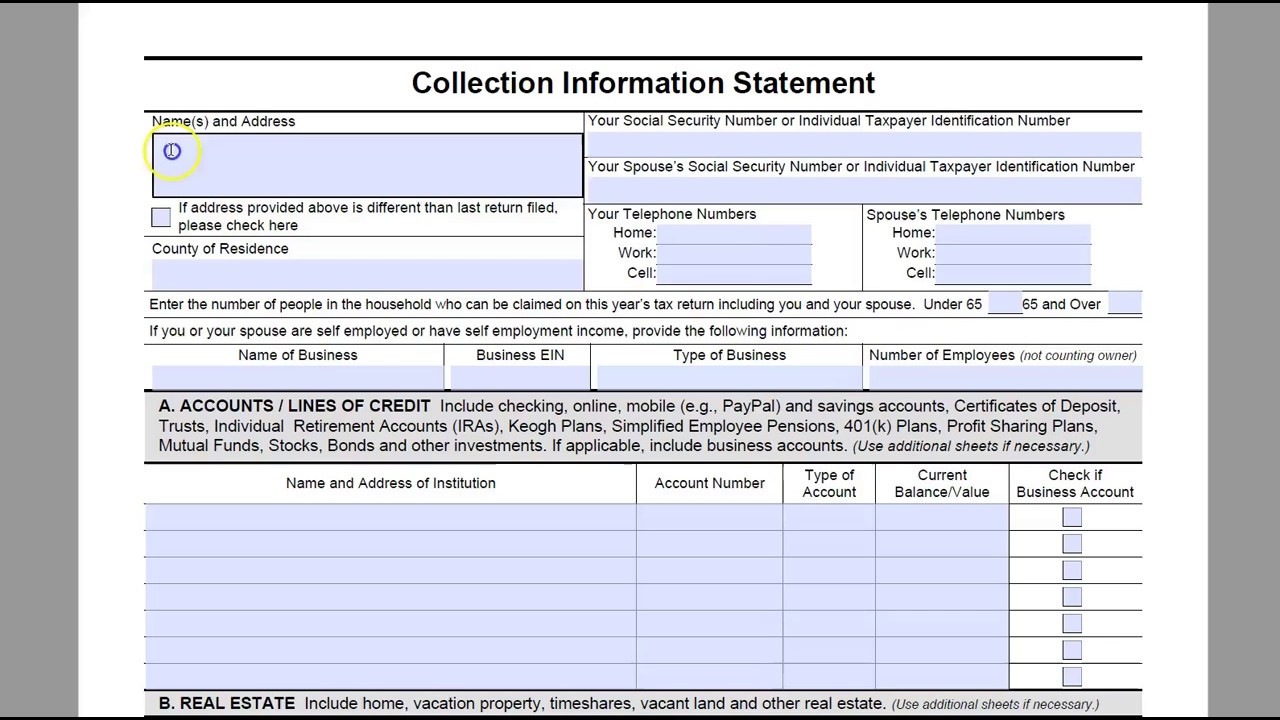

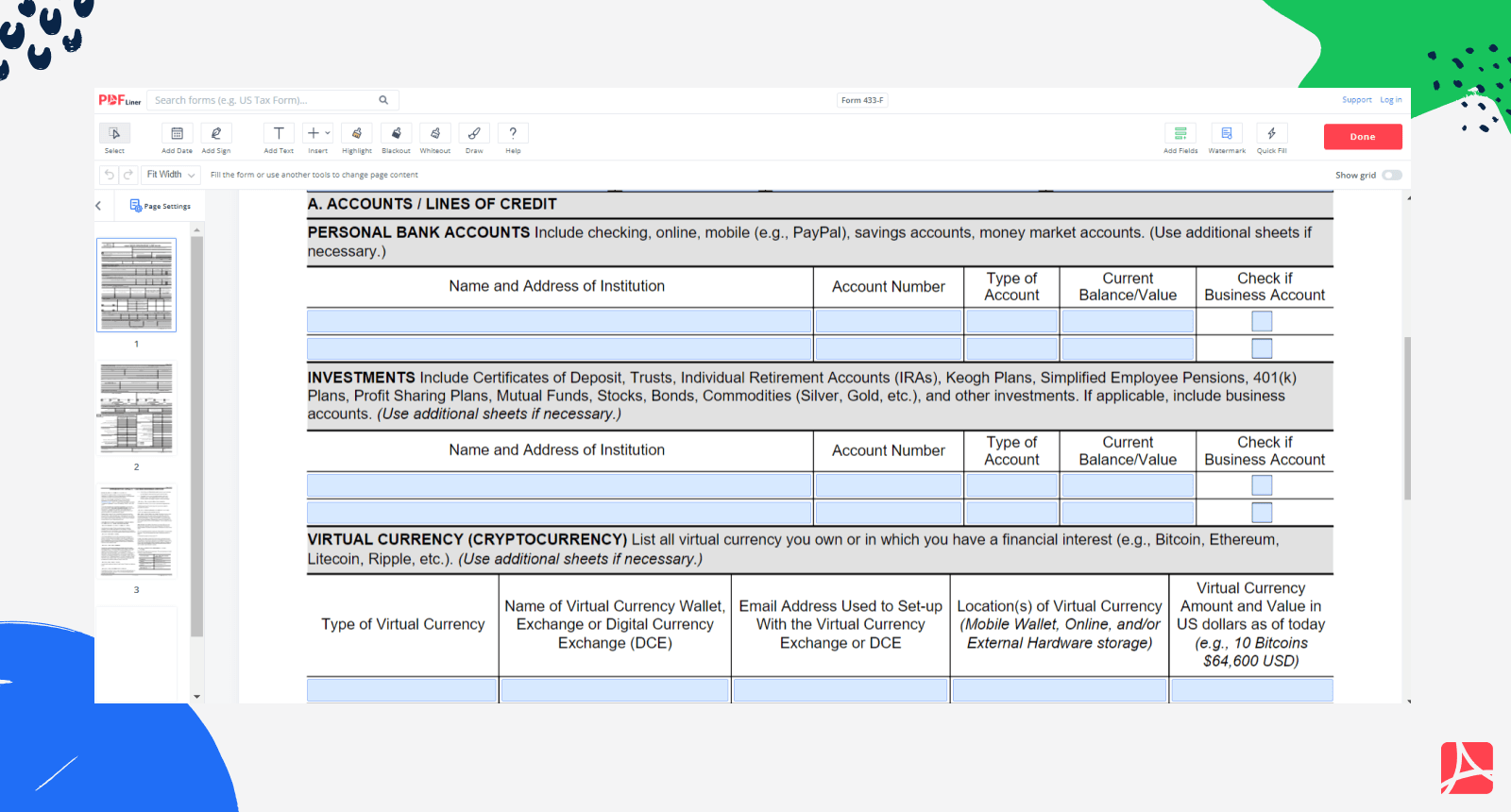

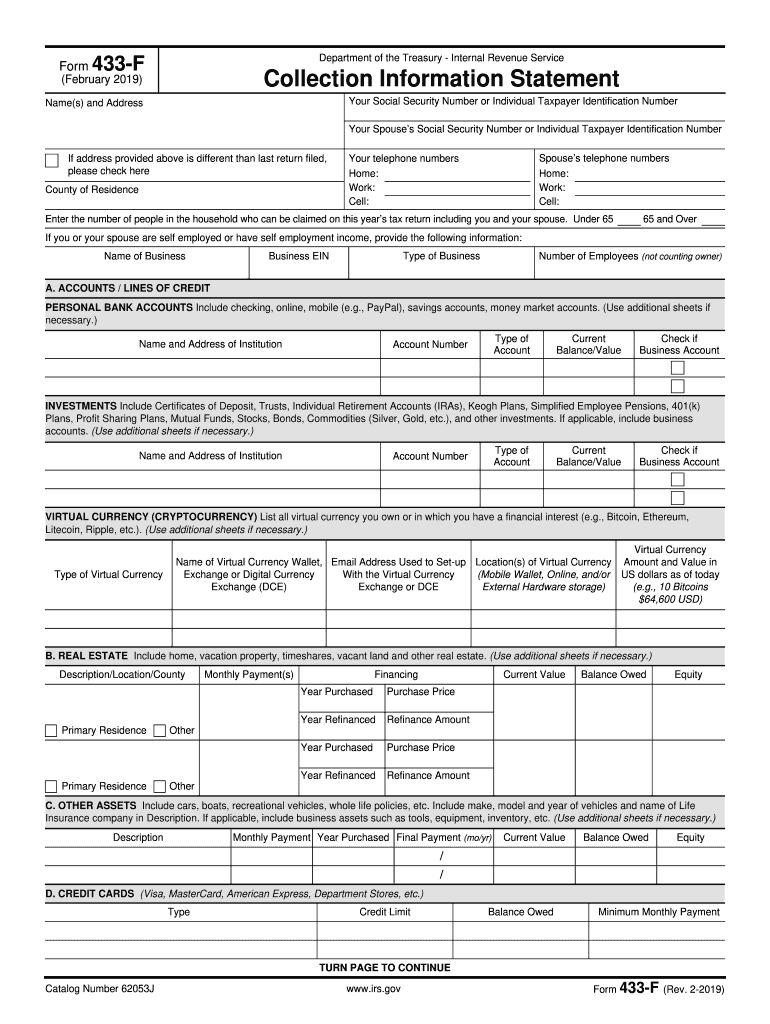

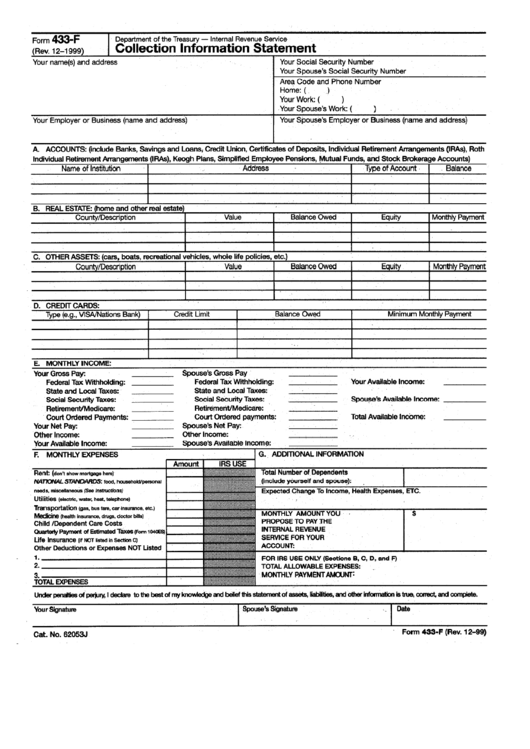

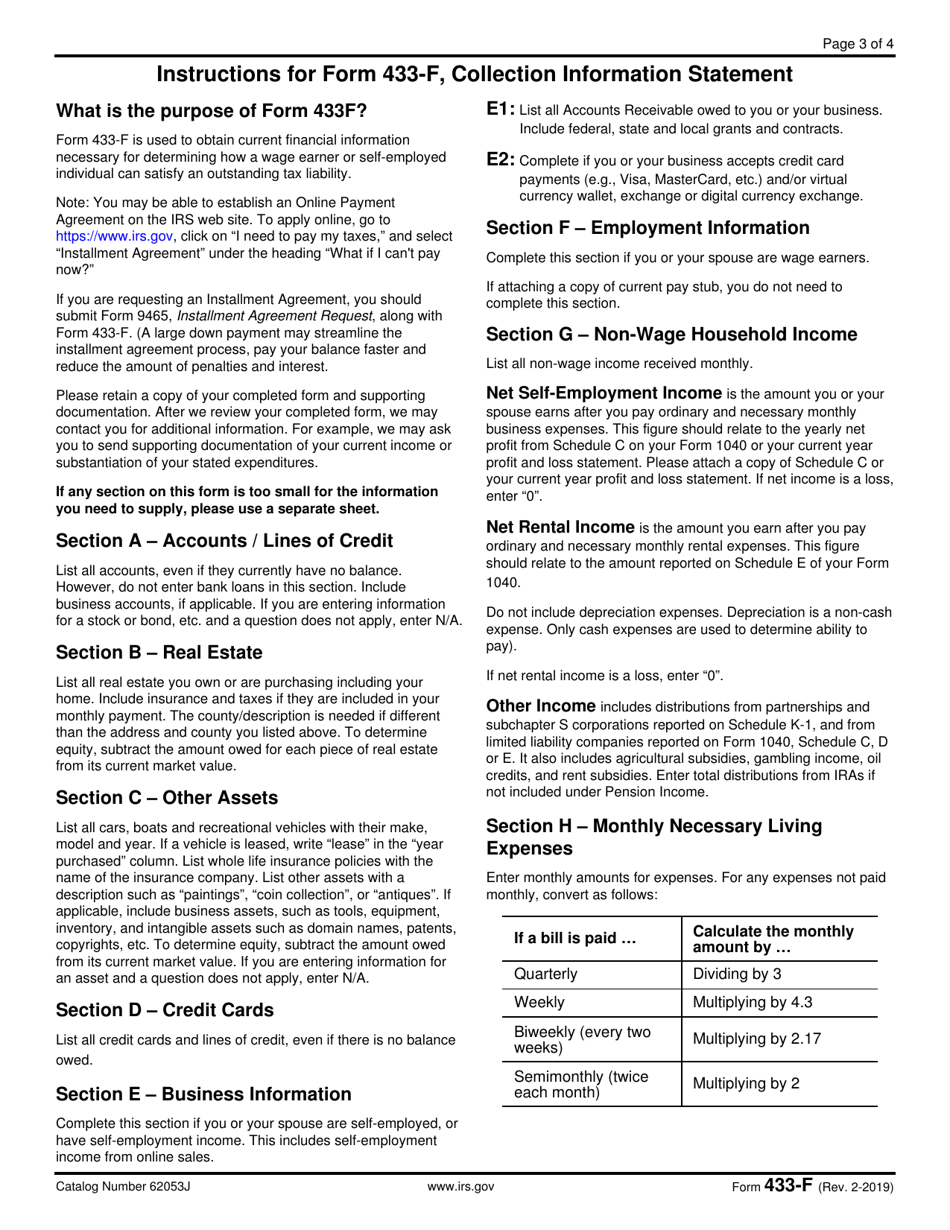

Printable Irs Form 433 F - For example, you’re not required to submit this form to the irs if your tax debt is under $25,000. If address provided above is different than last return filed please check here. $856.23 x 2 = $1,712.46. This form seeks to determine your ability to pay, ensuring that any arrangement made by taxpayers and the agency will suit both parties. Its purpose is to collect information about an individual's or a business's financial situation in order to assess their ability to pay outstanding tax debts. The irs requests this form when you owe more than $50,000 or can’t afford to pay off your tax liability within six years. It shows the irs the taxpayer's ability to pay (monthly cash flow). Moreover, taxpayers eligible to apply for a payment plan online can skip filling out this form. Your social security number or individual taxpayer identification number. Business information complete e1 for accounts receivable owed to you or your business. Business information complete e1 for accounts receivable owed to you or your business. This is the amount earned after ordinary and necessary monthly business expenses are paid. This form seeks to determine your ability to pay, ensuring that any arrangement made by taxpayers and the agency will suit both parties. (use additional sheets if necessary.) complete e2 if you or. Note you are signing this form under penalty of perjury so you want to make sure the form is accurate and not leaving off any information before you sign it. Moreover, taxpayers eligible to apply for a payment plan online can skip filling out this form. Web for example, the half degree of warming from 1.5 to 2 °c (0.9. This form seeks to determine your ability to pay, ensuring that any arrangement made by taxpayers and the agency will suit both parties. The taxpayer should note the current value of the property, the amount owed, and the equity. This is the amount earned after ordinary and necessary monthly business expenses are paid. Note you are signing this form under. Moreover, taxpayers eligible to apply for a payment plan online can skip filling out this form. (use additional sheets if necessary.) complete e2 if you or your business accepts credit card payments. Web for example, the half degree of warming from 1.5 to 2 °c (0.9 °f of warming from 2.7 °f to 3.6 °f) above preindustrial temperatures is projected. Sign and date the form. Web the irs may ask you to file any past due returns. The form is typically used in cases where taxpayers owe back. The irs requests this form when you owe more than $50,000 or can’t afford to pay off your tax liability within six years. Its purpose is to collect information about an individual's. This is the amount earned after ordinary and necessary monthly business expenses are paid. It shows the irs the taxpayer's ability to pay (monthly cash flow). $856.23 x 2 = $1,712.46. Web the irs may ask you to file any past due returns. Business information complete e1 for accounts receivable owed to you or your business. (use additional sheets if necessary.) complete e2 if you or your business accepts credit card payments. Sign and date the form. This form seeks to determine your ability to pay, ensuring that any arrangement made by taxpayers and the agency will suit both parties. The form is typically used in cases where taxpayers owe back. Include virtual currency wallet, exchange. $856.23 x 2 = $1,712.46. The irs requests this form when you owe more than $50,000 or can’t afford to pay off your tax liability within six years. For example, you’re not required to submit this form to the irs if your tax debt is under $25,000. It shows the irs the taxpayer's ability to pay (monthly cash flow). The. Web it is called the installment agreement request and collection information statement. This is the amount earned after ordinary and necessary monthly business expenses are paid. For example, you’re not required to submit this form to the irs if your tax debt is under $25,000. This form seeks to determine your ability to pay, ensuring that any arrangement made by. Note you are signing this form under penalty of perjury so you want to make sure the form is accurate and not leaving off any information before you sign it. Its purpose is to collect information about an individual's or a business's financial situation in order to assess their ability to pay outstanding tax debts. (use additional sheets if necessary.). This form seeks to determine your ability to pay, ensuring that any arrangement made by taxpayers and the agency will suit both parties. The irs requests this form when you owe more than $50,000 or can’t afford to pay off your tax liability within six years. The taxpayer should note the current value of the property, the amount owed, and the equity. Enter monthly net business income. $856.23 x 2 = $1,712.46. The irs uses the information on this form to determine eligibility for payment plans and uncollectible status , among other resolutions. It shows the irs the taxpayer's ability to pay (monthly cash flow). Moreover, taxpayers eligible to apply for a payment plan online can skip filling out this form. Business information complete e1 for accounts receivable owed to you or your business. Web catalog number 62053j www.irs.gov. Include virtual currency wallet, exchange or digital currency exchange. Web the irs may ask you to file any past due returns. Note you are signing this form under penalty of perjury so you want to make sure the form is accurate and not leaving off any information before you sign it. Your social security number or individual taxpayer identification number. Its purpose is to collect information about an individual's or a business's financial situation in order to assess their ability to pay outstanding tax debts. (use additional sheets if necessary.) complete e2 if you or your business accepts credit card payments.

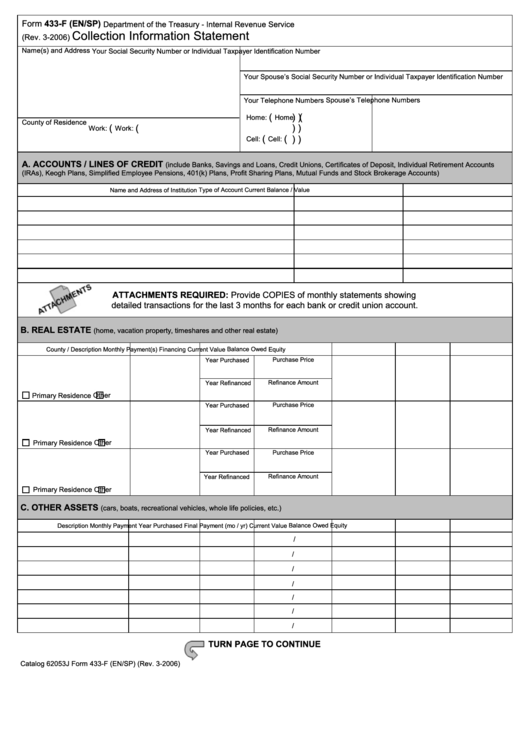

Fillable Form 433F Collection Information Statement Department Of

Irs form 433 f Fill out & sign online DocHub

IRS Form 433F Download Fillable PDF or Fill Online Collection

How to complete IRS form 433F YouTube

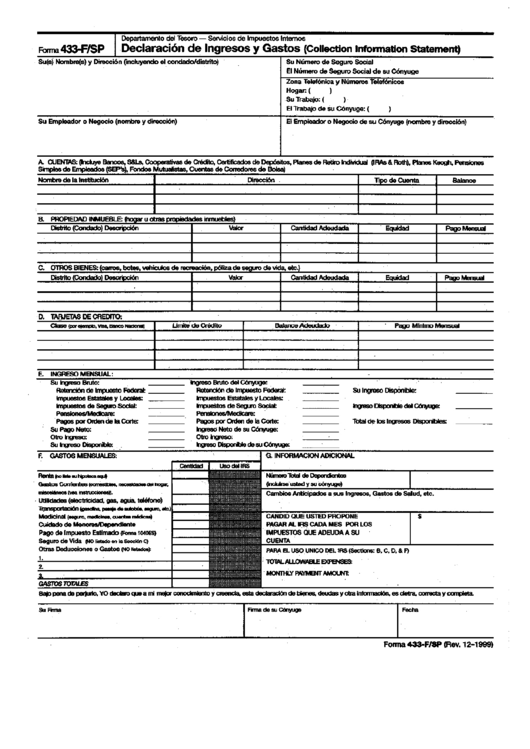

Forma 433F/sp Declaracion De Ingresos Y Gastos (Collection

Form 433F Printable Form 433F blank, sign forms online — PDFliner

20192024 Form IRS 433F Fill Online, Printable, Fillable, Blank

Form 433F Collection Information Statement printable pdf download

Form 433F Collection Information Statement (2013) Free Download

IRS Form 433F Download Fillable PDF or Fill Online Collection

Web For Example, The Half Degree Of Warming From 1.5 To 2 °C (0.9 °F Of Warming From 2.7 °F To 3.6 °F) Above Preindustrial Temperatures Is Projected On A Global Scale To Expose 420 Million More People To Frequent Extreme Heatwaves At Least Every Five Years, And 62 Million More People To Frequent Exceptional Heatwaves At Least Every Five Years.

Sign And Date The Form.

This Is The Amount Earned After Ordinary And Necessary Monthly Business Expenses Are Paid.

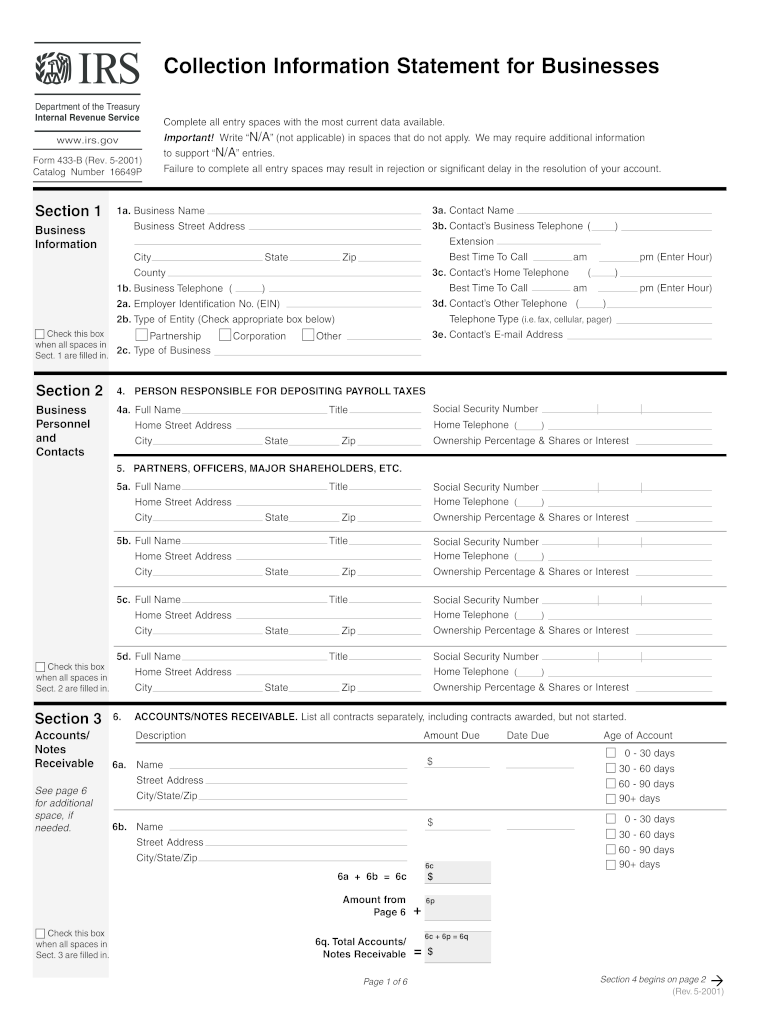

Collection Information Statement For Businesses.

Related Post: