Printable Tax Extension Form

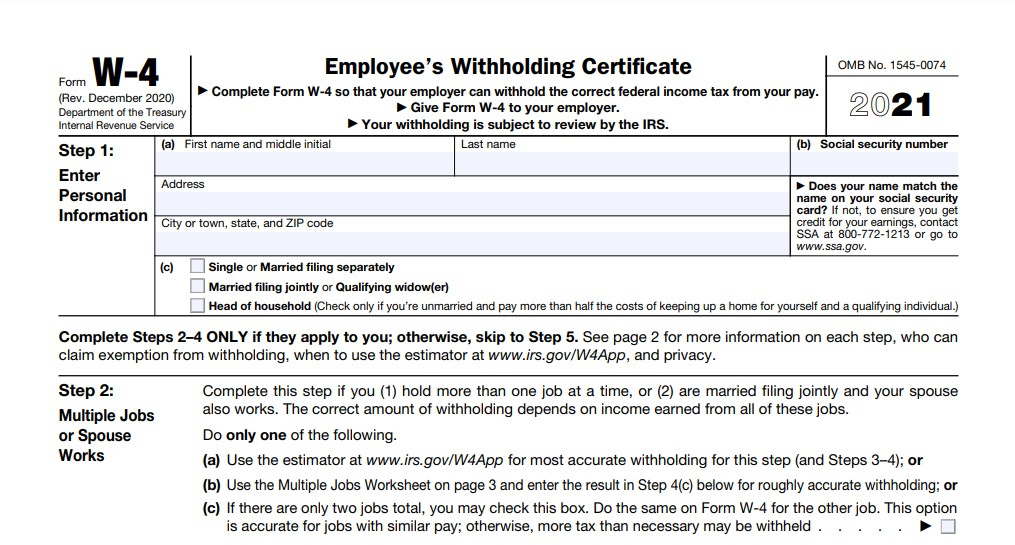

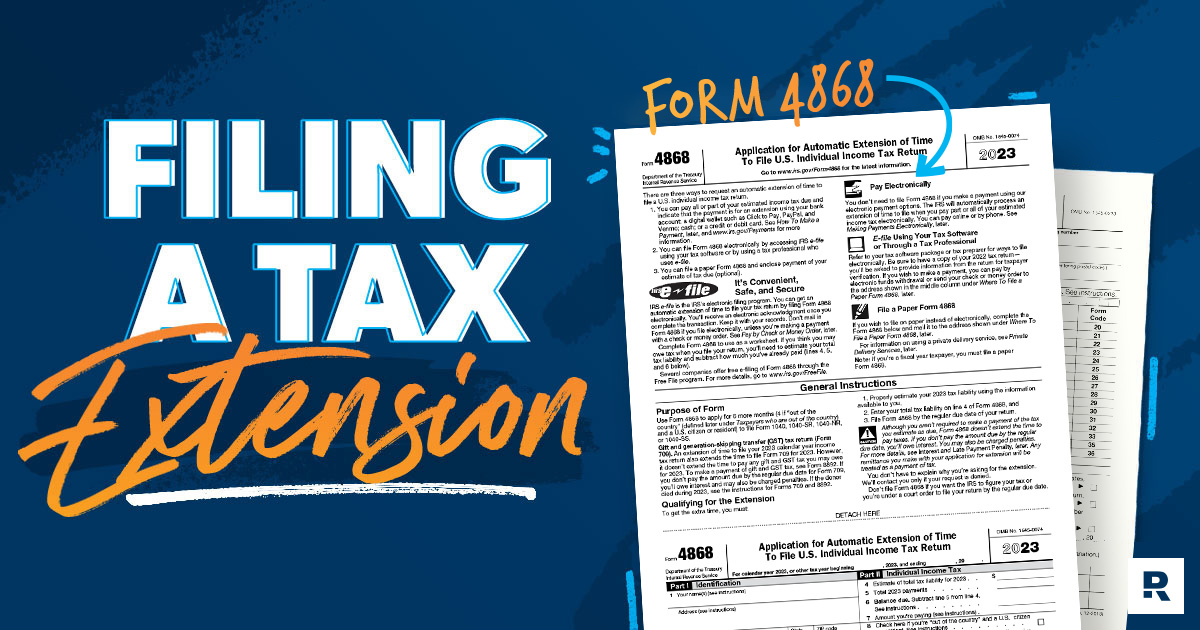

Printable Tax Extension Form - All you need to do is submit form 4868. You can pay all or part of your estimated income tax. Individual income tax return is an internal revenue service (irs) form for individuals. Web the internal revenue service will automatically grant you an extension to file your tax return by oct. There are three ways to request an automatic extension of time to file a u.s. Web download or print the 2023 federal (application for automatic extension of time to file u.s. Web 2022 tax federal extension form. Go to www.freetaxusa.com to start your free return today! Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. File an irs tax extensiontax documents checklistprofessional tax softwaretax tips Extension payment with this form. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. There are three ways to request an automatic extension of time to file a u.s. Department of the treasury internal revenue. Go to www.freetaxusa.com to start. There are three ways to request an automatic extension of time to file a u.s. Individual income tax return is an internal revenue service (irs) form for individuals. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. All you need. Individual income tax return is an internal revenue service (irs) form for individuals. Web generally grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for fiduciary returns. All you need to do is submit form 4868. Go to www.freetaxusa.com to start your free return today! Web 2022 tax federal extension form. Go to www.freetaxusa.com to start your free return today! Web download or print the 2023 federal (application for automatic extension of time to file u.s. Web 2022 tax federal extension form. Web you can pay your tax balance by electronic funds withdrawal or by money order. Individual income tax return) (2023) and other income tax forms from the federal. Individual income tax return is an internal revenue service (irs) form for individuals. Department of the treasury internal revenue. Web generally grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for fiduciary returns. There are three ways to request an automatic extension of time to file a u.s. Web you can. Application for automatic extension of time to file u.s. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. Department of the treasury internal revenue. Go to www.freetaxusa.com to start your free return today! Web 2022 tax federal extension form. You can pay all or part of your estimated income tax. Individual income tax return) (2023) and other income tax forms from the federal. For calendar year filers, the. Department of the treasury internal revenue. Extension payment with this form. Web the internal revenue service will automatically grant you an extension to file your tax return by oct. Web extension process for individual income taxpayers. Go to www.freetaxusa.com to start your free return today! Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868,. Web download or print the 2023 federal (application for automatic extension of time to file u.s. For calendar year filers, the. Web 2022 tax federal extension form. You can pay all or part of your estimated income tax. Easily file a personal income tax extension online and learn more about filing. File an irs tax extensiontax documents checklistprofessional tax softwaretax tips Where to file a paper. Web 2022 tax federal extension form. Web extension process for individual income taxpayers. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. Application for automatic extension of time to file u.s. Easily file a personal income tax extension online and learn more about filing. Go to www.freetaxusa.com to start your free return today! Web generally grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month extension for fiduciary returns. Web if you prefer to fill out the request yourself, you can use the irs’s free fillable forms tool to manually complete and submit form 4868, aka the extension. Go to www.freetaxusa.com to start your free return today! For calendar year filers, the. Web you can pay your tax balance by electronic funds withdrawal or by money order. Web extension process for individual income taxpayers. File an irs tax extensiontax documents checklistprofessional tax softwaretax tips There are three ways to request an automatic extension of time to file a u.s. Individual income tax return) (2023) and other income tax forms from the federal. Extension payment with this form. Web download or print the 2023 federal (application for automatic extension of time to file u.s. Web the internal revenue service will automatically grant you an extension to file your tax return by oct. Where to file a paper.

Irs Tax Extension Form Number Elsy Christin

When To File Child Tax Credit 2024 Adi Kellyann

Tax Filing Extension 2024 Cyndy Madlen

2024 Oregon Tax Forms Maddi Christean

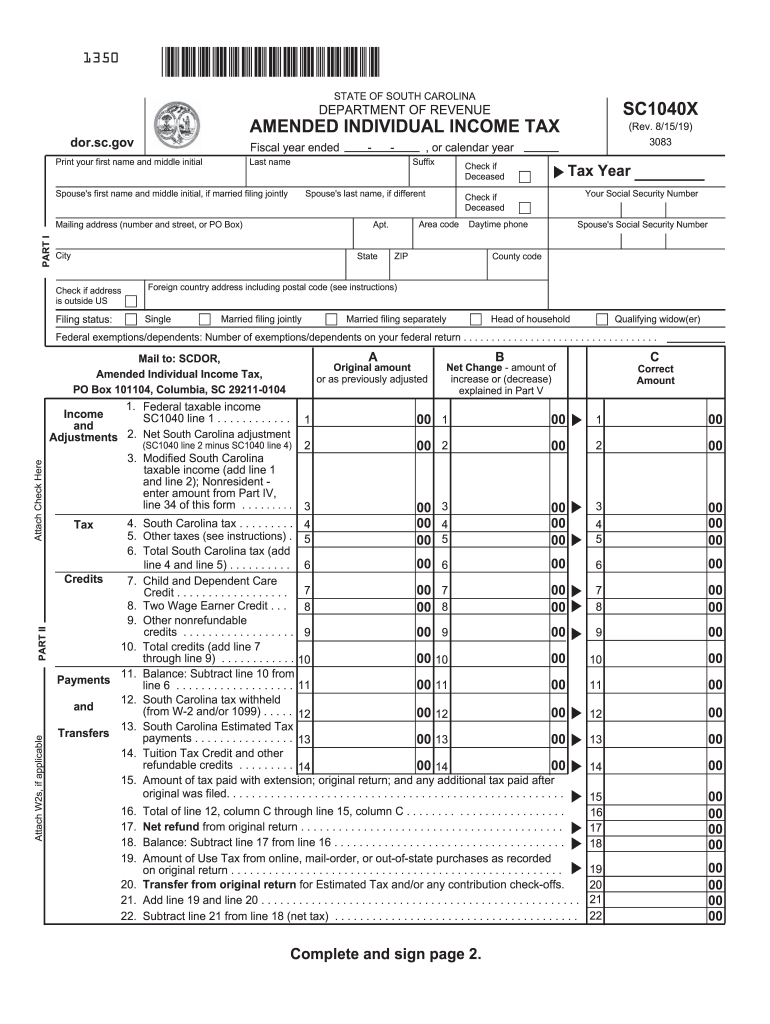

South Carolina Tax Return 2024 Olive Ashleigh

Tax Return 2024 Filing Date Ame Teddie

Illinois State Tax Extension 2024 Inez Reggie

Tax Extension 2024 H&R Block Cari Marsha

Will There Be A Tax Extension In 2024 Orel Tracey

2024 Oregon Tax Forms Maddi Christean

Individual Income Tax Return Is An Internal Revenue Service (Irs) Form For Individuals.

You Can Pay All Or Part Of Your Estimated Income Tax.

Web What Are The Extensions?

Web 2022 Tax Federal Extension Form.

Related Post: