Printable W4V Form

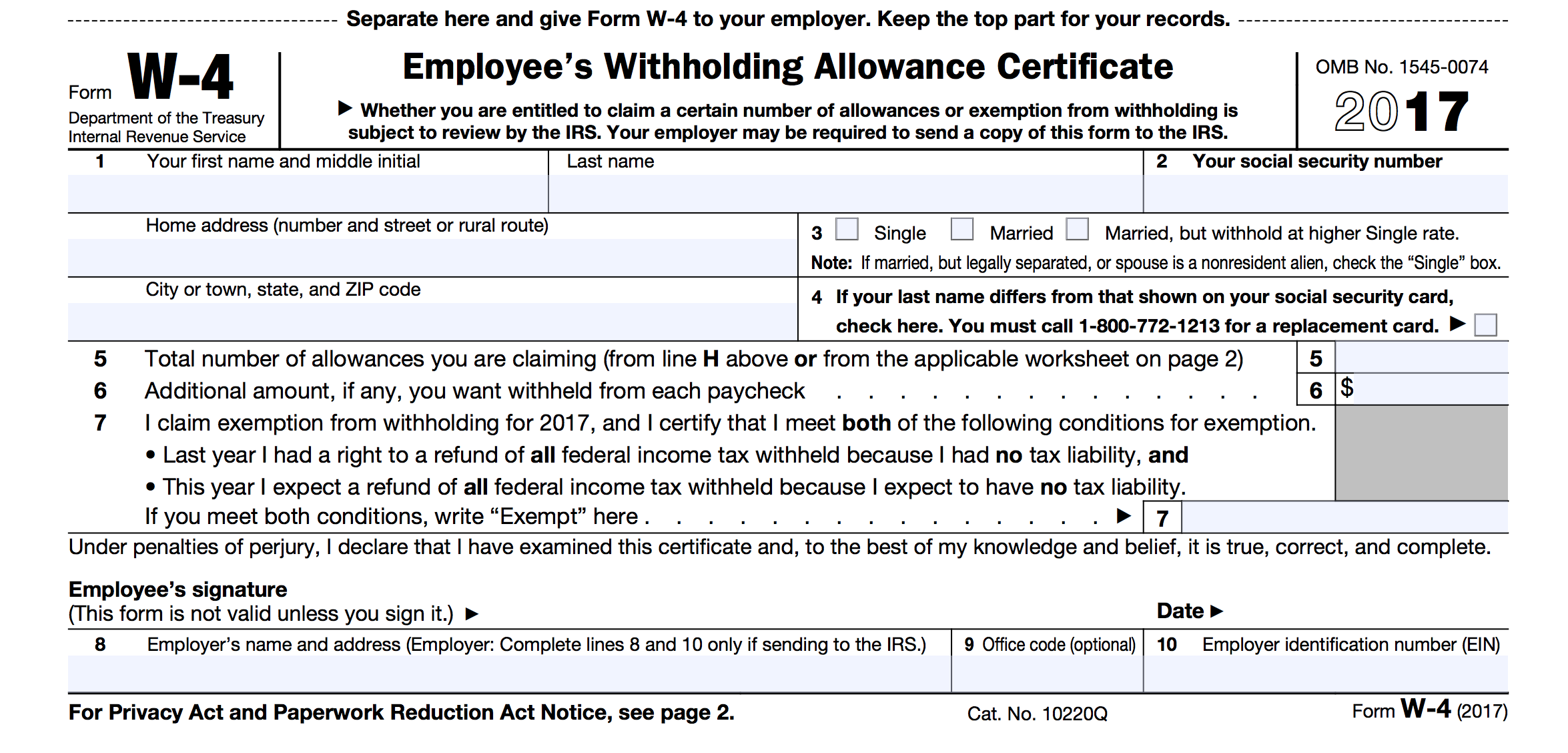

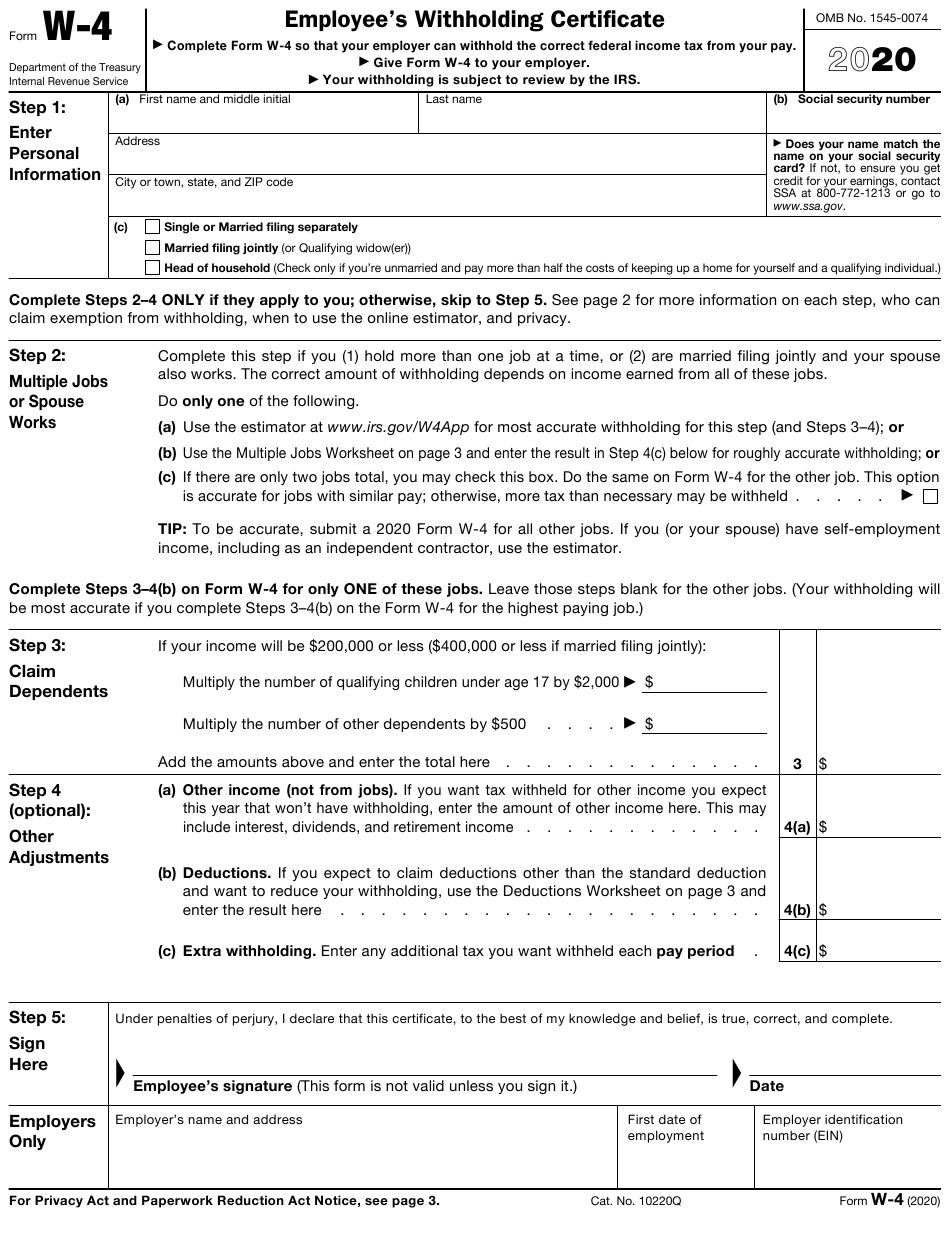

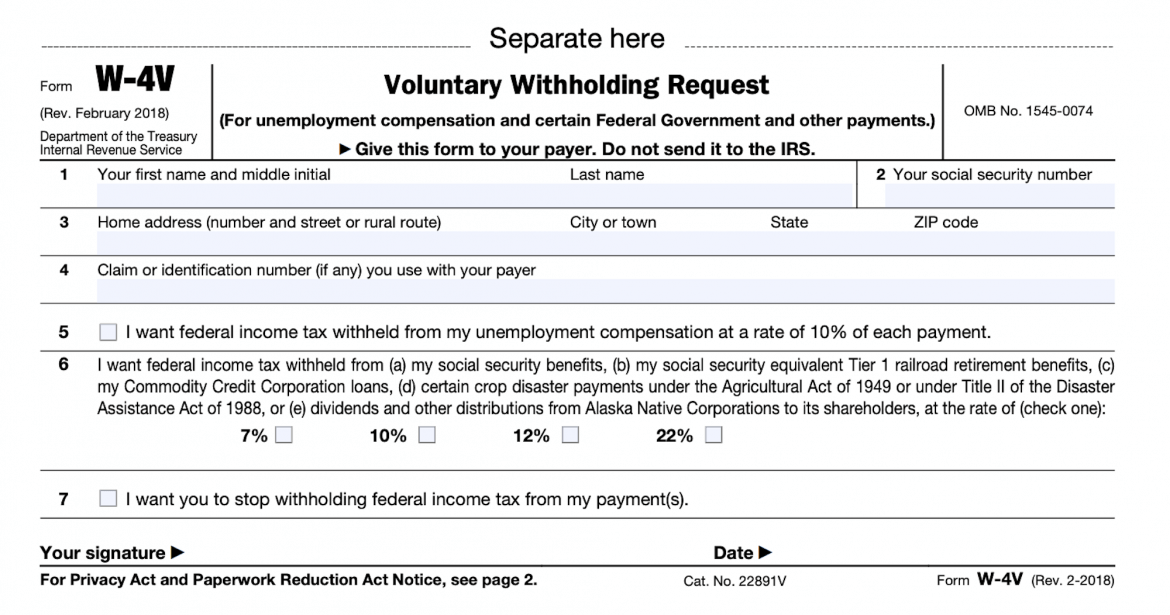

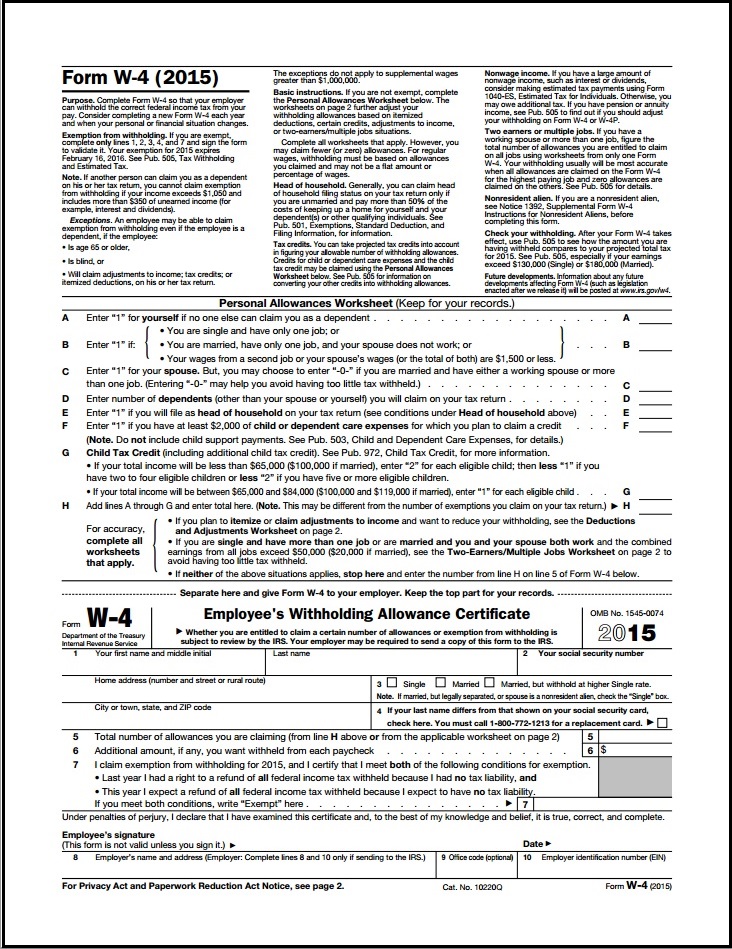

Printable W4V Form - Payers may develop their own form for you to request federal income tax withholding. (for unemployment compensation and certain federal government payments.) internal revenue service. Learn how to complete the form, where to. • unemployment compensation (including railroad unemployment. Find more information about the form, other federal tax forms, and efiling options. If a payer gives you its own form instead of form w. If too little is withheld, you will generally owe tax when. Web your request is voluntary. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. If too little is withheld, you will generally owe tax when you file your tax return. If a payer gives you its own form instead of form w. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. Web w4v form 2022 printable printable world holiday, your withholding is subject to review by the. (for unemployment compensation and certain federal government payments.) internal revenue service. Find out the percentages, deadlines and. Web your request is voluntary. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. If too little is withheld, you will generally owe tax when. Payers may develop their own form for you to request federal income tax withholding. (for unemployment compensation and certain federal government. If too little is withheld, you will generally owe tax when. Web your request is voluntary. Payers may develop their own form for you to request federal income tax withholding. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. Find more information about the form, other. Web w4v form 2022 printable printable world holiday, your withholding is subject to review by the. Web your request is voluntary. If too little is withheld, you will generally owe tax when. Learn how to complete the form, where to. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill. If too little is withheld, you will generally owe tax when you file your tax return. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Find out the percentages, deadlines and contact information. Web w4v form 2022 printable printable world holiday, your withholding is subject to. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Learn how to complete the form, where to. • unemployment compensation (including railroad unemployment.. Web your request is voluntary. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. • unemployment compensation (including railroad unemployment. Find more information. Web use this form to ask payers to withhold federal income tax from certain government payments, such as unemployment compensation or social security. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Web w4v form 2022 printable printable world holiday, your withholding is subject to review. (for unemployment compensation and certain federal government payments.) internal revenue service. Learn how to complete the form, where to. You can download or print current or. Payers may develop their own form for you to request federal income tax withholding. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. If too little is withheld, you will generally owe tax when you file your tax return. • unemployment compensation (including railroad unemployment. Learn how to complete the form, where to. Web w4v form 2022 printable printable world holiday, your withholding is subject to review by the. Find out the percentages, deadlines and contact information. (for unemployment compensation and certain federal government payments.) internal revenue service. If a payer gives you its own form instead of form w. Find more information about the form, other federal tax forms, and efiling options. Web w4v form 2022 printable printable world holiday, your withholding is subject to review by the. You can download or print current or. Find out the percentages, deadlines and contact information. Payers may develop their own form for you to request federal income tax withholding. • unemployment compensation (including railroad unemployment. Web your request is voluntary. Web learn how to pay taxes on your social security benefit throughout the year instead of paying a large bill at tax time. Learn how to complete the form, where to. If too little is withheld, you will generally owe tax when you file your tax return.

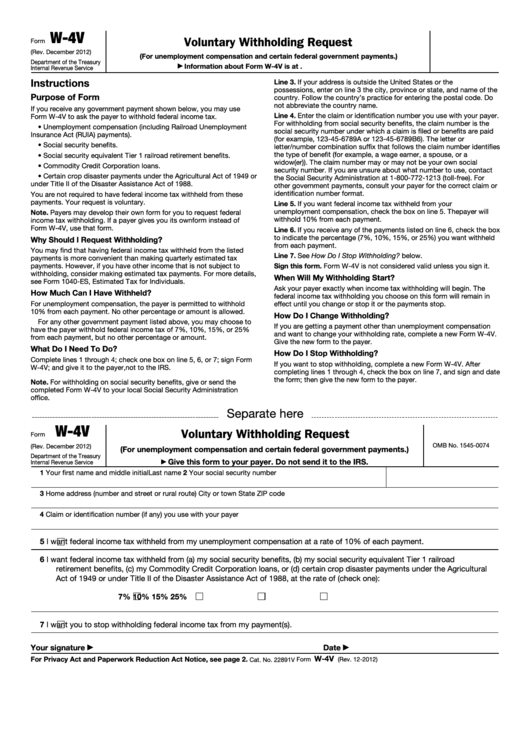

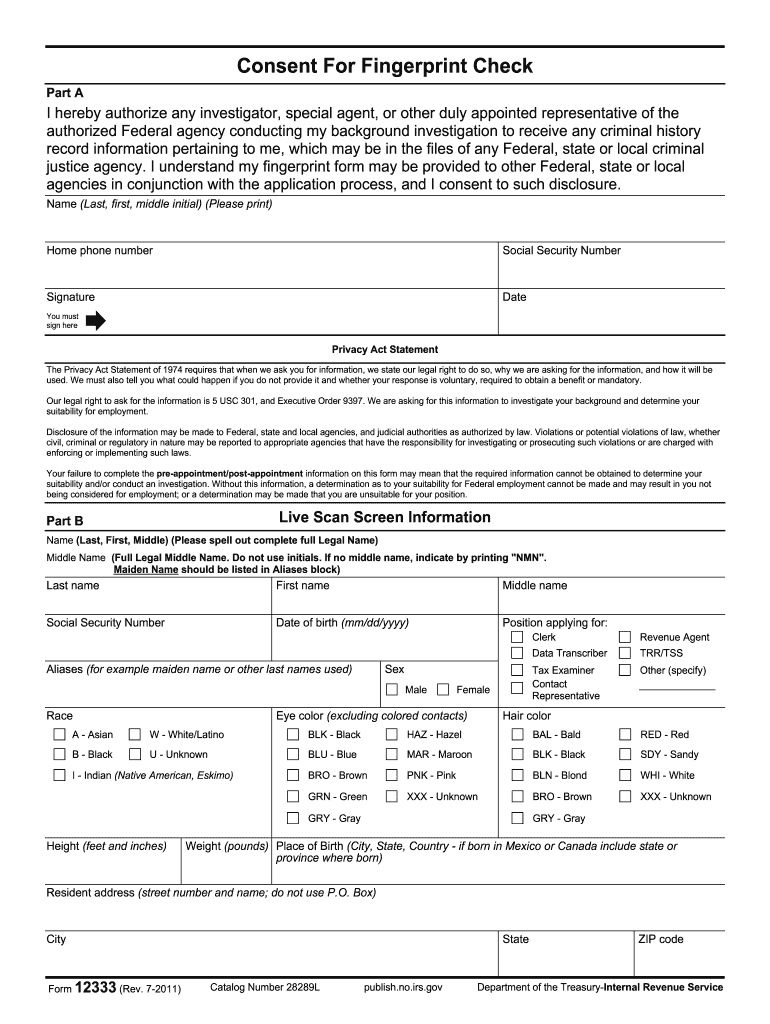

Fillable Form W4v Voluntary Withholding Request printable pdf download

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

Irs Form W 4V Printable

Federal Withholding Tax Form W4v

Form W4V template

Printable W4v Form 2022 Printable World Holiday

Irs Printable Forms

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

Irs Form W4V Printable W4v Printable 2019 cptcode.se

Irs Form W4V Printable Printable W4v Form Master of

Web Use This Form To Ask Payers To Withhold Federal Income Tax From Certain Government Payments, Such As Unemployment Compensation Or Social Security.

February 2018) (For Unemployment Compensation And Certain Federal Government And Other Payments.) Department Of The.

If Too Little Is Withheld, You Will Generally Owe Tax When.

Related Post: