Put Call Skew Chart

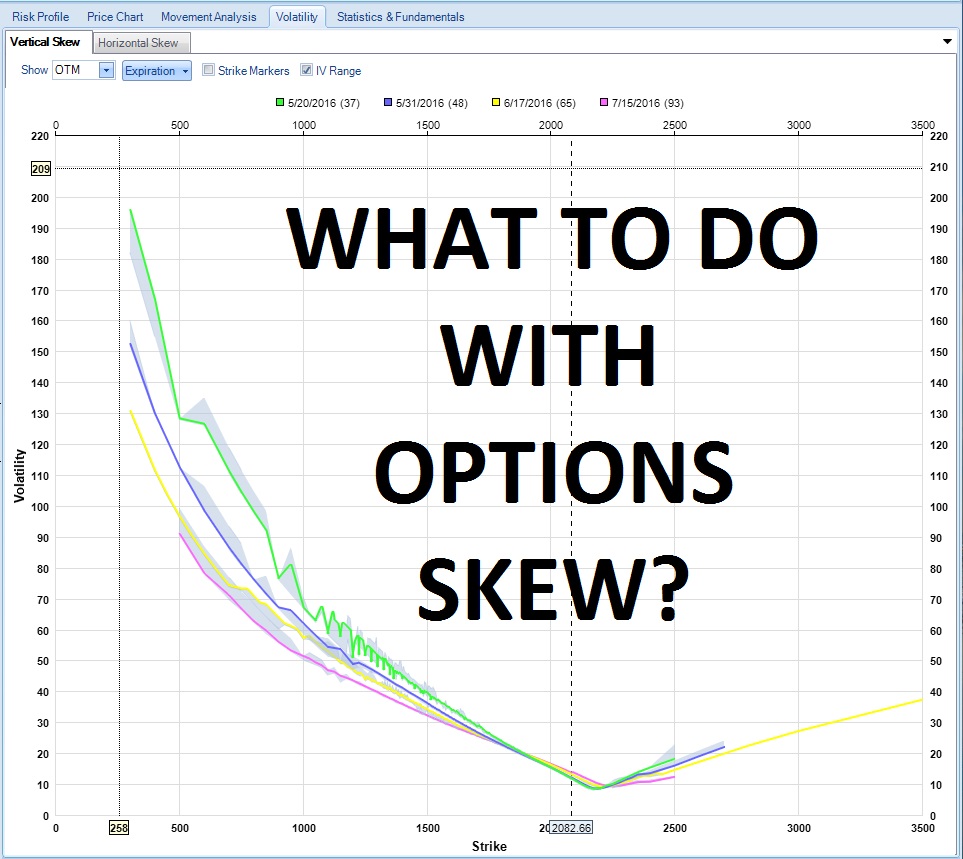

Put Call Skew Chart - It shows the skew within cvol, the relative preference for gbp upside (call) options vs. Web by desiree ibekwe. Web option skew chart. Ivol price volume ivol price volume; Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. The delta at a given contract is the probability that the. Web calculating/searching for put skew/call skew? For a more comprehensive view of implied volatility skew across all. Interpreting a volatility skew involves understanding the implications of the shape and slope of the skew. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. Ivol price volume ivol price volume; King crypto now finds itself on the cusp. Some interpretations of the volatility skew include: Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Web after dropping to support at $67,000 overnight, bitcoin ( btc) reversed course on thursday afternoon to hit a high of $69,536. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. Some interpretations of the volatility skew include: Web option skew chart. The delta at a given contract is the probability that the. Web calculating/searching for put skew/call skew? As we know, most indexes and etfs (like spy) have high levels of put skew, making puts much more expensive than calls. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. If the skew is positive, it means that otm call options have a higher. Web calculating/searching for put skew/call skew? As we know, most indexes and etfs (like spy) have high levels of put skew, making puts much more expensive than calls. For a more comprehensive view of implied volatility skew across all. View an implied volatility skew chart for spdr s&p 500 etf trust (spy) comparing historical. Web by desiree ibekwe. Including but not limited to any. King crypto now finds itself on the cusp. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts at one standard. View an implied volatility skew chart for spdr s&p 500 etf trust (spy) comparing. Interpreting a volatility skew involves understanding the implications of the shape and slope of the skew. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Web the call skew history chart tracks the call skew, which is the delta of calls at one standard deviation above current stock price minus the delta of puts. View an implied volatility skew chart for apple (aapl) comparing historical and most recent. Call iv30 skew by delta iv smile graph compare expirations. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. Web the skew chart allows the user to identify option volatility skews in a line graph view. The volatility strike skew chart shows the option volatility and volume for option contracts for the selected expiration. Web by desiree ibekwe. [ [ strike ]] x. This view quickly shows the user. Ivol price volume ivol price volume; Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Web by desiree ibekwe. May 25, 2024, 6:28 a.m. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. Web volatility strike skew for spx. [ [ strike ]] x. King crypto now finds itself on the cusp. Including but not limited to any. Call iv30 skew by delta iv smile graph compare expirations. Some interpretations of the volatility skew include: [ [ strike ]] x. Web calculating/searching for put skew/call skew? If the skew is positive, it means that otm call options have a higher implied volatility than otm put options. Web option skew chart. Eps of $0.88 beats by $0.06 | revenue of $955.40m (38.90% y/y) beats by $3.51m. Implied volatility skew is a graphical representation of the implied volatility (iv) for different strike prices of call and put options for a specific. Hei) q2 2024 results conference. Web the skew chart allows the user to identify option volatility skews in a line graph view to display implied volatility across various strikes. It shows the skew within cvol, the relative preference for gbp upside (call) options vs. Web by desiree ibekwe. Gamma exposure (gex) highest volume options. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. Web the second chart may be more telling. Some interpretations of the volatility skew include: Call iv30 skew by delta iv smile graph compare expirations. Interpreting a volatility skew involves understanding the implications of the shape and slope of the skew.

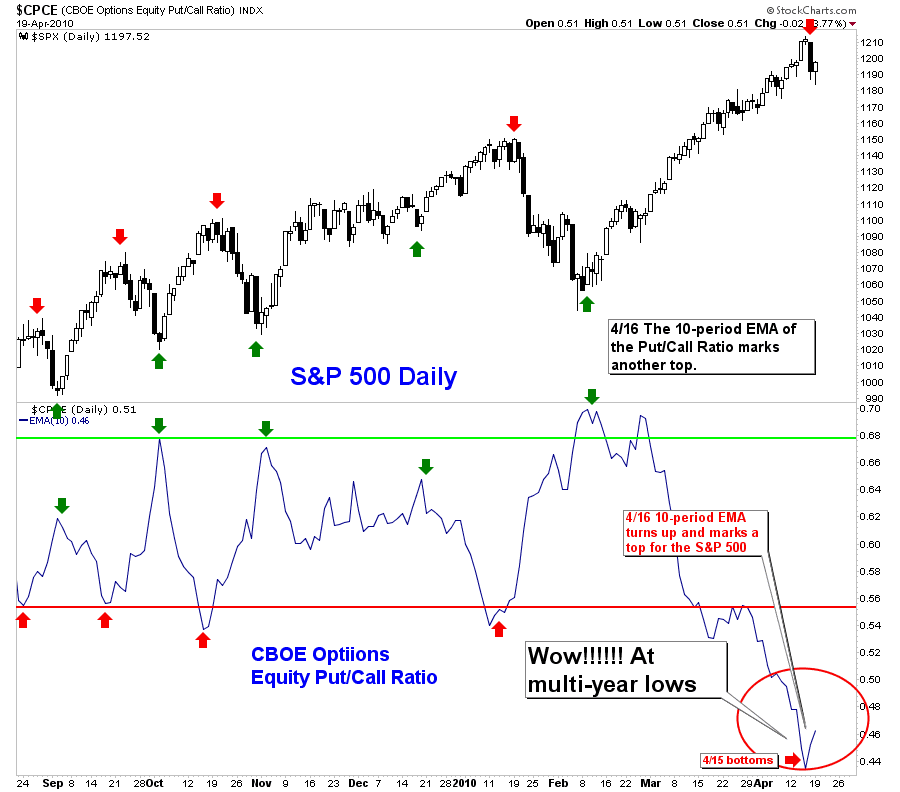

chartramblings Put/call chart

Feature Skew Chart

Volatility Skews Defined, Explained and Updated LaptrinhX

Bitcoin's OI and volume put/call ratio close to historical low AMBCrypto

Put Call Ratio/Volatility Skew Curve for COINBASEBTCUSD by BitOoda_LLC

Volatility Skews Defined, Explained and Updated LaptrinhX

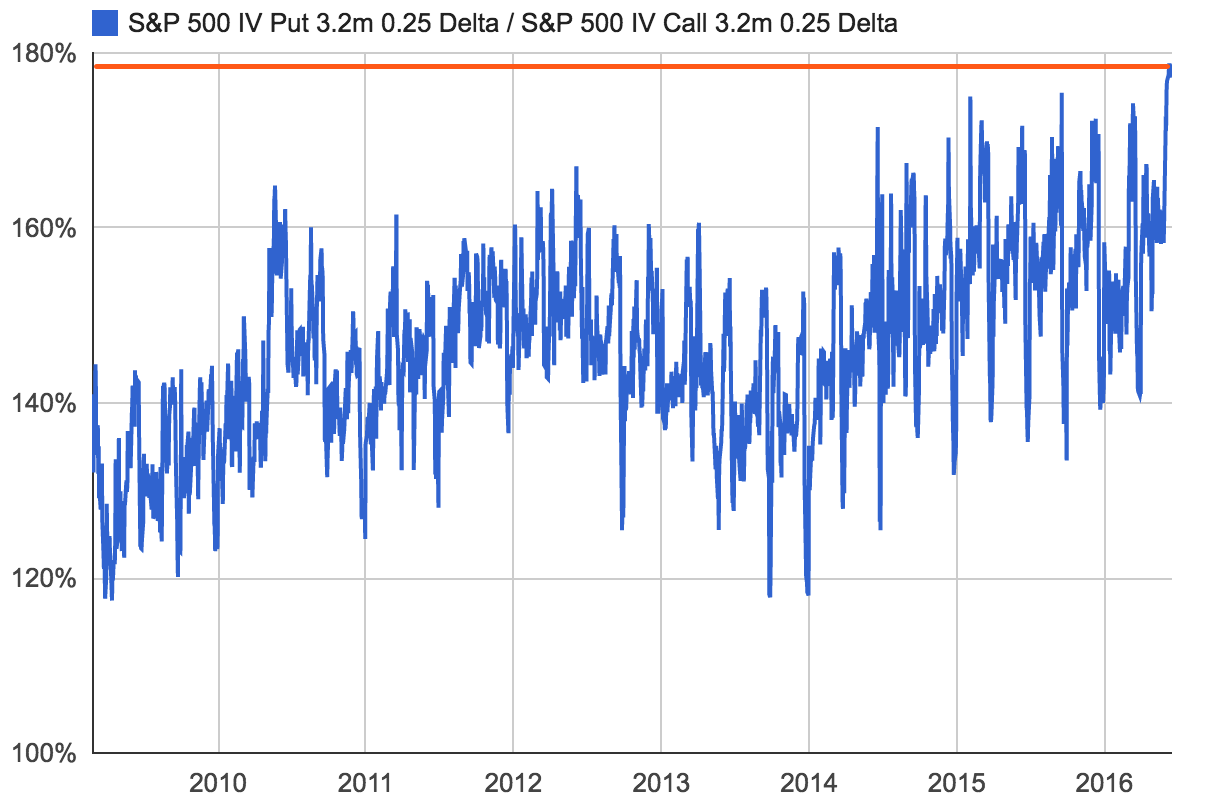

Put vs. call options skew is at the highest level in seven years

PutCall Skew Dips in Coincidence with Market Rallies

What does an option trader do and also how to get loads of money on chobots

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Investopedia Basics Of Technical Analysis Options Alpha Put

The Put Call Ratio Can Be An Indicator Of Investor.

View An Implied Volatility Skew Chart For Apple (Aapl) Comparing Historical And Most Recent.

See Open Interest Of Options And Futures, Long/Short Build Up, Max Pain, Pcr, Iv, Ivp And Volume Over.

View An Implied Volatility Skew Chart For Spdr S&P 500 Etf Trust (Spy) Comparing Historical.

Related Post: