Pv Of Annuity Chart

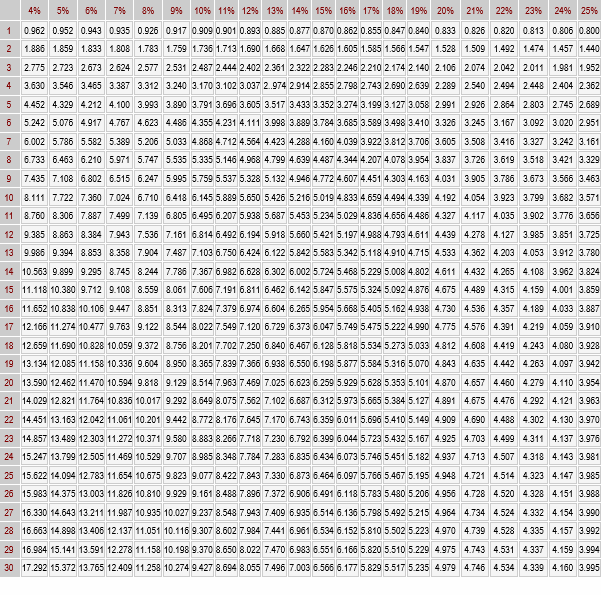

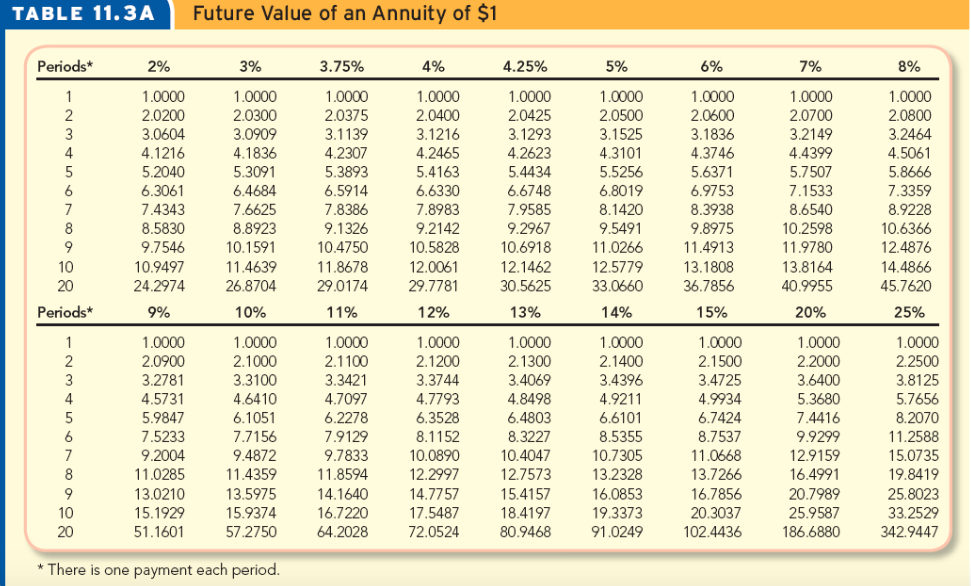

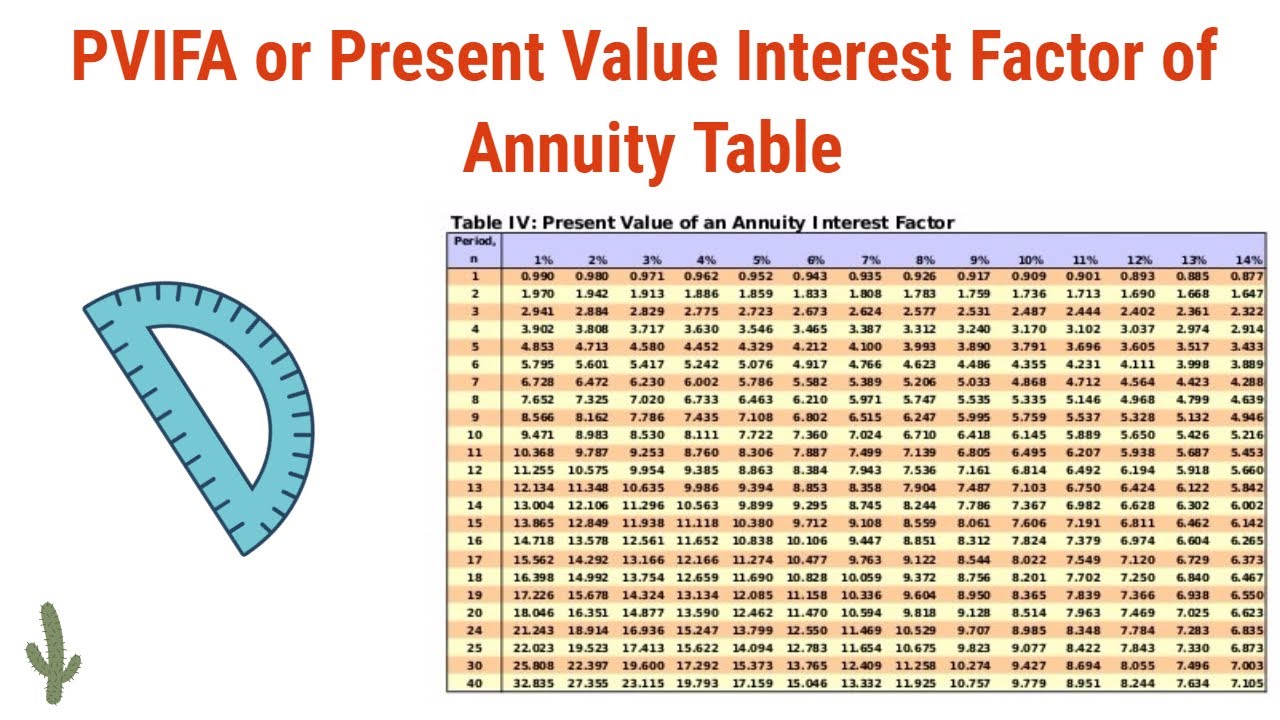

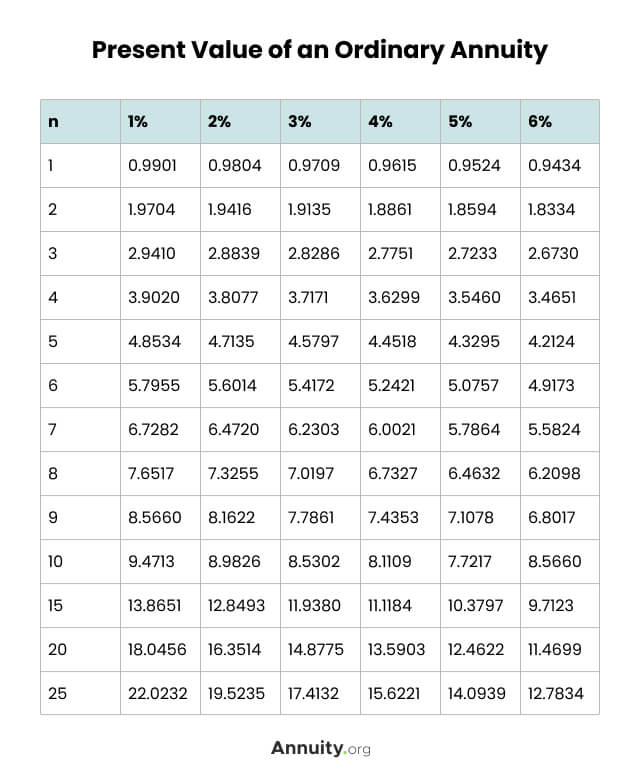

Pv Of Annuity Chart - Web calculate the present value interest factor of an annuity ( pvifa) and create a table of pvifa values. Web an annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. Web in the world of finance, an annuity is a contract between you and a life insurance company in which you give the company a lump sum or series of payments, and in return, the insurer promises to. Web future and present value tables. It is calculated using a formula that takes. Web the present value of annuity formula determines the value of a series of future periodic payments at a given time. By finding the present value interest factor of an annuity (pvifa) on the table, you can easily determine the current worth of your annuity payments. Pv = pmt x present value annuity factor But how do you know what those future payments are worth? When you multiply this factor by one of the payments, you arrive at the present value of the stream of. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. Web (interest rate = r, number of periods = n) The tables provide the value now of 1 received at the beginning of each period for n periods at a discount rate of i%. Web you can view. Web calculate the present value interest factor of an annuity ( pvifa) and create a table of pvifa values. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. As can be seen present value annuity tables can be used to provide a solution for the part of. Web you can view a present value of an ordinary annuity table by clicking pvoa table. People choose annuities in order to secure guaranteed income payments for a long period of time. Web present value annuity due tables. Web (interest rate = r, number of periods = n) The annuity table contains a factor specific to the number of payments. The purpose of the present value annuity due tables (pvad tables) is to make it possible to carry out annuity due calculations without the use of a financial calculator. Web the present value of an annuity formula is: People choose annuities in order to secure guaranteed income payments for a long period of time. Additionally this is sometimes referred to. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. Web an annuity table calculates the present value of an annuity using a formula that applies a discount rate to future payments. Web what is an annuity table? Web an annuity table, often referred to as a “present. So, for example, if you plan to invest a. Create a printable compound interest table for the present value of an ordinary annuity or present value of an annuity due for payments of $1. But how do you know what those future payments are worth? By finding the present value interest factor of an annuity (pvifa) on the table, you. Web an annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. To find the present value of ordinary annuity find the appropriate period and rate in the tables below. Web an annuity table calculates the present value of an annuity using a. When you multiply this factor by one of the payments, you arrive at the present value of the stream of. Pmt is the dollar amount of each payment. Web you can view a present value of an ordinary annuity table by clicking pvoa table. The purpose of the present value annuity due tables (pvad tables) is to make it possible. Additionally this is sometimes referred to as the present value annuity factor. Pmt is the dollar amount of each payment. Web an annuity table represents a method for determining the present value of an annuity. The first column ( n) refers to the number of recurring identical payments (or periods) in an annuity. The tables provide the value now of. To find the present value of ordinary annuity find the appropriate period and rate in the tables below. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. Pv = pmt x present value annuity factor Web (interest rate = r, number of periods = n) Web the. Web present value annuity tables formula: Present value of an annuity: The present value of annuity formula relies on the concept of time value of money, in that one dollar present day is worth more than that same dollar at a future date. The value today of a series of equal payments or receipts to be made or received on specified future dates is called the present value of an annuity. Calculate the present value of an annuity due, ordinary annuity, growing annuities and annuities in perpetuity with optional compounding and payment frequency. Web the present value of an annuity formula is: Web an annuity table, often referred to as a “present value table,” is a financial tool that simplifies the process of calculating the present value of an ordinary annuity. As can be seen present value annuity tables can be used to provide a solution for the part of the present value of an annuity formula shown in red. Web the present value of an annuity refers to the present value of a series of future promises to pay or receive an annuity at a specified interest rate. Web an annuity table represents a method for determining the present value of an annuity. Additionally this is sometimes referred to as the present value annuity factor. So, for example, if you plan to invest a. Pmt is the dollar amount of each payment. The first column ( n) refers to the number of recurring identical payments (or periods) in an annuity. The purpose of the present value annuity due tables (pvad tables) is to make it possible to carry out annuity due calculations without the use of a financial calculator. People choose annuities in order to secure guaranteed income payments for a long period of time.AnnuityF Ordinary Annuity Table

Present Value Interest Factor Annuity Table Pdf

What is an Annuity? Present Value Formula + Calculator

Present Value Of An Annuity Chart

Present Value Of Ordinary Annuity Table 60 Periods Bruin Blog

Present Value Of Annuity Table change comin

Pv annuity factor MinnieKalin

What Is an Annuity Table and How Do You Use One?

Present value of annuity due calculator KeireneCully

Present Value Annuity Due Tables Double Entry Bookkeeping

Web In The World Of Finance, An Annuity Is A Contract Between You And A Life Insurance Company In Which You Give The Company A Lump Sum Or Series Of Payments, And In Return, The Insurer Promises To.

Web An Annuity Table Represents A Method For Determining The Present Value Of An Annuity.

Web Present Value Annuity Due Tables.

But How Do You Know What Those Future Payments Are Worth?

Related Post: