Risk Reward Chart

Risk Reward Chart - Web depending on their risk tolerance and reward anticipation, traders can instantly calculate the correct quantity for all order types and trade directions, with an interactive visualisation provided directly in the chart area. It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). Essentially, this ratio quantifies the expected return on a trade in comparison to the level of risk undertaken. Web the risk/reward ratio is fundamentally straightforward. These categories, ranging from conservative to very aggressive, correspond with the. Web our risk reward calculator helps you assess your investment or trading strategy by calculating your risk and reward ratios, stop percentage, profit percentage, and breakeven win rate. Calculate your breakeven win rate and risk/reward ratio. Web a risk/reward ratio tells investors how much return they can get on their investment in relation to the risk taken on. Risk and reward are important because they’re the two key factors that inform any trade or investment decision. Web the risk to reward ratio (r/r ratio) measures expected income and losses in investments and trades. With this tool, you can make informed decisions and optimize your portfolio for better returns. The calculation itself is very simple. Simply choose one of our two options. The breakeven rate shows how many winning trades a strategy should produce (compared to the losers) in order to be considered profitable. By techrepublic academy may 21. It compares an investment or trade’s expected or potential profit (reward) to its possible loss (risk). Any investment with a ratio above 1:3 is considered very risky. How do you do that? Web depending on their risk tolerance and reward anticipation, traders can instantly calculate the correct quantity for all order types and trade directions, with an interactive visualisation provided. Web the reward to risk ratio (rrr, or reward risk ratio) is maybe the most important metric in trading and a trader who understands the rrr can improve his chances of becoming profitable. It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). Any investment with a ratio above 1:3 is considered. Each point on the risk/reward. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes, the greater the expected return. The risk is the possible downside of the position, while the reward is what you stand to gain. By techrepublic academy may 21. You divide your maximum risk by your net target. Any investment with a ratio above 1:3 is considered very risky. These categories, ranging from conservative to very aggressive, correspond with the. It quantifies the potential profit (reward) to be gained from a trade against the possible loss (risk) if things don't go your way. It compares an investment or trade’s expected or potential profit (reward) to its possible loss. Risk and reward are important because they’re the two key factors that inform any trade or investment decision. Basically, the reward risk ratio measures the distance from your entry to your stop loss and your take profit order and then compares the two distances. Web the risk/reward ratio of an investment is a useful trading tool that compares a trade’s. It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). Web the risk/reward ratio (r/r ratio or r) calculates how much risk a trader is taking for potentially how much reward. Any investment with a ratio above 1:3 is considered very risky. The breakeven rate shows how many winning trades a strategy. Why are risk and reward important? It’s determined by dividing the potential loss (risk) of a trade by the amount of potential gain (reward). Reward by dividing your net profit (the reward) by the price of your maximum risk. Web in the chart below, we see the range of risk levels that apply to different types of investment securities. Web. Web the risk/reward ratio in trading applies to the principal that the greater the risk a trader makes, the greater the expected return. By techrepublic academy may 21. Web the risk/reward ratio is fundamentally straightforward. With this tool, you can make informed decisions and optimize your portfolio for better returns. Web the risk curve is a visual depiction of the. Reward by dividing your net profit (the reward) by the price of your maximum risk. More risk requires a higher potential reward. Web the risk curve is a visual depiction of the tradeoff between risk and return among investments. In other words, it shows what the potential rewards for each $1 you risk on an investment are. Why are risk. It compares an investment or trade’s expected or potential profit (reward) to its possible loss (risk). These categories, ranging from conservative to very aggressive, correspond with the. Risk and reward are important because they’re the two key factors that inform any trade or investment decision. Web over the weekend, an account associated with roaring kitty — real name keith gill — posted a screenshot disclosing ownership of 5 million shares of gme as well as 120,000 $20 gme calls. It quantifies the potential profit (reward) to be gained from a trade against the possible loss (risk) if things don't go your way. Web the risk curve is a visual depiction of the tradeoff between risk and return among investments. Traders use the r/r ratio to precisely define the amount of money they are willing to risk and wish to get in each trade. More risk requires a higher potential reward. Why are risk and reward important? The risk is the possible downside of the position, while the reward is what you stand to gain. For example, if you're considering a trade where you could either gain $200 or lose $100, the risk/reward ratio is 1:2. Web our risk reward calculator helps you assess your investment or trading strategy by calculating your risk and reward ratios, stop percentage, profit percentage, and breakeven win rate. Simply choose one of our two options. Web a risk/reward ratio tells investors how much return they can get on their investment in relation to the risk taken on. In other words, it shows what the potential rewards for each $1 you risk on an investment are. Calculate your breakeven win rate and risk/reward ratio.

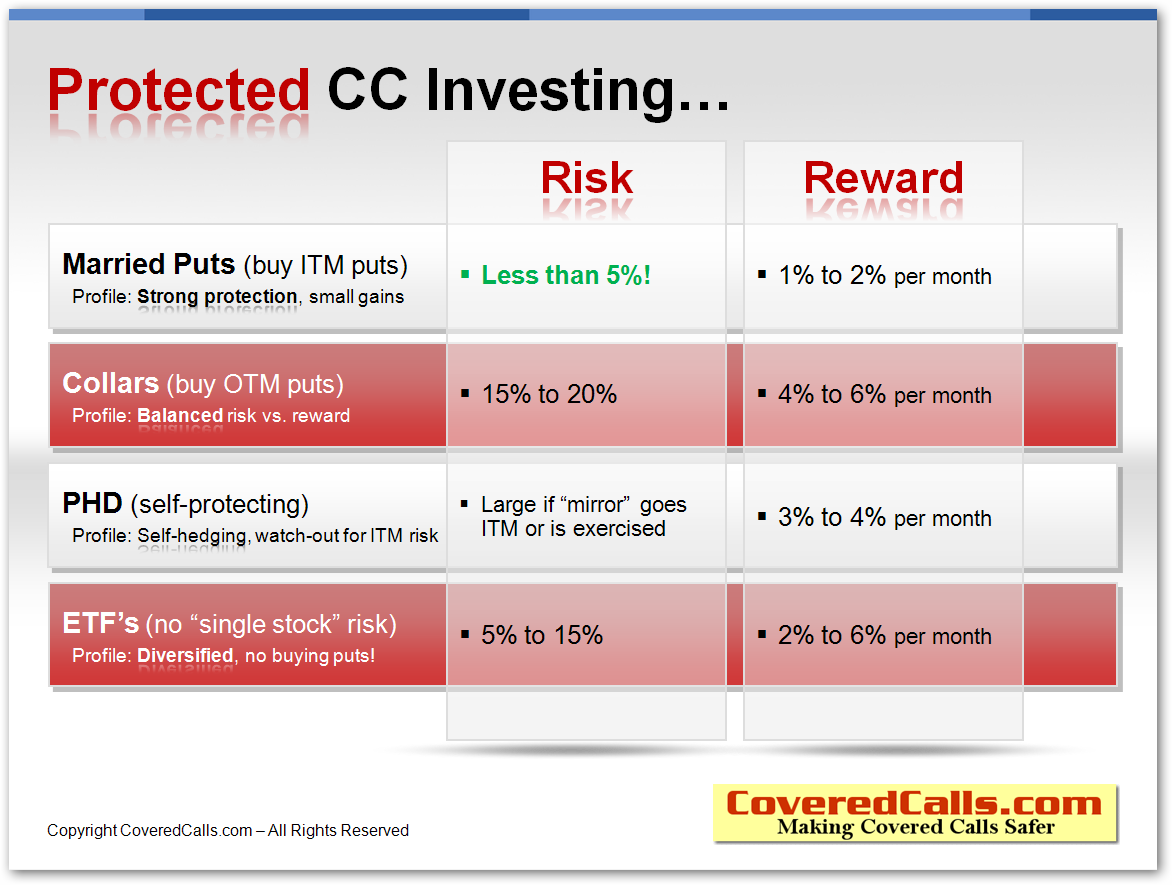

Risk Vs Reward Chart A Visual Reference of Charts Chart Master

Risk To Reward Chart

Risk Reward Chart

Risk Reward Chart

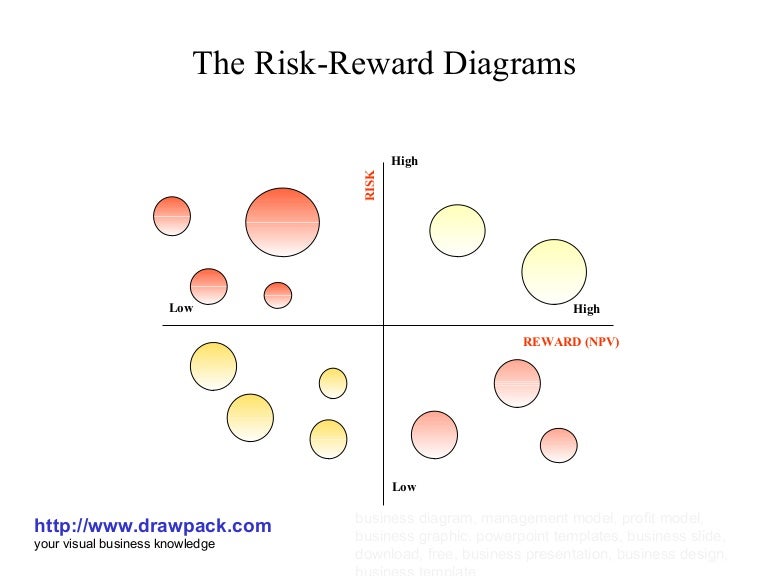

The risk reward diagrams

Risk Reward Chart

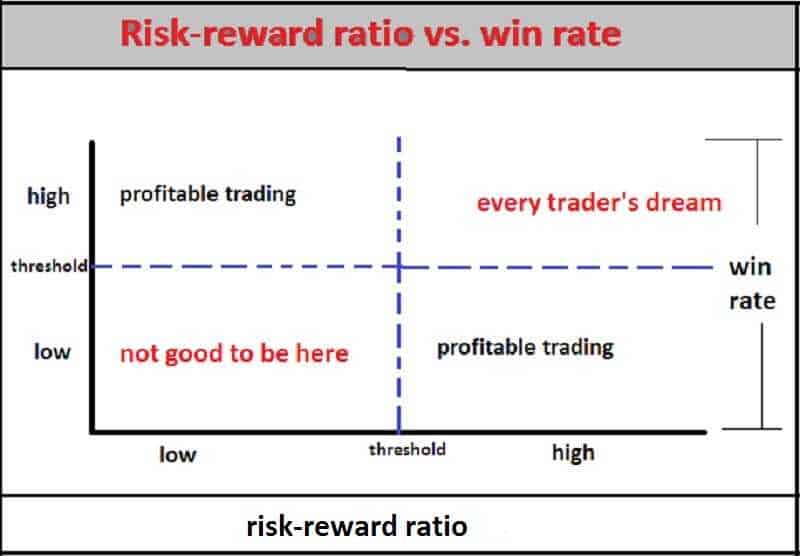

Risk Reward Vs Win Rate

Risk Vs Reward Chart

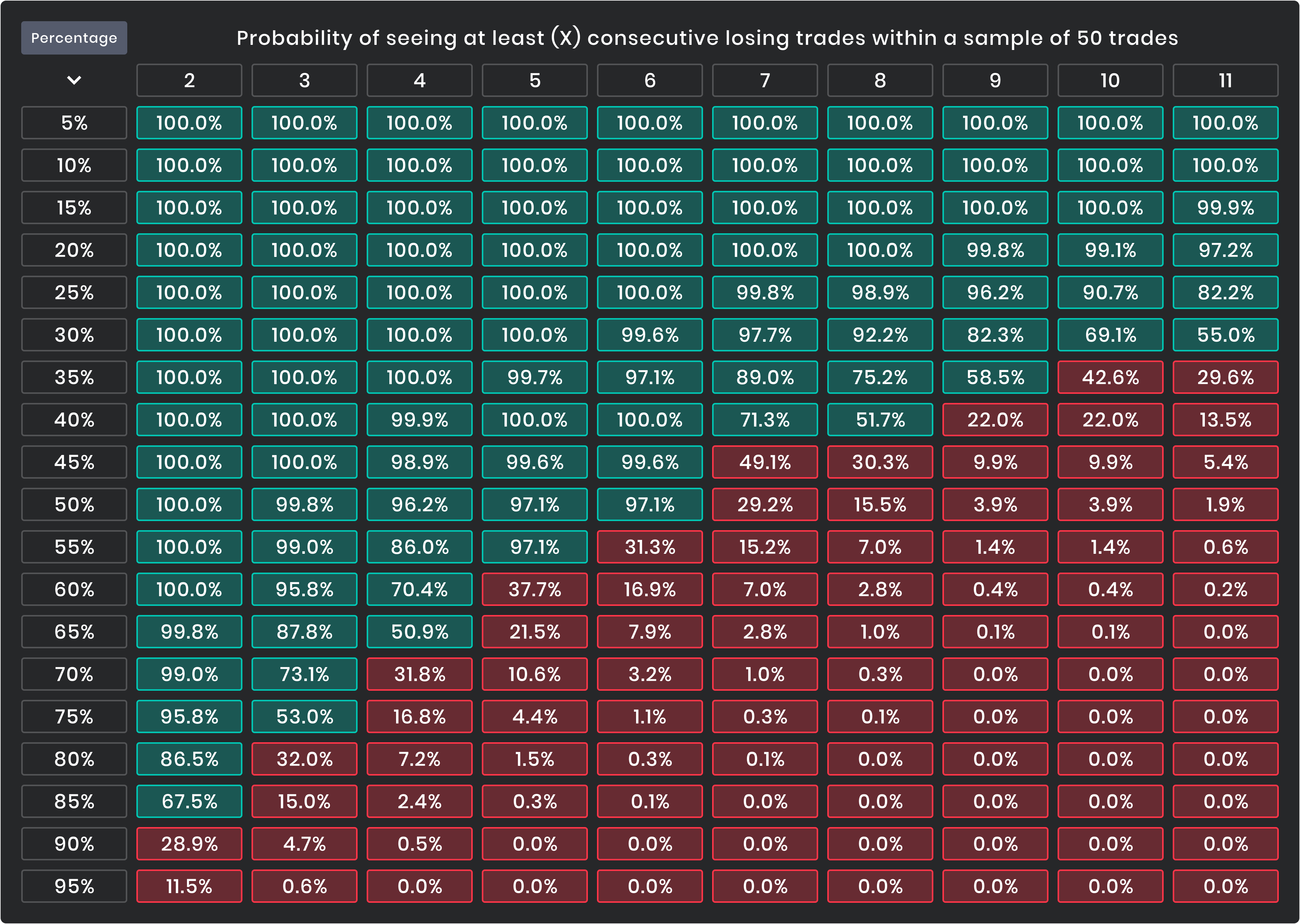

Risk Management in Trading FTMO

Every forex trader should know this risk reward and win rate

Any Investment With A Ratio Above 1:3 Is Considered Very Risky.

With This Tool, You Can Make Informed Decisions And Optimize Your Portfolio For Better Returns.

Web The Risk/Reward Scatterplot Chart Displays Up To 100 Items (99 Securities + A Benchmark Index) With At Least Three Years Of Investment History On An X/Y Axis.

The Calculation Itself Is Very Simple.

Related Post: