S Corp Owner Draw

S Corp Owner Draw - An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. English football league chairman rick parry has told reading fans he is trying to force out the league one club’s unpopular owner dai yongge but he cannot make. Web you are able to take an owner’s draw from your business if your business is part of: There is no fixed amount and no fixed interval for these payments. From there, she could do the math to determine what her. A c corp dividend is taxable to the shareholder, though, and is not a tax deduction for the c corp. Web with an s corp election, it is a tax election which allows any profit and loss to flow through to itd owner or owners (i.e. Types of business where you can take an owner’s draw: Understanding the concept of owner’s draws. Web here's the kicker, by the way: Can trigger penalties from the irs if your salary is considered unreasonable. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. It is not a business expense; Web it is vital to note that an owner’s draw differs from a. English football league chairman rick parry has told reading fans he is trying to force out the league one club’s unpopular owner dai yongge but he cannot make. However, this has become a hot button. No taxes are withheld from the check since an owner's draw is considered a removal of profits and not personal income. This method of payment. C corp owners typically do not take draws. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Web the owner's draw method. Can trigger penalties from the irs if your salary is considered unreasonable. Web may 9, 2024. Web you are able to take an owner’s draw from your business if your business is part of: This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Web may 9, 2024. For sole proprietors, an owner’s draw is the only option for payment. Web owner’s draws are. Owner’s draws are usually taken from your owner’s equity account. The pirates won by a. The selling of the stock may result in capital gains. Web section 1368 notes the distribution by an s corporation of property or cash may result in three distinct tax consequences to the shareholder receiving the distribution. Shareholders of norfolk southern, the beleaguered freight railroad,. A draw lowers the owner's equity in the business. A c corp dividend is taxable to the shareholder, though, and is not a tax deduction for the c corp. The pirates won by a. For sole proprietors, an owner’s draw is the only option for payment. It is not a business expense; It is not a business expense; Instead, shareholders can take both a salary and a dividend distribution. One of the biggest reasons is that an s corporation can save a business owner social security and medicare taxes. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Unlike a sole. The right choice depends largely on how you contribute to the company and the company. Pros:using the owner's draw method can help you, as an owner, keep funds in your. If the irs determines that you are underpaying yourself as a way to evade payroll taxes, they can take legal action. Web in 2022, fosterville gold mine's former owner kirkland. Web you are able to take an owner’s draw from your business if your business is part of: From there, she could do the math to determine what her. I take it that you've already entered the withdrawal as an expense transaction. Web with an s corp election, it is a tax election which allows any profit and loss to. Owner’s draws are usually taken from your owner’s equity account. You can adjust it based on your cash flow, personal expenses, or how your company is performing. Payroll software can help you distribute salaries to s corp owners and employees. Web may 9, 2024. The business’s profits and losses are passed through to the owner). She has decided to give herself a salary of $50,000 out of her catering business. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. Rather, an owner's draw reduces the owner. When taking an owner's draw, the business cuts a check to the owner for the full amount of the draw. Pros:using the owner's draw method can help you, as an owner, keep funds in your. For sole proprietors, an owner’s draw is the only option for payment. The more an owner takes, the fewer funds the business has to operate. While a salary is compensation for services rendered by an employee, an owner’s draw is a distribution of profits to the business owner. The right choice depends largely on how you contribute to the company and the company. Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. A c corp dividend is taxable to the shareholder, though, and is not a tax deduction for the c corp. Irs guidelines on paying yourself from a corporation. It is not a business expense; An owner’s draw gives you more flexibility than a salary because you can pay yourself practically whenever you’d like. An owner of a c corporation may not. One of the biggest reasons is that an s corporation can save a business owner social security and medicare taxes.

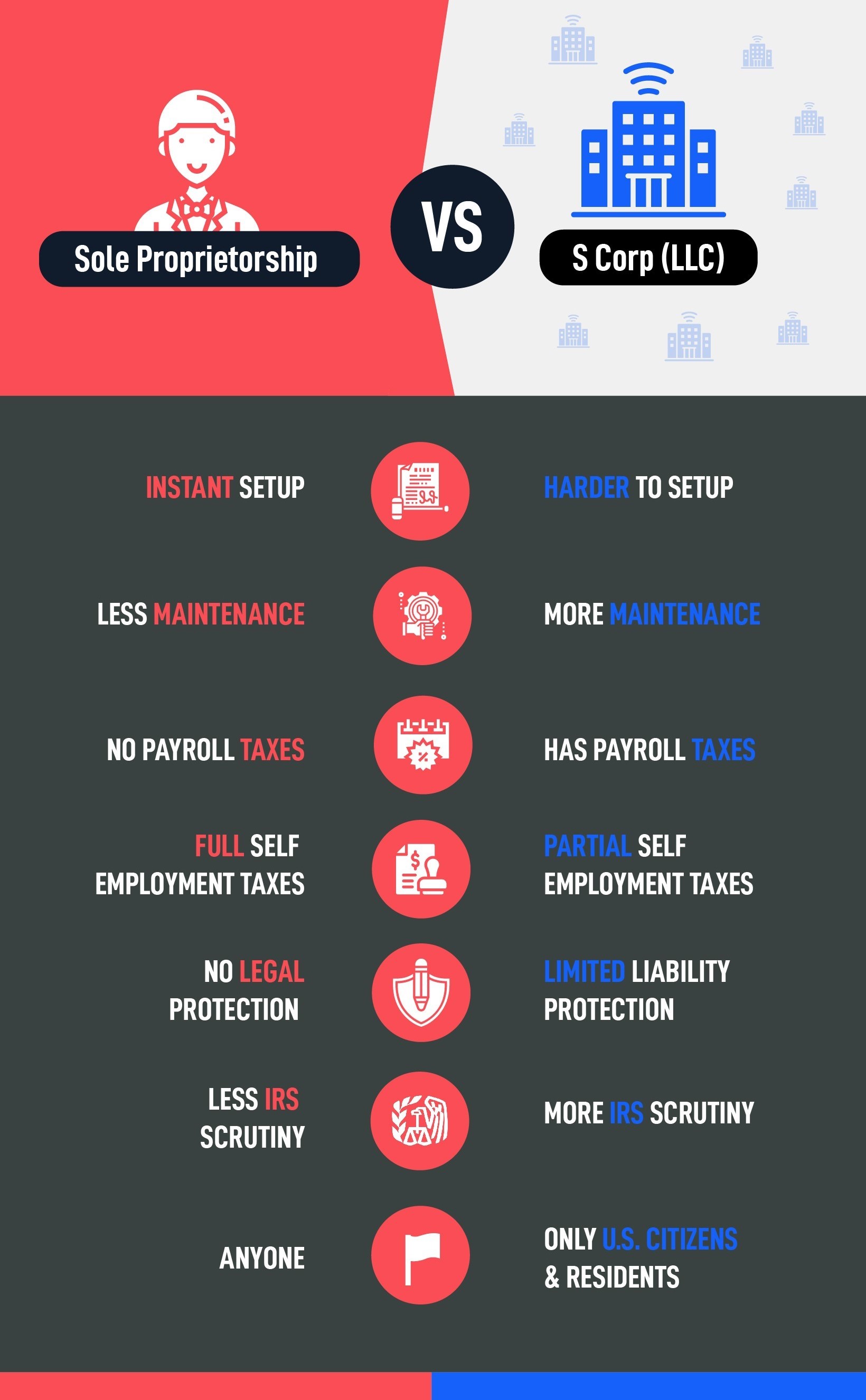

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

owner draw quickbooks scorp Arlinda Lundberg

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

What Is An S Corp?

.png)

Reasonable salaries What every S corp owner needs to know Finaloop

I own an SCorp, how do I get paid? ClearPath Advisors

owner draw quickbooks scorp Anton Mintz

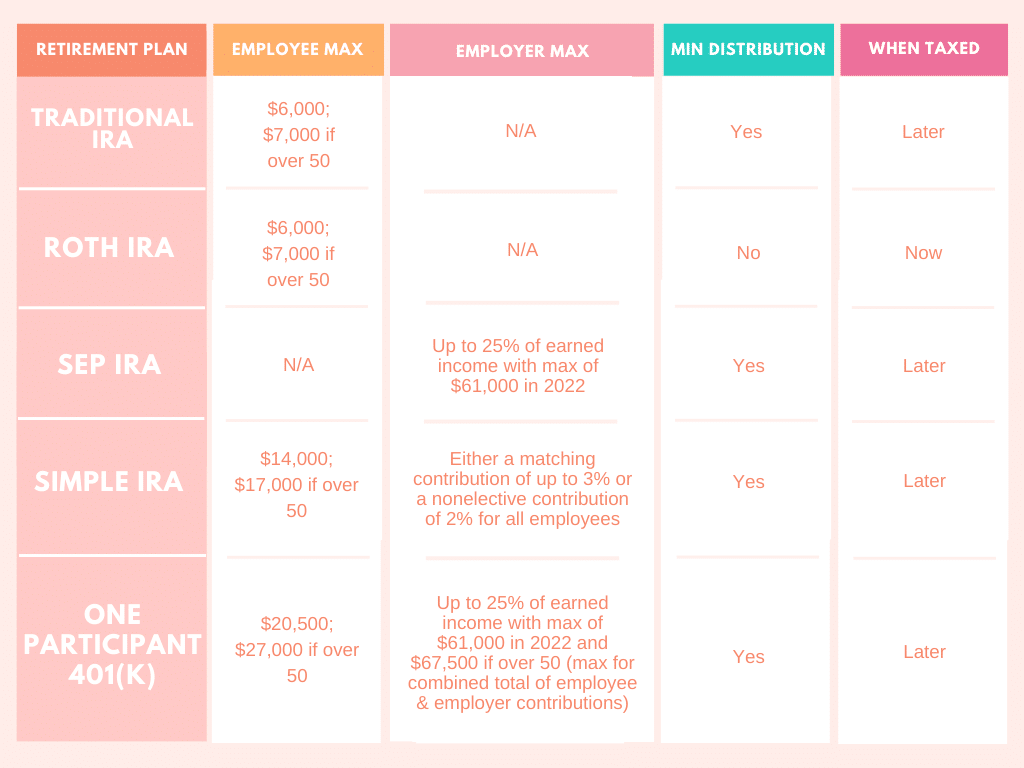

Retirement Account Options for the SCorp Owner

Owner Draw Quickbooks Scorp DRAWING IDEAS

Owner Draw Quickbooks Scorp DRAWING IDEAS

If The Irs Determines That You Are Underpaying Yourself As A Way To Evade Payroll Taxes, They Can Take Legal Action.

The Business’s Profits And Losses Are Passed Through To The Owner).

Web Section 1368 Notes The Distribution By An S Corporation Of Property Or Cash May Result In Three Distinct Tax Consequences To The Shareholder Receiving The Distribution.

From There, She Could Do The Math To Determine What Her.

Related Post: