S Corp Owners Draw

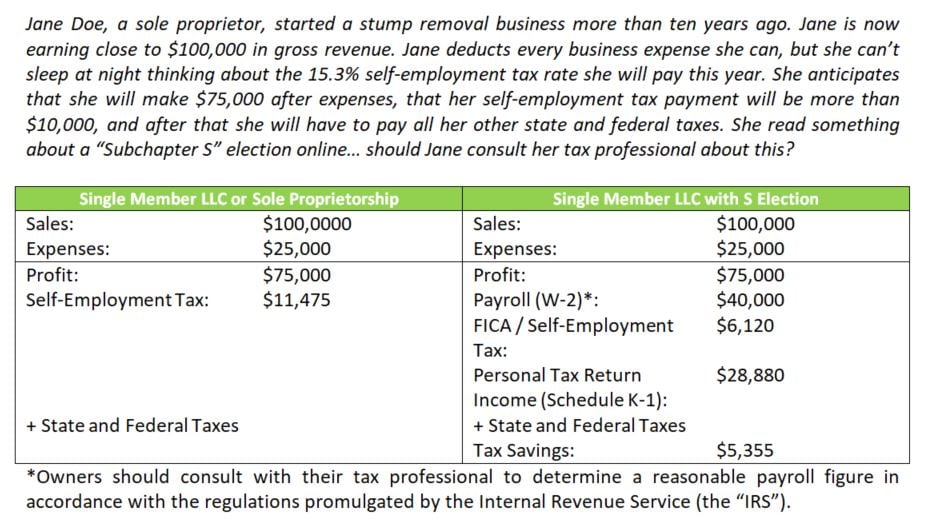

S Corp Owners Draw - Are usually either for estimated taxes, due to a specific event, or from business growth. However, corporation owners can use salaries and dividend distributions to pay themselves. Web when setting up an owner's draw, you'll want to set it up as an equity account instead of an expense. How an owner’s draw affects taxes. Reduce your basis (ownership interest) in the company because they. Instead, you must pay two kinds of taxes on your business's profits: By salary, distributions or both. Web a business owner might opt for an s corp tax election for an llc or corporation for several reasons. Web if you’re the owner of an s corp, and actively engaged in business operations, you’ll need to pay yourself a salary—and not an owner’s draw. Web s generates $100,000 of taxable income in 2011, before considering a’s compensation. Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. Web in illinois, as an s corp owner, you are exempt from paying the illinois corporate tax rate, which is 9.5%. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare).. You can, however, take shareholder distributions from your business in addition to your salary. What is the best way to pay yourself as a business owner? Web an owner's draw is money taken out of a business for personal use. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal. Reduce your basis (ownership interest) in the company because they. If there’s additional profit in the business, you can take those as distributions, which come with a lower tax bill. A reports $100,000 of wage income on his individual income tax return, and s and a are liable for the necessary payroll taxes. Many small business owners compensate themselves using. Typically, owners will use this method for paying themselves instead of taking a regular salary, although an owner's draw can also be taken in addition to receiving a regular salary from the business. Web how are s corp distributions taxed? Web if you’re the owner of an s corp, and actively engaged in business operations, you’ll need to pay yourself. Create a new account for the owner's draw and set it up as an owner's equity account. Web what is the difference between taking an owners draw and paying a shareholder? Web an owner’s draw refers to an owner taking funds out of the business for personal use. It is vital to note that an owner’s draw differs from a. What is the salt cap? You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). Web what is the difference between taking an owners draw and paying a shareholder? However, corporation owners can use salaries and dividend distributions to pay themselves. Reduce your basis (ownership. Do sole proprietors pay more taxes than s corps? Web a business owner might opt for an s corp tax election for an llc or corporation for several reasons. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. Web s. Web a business owner might opt for an s corp tax election for an llc or corporation for several reasons. A reports $100,000 of wage income on his individual income tax return, and s and a are liable for the necessary payroll taxes. I take it that you've already entered the withdrawal as an expense transaction. By salary, distributions or. S corp is a tax treatment, meaning it determines how you’re taxed by the irs. Web s corporation owners can draw on social security, but if earnings exceed certain thresholds, benefits may be taxed. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). How. Web can i take both an owner's draw and a salary in an s corp? Yes, but it's advisable to pay yourself a reasonable salary first to avoid potential irs scrutiny. I take it that you've already entered the withdrawal as an expense transaction. Are usually either for estimated taxes, due to a specific event, or from business growth. How. Web an s corp owner has to receive what the irs deems a “reasonable salary” — basically, a paycheck comparable to what other employers would pay for similar services. Web what is the difference between taking an owners draw and paying a shareholder? Are usually either for estimated taxes, due to a specific event, or from business growth. Web an owner’s draw refers to an owner taking funds out of the business for personal use. The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business. Web an owner's draw is money taken out of a business for personal use. Instead, you must pay two kinds of taxes on your business's profits: Web an owner’s draw is simply a distribution of profits from the s corporation to its owners. Web an owner's draw is a way for a business owner to withdraw money from the business for personal use. S corp is a tax treatment, meaning it determines how you’re taxed by the irs. My figure comes from researching actual irs cases. How an owner’s draw affects taxes. Typically, owners will use this method for paying themselves instead of taking a regular salary, although an owner's draw can also be taken in addition to receiving a regular salary from the business. You can, however, take shareholder distributions from your business in addition to your salary. Any additional compensation can be taken as an owner's draw. This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations.

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

Owner Draw Quickbooks Scorp DRAWING IDEAS

What is an S Corp and Why Should You Consider One

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

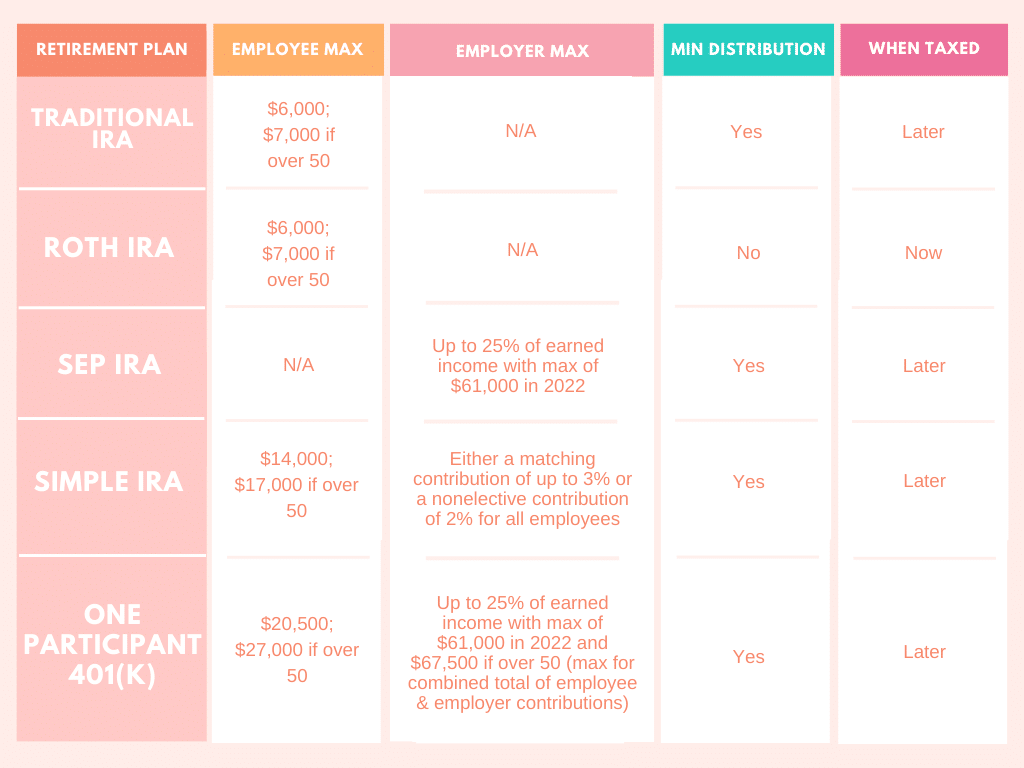

Retirement Account Options for the SCorp Owner

Owner Draw Quickbooks Scorp DRAWING IDEAS

I own an SCorp, how do I get paid? ClearPath Advisors

owner's drawing account definition and Business Accounting

Owner's Draws What they are and how they impact the value of a business

owner draw quickbooks scorp Anton Mintz

It Is Vital To Note That An Owner’s Draw Differs From A Salary.

I Take It That You've Already Entered The Withdrawal As An Expense Transaction.

Web S Generates $100,000 Of Taxable Income In 2011, Before Considering A’s Compensation.

By Salary, Distributions Or Both.

Related Post: