Sample Nonprofit Chart Of Accounts

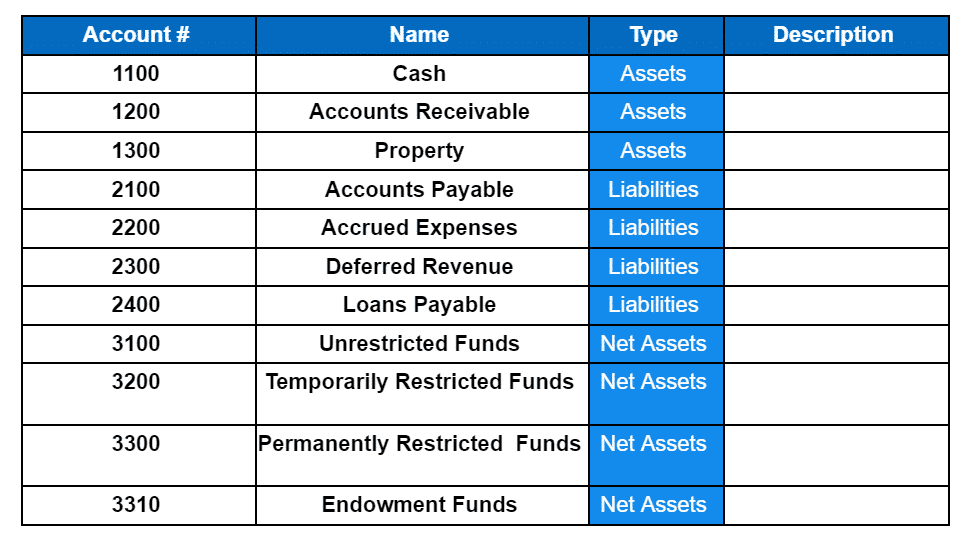

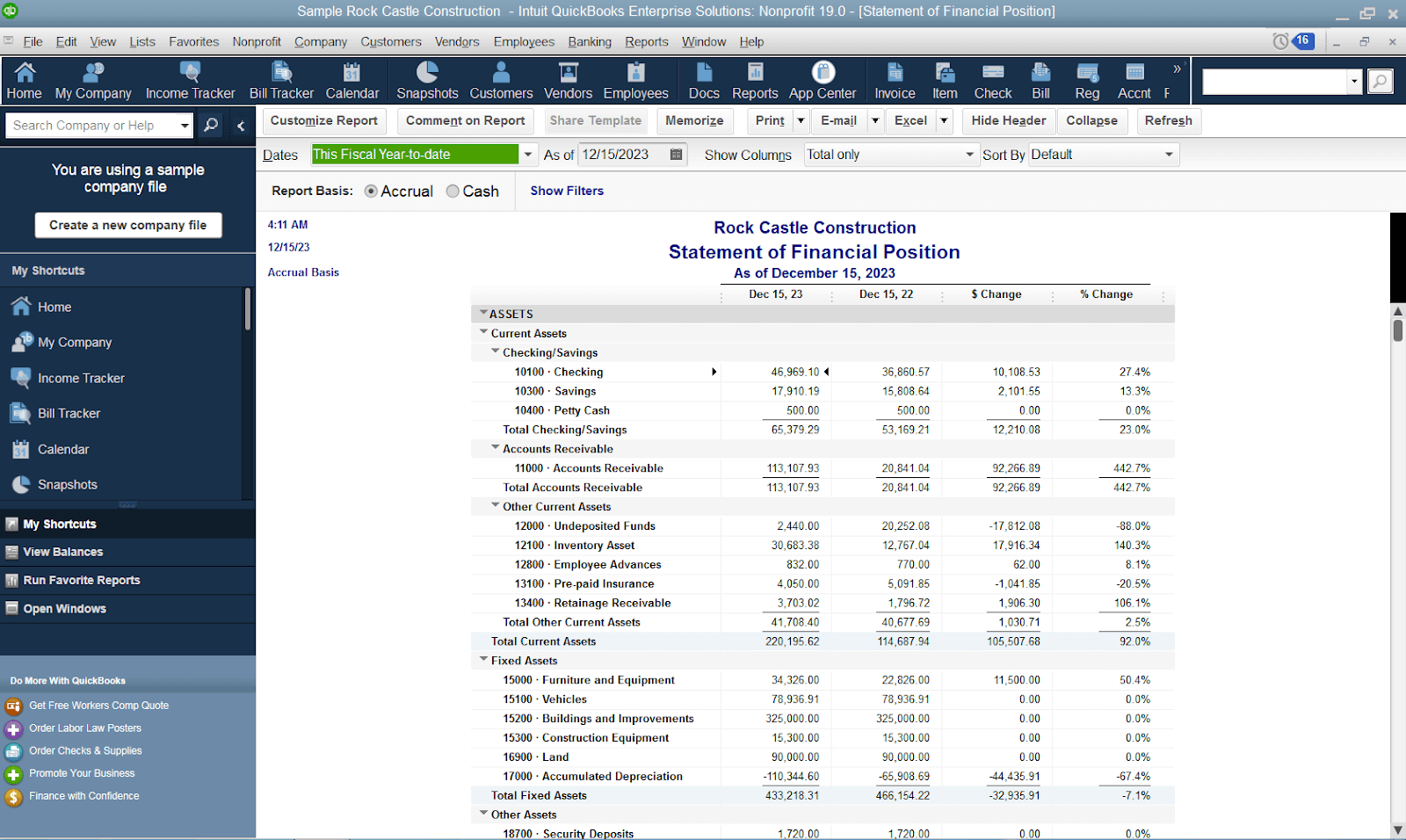

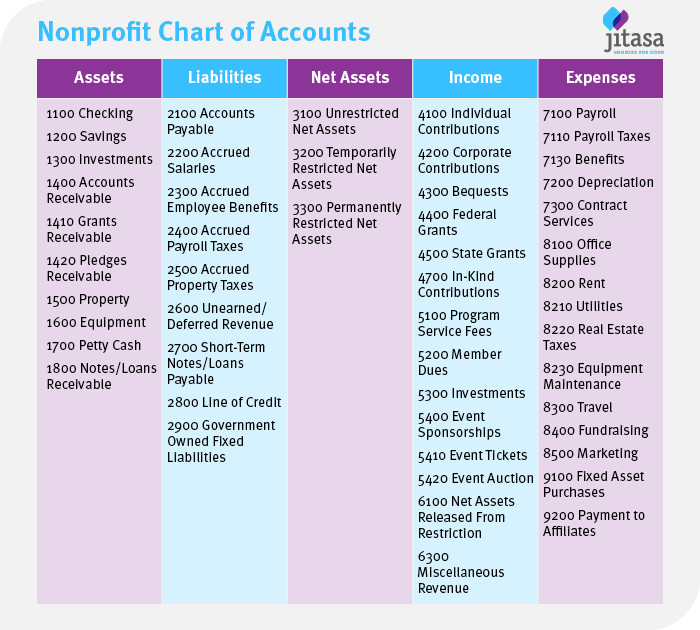

Sample Nonprofit Chart Of Accounts - Asset = what you own = 1000 range. But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. Web in a nonprofit’s chart of accounts, each account is identified in four ways: The second resource will give you spreadsheets that you can download and use as a learning aid. Use the list above as a guideline, and think. Web nonprofit chart of accounts examples. Reporting is critical for nonprofit financial management, and having the right accounts enables accurate reports. The chart of accounts is a foundational part of your financial management system. A coa categorizes an expense. Get all the details in this blog. Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. Equity = overall worth = 3000 range. It defines classes of items your accounting system will use to aggregate transactions into your organization’s financial reporting. Web the chart of accounts (or coa) is a. Expenses that are expected to be reimbursed. Equity = overall worth = 3000 range. Your nonprofit might have different types of revenue and expenses or own different assets that will alter your chart of accounts. Get all the details in this blog. When accounts are created in an accounting system, they are organized using names and numbers. Number, name, category type, and a short description. What accounts are needed for financial reporting? A markup could be included with this. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including: Purpose of the nonprofit chart of accounts; Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Accounts represent five areas of your organization that you need to track: Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. Web the account numbers, account number ranges,. A nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Asset = what you own = 1000 range. This comprehensive tool allows you to categorize financial activity by class, location, and project, giving you a clear and detailed view of your organization's financial performance. Account numbers are, for the most part, up. What is the chart of accounts for nonprofits. Equity = overall worth = 3000 range. Use the list above as a guideline, and think. When accounts are created in an accounting system, they are organized using names and numbers. See the attached screenshot below for your visual reference. Number, name, category type, and a short description. However, the standard number ranges applied to each account is as follows: But why should it matter to your nonprofit, and how will you create and maintain one? Web examples of a nonprofit chart of accounts. Web nonprofit chart of accounts examples. Web the account numbers, account number ranges, account names, breakdowns of each account category, and account descriptions will vary based on the nonprofit's structure and needs. Web a chart of accounts (coa) is a list of financial accounts that helps nonprofits keep track of their transactions. It defines classes of items your accounting system will use to aggregate transactions into. What is a nonprofit chart of accounts? Web in a nonprofit’s chart of accounts, each account is identified in four ways: Following are some examples of a nonprofit coa (or budget) below. What is the chart of accounts for nonprofits. Use the list above as a guideline, and think. Web the nonprofit chart of accounts is a crucial tool, offering a structured method to keep track of financial transactions, including payroll taxes, ensuring efficient financial management, regulatory adherence, and accurate reporting. A markup could be included with this. The second resource will give you spreadsheets that you can download and use as a learning aid. The following chart of. What accounts are needed for financial reporting? Web the nonprofit chart of accounts is a crucial tool, offering a structured method to keep track of financial transactions, including payroll taxes, ensuring efficient financial management, regulatory adherence, and accurate reporting. The chart of accounts is a foundational part of your financial management system. Account numbers are, for the most part, up to you and how you would like to organize them. Users use this non profit accounting template at their own risk. Expenses that are expected to be reimbursed. A coa categorizes an expense. Web examples of a nonprofit chart of accounts. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. See the attached screenshot below for your visual reference. Expenses incurred on behalf of the client: Nonprofit chart of accounts example; Reporting is critical for nonprofit financial management, and having the right accounts enables accurate reports. Web on the other hand, i can provide the sample chart of accounts for nonprofit organizations. This comprehensive tool allows you to categorize financial activity by class, location, and project, giving you a clear and detailed view of your organization's financial performance. Web in this guide, we’ll cover the basics of the nonprofit chart of accounts, including:

Nonprofit Accounting Software > QuickBooks® Enterprise Industry Solutions

The Beginner’s Guide to Nonprofit Chart of Accounts

Sample Nonprofit Chart Of Accounts Quickbooks

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

Sample Nonprofit Chart Of Accounts Quickbooks

Nonprofit Chart of Accounts How to Get Started + Example

sample nonprofit chart of accounts

Example Of Chart Of Accounts For Nonprofit

Chart Of Accounts For Nonprofit Sample

When Accounts Are Created In An Accounting System, They Are Organized Using Names And Numbers.

Web Nonprofit Chart Of Accounts Examples.

Liability = What You Owe = 2000 Range.

Use The List Above As A Guideline, And Think.

Related Post: