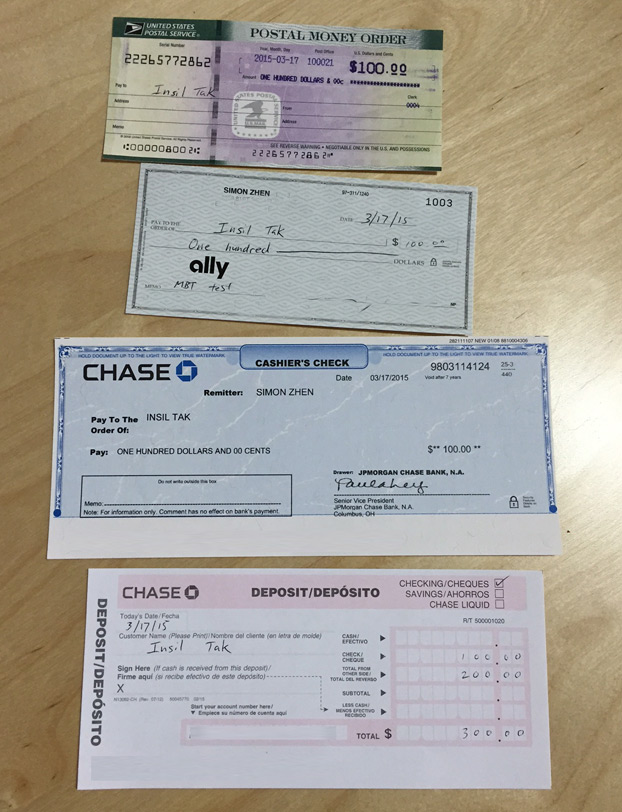

Sender Drawer Money Order Chase

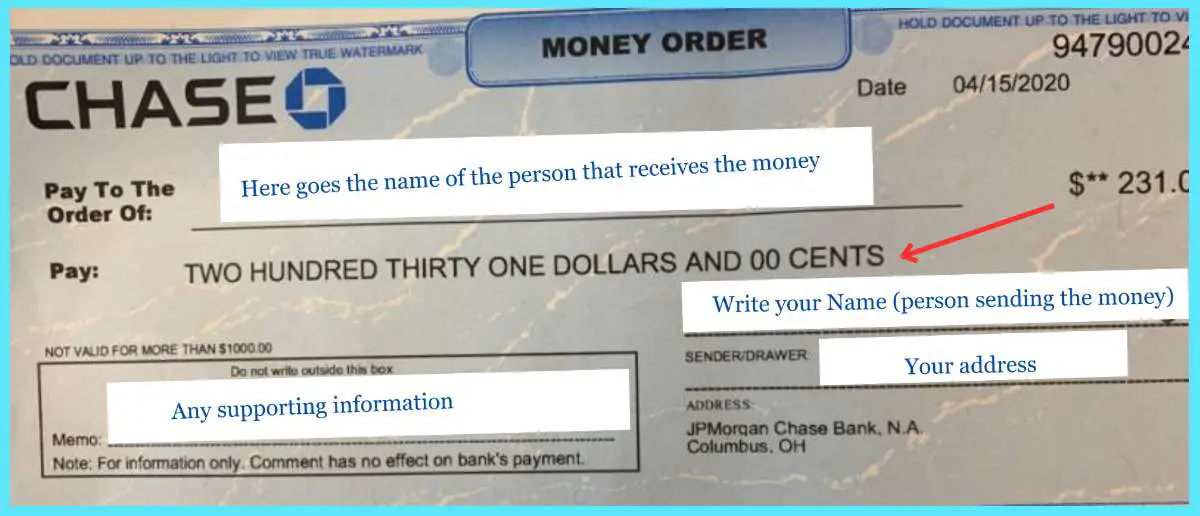

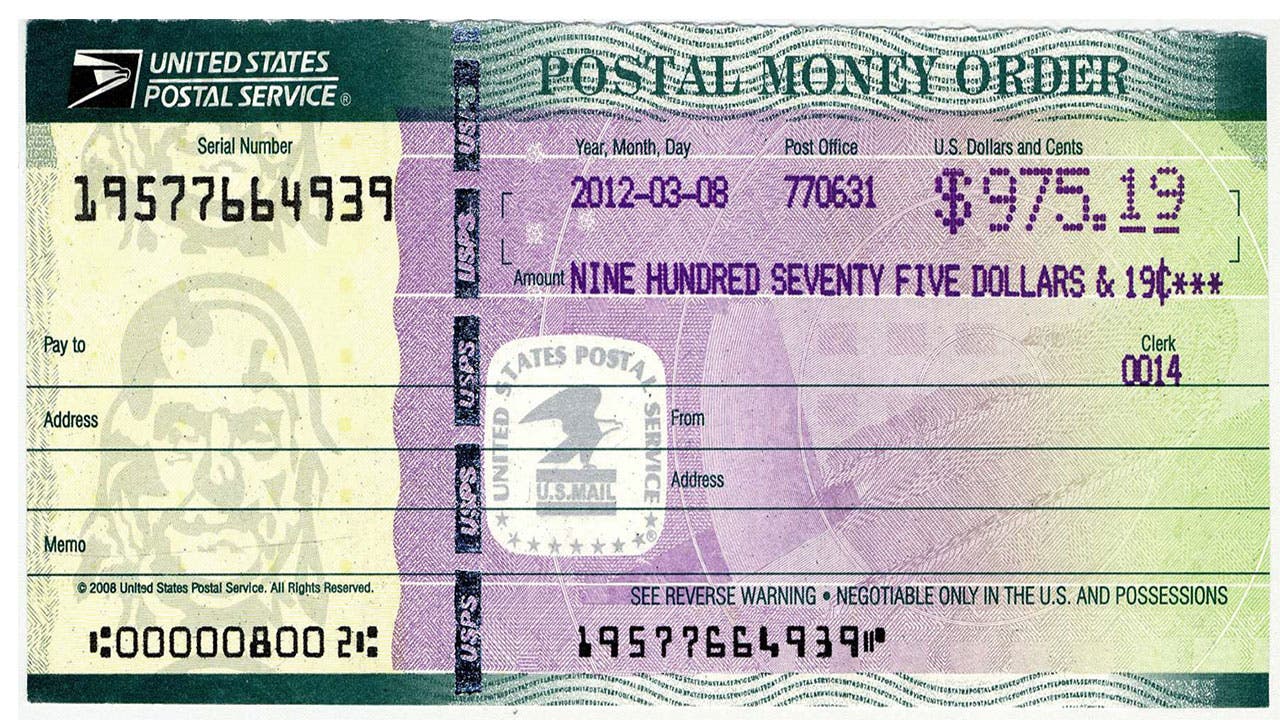

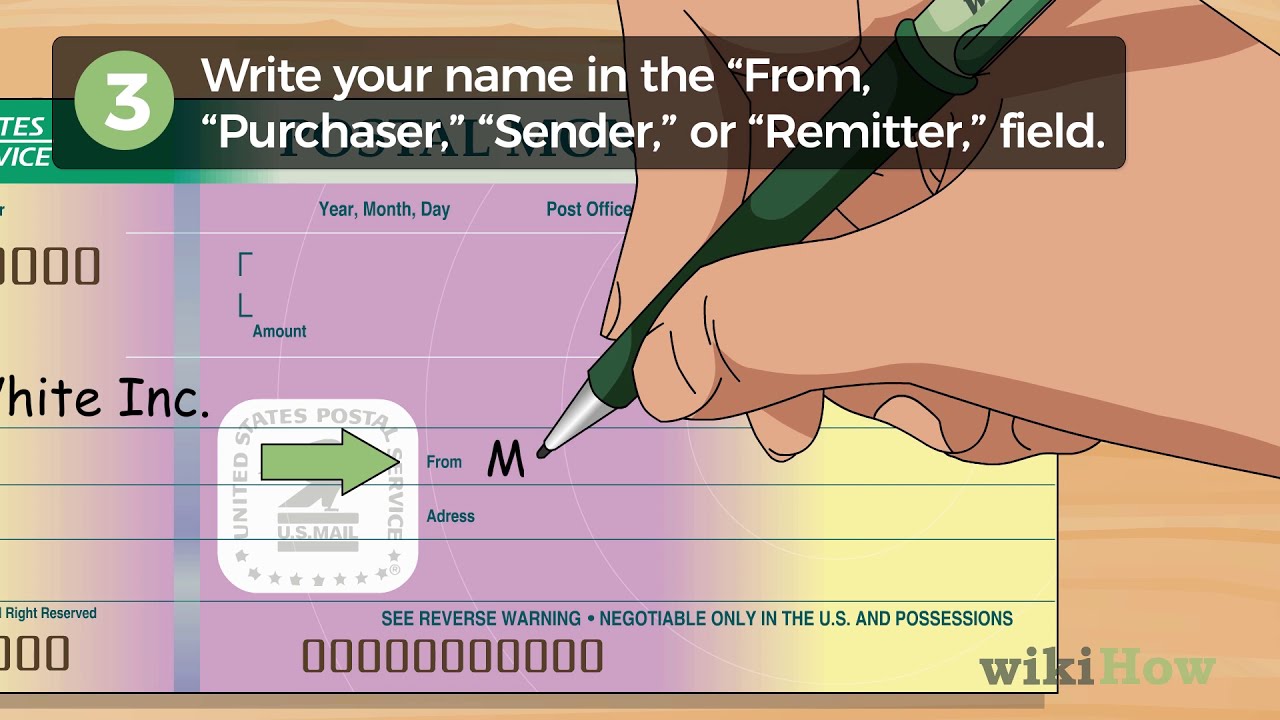

Sender Drawer Money Order Chase - Web however, keep in mind online orders have $7.50 fee and a maximum order limit of $1,500. Fees vary widely based on the transaction amount, location, purchase method and transfer method. If you’re paying a business, use the business’s name. Money orders offer a secure alternative to cash or checks, allowing you to make payments without the need for a bank account. Fill in your address where the money. Depending on the institution that you are working with, there will be one of two fields: Fill in the recipient's name. Print the name clearly and use ink. The purchaser of a money order needs to follow some precise steps to complete the. You would need to confirm this information based on. Are you looking for a safe and reliable way to make payments or send money? Most money orders require the name of the recipient, your address, and your signature, with space for a memo or your account number if you’re paying a bill. In the field labeled “pay to the order of” or pay to”. Money orders make payments easy,. A money order is a negotiable instrument. Print the name clearly and use ink. Write the recipient’s name & address. Are you looking for a safe and reliable way to make payments or send money? A money order requires just a few pieces of information, including the payee. Filling out a money order is pretty simple. Write the recipient’s information clearly and correctly. Web fill in the recipient’s name. Web what is the correct way of filling a chase money order to uscis? Fill out the purchaser’s address and/or the recipient’s address. If it is blank, the money order can be cashed by anyone and you're losing out on its primary security feature. Include your address in the purchaser section. A money order requires just a few pieces of information, including the payee. Web if you need to send money through the mail or to someone who doesn’t have a bank account,. Web don't leave the payee field blank; Fill in the recipient's name. Filling out a money order. I know that the 'pay to the order of' line should say 'u.s. If you’re paying a business, use the business’s name. Fill in the recipient's name. Print the name clearly and use ink. Chase bank offers money orders to its customers. As with personal checks, the first line on a money order will. Web fees range from $0 to $5 for money orders up to $1,000. Write the name of the person or company you’re sending the money to on the line labeled “pay to the order of,” “pay to, or “payee.” address information: Most money orders require the name of the recipient, your address, and your signature, with space for a memo or your account number if you’re paying a bill. Print the name and. Print your full name and address on the from and address lines. Web fees range from $0 to $5 for money orders up to $1,000. Chase bank offers money orders to its customers. In the field labeled “pay to the order of” or pay to”. Put the name of the person or business to receive the money order that you. Fill in your name in the from, purchaser or purchaser, signer for drawer field, though this. Web money orders are a safe alternative to cash or checks. A money order requires just a few pieces of information, including the payee. The name that you add here could be either a business or a person’s name. Web don't leave the payee. Print the name and address of the recipient on the pay to and address lines. “pay to the order of,” or “pay to.”. This section might be titled “pay to the order of,” “pay to,” or “payee.”. Fill out the purchaser’s address and/or the recipient’s address. You’ll need to know how to fill out a money order before you can. Frequently asked questions (faqs) photo: Web a money order is a secure form of payment you can use in place of checks, cash or credit cards. Chase money orders might be the solution you’re seeking. As with personal checks, the first line on a money order will. Fees vary widely based on the transaction amount, location, purchase method and transfer method. Make sure that the name of the person is spelled correctly and that you’ve written it in ink, legibly. Web information to fill out a money order. Put the name of the person or business to receive the money order that you are paying. I know that the 'pay to the order of' line should say 'u.s. Web write the name of the recipient, the person whom you are paying, in the “pay to” or “pay to the order of” field. This indicates who is authorized to deposit or cash the money order. Web however, keep in mind online orders have $7.50 fee and a maximum order limit of $1,500. Fill in your name in the from, purchaser or purchaser, signer for drawer field, though this. You'll want to fill out each line of your money order with a pen in large and legible letters. Web fees range from $0 to $5 for money orders up to $1,000. A money order is a negotiable instrument.

How to Fill Out a Chase Money Order. A Friendly Guide The Wealth Seeds

How to Send Money with Zelle® Chase Mobile® App YouTube

How To Fill Out A Money Order

How to Transfer Money Between Accounts Chase Mobile® App YouTube

How to make goo materials, how to train pointer dog for hunting coyotes

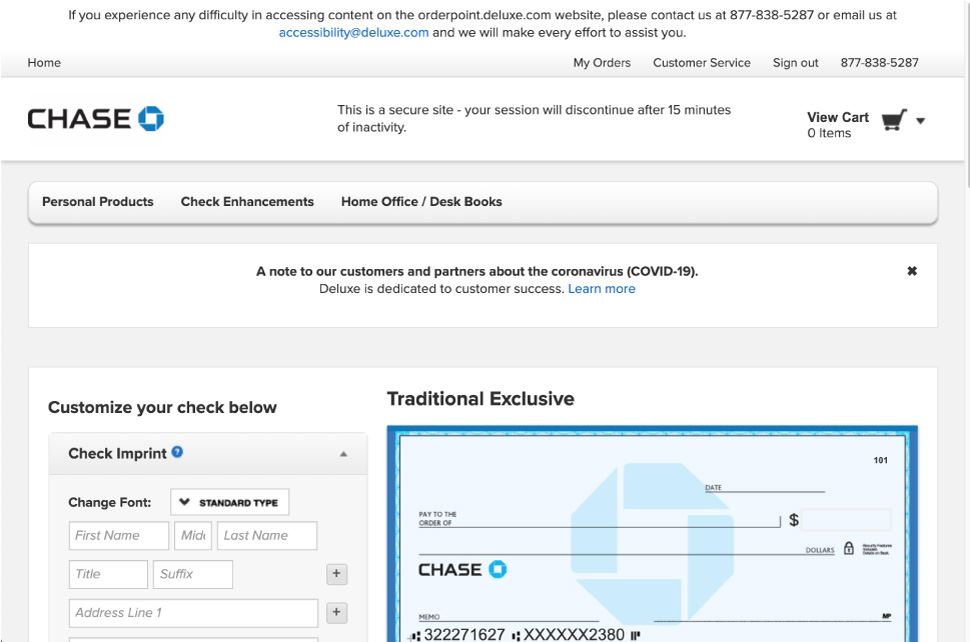

How To Fill A Chase Check / Chase Checks Examples Nengu / If you're not

How to write a money order from chase bank forex vacancies in cyprus

Does the sender endorse a money order? YouTube

How to Fill Out a Money Order YouTube

How To Fill Out A Chase Money Order Chase Pay Vs Chase Quickpay

Are You Looking For A Safe And Reliable Way To Make Payments Or Send Money?

The Name That You Add Here Could Be Either A Business Or A Person’s Name.

Fill In The Recipient's Name.

If It Is Blank, The Money Order Can Be Cashed By Anyone And You're Losing Out On Its Primary Security Feature.

Related Post: