Sequence Of Return Risk Chart

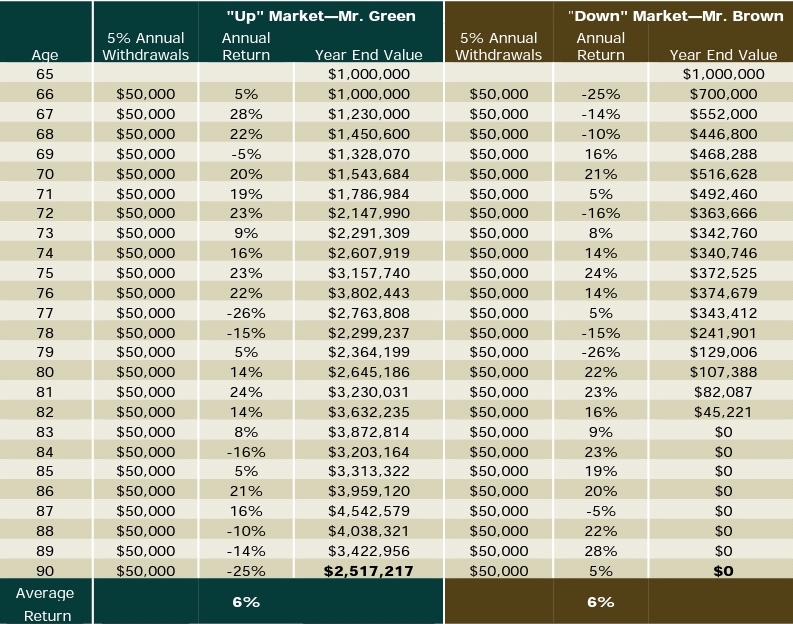

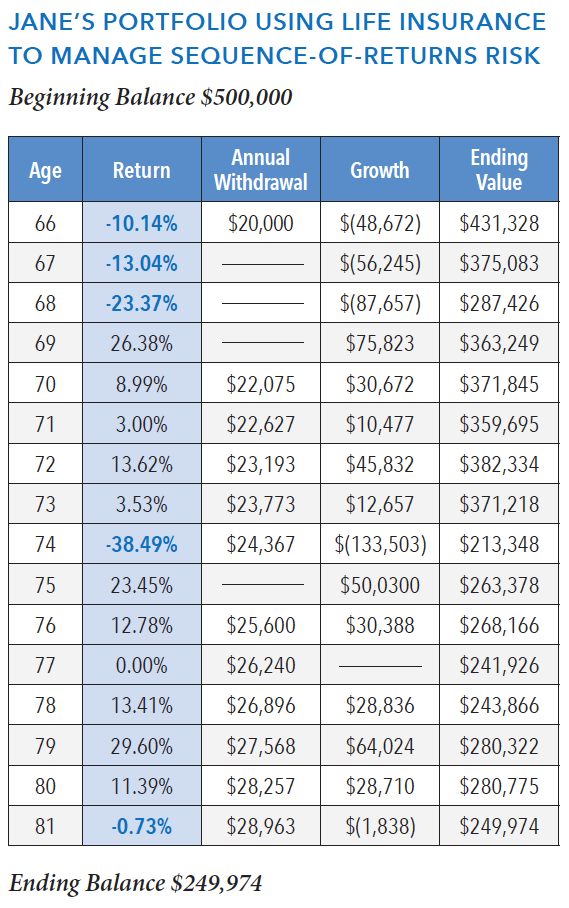

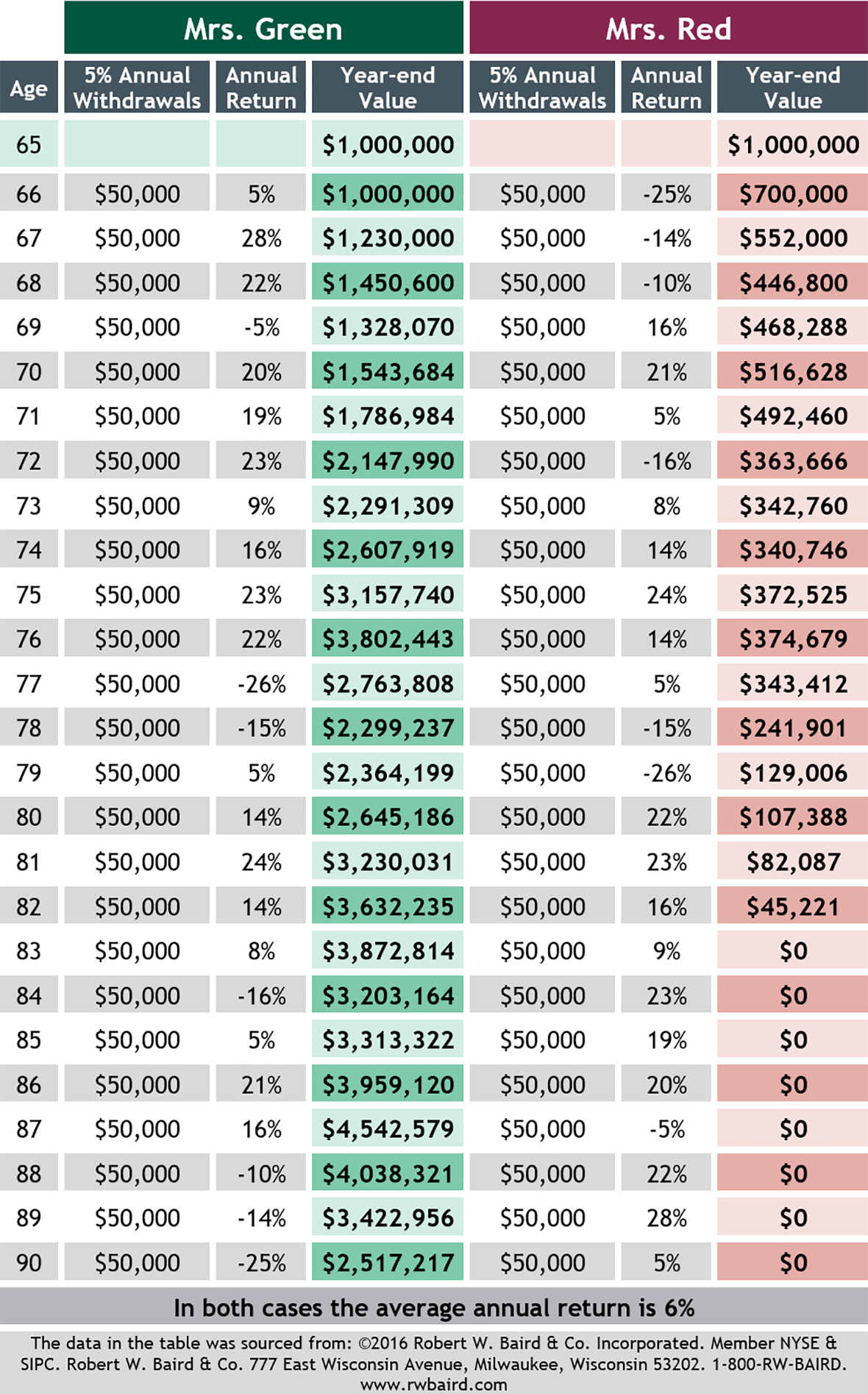

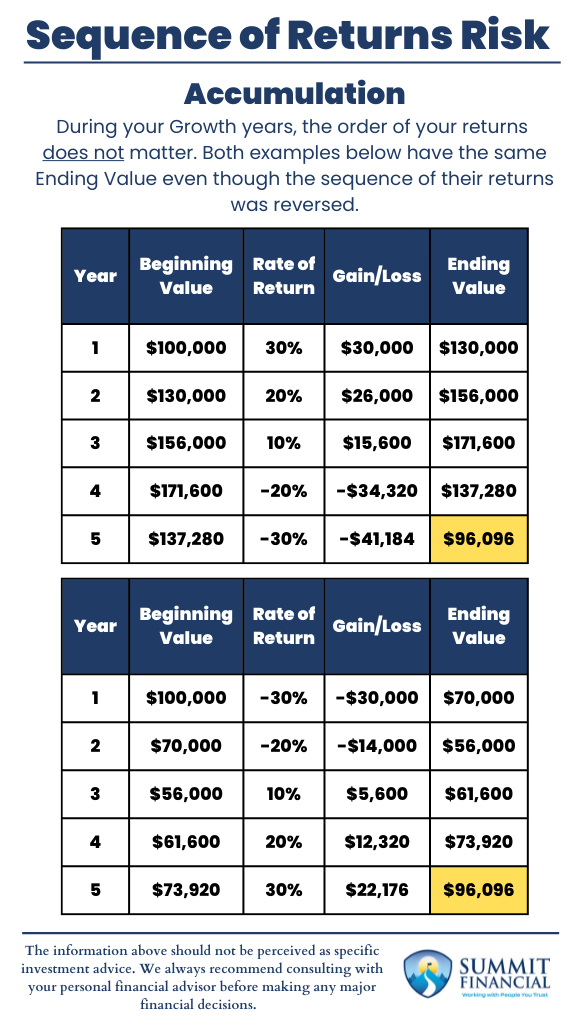

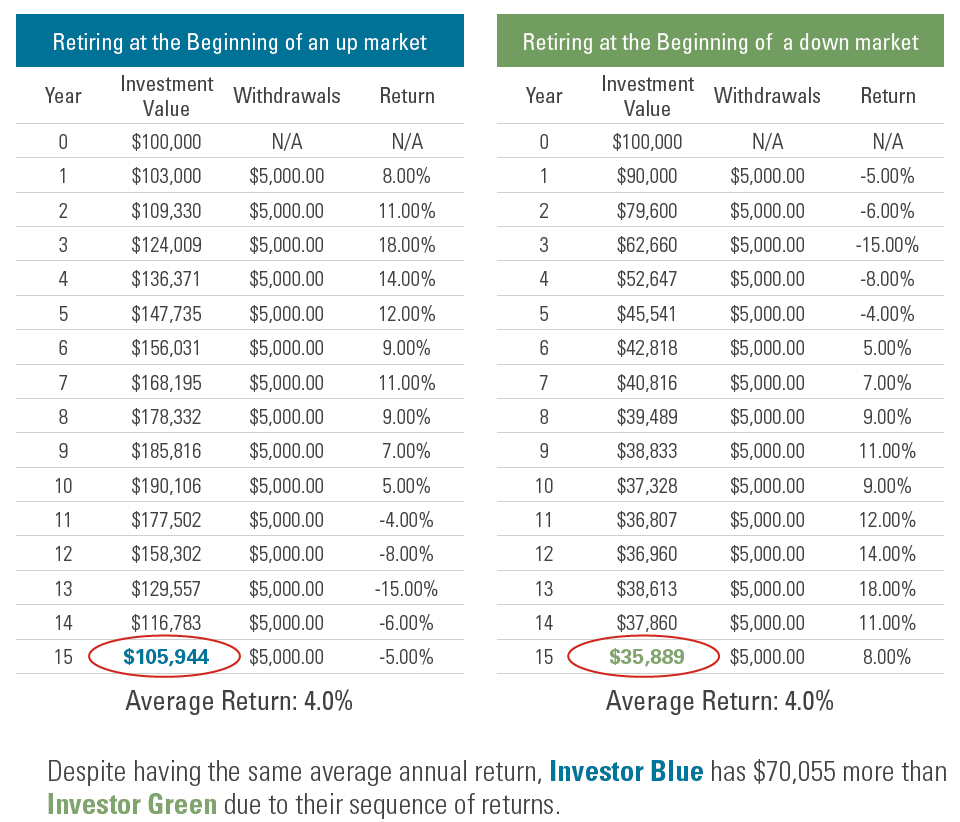

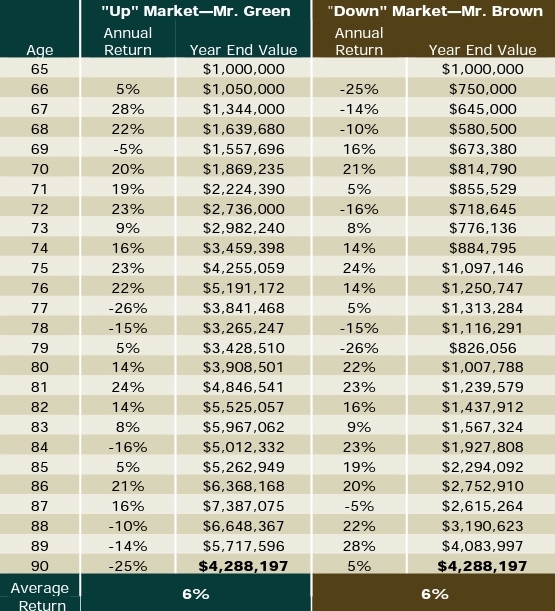

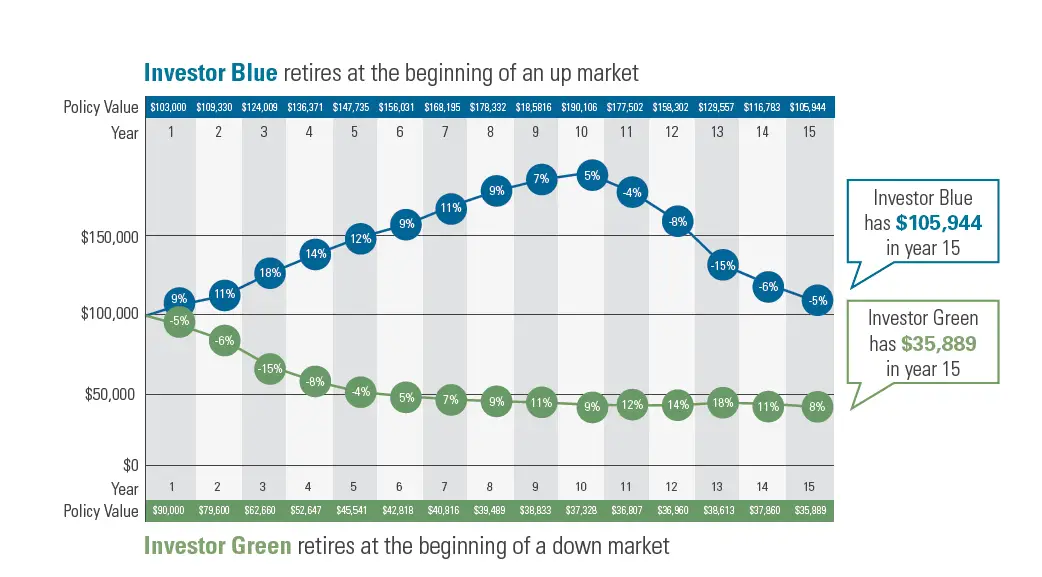

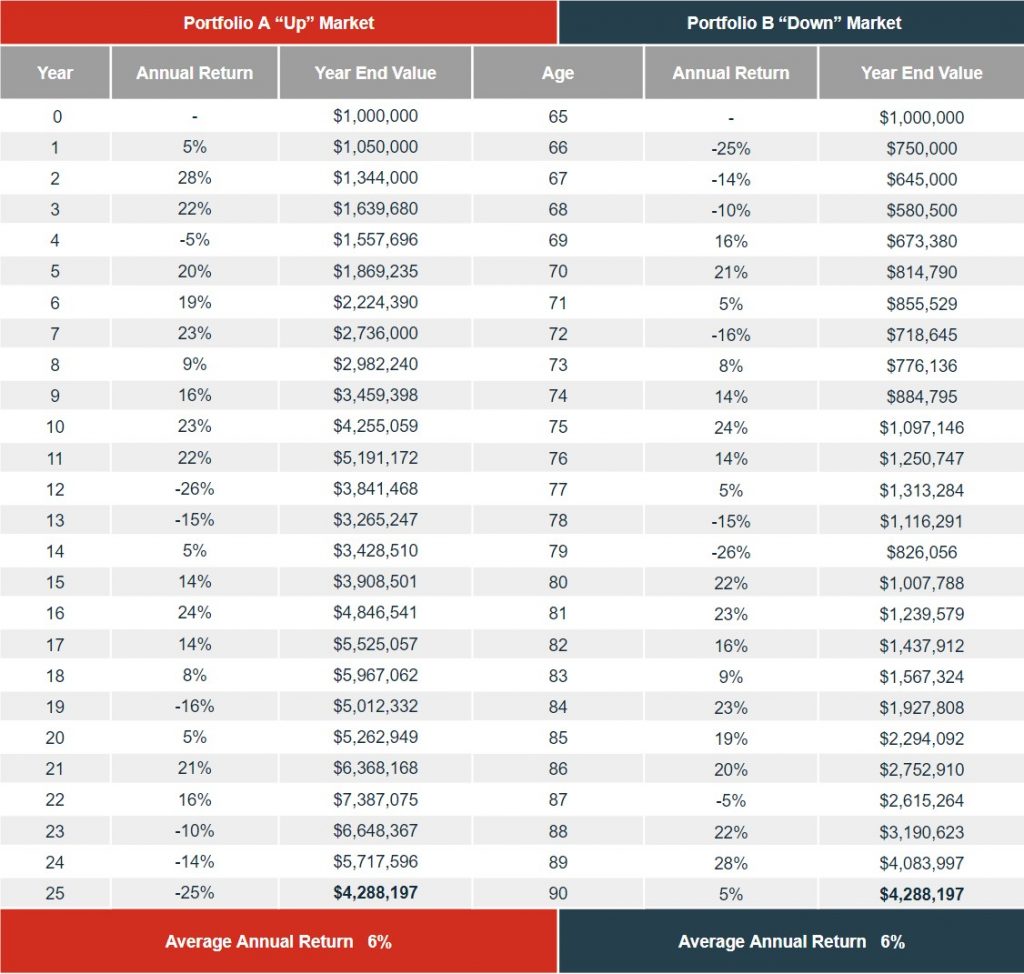

Sequence Of Return Risk Chart - The hypothetical retiree’s initial spend is 5% of their portfolio value. Web sequence of returns risk: Web sequence of returns risk refers to the fact that the order, or sequence, of your portfolio’s returns over time, when paired with withdrawals, can have a significant. Sequence risk is the danger that the timing of withdrawals from a. When you’re far away from retirement. Web sequence of returns risk is the dynamic an investor faces if the market suffers major losses in the early retirement years, which shortens the life of a portfolio, even when. If we add these up and divide by three, the. We use the same portfolio and return scenarios from figure 1, but instead of withdrawing a. In most retirement withdrawal strategies, such as the 4% rule, the size of annual distributions is adjusted each year by the rate of inflation. Web sequence of returns calculator How to mitigate sequence of return. At issue here is a phenomenon known as sequence of returns risk. When you’re far away from retirement. First, the market returns for this example are: The years 1929 and 1966 exemplify this. Timing and volatility are at the heart of sequence. Example pdf, chart, table & excel. How to mitigate sequence of return. First, the market returns for this example are: Arnott, cfa aug 8, 2021. By ig wealth management • april 2024 • 8 min. What it means and how to deal. Example pdf, chart, table & excel. We use the same portfolio and return scenarios from figure 1, but instead of withdrawing a. Web sequence of returns calculator Web the chart below shows how these two measures help reduce sequence of return risk. The impact of cash flows and sequence of returns on retirement savings. At issue here is a phenomenon known as sequence of returns risk. Web this sequence of return risk calculator demonstrates that the order in which market returns occur can vastly impact the outcome. First, the market returns for this example are: The risk of receiving lower or negative returns early in a period when withdrawals are made from an investment portfolio is known as sequence of. At issue here is a phenomenon known as sequence of returns risk. Web schultz collins sequence of returns risk commentary it’s common for advisors to emphasize that. We use the same portfolio and return scenarios from figure 1, but instead of withdrawing a. Web the chart below shows how these two measures help reduce sequence of return risk. Web what is sequence of returns risk and why is it important? Web sequence of returns risk: Web sequence of returns calculator In most retirement withdrawal strategies, such as the 4% rule, the size of annual distributions is adjusted each year by the rate of inflation. “sequence” refers to the fact that the order and timing of poor investment returns can. The risk associated with your returns coming out of sequence, i.e., the ‘down’ years happening. Web sequence of returns risk refers. The risk associated with your returns coming out of sequence, i.e., the ‘down’ years happening. Web sequence of returns risk refers to the fact that the order, or sequence, of your portfolio’s returns over time, when paired with withdrawals, can have a significant. In most retirement withdrawal strategies, such as the 4% rule, the size of annual distributions is adjusted. If we add these up and divide by three, the. Arnott, cfa aug 8, 2021. The risk of receiving lower or negative returns early in a period when withdrawals are made from an investment portfolio is known as sequence of. As a result, a combination of low market returns with significantly high inflation creates a “perfect storm” for a retirement. As a result, a combination of low market returns with significantly high inflation creates a “perfect storm” for a retirement portfolio. First, the market returns for this example are: Web what is sequence of returns risk and why is it important? When you’re far away from retirement. If we add these up and divide by three, the. Web sequence of returns risk: The impact of cash flows and sequence of returns on retirement savings. As a result, a combination of low market returns with significantly high inflation creates a “perfect storm” for a retirement portfolio. How to mitigate sequence of return. The years 1929 and 1966 exemplify this. In most retirement withdrawal strategies, such as the 4% rule, the size of annual distributions is adjusted each year by the rate of inflation. Web schultz collins sequence of returns risk commentary it’s common for advisors to emphasize that a successful investing strategy involves focusing on returns over the. By ig wealth management • april 2024 • 8 min. When you’re far away from retirement. Web sequence of returns risk is a crucial financial concept in retirement planning, highlighting the risk that the timing of withdrawals from a retirement account. Web the chart below shows how these two measures help reduce sequence of return risk. Web this sequence of return risk calculator demonstrates that the order in which market returns occur can vastly impact the outcome of your retirement and proves returns don’t. Sequence risk is the danger that the timing of withdrawals from a. If we add these up and divide by three, the. What it means and how to deal. The order of when things happen can be your friend or your foe.

What is Sequence of return risk? Why Does it Matter Canady Financial

Sequence Of Return Risk Chart

Explaining Sequence of Return Risk and Possible Solutions Investment

What is Sequence of Returns Risk? Goldenlight Financial Services

Understand Sequence of Returns Risk Summit Financial

What is SequenceofReturns Risk? RetireOne for RIAs

What is Sequence of return risk? Why Does it Matter Canady Financial

Sequence of Return Risk in Retirement Explained

Understanding Sequence of Returns Risk Retirement Tips

Sequence Of Returns Risk How WHEN You Retire Could Make or Break Your

Web Sequence Of Returns Calculator

Example Pdf, Chart, Table & Excel.

The Risk Associated With Your Returns Coming Out Of Sequence, I.e., The ‘Down’ Years Happening.

We Use The Same Portfolio And Return Scenarios From Figure 1, But Instead Of Withdrawing A.

Related Post: