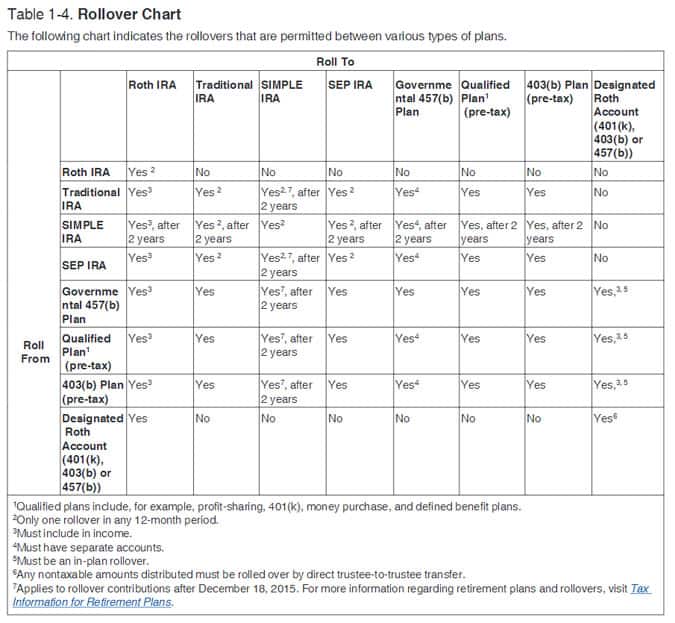

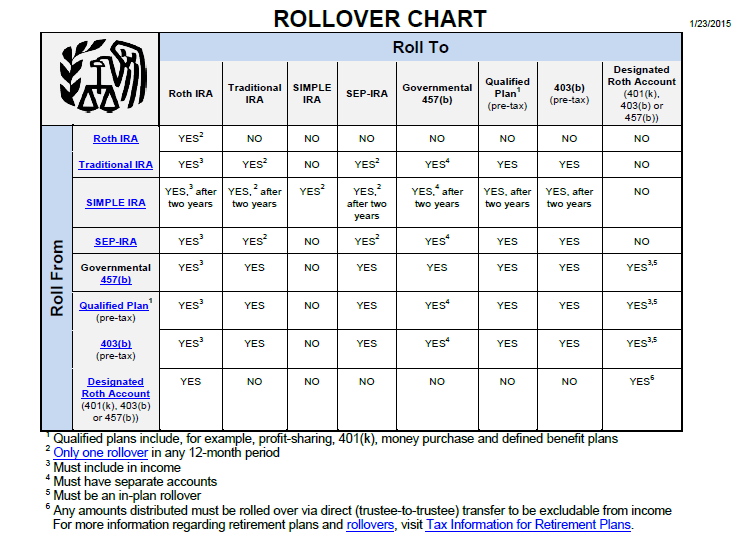

Simple Ira Rollover Chart

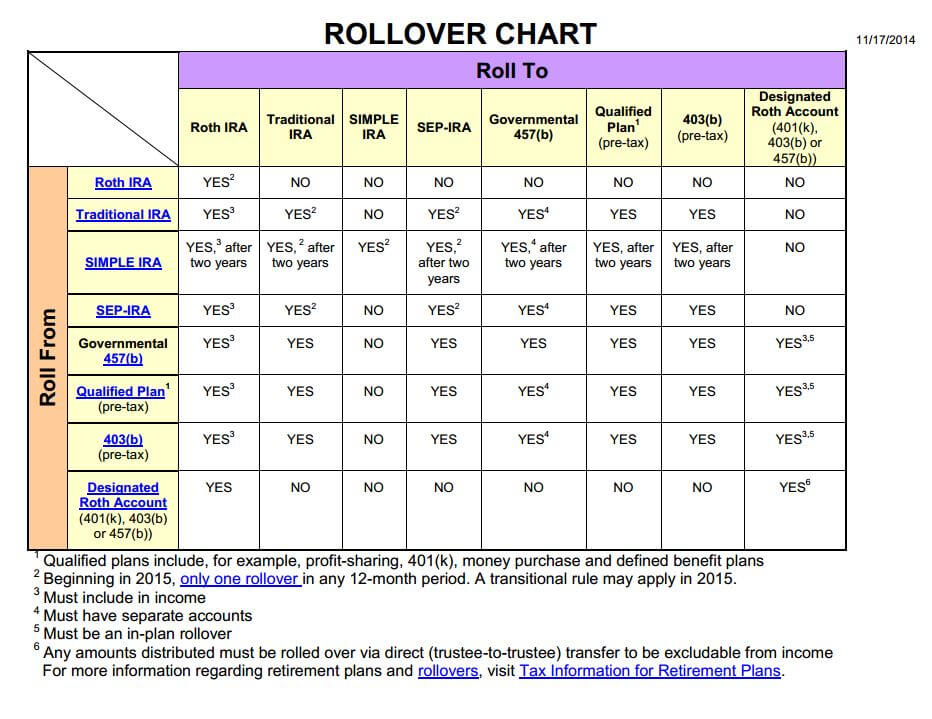

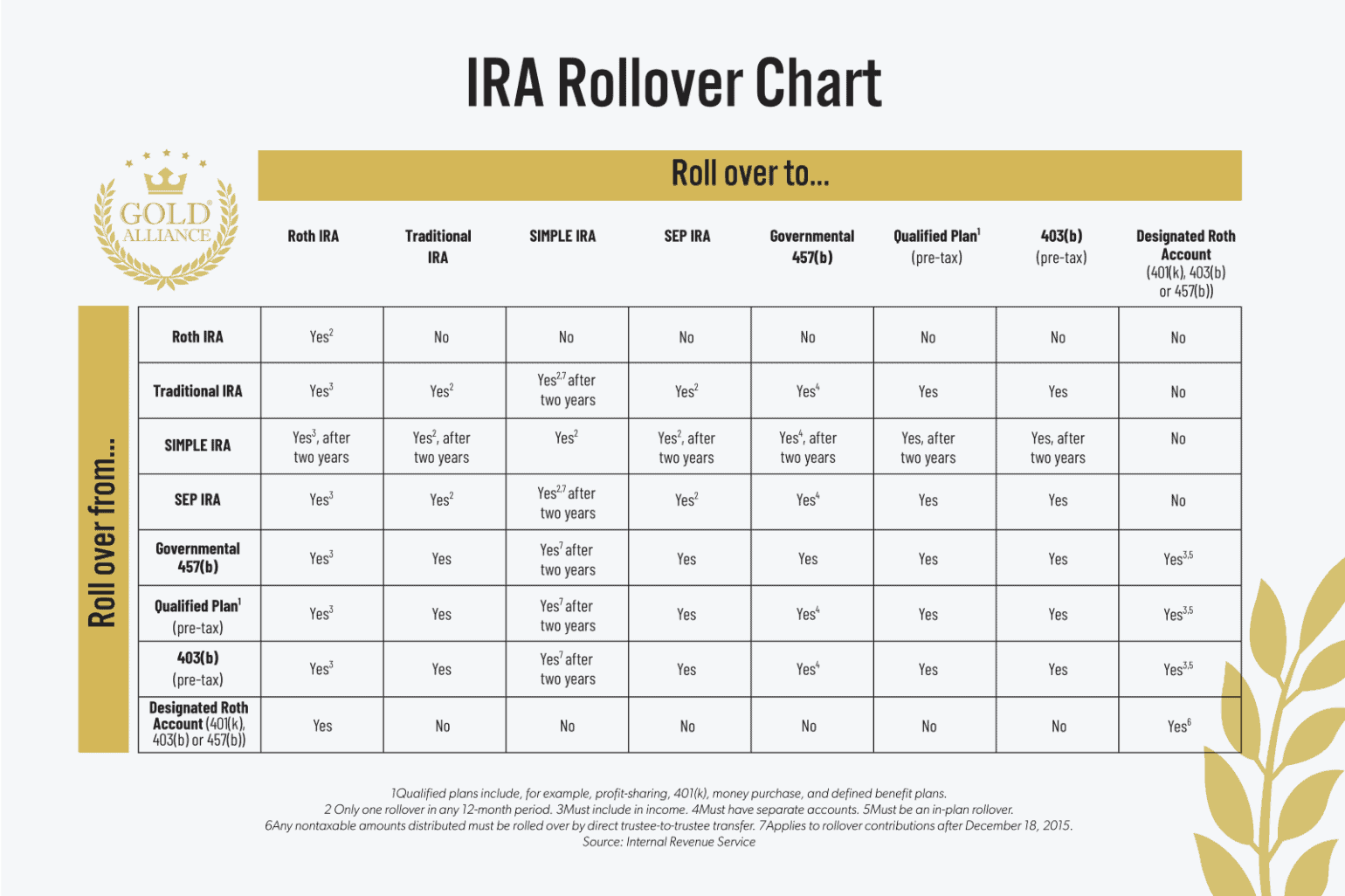

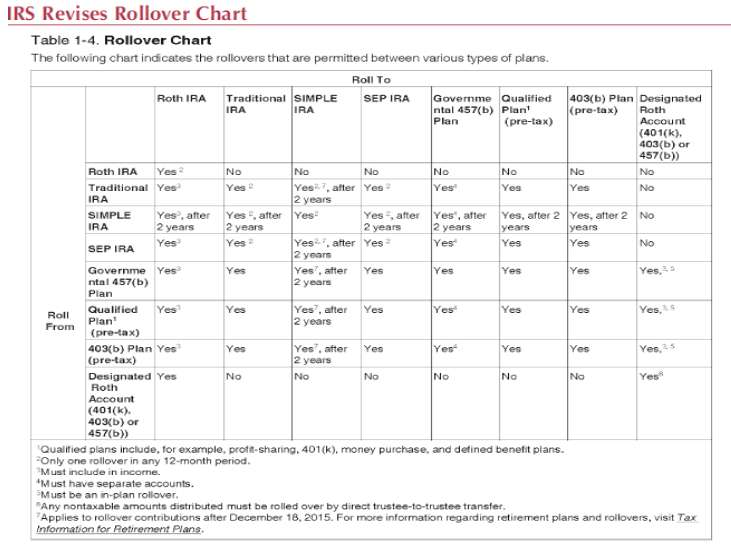

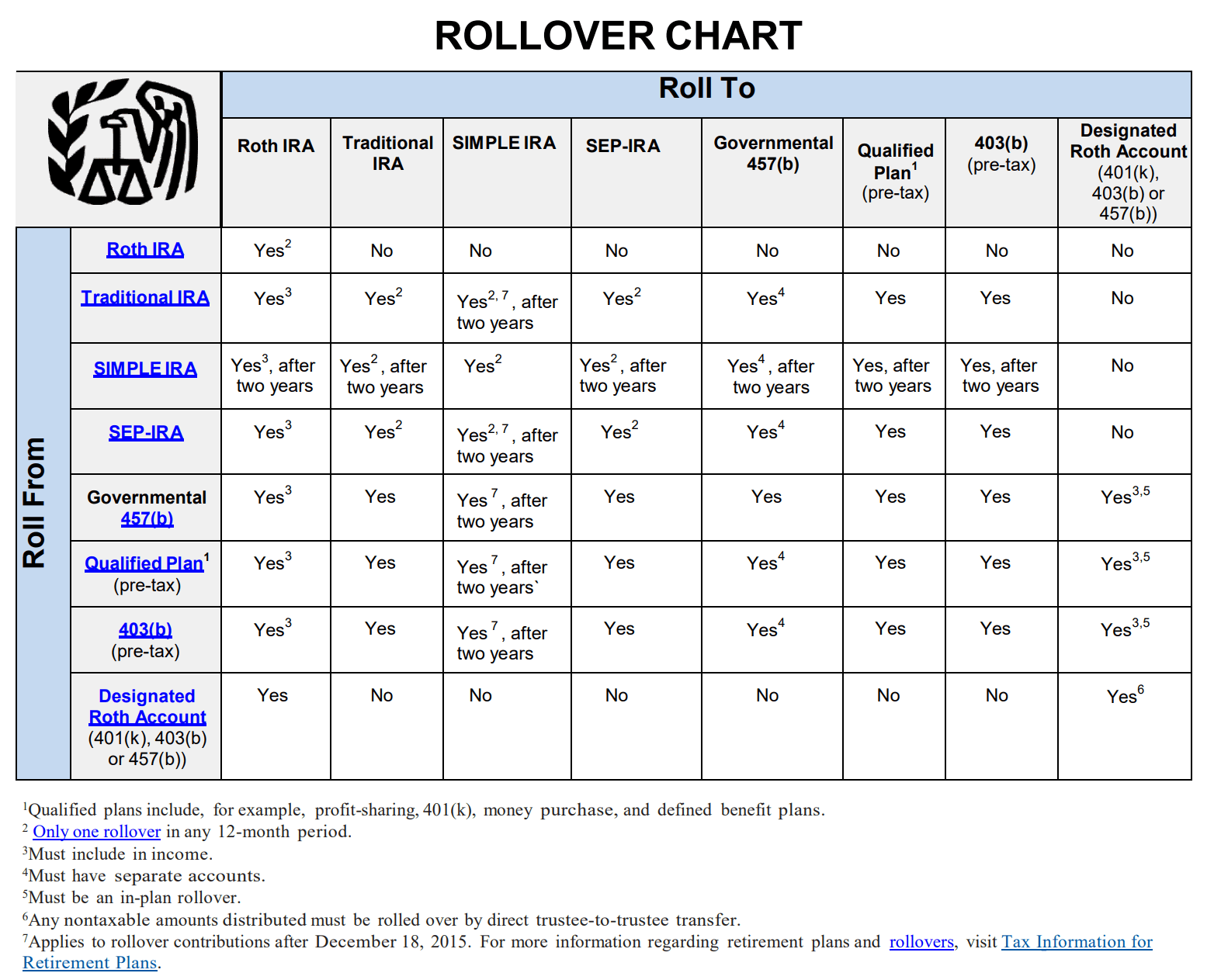

Simple Ira Rollover Chart - Can be rolled to the following after two years: Simple ira plans combine employer and employee contributions for retirement savings. If you are age 50 or over, you get to contribute an additional $1,000. Alternatively, you can also roll your 401 (k) over into a traditional or roth ira so you have more investment choices. But just like with a 401(k), you have to ensure that you follow the proper process. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Simple iras are easy to set up, and they can be a good option. This can help you avoid taxes or penalties on the asset transfer. Web the rollover chart pdf summarizes allowable rollover transactions. You can only do the same with personal iras or another. Web skynesher / getty images. Alternatively, you can also roll your 401 (k) over into a traditional or roth ira so you have more investment choices. You can only do the same with personal iras or another. Choose a simple ira plan. If you are age 50 or over, you get to contribute an additional $1,000. Can be rolled to the following after two years: With a rollover, the idea is that you keep all your money in one place, which is often easier to. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web if you leave your job. A transitional rule may apply in 2015. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. With a rollover, the idea is that you keep all your money in one place, which is often easier to. The irs provides a handy chart detailing which types of. Web the aptly named simple ira, which stands for savings incentive match plan for employees, is the more straightforward of the two options. You can rollover simple ira retirement funds into another simple ira tax and penalty free at any time. Choose a simple ira plan. Alternatively, you can also roll your 401 (k) over into a traditional or roth. It’s quick to set up, and ongoing maintenance is easy. Choose a simple ira plan. Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative responsibilities. You can only do the same with personal iras or another. Web if you leave your job and leave. Web a simple ira plan account is an ira and follows the same investment, distribution and rollover rules as traditional iras. Web beginning in 2023, the ira contribution limit is increased to $6,500 ($7,500 for individuals age 50 or older) from $6,000 ($7,000 for individuals age 50 or older). What is an ira rollover? Can be rolled to the following. Web the rollover chart pdf summarizes allowable rollover transactions. Can be rolled to the following after two years: Savings can also be converted into a roth ira or recharacterized from it. What is an ira rollover? Choose a simple ira plan. Web here’s a recent and handy rollover chart by the internal revenue service updated for new rules that may be helpful. The irs provides a handy chart detailing which types of accounts are eligible for rollovers (left column) and what types of accounts you can roll them into (top row). Web a simple ira plan account is an ira and. A rollover is the process of moving retirement plan or ira assets to another qualified plan or ira. Simple ira plans combine employer and employee contributions for retirement savings. Web ira rollover chart. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web the. What is an ira rollover? Choose a simple ira plan. If you are age 50 or over, you get to contribute an additional $1,000. This can help you avoid taxes or penalties on the asset transfer. Web if you leave your job and leave behind a savings incentive match plan for employees (simple) individual retirement account (ira), you have the option to roll over the simple ira balance. Web a simple ira plan account is an ira and follows the same investment, distribution and rollover rules as traditional iras. Web a simple ira plan ( s avings i ncentive m atch pl an for e mployees) allows employees and employers to contribute to traditional iras set up for employees. Web the aptly named simple ira, which stands for savings incentive match plan for employees, is the more straightforward of the two options. Web funds from a simple ira can be rolled over into another simple ira, a traditional ira, or another qualified plan, such as a 401(k). Web there is one combined limit for both traditional and roth iras. Many retirement plans that work well for large companies are not practical for small businesses, which often require plans with lower costs and fewer administrative responsibilities. Increase in required minimum distribution age. Rules regarding rollovers and conversions. Web what is a simple ira? For the tax year 2024, that limit is $7,000. Web simple ira rollovers.

IRA Rollover Chart

IRS issues updated Rollover Chart The Retirement Plan Blog

Follow the Rules When Rolling Over Your EmployerSponsored Retirement

Learn the Rules of IRA Rollover & Transfer of Funds

IRA Rollover Chart Where Can You Roll Over Your Retirement Account

"The Pension Specialists" Blog New SIMPLEIRA Rollover and Transfer Rules

Learn the Rules of IRA Rollover & Transfer of Funds

The Ultimate Guide To Easily Roll Over Your Retirement Plan Into An IRA

How to Transfer a SIMPLE IRA to a SelfDirected IRA

IRA Rollovers Simple and GREAT chart from the IRS

Alternatively, You Can Also Roll Your 401 (K) Over Into A Traditional Or Roth Ira So You Have More Investment Choices.

Savings Can Also Be Converted Into A Roth Ira Or Recharacterized From It.

Simple Ira Plans Combine Employer And Employee Contributions For Retirement Savings.

But Just Like With A 401(K), You Have To Ensure That You Follow The Proper Process.

Related Post: