Smart Money Vs Dumb Money Chart

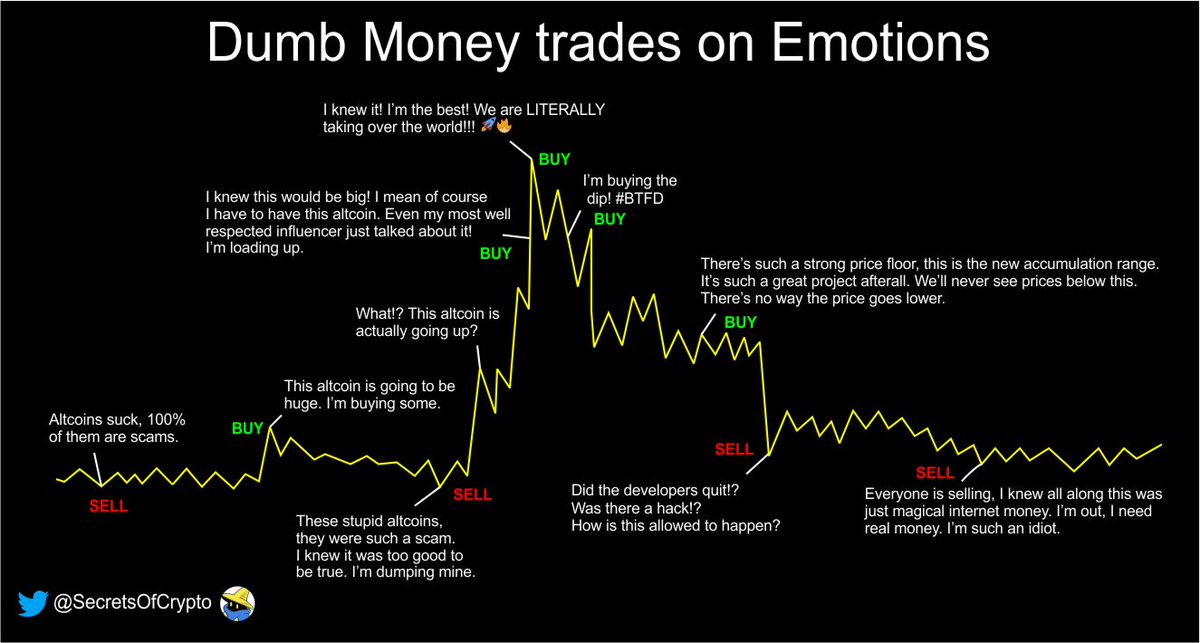

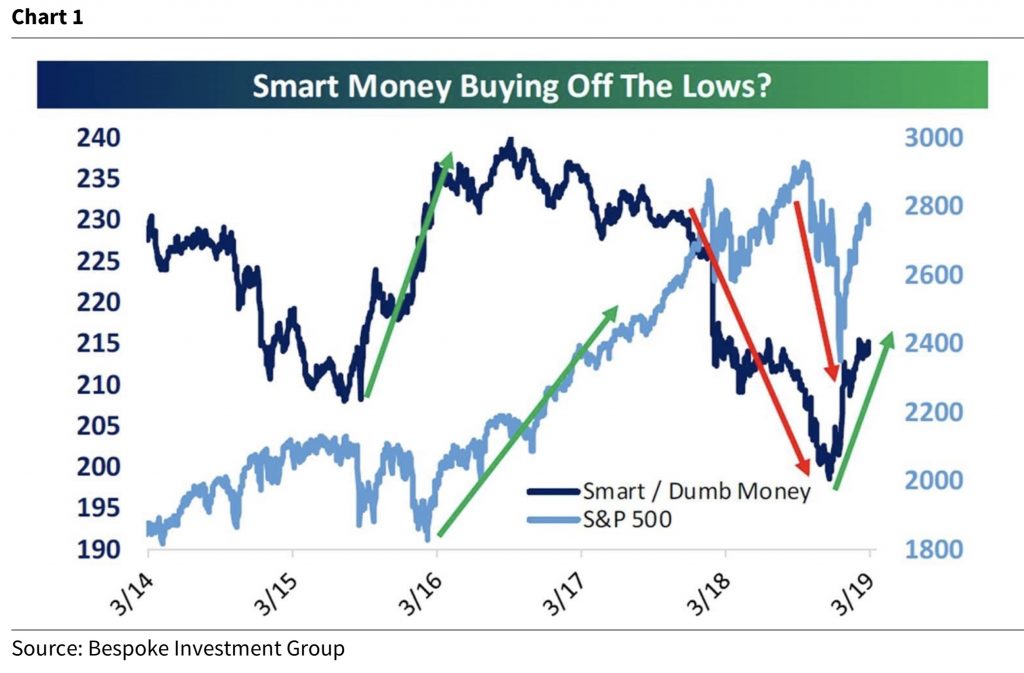

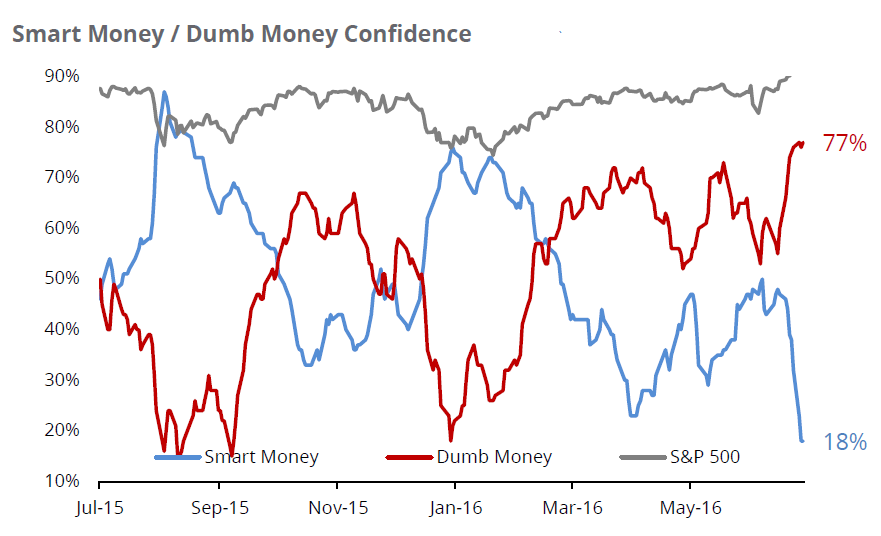

Smart Money Vs Dumb Money Chart - Web in this video, you will learn the basics of the smart/dumb money confidence indicators. Web despite the weird increase in a net short position in index futures, smart money confidence jumped to 77%, the highest since late april 2020. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. Web combing through the latest commitments of traders report from the cftc, we found that commercial traders (“smart money”) have a record number of short. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. The smart money flow index is based on the concept of don. Dumb money chart provides investors with valuable data and a framework for forming informed theories. Web smart money is becoming less confident that stocks will rally in the weeks and months ahead, while dumb money is becoming more confident than they will. Web institutional investors and mutual fund companies are labeled “smart money, while retail (individual) investors are called dumb money. key takeaways. We go over how they are calculated, how to read the charts, and what is. Web institutional investors and mutual fund companies are labeled “smart money, while retail (individual) investors are called dumb money. key takeaways. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web the terms “smart money” and “dumb money” are used. Institutional investors and market insiders are labeled “smart. Web institutional investors and mutual fund companies are labeled “smart money, while retail (individual) investors are called dumb money. key takeaways. Smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock. Read reports, study financials, talk to customers/suppliers, and. Or, they're just contrarian. We go over how they are calculated, how to read the charts, and what is. Institutional investors and market insiders are labeled “smart. Web despite the weird increase in a net short position in index futures, smart money confidence jumped to 77%, the highest since late april 2020. Web the terms “smart money” and “dumb money” are used to describe. Dumb money chart provides investors with valuable data and a framework for forming informed theories. Web smart money is becoming less confident that stocks will rally in the weeks and months ahead, while dumb money is becoming more confident than they will. Web dumb money chases hype, smart money does deep qualitative and quantitative analysis. Read reports, study financials, talk. We go over how they are calculated, how to read the charts, and what is. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. When it is at 0%,. Web the smart money is the surroundings like the sun. If. Institutional investors and market insiders are labeled “smart. Web institutional investors and mutual fund companies are labeled “smart money, while retail (individual) investors are called dumb money. key takeaways. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. The smart money flow index is based on the concept of don. Web the. Web in this video, you will learn the basics of the smart/dumb money confidence indicators. Web combing through the latest commitments of traders report from the cftc, we found that commercial traders (“smart money”) have a record number of short. The better the vegetable the more. It encourages due diligence, urging. Read reports, study financials, talk to customers/suppliers, and. Web the smart money vs. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. Web uncover the secrets behind smart money and dumb money in trading with our faqs, empowering you to navigate the markets like a seasoned investor! We go over how they are calculated, how. Read reports, study financials, talk to customers/suppliers, and. Web dumb money chases hype, smart money does deep qualitative and quantitative analysis. You will note that the “dumb” money (red line) is well over the “too. The smart money flow index is based on the concept of don. Institutional investors and market insiders are labeled “smart. Web despite the weird increase in a net short position in index futures, smart money confidence jumped to 77%, the highest since late april 2020. Web combing through the latest commitments of traders report from the cftc, we found that commercial traders (“smart money”) have a record number of short. The better the vegetable the more. Web the smart money. You will note that the “dumb” money (red line) is well over the “too. Web dumb money chases hype, smart money does deep qualitative and quantitative analysis. Web despite the weird increase in a net short position in index futures, smart money confidence jumped to 77%, the highest since late april 2020. The smart money flow index is based on the concept of don. Web dumb money (last 0.56) smart money confidence is a model that aggregates indicators reflecting sentiment among investors that tend to use the stock market to hedge underlying positions. Web the terms “smart money” and “dumb money” are used to describe different groups of market participants. Web in general, smart money indicators are used to assess institutional investors’ stock buying behavior for insight into their actions and approaches. We go over how they are calculated, how to read the charts, and what is. The better the vegetable the more. Or, they're just contrarian investors who prefer to sell into a rising market and. Read reports, study financials, talk to customers/suppliers, and. Web the smart money vs. Web when the smart money confidence index is at 100%, it means that those most correct on market direction are 100% confident of a rising market. Dumb money chart provides investors with valuable data and a framework for forming informed theories. When it is at 0%,. Institutional investors and market insiders are labeled “smart.

Secrets on Twitter "5/ Dumb Money vs. Smart Money Comparison Why is it

Here Is An important Look At What The “Smart Money” And “Dumb Money

Smart Money vs. Dumb Money? A Quick Look at a Unique Sentiment

Smart Money/Dumb Money The Joseph Group

Smart money vs dumb money divergences for AMEXHYG by Roral — TradingView

Smart Money / Dumb Money Sentiment Indicators ValueTrend

DUMB MONEY VS SMART MONEY ) for FXSPX500 by 001011001010001110110

Smart Money Versus Dumb Money Which are You?

Smart Money Versus Dumb Money Which are You?

A Dumb vs Smart Money Index (and how to get on the smart side)

Web Combing Through The Latest Commitments Of Traders Report From The Cftc, We Found That Commercial Traders (“Smart Money”) Have A Record Number Of Short.

Web Smart Money Is Becoming Less Confident That Stocks Will Rally In The Weeks And Months Ahead, While Dumb Money Is Becoming More Confident Than They Will.

If There's Too Much Sun (Smart Money) The Plant Will Die Because Of It.

Web Uncover The Secrets Behind Smart Money And Dumb Money In Trading With Our Faqs, Empowering You To Navigate The Markets Like A Seasoned Investor!

Related Post: