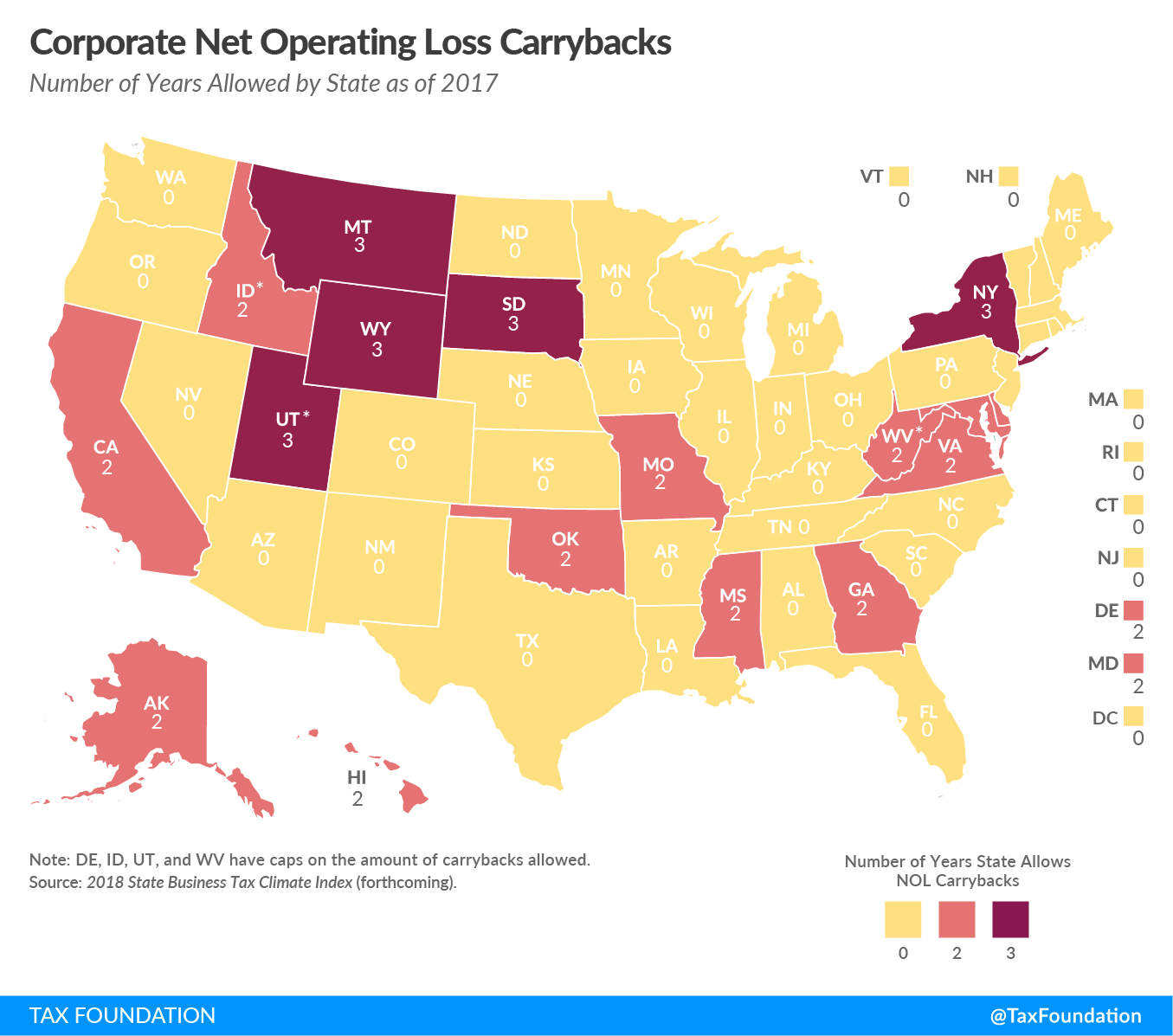

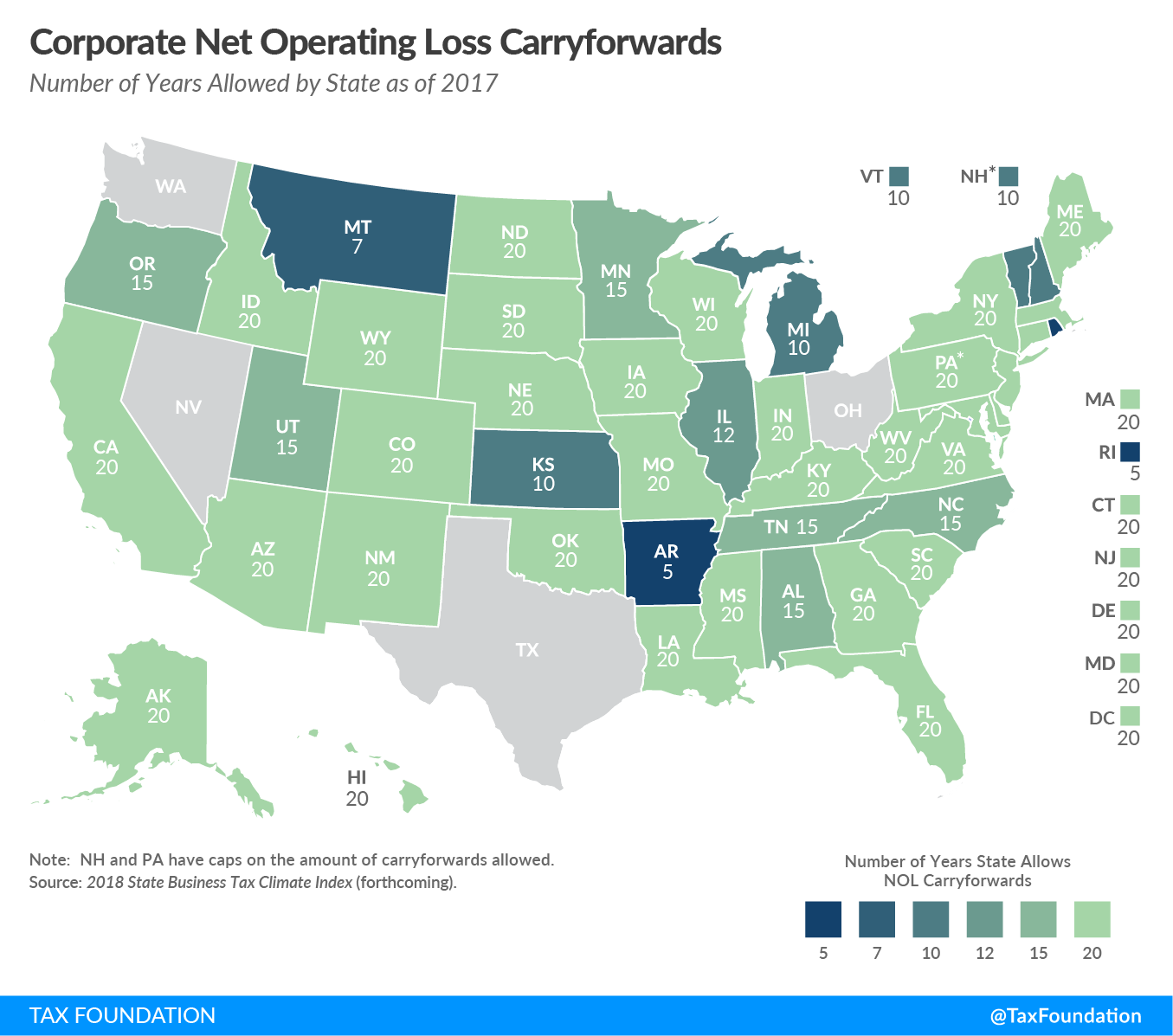

State Nol Carryforward Chart

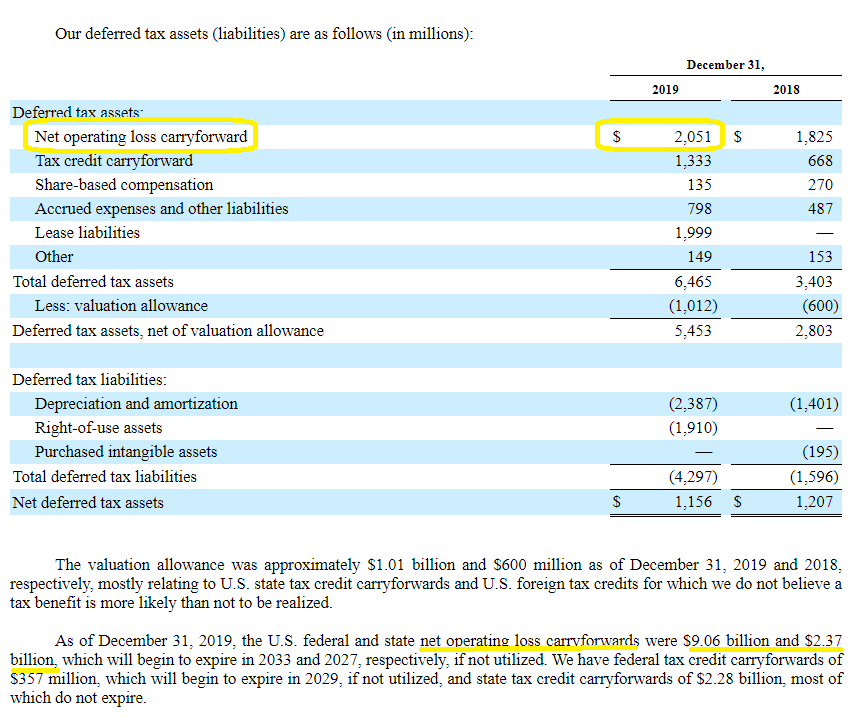

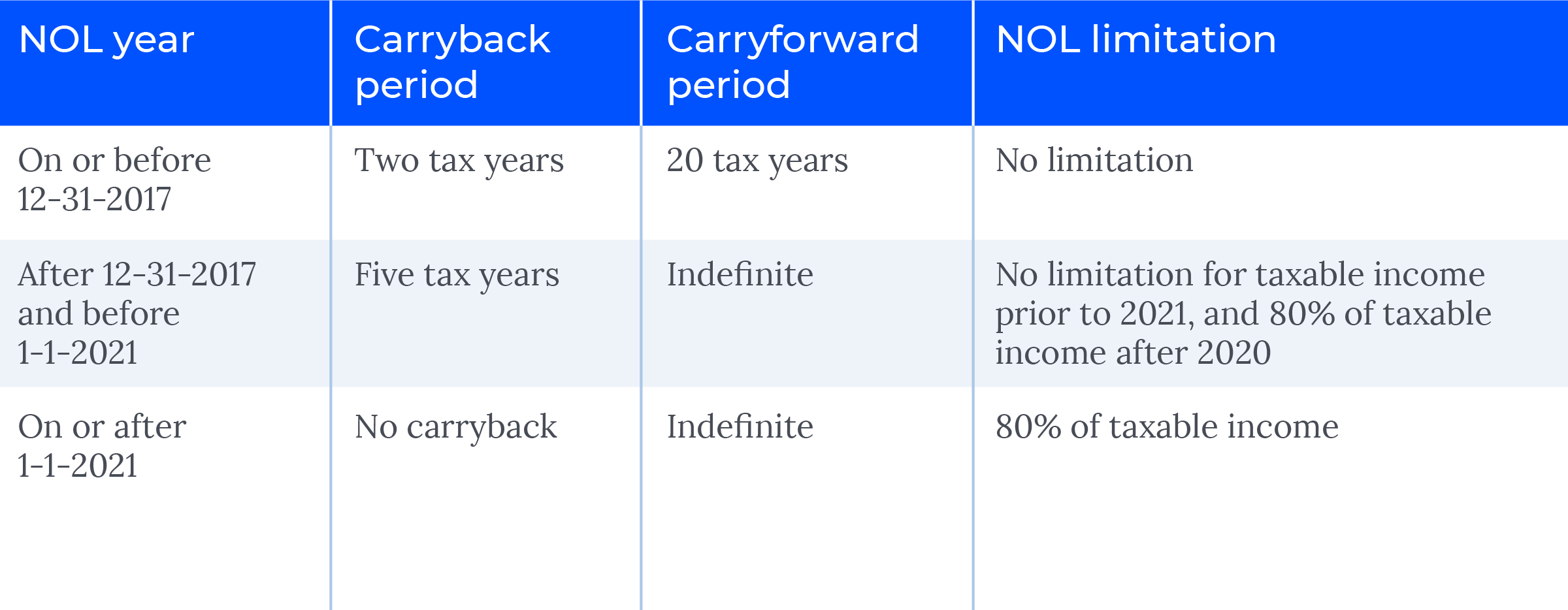

State Nol Carryforward Chart - 2013 through 2018, nol can be carried back to each of the past 2 years. The states vary in terms of following the federal net operating loss. For losses incurred in tax years: Web a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. Web the first map below shows the number of nol carryforward years allowed by states. The second map shows nol carryback years. 172 (b) (1) (a) allows taxpayers to carry nols back 2 and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. December 11, 20152 min read by: Web the federal government allows nol provisions to be carried forward indefinitely, and to reduce tax liability by up to 80 percent in any given year. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. Web corporate net operating loss carryforward and carryback provisions by state. Web specifically, the legislation limits c corporations to a deduction of. Web as the combined group sustained an nol, each member computes its share of the nol as follows: Web a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. The nol can generally be used to offset a. 31, 2021, and prior to dec. 2013 through 2018, nol can be carried. Web for tax years before 2018, taxpayers could generally carry nols back 2 years and then forward 20 years. Web corporate net operating loss carryforward and carryback provisions by state. Web many conformed with the federal tax code regarding nols (internal revenue code § 172), which generally stated that an nol could be carried forward to offset any taxable. The. Web [nols arising in tax years beginning in 2018, 2019, and 2020 may be carried back for a period of five years and carried forward indefinitely. Web below are two maps taken from data in our 2015 state business tax climate index, one showing the number of nol carryforward years allowed by each state’s. Web irc § 172 (b) (1). Carryback your nol deduction to the past 2 tax years by filing your amended return s and carryforward any excess. 2019 and after, nol can no longer be carried back to the past 2 years. The states vary in terms of following the federal net operating loss. Web corporate net operating loss carryforward and carryback provisions by state. 2013 through. 31, 2021, and prior to dec. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. Web the federal government allows nol provisions to be carried forward indefinitely, and to reduce tax. Web for tax years before 2018, taxpayers could generally carry nols back 2 years and then forward 20 years. For losses incurred in tax years: Web corporate net operating loss carryforward and carryback provisions by state. 31, 2021, and prior to dec. Web in california, the standard rule for nol carryovers is that they can be carried forward for 10. 31, 2021, and prior to dec. Web a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. Web below are two maps taken from data in our 2015 state business tax climate index, one showing the number of nol carryforward years allowed by each state’s. Web the federal government allows nol. 172 (b) (1) (a) allows taxpayers to carry nols back 2 and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Web irc § 172 (b) (1) (a) allows taxpayers to carry nols back two and forward 20 years, unless a taxpayer elects to waive the carryback period, in. For losses incurred in tax years: Web in california, the standard rule for nol carryovers is that they can be carried forward for 10 years 2 following the loss year for losses generated in 2000 through 2007. Carryback your nol deduction to the past 2 tax years by filing your amended return s and carryforward any excess. Web if you. Web specifically, the legislation limits c corporations to a deduction of $100,000 of nol carryforwards for each tax year ending on or after dec. The states vary in terms of following the federal net operating loss. Web if you carry forward your nol to a tax year after the nol year, list your nol deduction as a negative figure on schedule 1 (form 1040), line 8a, for 2023, for the year to which the. Web the first map below shows the number of nol carryforward years allowed by states. 2019 and after, nol can no longer be carried back to the past 2 years. If taxpayers l, m, n, and o file a combined report in 2016, the nol. Web the federal government allows nol provisions to be carried forward indefinitely, and to reduce tax liability by up to 80 percent in any given year. Web a net operating loss (nol) occurs when a company’s allowable deductions exceed its taxable income within a tax period. Web irc § 172 (b) (1) (a) allows taxpayers to carry nols back two and forward 20 years, unless a taxpayer elects to waive the carryback period, in which case nols will only be carried. Carryback your nol deduction to the past 2 tax years by filing your amended return s and carryforward any excess. 31, 2021, and prior to dec. For most taxpayers, nols arising in tax years ending after 2020 can only be carried. 2013 through 2018, nol can be carried back to each of the past 2 years. The second map shows nol carryback years. Web many conformed with the federal tax code regarding nols (internal revenue code § 172), which generally stated that an nol could be carried forward to offset any taxable. Most taxpayers no longer have the option to carryback a net operating loss (nol).

What Are Net Operating Loss Carrybacks? Tax Foundation

Net Operating Loss Carryforward & Carryback Provisions by State

(NOL) Net Operating Loss Carryforward Explained Losses Assets

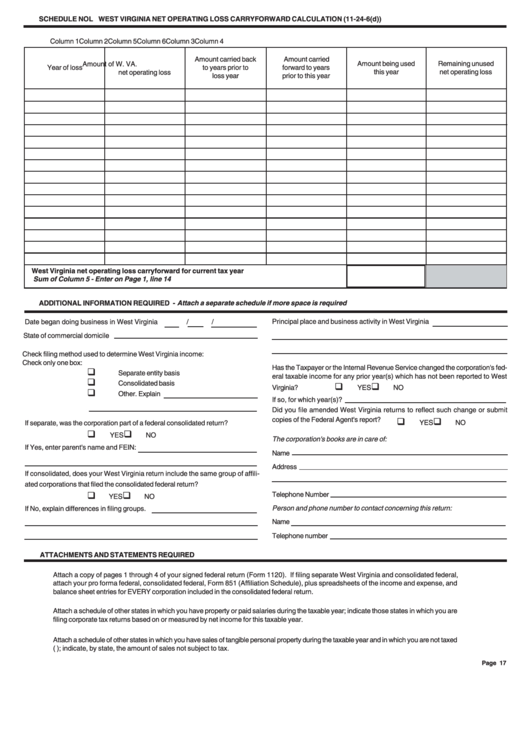

Schedule Nol West Virginia Net Operating Loss Carryforward

Tax relief options for real estate brokers Wipfli

Nol Carryforward Worksheet 2021

Corporate Net Operating Loss Carryforward and Carryback Provisions by

Net Operating Loss (NOL) Formula + Calculator

(NOL) Net Operating Loss Carryforward Explained Losses Assets

Corporate Net Operating Loss Carryforward and Carryback Provisions by State

Web For Tax Years Before 2018, Taxpayers Could Generally Carry Nols Back 2 Years And Then Forward 20 Years.

172 (B) (1) (A) Allows Taxpayers To Carry Nols Back 2 And Forward 20 Years, Unless A Taxpayer Elects To Waive The Carryback Period, In Which Case Nols Will Only Be Carried.

Web Corporate Net Operating Loss Carryforward And Carryback Provisions By State.

The Nol Can Generally Be Used To Offset A.

Related Post: