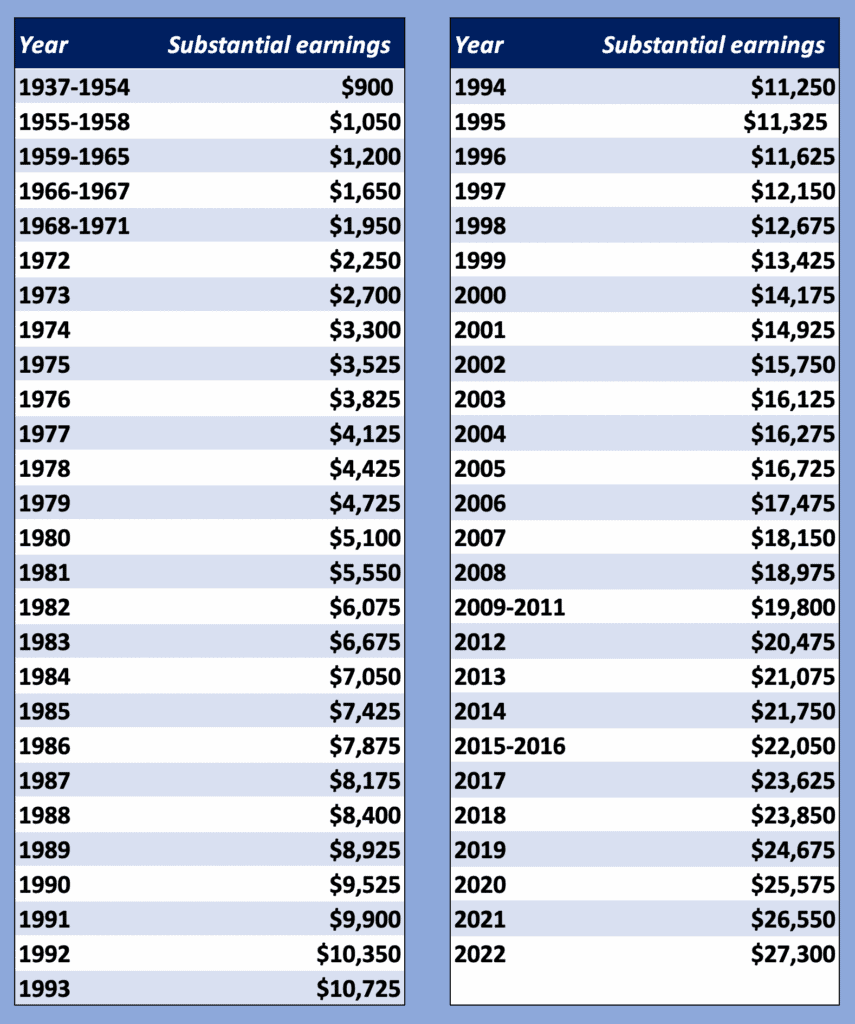

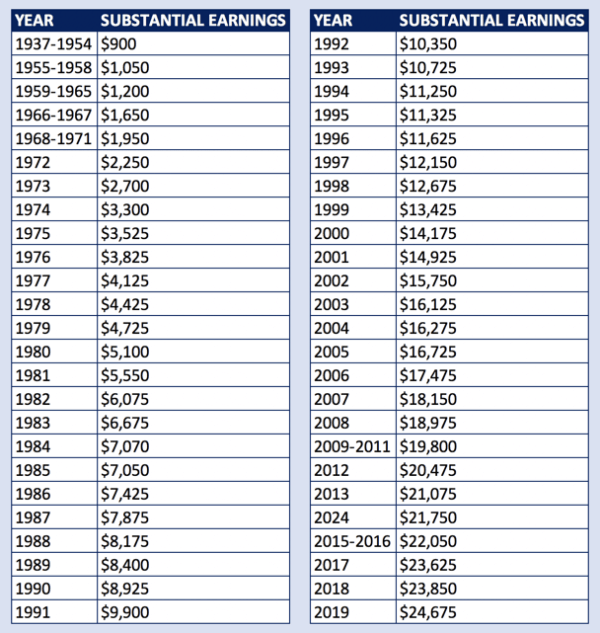

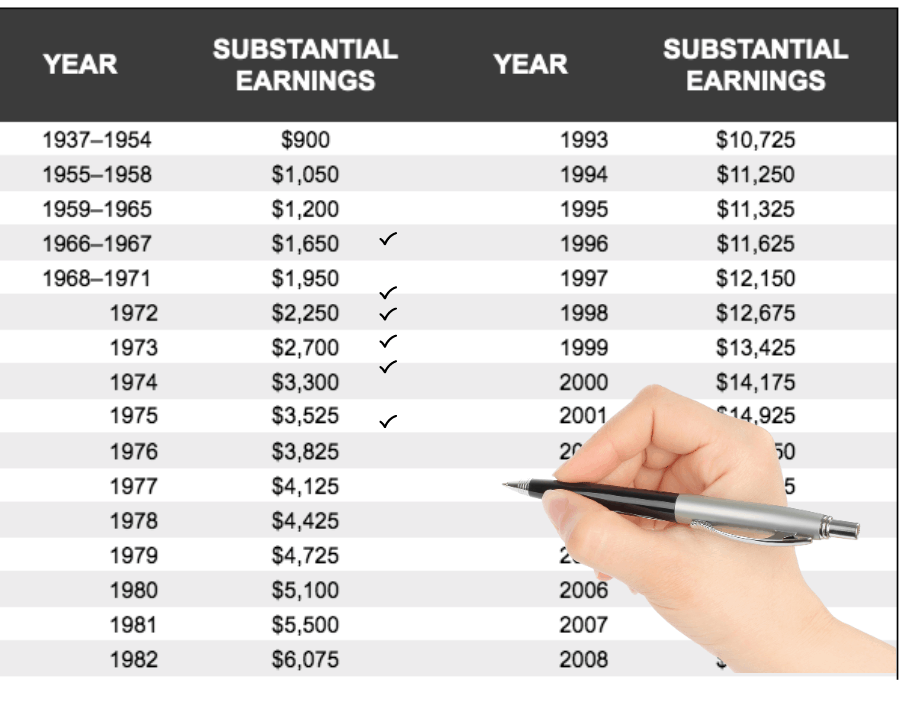

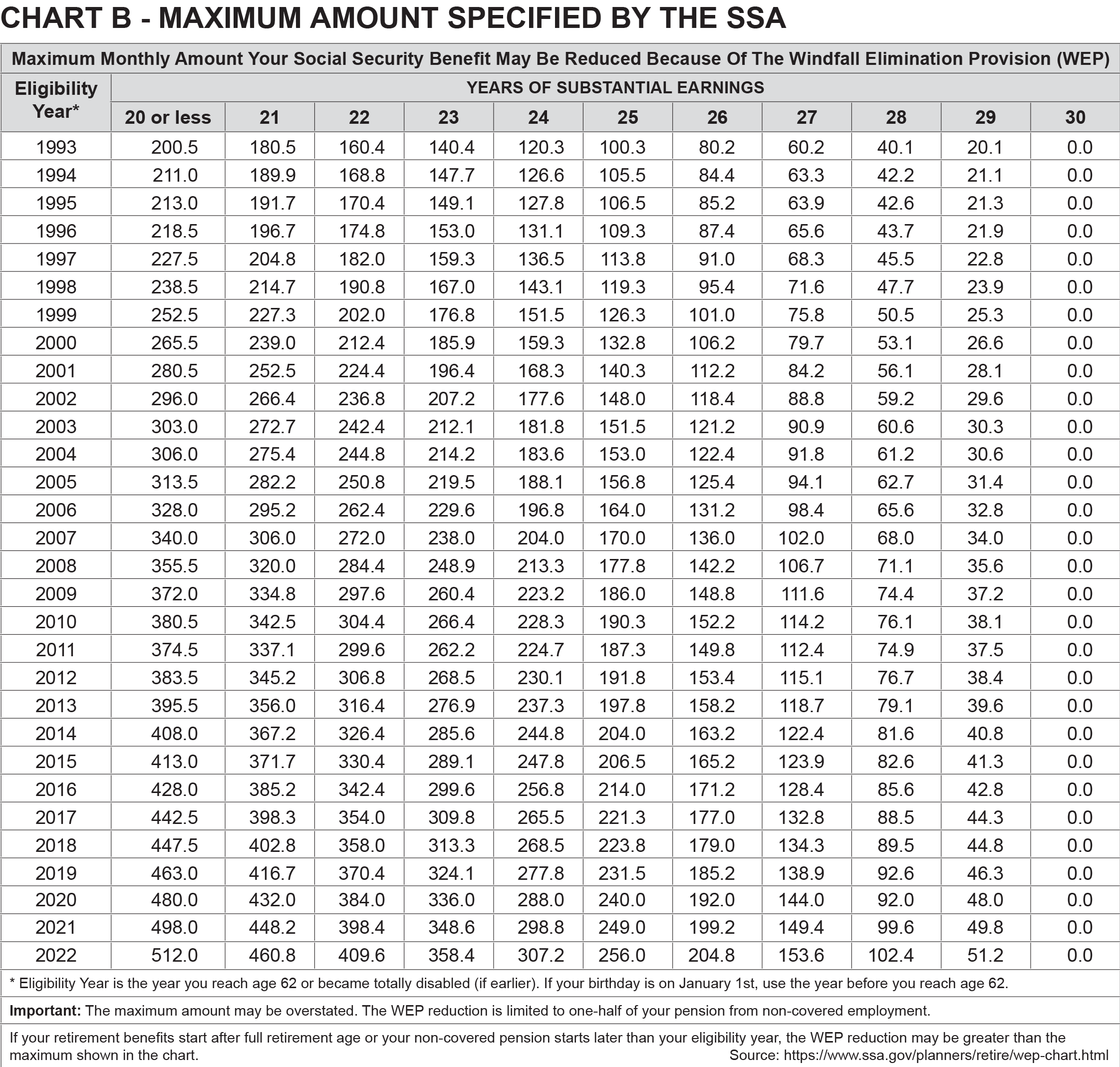

Substantial Earnings Chart

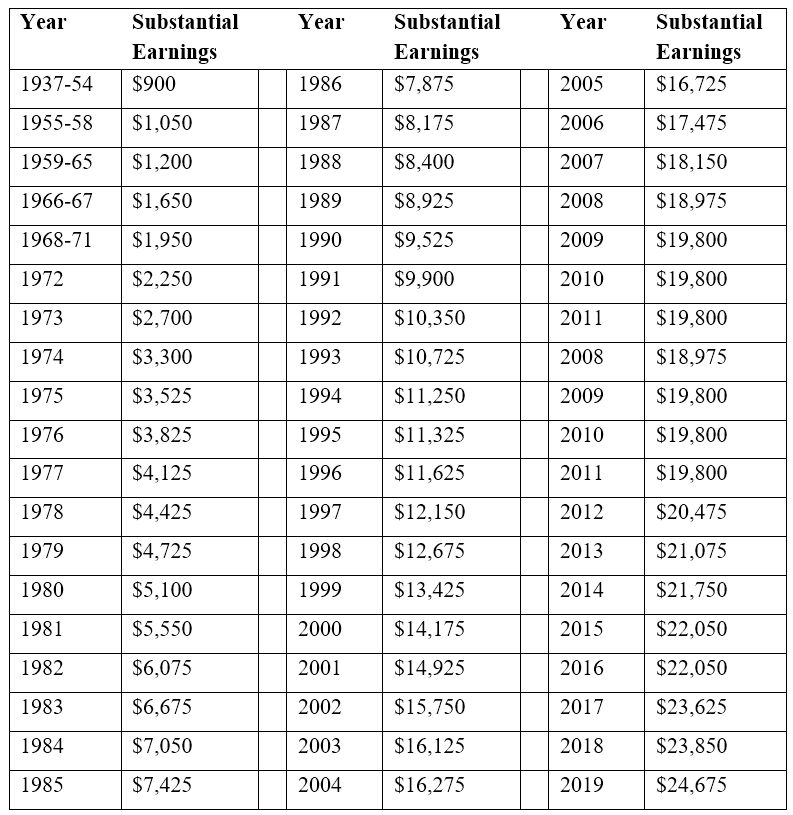

Substantial Earnings Chart - Notice that years in the chart are shown horizontally rather than vertically. A person who is earning more than a. Web you can find the chart at the social security website but for our purposes, “substantial earnings” range from $900 in 1937 to $25,575 in 2020. See chart in rs 00605.362a.1. Web for the first quarter of fiscal 2025, marvell delivered revenue of $1.16 billion, above the midpoint of guidance, driven by stronger than forecasted results from our data. Web if one has 21 to 29 years of “substantial” earnings, the 90 percent figure is reduced to between 45 and 85 percent. Web the term “substantial gainful activity” (sga) is used to describe a level of work activity and earnings. If one has 20 or less substantial years of. Web earnings growth for these companies would have been +10% instead of +7% had it not been for the substantial energy sector drag. Web it calculates a fair benefit that is proportional to the number of years that you had substantial earnings from an eligible job (one that withheld fica). Web 57 rows according to the social security administration, substantial. Web if one has 21 to 29 years of “substantial” earnings, the 90 percent figure is reduced to between 45 and 85 percent. You can tab from year to year and the zeros will be. The monthly retirement benefits are reduced or increased based on your age after wep reduces. Web the maximum wep reduction is applicable to people who have less than 20 years of “substantial earnings” in the social security system. Web according to the social security administration, substantial earnings is defined as an amount equal or above the amounts shown in the table below: Notice that years in the chart are shown horizontally rather than vertically. See. Web if you have more than 20 years of substantial covered earnings (where you paid social security tax), the impact of the wep begins to diminish. Web for the first quarter of fiscal 2025, marvell delivered revenue of $1.16 billion, above the midpoint of guidance, driven by stronger than forecasted results from our data. Web if one has 21 to. Web 57 rows according to the social security administration, substantial. Web chart industries provides a variety of cryogenic equipment for storage,. Web if one has 21 to 29 years of “substantial” earnings, the 90 percent figure is reduced to between 45 and 85 percent. If you turn 62 in 2024 (ely 2024) and you. Web you can find the chart. Notice that years in the chart are shown horizontally rather than vertically. In comparison to its industry. Web you can find the chart at the social security website but for our purposes, “substantial earnings” range from $900 in 1937 to $25,575 in 2020. Web if you have more than 20 years of substantial covered earnings (where you paid social security. Web if one has 21 to 29 years of “substantial” earnings, the 90 percent figure is reduced to between 45 and 85 percent. This amount is adjusted annually by. Web yocs are substantial years of social security earnings. Web 57 rows according to the social security administration, substantial. In comparison to its industry. Web you can find a table that lists the amount of substantial earnings for each year at the bottom of the second page of our windfall elimination provision fact sheet. Web you can find the chart at the social security website but for our purposes, “substantial earnings” range from $900 in 1937 to $25,575 in 2020. A person who is. Web substantial earnings under social security refers to the amount of income earned in a given year that is considered significant enough to count towards your. Estimate the most your retirement or disability benefit could decrease:. In comparison to its industry. Web you can find a table that lists the amount of substantial earnings for each year at the bottom. Web social security’s website provides a calculator to help you gauge the impact on your benefits from the windfall elimination provision (wep), the rule that reduces. This amount is adjusted annually by. Web 45 rows the following chart shows the wep reduction in 2021 for 20 or less. Work is “substantial” if it involves doing significant physical or mental activities.. Work is “substantial” if it involves doing significant physical or mental activities. Web it calculates a fair benefit that is proportional to the number of years that you had substantial earnings from an eligible job (one that withheld fica). Web social security’s website provides a calculator to help you gauge the impact on your benefits from the windfall elimination provision. Work is “substantial” if it involves doing significant physical or mental activities. In comparison to its industry. Web for many earners, though, the more substantial increase will be from the independent earner tax credit (ietc), which has been extended to an extra 420,000. Web earnings growth for these companies would have been +10% instead of +7% had it not been for the substantial energy sector drag. Web substantial earnings under social security refers to the amount of income earned in a given year that is considered significant enough to count towards your. If one has 20 or less substantial years of. Web the term “substantial gainful activity” (sga) is used to describe a level of work activity and earnings. Notice that years in the chart are shown horizontally rather than vertically. Web if one has 21 to 29 years of “substantial” earnings, the 90 percent figure is reduced to between 45 and 85 percent. At 30 years of substantial. Web you can find a table that lists the amount of substantial earnings for each year at the bottom of the second page of our windfall elimination provision fact sheet. Web chart industries provides a variety of cryogenic equipment for storage,. Web if you have more than 20 years of substantial covered earnings (where you paid social security tax), the impact of the wep begins to diminish. See chart in rs 00605.362a.1. Web 57 rows according to the social security administration, substantial. Web see a wep chart that shows how years of substantial earnings can change your reduction (pdf).

The Best Explanation of the Windfall Elimination Provision (2022 Update

The Best Explanation of the Windfall Elimination Provision (2021 Update

Navigating Social Security’s Windfall Elimination Provision (WEP) With

Year Up Announces Significant, Sustained Earnings Gains for Young

Ssa Threshold 2024 Letty Olympie

How Do You Avoid The Windfall Elimination Provision

WEP 2021 Social Security Intelligence

Social Security SERS

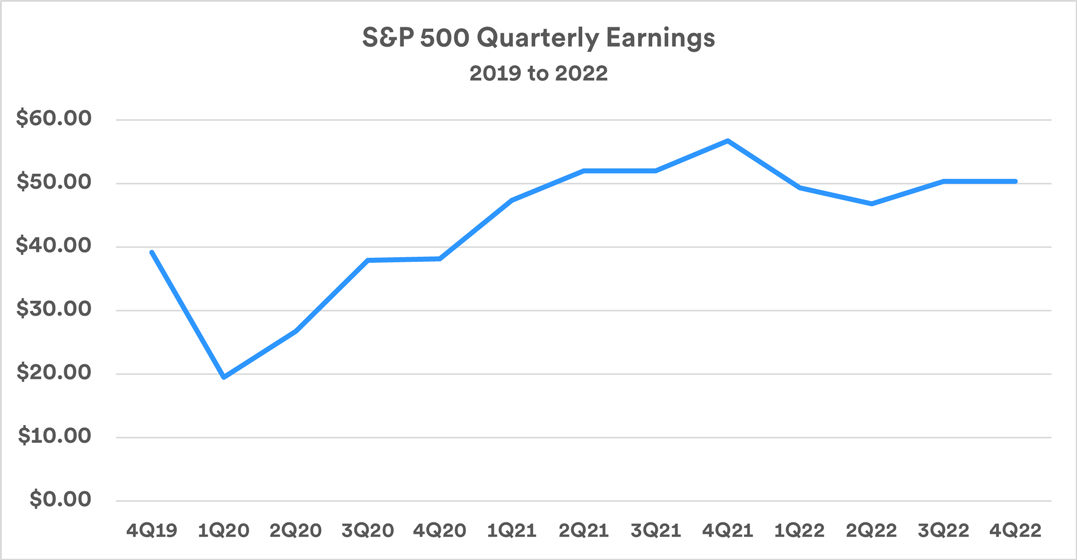

Investors Focus Attention on Corporate Earnings U.S. Bank

Windfall Elimination Program (WEP) 2019 Social Security Retirement Guide

Web Yocs Are Substantial Years Of Social Security Earnings.

If You Turn 62 In 2024 (Ely 2024) And You.

A Person Who Is Earning More Than A.

Estimate The Most Your Retirement Or Disability Benefit Could Decrease:.

Related Post: