Tax Equivalent Yield Chart

Tax Equivalent Yield Chart - The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. Determine your total tax rate. Web 2024 taxable equivalent yield table for california. Web the tax equivalent yield will be 11.11%. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. This table is for illustrative purposes. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Web the shift is apparent. This is the annual yield of your municipal bond or bond fund. This is your total income, after. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. Web 22% tax equivalent yield. This is the annual yield of your municipal bond or bond fund. The chart to the right shows how much more you will have to. This table is for illustrative purposes. Web the tax equivalent yield will be 11.11%. Determine your total tax rate. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Web 22% tax equivalent yield. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Determine your total tax rate. Your bond is highlighted in green. Thus, the higher a bond's displayed yield, the more taxes incurred. You can calculate this metric using the tax equivalent yield formula below: The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. Web the shift is apparent. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Web 2024 taxable equivalent yield table for california. Thus, the higher a bond's displayed yield, the more. This table is for illustrative purposes. Web the shift is apparent. The chart below displays the amount of additional yield that is required from a “taxable” fixed. When presented with investments that are free from taxation at the state, federal, and/or local. Determine your total tax rate. Web 2024 taxable equivalent yield table for california. Web the tax equivalent yield will be 11.11%. Web the shift is apparent. In other words, the calculator. Determine your total tax rate. Web the shift is apparent. In other words, the calculator. When presented with investments that are free from taxation at the state, federal, and/or local. This is your total income, after. The chart to the right shows how much more you will have to earn with a taxable investment to equal the return of a. Web the tax equivalent yield will be 11.11%. This is the annual yield of your municipal bond or bond fund. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Determine your total tax rate. Web 22% tax equivalent yield. The chart below displays the amount of additional yield that is required from a “taxable” fixed. Thus, the higher a bond's displayed yield, the more taxes incurred. Determine your total tax rate. Web the shift is apparent. This table is for illustrative purposes. Web how to use this calculator: You can calculate this metric using the tax equivalent yield formula below: When presented with investments that are free from taxation at the state, federal, and/or local. Web 22% tax equivalent yield. Web 2024 taxable equivalent yield table for california. Web 22% tax equivalent yield. This is your total income, after. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. Determine your total tax rate. Web here you'll find a tax equivalent yield calculator, sometimes called a tey calculator. Web the shift is apparent. You can calculate this metric using the tax equivalent yield formula below: Web how to use this calculator: This table is for illustrative purposes. Your bond is highlighted in green. This is the annual yield of your municipal bond or bond fund. When presented with investments that are free from taxation at the state, federal, and/or local. Determine your total tax rate. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond. The chart below displays the amount of additional yield that is required from a “taxable” fixed.

My Favorite Fund To Get High Yields Without Paying Taxes Reliable

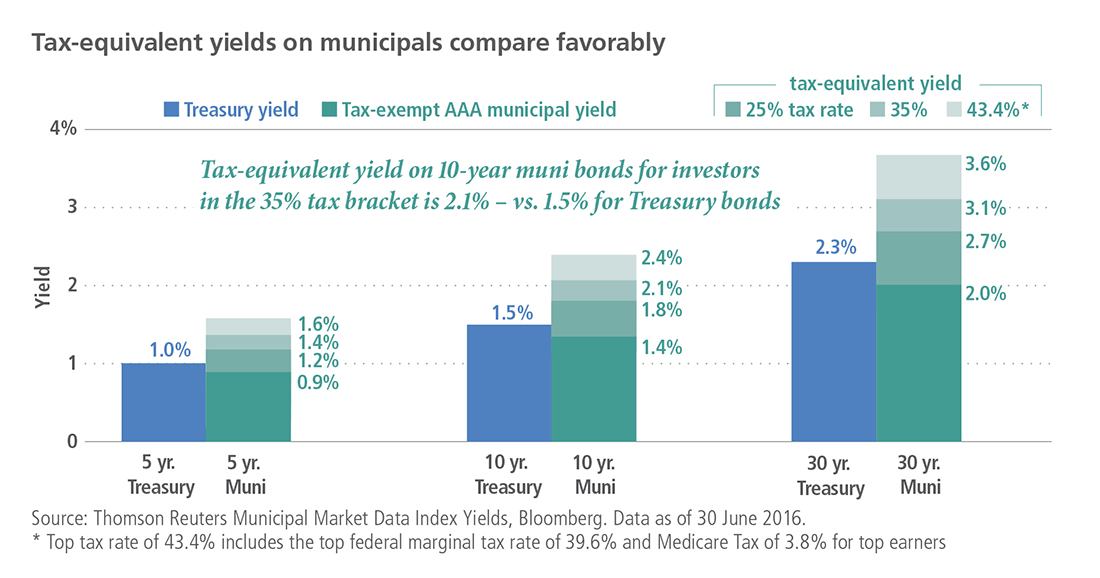

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

Rieger Report “Belly of the Curve” Good for Muni & Corporate Bonds S

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

The Best 6+ Yields for the New Tax Plan

Tax Equivalent Yield Calculator Begin To Invest

Tax Equivalent Yield Definition, Formula, How to Calculate Tax

Tax Equivalent Yield What Is It, Calculator, Formula

Taxequivalent Yields on Municipal Bonds The Big Picture

:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

TaxEquivalent Yield Definition

Thus, The Higher A Bond's Displayed Yield, The More Taxes Incurred.

Web The Tax Equivalent Yield Will Be 11.11%.

In Other Words, The Calculator.

The Chart To The Right Shows How Much More You Will Have To Earn With A Taxable Investment To Equal The Return Of A.

Related Post: