Tax Form 8962 Printable

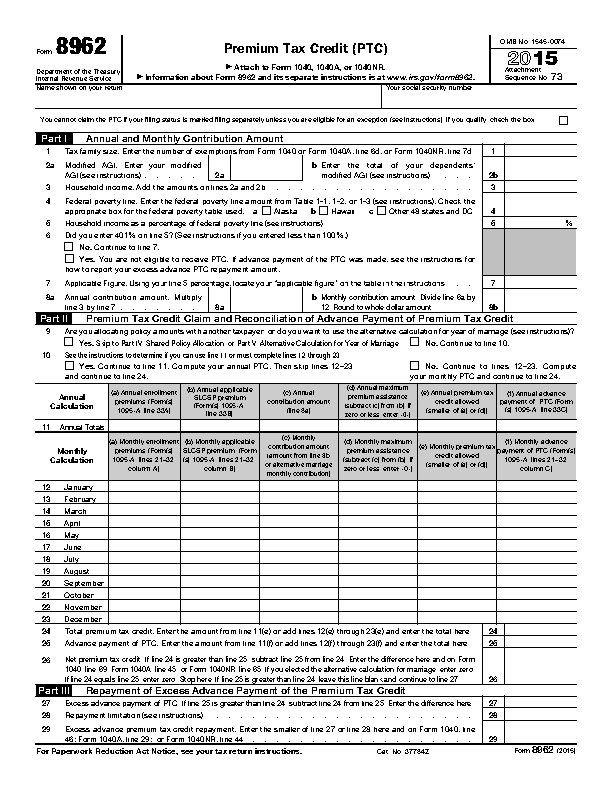

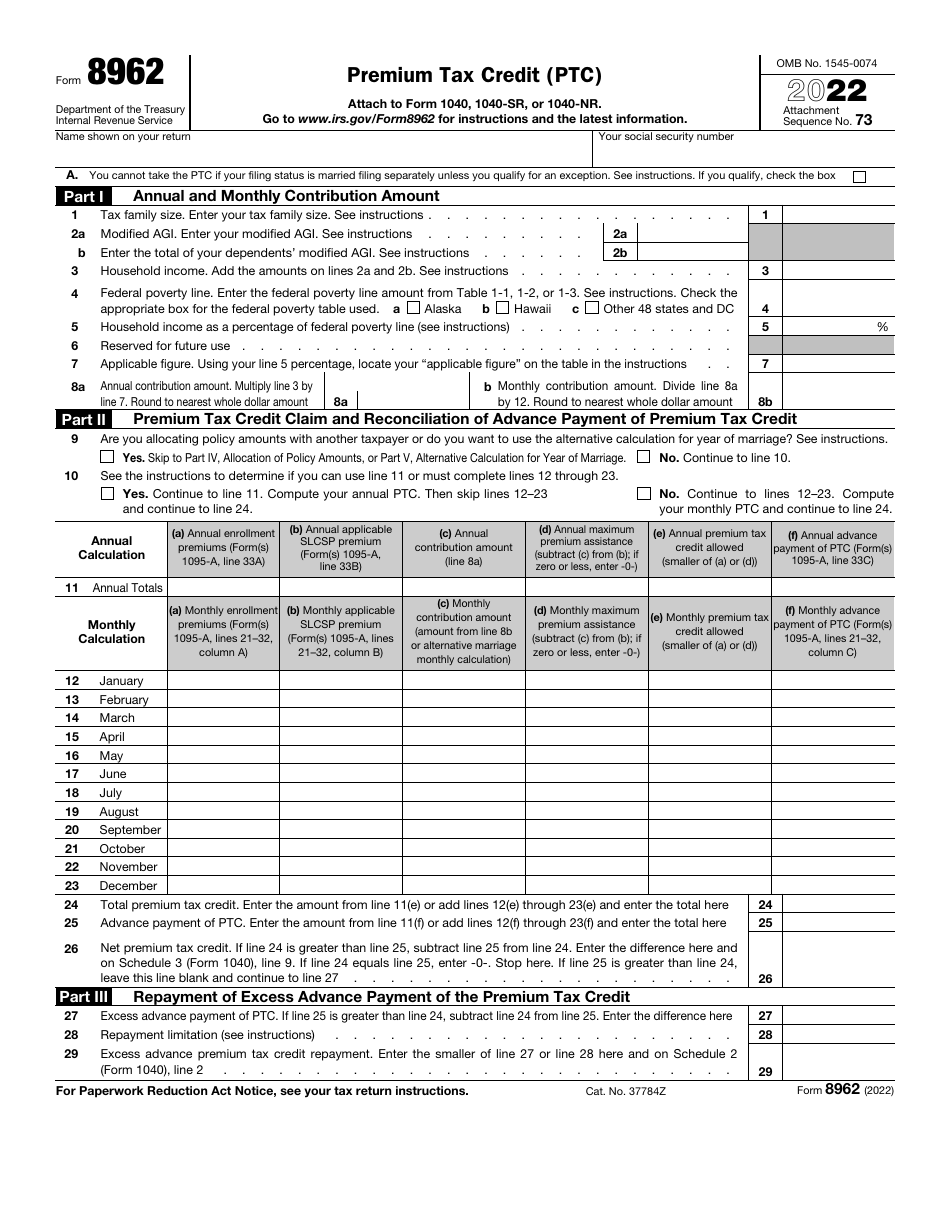

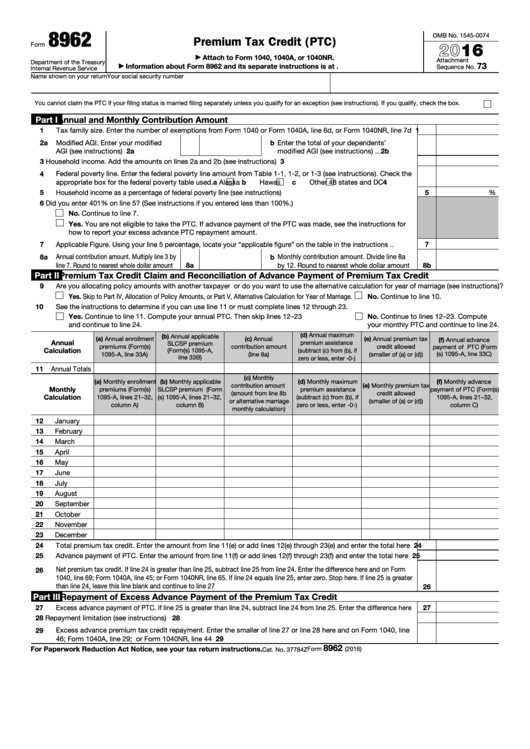

Tax Form 8962 Printable - Sign on any devicepaperless solutionscompliant and securefree mobile app Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Eligibility requirements for the premium tax credit. Filing irs form 8962 can save you some money you spend on your health plan. The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. You qualified for the premium tax credit in. We last updated the premium tax credit in january 2024, so this is the latest version of form 8962, fully updated for tax year 2023. You’ll need it to complete form 8962, premium tax credit. More about the federal form 8962 other ty 2023. This amount will increase taxpayer’s refund or reduce the balance due. Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. If there's a change to your refund amount or the amount you owe, print and send page 2 of. Eligibility requirements. Web how to print 8962 form here are the blank template in pdf and doc. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. Web the net premium tax credit a taxpayer can claim (the excess of the. What is the premium tax credit? The premium tax credit took effect beginning in the 2014 tax year, and provides tax savings to offset the cost of health insurance, for those who qualify. Web form 8962, also known as the premium tax credit (ptc) form, is used to reconcile and calculate the premium tax credit for those who have health. What is the premium tax credit? You’ll need it to complete form 8962, premium tax credit. Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Web the net premium tax credit a taxpayer can claim (the excess of the taxpayer’s premium. What is the premium tax credit? You have to include form 8962 with your tax return if: More about the federal form 8962 other ty 2023. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). This amount will increase taxpayer’s refund. Filing irs form 8962 can save you some money you spend on your health plan. You qualified for the premium tax credit in. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Purpose of form use form 8962 to figure the amount of your premium tax. What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Sign. Filing irs form 8962 can save you some money you spend on your health plan. This form is only used by taxpayers who purchased a health plan through the health insurance marketplace, including healthcare.gov. If a taxpayer must repay aptc or gets additional ptc, remember to adjust the insurance premium deduction on schedule a. This form includes details about the. Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that. Web form. Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that. Web form 8962 is used to figure the amount of premium tax credit and reconcile it with any advanced premium tax credit paid. Purpose of form use form 8962 to. Purpose of form use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). What is a 8962 form form 8962 is used to calculate the amount of premium tax credit you're eligible to claim if you paid premiums for health insurance purchased through the. Form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance through the health insura… If there's a change to your refund amount or the amount you owe, print and send page 2 of. More about the federal form 8962 other ty 2023. You qualified for the premium tax credit in. Sign on any devicepaperless solutionscompliant and securefree mobile app Web when you're done in turbotax, print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. This form includes details about the marketplace insurance you and household members had in 2023. Eligibility requirements for the premium tax credit. Web form 8962, also known as the premium tax credit (ptc) form, is used to reconcile and calculate the premium tax credit for those who have health insurance through the health insurance marketplace. Web how to print 8962 form here are the blank template in pdf and doc. If a taxpayer must repay aptc or gets additional ptc, remember to adjust the insurance premium deduction on schedule a. Form 8962 must be completed if you received advance payments of the premium tax credit (aptc) or if you want to claim the credit on your tax return. You have to include form 8962 with your tax return if: Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that.

Form 8962 Fill out & sign online DocHub

![74 [PDF] 8962 FORM APPROVAL 2017 FREE PRINTABLE DOCX 2020 ApprovalForm2](https://www.irs.gov/pub/xml_bc/33455805.gif)

74 [PDF] 8962 FORM APPROVAL 2017 FREE PRINTABLE DOCX 2020 ApprovalForm2

Fillable Online Instructions Tax Form 8962 Fax Email Print pdfFiller

Irs form 8962 Fillable Brilliant form 8962 Instructions 2018 at Models

pasezine Blog

Best IRS 8962 For 2015 (US) 2019 Update FormsPro.io

IRS Form 8962 Download Fillable PDF or Fill Online Premium Tax Credit

Fillable Form 8962 Premium Tax Credit (Ptc) 2016 printable pdf download

How to Fill out IRS Form 8962 Correctly?

8962 Form 2021 Printable

This Form Is Only Used By Taxpayers Who Purchased A Health Plan Through The Health Insurance Marketplace, Including Healthcare.gov.

Solved•By Turbotax•2677•Updated November 22, 2023.

What Is The Premium Tax Credit?

We Last Updated The Premium Tax Credit In January 2024, So This Is The Latest Version Of Form 8962, Fully Updated For Tax Year 2023.

Related Post: