Taxequivalent Yield Chart

Taxequivalent Yield Chart - In general, municipal bonds have a low. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as a municipal bond. To understand how it works, it first helps to know a little about bond yields. In addition, if the bond was issued in your state of residence, you. The bond’s current price on the secondary market; The calculator needs a total of five inputs, including: Learn more about how taxes affect your investment returns. Web estimating tax equivalent yields. Municipal bonds are sold by cities, counties, states and other political bodies (public hospital, school district). The coupon yield of a bond, or coupon rate, is the annual interest rate set when the bond is. Web cash earnings per share (ceps) calculator. The par value of the bond, also known as the bond’s face value Thus, the higher a bond's displayed yield, the more taxes incurred. Degree of operating leverage (dol) calculator. The information presented in the tax calculator tool is for hypothetical and illustrative purposes only. Earnings before interest, taxes, depreciation, and amortization (ebitda) calculator. Income generated from municipal bond coupon payments are not subject to federal income tax. Web cash earnings per share (ceps) calculator. Thus, the higher a bond's displayed yield, the more taxes incurred. Bond yield measures the return an investor can expect to get from it. Earnings before interest, taxes, depreciation, and amortization (ebitda) calculator. Income generated from municipal bond coupon payments are not subject to federal income tax. Determine your total tax rate. Municipal bonds are sold by cities, counties, states and other political bodies (public hospital, school district). The coupon yield of a bond, or coupon rate, is the annual interest rate set when. Learn more about how taxes affect your investment returns. Income generated from municipal bond coupon payments are not subject to federal income tax. Your bond is highlighted in green. The calculator needs a total of five inputs, including: Earnings before interest, taxes, depreciation, and amortization (ebitda) calculator. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. The information presented in the tax calculator tool is for hypothetical and illustrative purposes only. The par value of the bond, also known as the bond’s face value Bond yield. Learn more about how taxes affect your investment returns. Use this calculator to determine an equivalent yield on a taxable investment. Income generated from municipal bond coupon payments are not subject to federal income tax. Web use this tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after tax income as. The calculator needs a total of five inputs, including: Earnings before interest and taxes (ebit) calculator. Determine your total tax rate. Thus, the higher a bond's displayed yield, the more taxes incurred. Web the taxable equivalent yield table shows the comparison of tax exempt yields of municipal bonds to the taxable yields of other investments. Determine your total tax rate. Your bond is highlighted in green. The par value of the bond, also known as the bond’s face value Thus, the higher a bond's displayed yield, the more taxes incurred. Web estimating tax equivalent yields. Earnings before interest and taxes (ebit) calculator. The par value of the bond, also known as the bond’s face value Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. The bond’s current price on the secondary market; Municipal bonds. Earnings before interest and taxes (ebit) calculator. The information presented in the tax calculator tool is for hypothetical and illustrative purposes only. Web the taxable equivalent yield table shows the comparison of tax exempt yields of municipal bonds to the taxable yields of other investments. Income generated from municipal bond coupon payments are not subject to federal income tax. In. Learn more about how taxes affect your investment returns. Web this tax equivalent yield calculator solves a taxable investment's interest rate needed to equal the interest rate or yield from a tax free investment such as a municipal bond. To understand how it works, it first helps to know a little about bond yields. Web the taxable equivalent yield table shows the comparison of tax exempt yields of municipal bonds to the taxable yields of other investments. Use this calculator to determine an equivalent yield on a taxable investment. The information presented in the tax calculator tool is for hypothetical and illustrative purposes only. In addition, if the bond was issued in your state of residence, you. Determine your total tax rate. Learn more about how taxes affect your investment returns. In general, municipal bonds have a low. Earnings before interest, taxes, depreciation, and amortization (ebitda) calculator. Bond yield measures the return an investor can expect to get from it. Municipal bonds are sold by cities, counties, states and other political bodies (public hospital, school district). Your bond is highlighted in green. Web cash earnings per share (ceps) calculator. The federal government and its.:max_bytes(150000):strip_icc()/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

TaxEquivalent Yield Definition

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

Tax Equivalent Yield Calculator Begin To Invest

How Do I Calculate Tax Equivalent Yield Tax Walls

Tax Equivalent Yield What Is It, Calculator, Formula

TaxEquivalent Yields and the New Tax Law Breckinridge Capital Advisors

My Favorite Fund To Get High Yields Without Paying Taxes Reliable

Rieger Report “Belly of the Curve” Good for Muni & Corporate Bonds S

Tax Equivalent Yield Definition, Formula, How to Calculate Tax

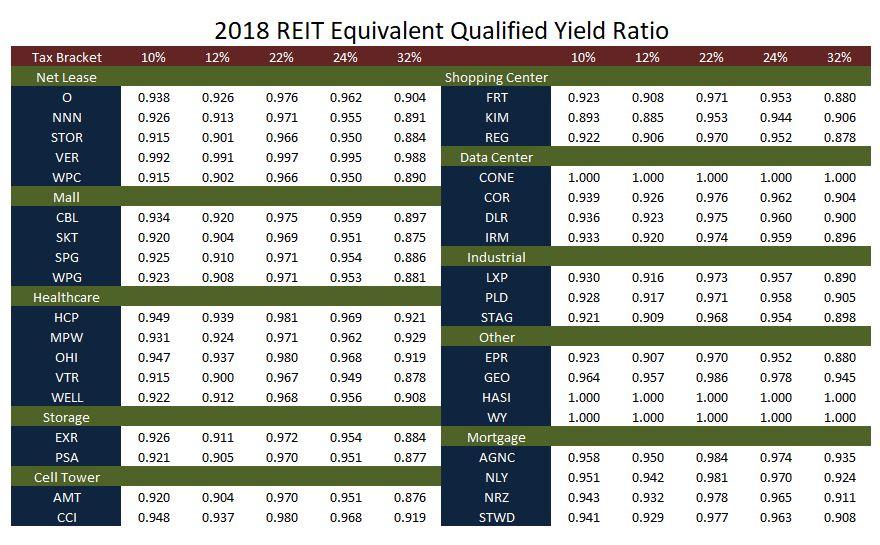

How Tax Efficient Are Your REITs? Seeking Alpha

Determine Your Total Tax Rate.

The Bond’s Current Price On The Secondary Market;

Income Generated From Municipal Bond Coupon Payments Are Not Subject To Federal Income Tax.

Degree Of Operating Leverage (Dol) Calculator.

Related Post: