Texas Sales Tax Chart

Texas Sales Tax Chart - Select the texas city from the list of popular cities below to see its current sales tax rate. Due to varying local sales tax rates, we strongly recommend our lookup and calculator tools on this page for the most accurate rates. Exact tax amount may vary for different items. Web 1648 rows 7.959% texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%. Use the sales tax rate locator to search for sales tax rates by address. Are your buyers required to pay sales tax? For a more advanced search, you can filter your results by loan type for 30 year fixed, 15 year fixed and. Web simply enter your home location, property value and loan amount to compare the best rates. Both state and local sales and use taxes are reported on your texas sales and use tax return. City sales and use tax codes and rates. In texas, the state sales tax is 6.25%, but local taxes of up to 2% can also be tacked onto purchases. You can use our texas sales tax calculator to look up sales tax rates in texas by address / zip code. Both state and local sales and use taxes are reported on your texas sales and use tax return.. Texas comptroller of public accounts. Web sales and use tax chart. Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. A lot has changed with regards to sales tax lawsto help you determine whether you need to collect sales tax in texas, start by answering these three questions: Web. The texas state sales tax rate is 6.25%, and the average tx sales tax after local surtaxes is 8.05%. City sales and use tax codes and rates. Local tax rates in texas range from 0.125% to 2%, making the sales tax range in texas 6.375% to 8.25%. Web the bulk of taxes paid by texans come in the form of. Web the last rates update has been made on january 2024. City sales and use tax. Are you selling taxable goods or services to texas residents? Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Sales tax rate differentials can induce consumers. Web 1648 rows 7.959% texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%. A lot has changed with regards to sales tax lawsto help you determine whether you need to collect sales tax in texas, start by answering these three questions: $50,000 × 8% = $4,000.. Texas state sales tax formula. Exact tax amount may vary for different items. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Web the state sales tax rate in texas is 6.250%. Web the local sales and use tax rate history shows the current. Web average local + state sales tax. Web texas sales tax calculator. Texas state sales tax formula. City sales and use tax codes and rates. Texas sales tax range for 2024. Texas has recent rate changes (thu jul 01 2021). The state sales tax, which is 6.25%, can be grouped with local sales taxes to total as much as 8.25% in some areas, including. Due to varying local sales tax rates, we strongly recommend our lookup and calculator tools on this page for the most accurate rates. Web the texas sales. Discover our free online 2024 us sales tax calculator specifically for texas residents. How to figure the tax. Web 1648 rows 7.959% texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%. Web sales and use tax chart. Sales tax rate files current and historical. Web texas sales tax calculator. Web the state sales tax rate in texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%. How to figure the tax. Web the last rates update has been made on january 2024. Texas comptroller of public accounts. Web average local + state sales tax. What is the sales tax rate in texas? Most recent (as of april 1, 2024) current sales tax rates (txt) historical tax rate files. The state sales tax rate in texas is 6.25%, but you can customize this table as needed to. There are a total of 964 local tax jurisdictions across the state, collecting an average local tax of 1.709%. Ruling by the supreme court. City rates with local codes and total tax rates. Product / service net sale amount ($) select location in texas. Web 1648 rows 7.959% texas has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 2%. Web texas sales tax calculator. Sales tax rate = s + c + l + sr. Web rate from 5.125 percent to 5 percent in july 2022. Texas state sales tax formula. How to figure the tax. Texas comptroller of public accounts.

Our World in Data Texas Covid Rates Chart

Sales Tax By State Chart

Sales Tax Expert Consultants Sales Tax Rates by State State and Local

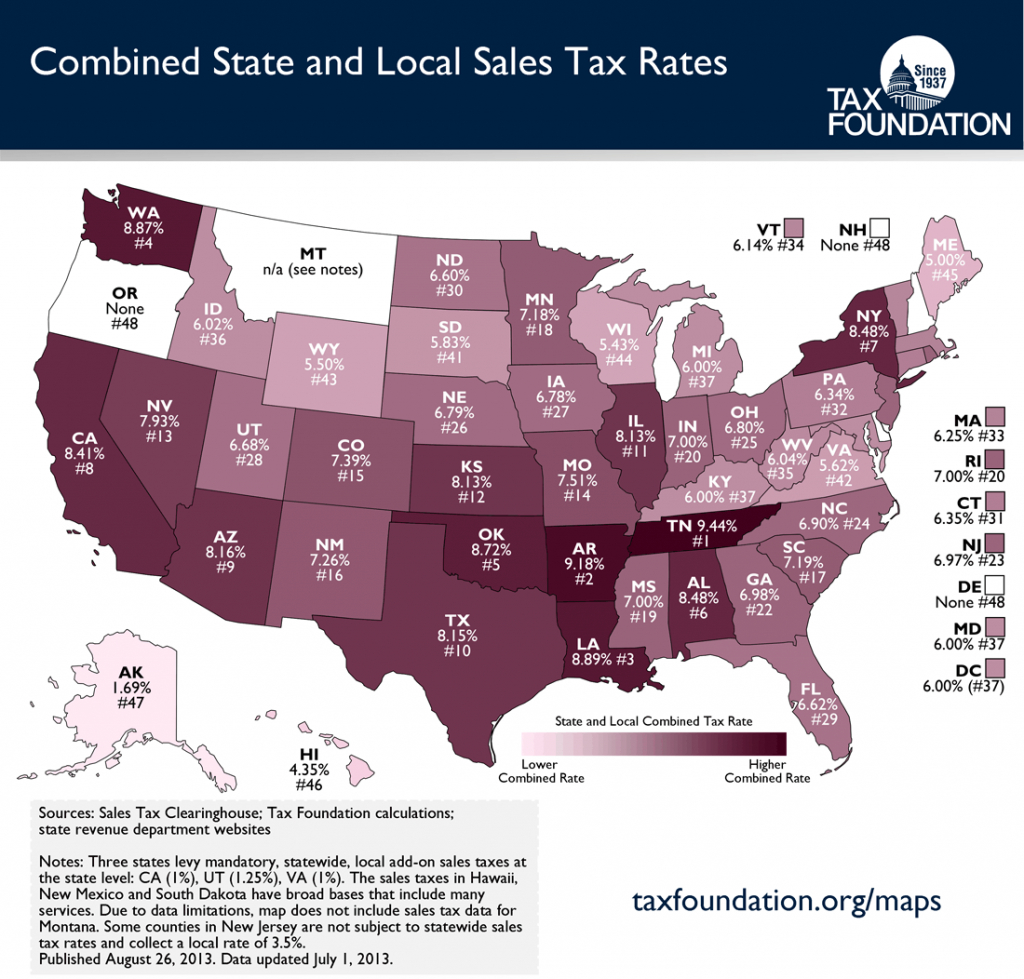

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Printable Sales Tax Chart A Visual Reference of Charts Chart Master

State and Local Sales Tax Rates in 2016 Tax Foundation

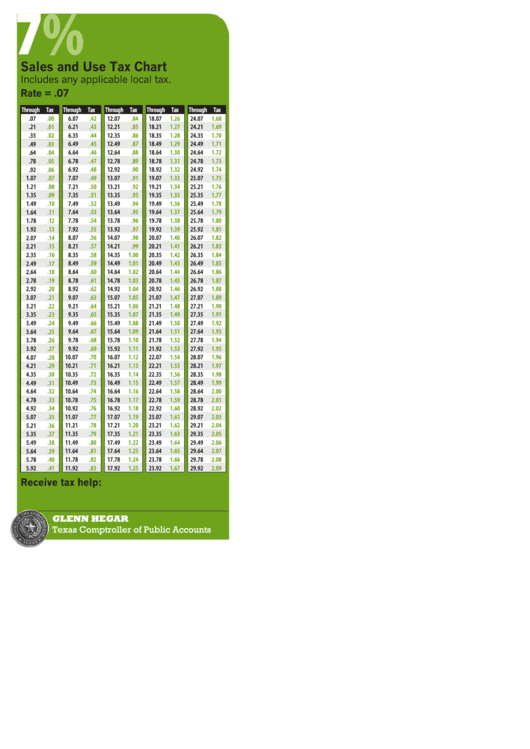

Sales and Use Tax Chart Texas Comptroller of Public Accounts

Texas Sales Tax Rate 2024 Jeanne Maudie

Texas Tax Chart Printable

7 Sales And Use Tax Chart Texas Comptroller printable pdf download

Web Taxes File And Pay.

Includes Any Applicable Local Tax.

Web Simply Enter Your Home Location, Property Value And Loan Amount To Compare The Best Rates.

Web Sales And Use Tax Chart.

Related Post: