Tqqq Vs Qqq Chart

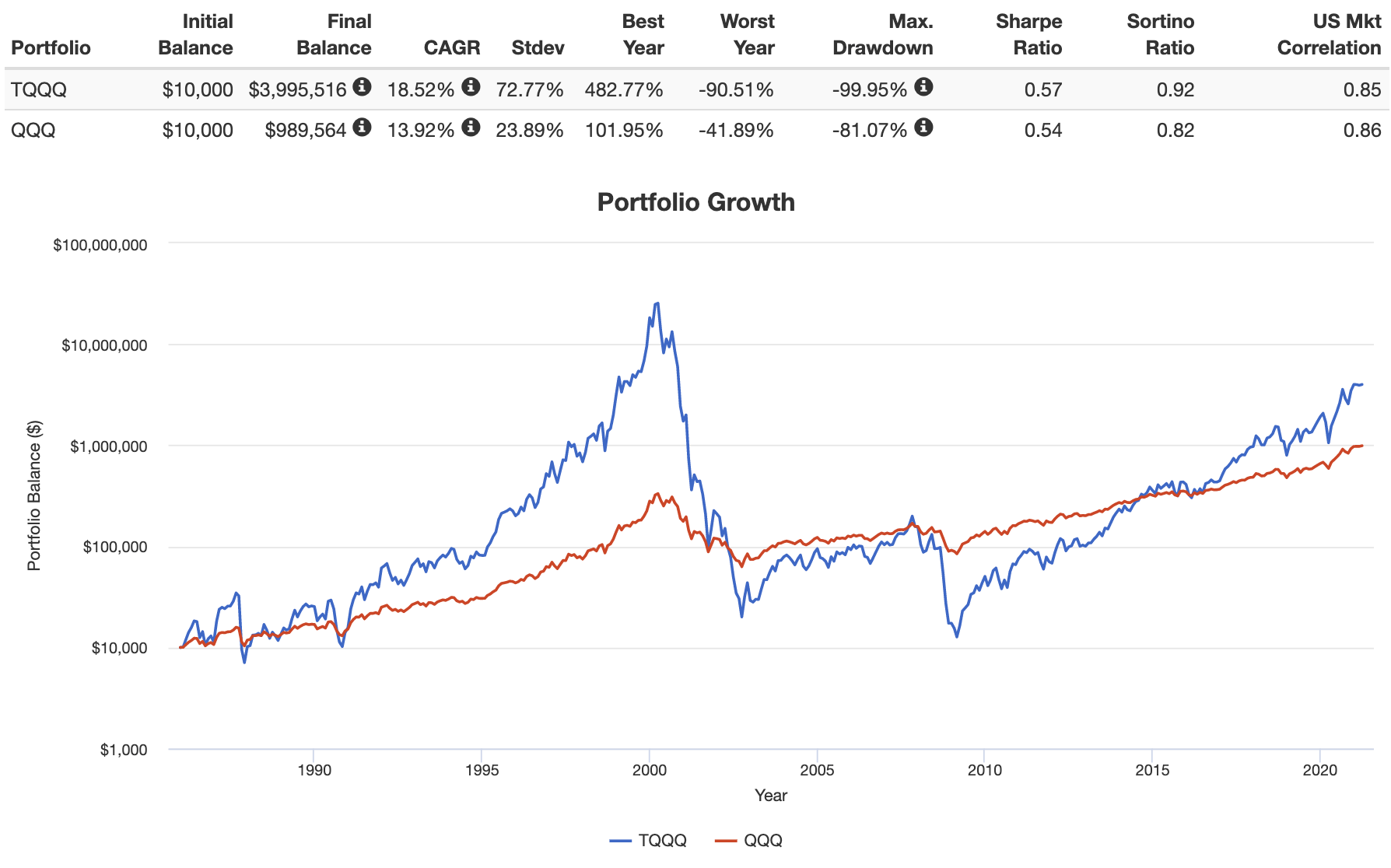

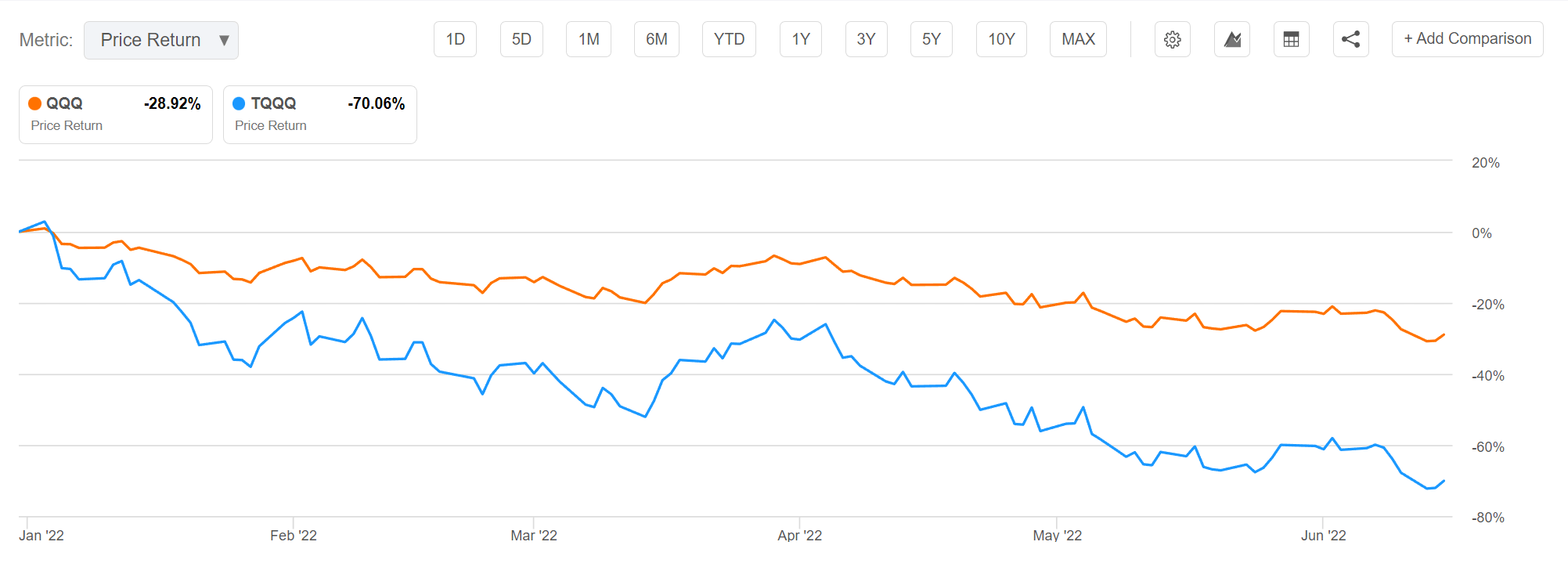

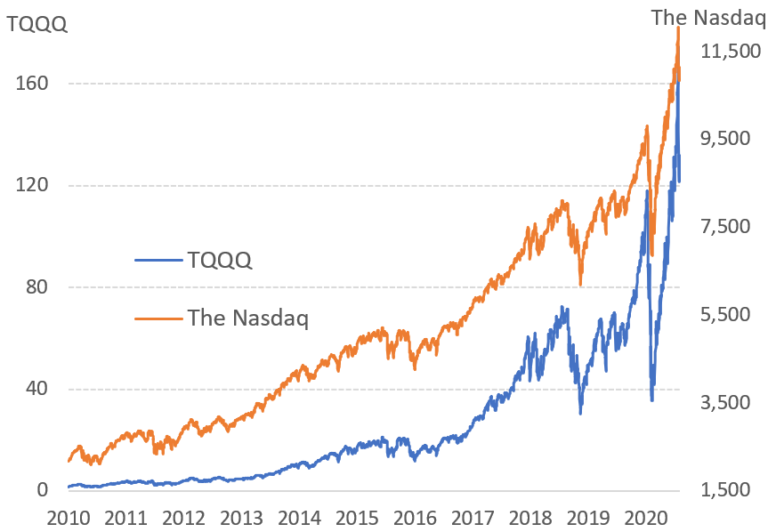

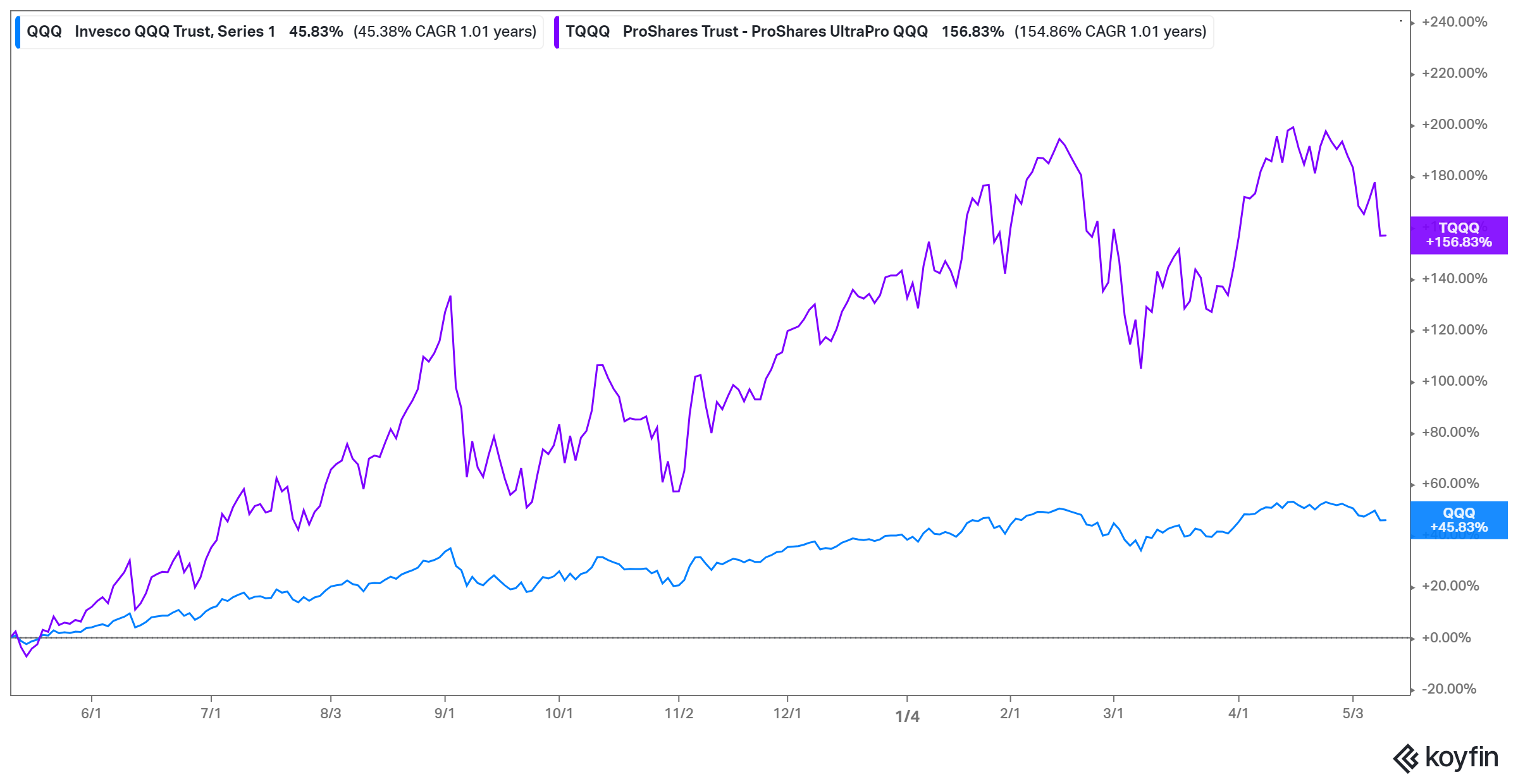

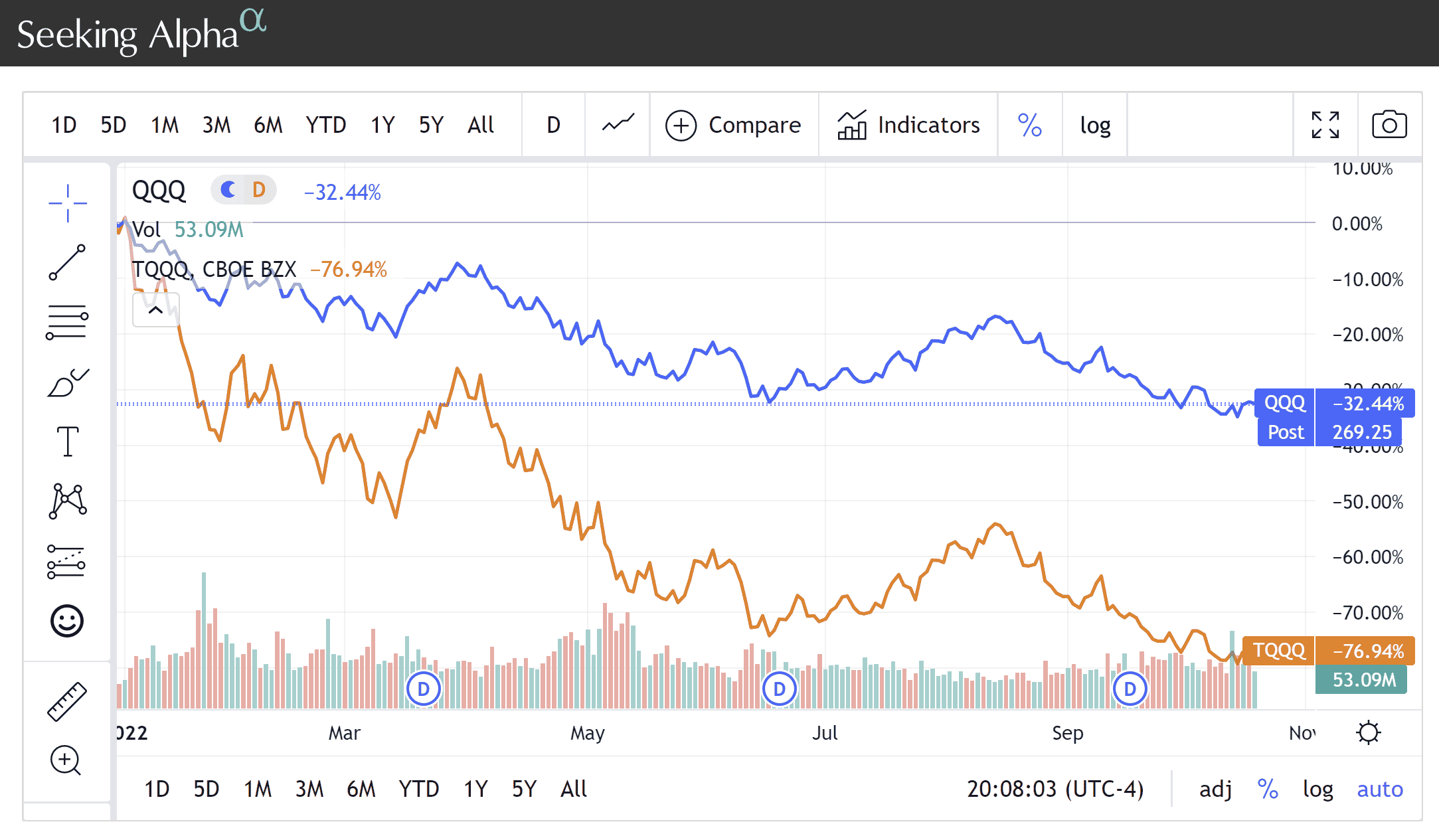

Tqqq Vs Qqq Chart - 1 day −0.11% 5 days −2.68% 1 month 19.90% 6 months 43.78% year to date 26.71% 1 year 79.99% 5 years 402.05% all time 15268.36% key stats. Learn the advantages and disadvantag… May 24 at 7:59 pm edt. Web tqqq stock price chart. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. 65.40 +0.05 (+0.08%) after hours: Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. These numbers are adjusted for stock splits and include dividends. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. All etfs by morningstar ratings. Web tqqq stock price chart. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better etf investing decisions. Web over the past 10 years, tqqq has outperformed qqq with an annualized return of 36.70%, while qqq has yielded a comparatively lower 18.35% annualized return. May 24 at 7:59. Web 65.35 +1.78 (+2.80%) at close: All etfs by morningstar ratings. May 24 at 7:59 pm edt. Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. These numbers are adjusted for stock splits and include dividends. All etfs by morningstar ratings. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on. Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. Web below i’ve compiled charts of the qqq and tqqq over 12 month, five year and 10 year timeframes. The bid & ask refers. Web compare etfs qqq and tqqq on performance, aum, flows, holdings, costs and esg ratings. 6:00 am. These numbers are adjusted for stock splits and include dividends. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics. 6:00 am 8:00 am 10:00 am 12:00 pm 2:00 pm 4:00 pm 6:00 pm. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better etf investing decisions. Over the past 10 years, qqq has had annualized average returns of 18.31% , compared to 36.60% for tqqq. Web over the past 10 years, tqqq. Web 65.35 +1.78 (+2.80%) at close: These numbers are adjusted for stock splits and include dividends. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Web below i’ve compiled charts of the qqq and tqqq over 12 month, five year and 10 year timeframes. As you can see, tqqq’s returns have ranged between 249% and 565% of qqq's return. The bid & ask refers. 61.4 61.5 61.6 61.7 61.8 61.9 62 62.1 62.2. Web over the past 10 years, tqqq has outperformed qqq with an annualized return of 36.70%, while qqq has yielded a comparatively lower 18.35% annualized return. Learn the advantages and disadvantag… Daily return during q2 2024. 65.40 +0.05 (+0.08%) after hours: Fund flows (1y) −5.77 b usd. Learn the advantages and disadvantag… The bid & ask refers. Assets under management (aum) 22.00 b usd. 6:00 am 8:00 am 10:00 am 12:00 pm 2:00 pm 4:00 pm 6:00 pm. Web tqqq stock price chart. Web below i’ve compiled charts of the qqq and tqqq over 12 month, five year and 10 year timeframes. The bid & ask refers. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better. Assets under management (aum) 22.00 b usd. Daily return during q2 2024. May 24 at 7:59 pm edt. 6:00 am 8:00 am 10:00 am 12:00 pm 2:00 pm 4:00 pm 6:00 pm. The bid & ask refers. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. All etfs by morningstar ratings. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that help make better etf investing decisions. Web over the past 10 years, tqqq has outperformed qqq with an annualized return of 36.70%, while qqq has yielded a comparatively lower 18.35% annualized return. Web tqqq stock price chart. 65.40 +0.05 (+0.08%) after hours: Learn the advantages and disadvantag… Web below i’ve compiled charts of the qqq and tqqq over 12 month, five year and 10 year timeframes. Web 65.35 +1.78 (+2.80%) at close: Web in the past year, qqq returned a total of 29.88%, which is significantly lower than tqqq's 79.16% return. 1 day −0.11% 5 days −2.68% 1 month 19.90% 6 months 43.78% year to date 26.71% 1 year 79.99% 5 years 402.05% all time 15268.36% key stats.

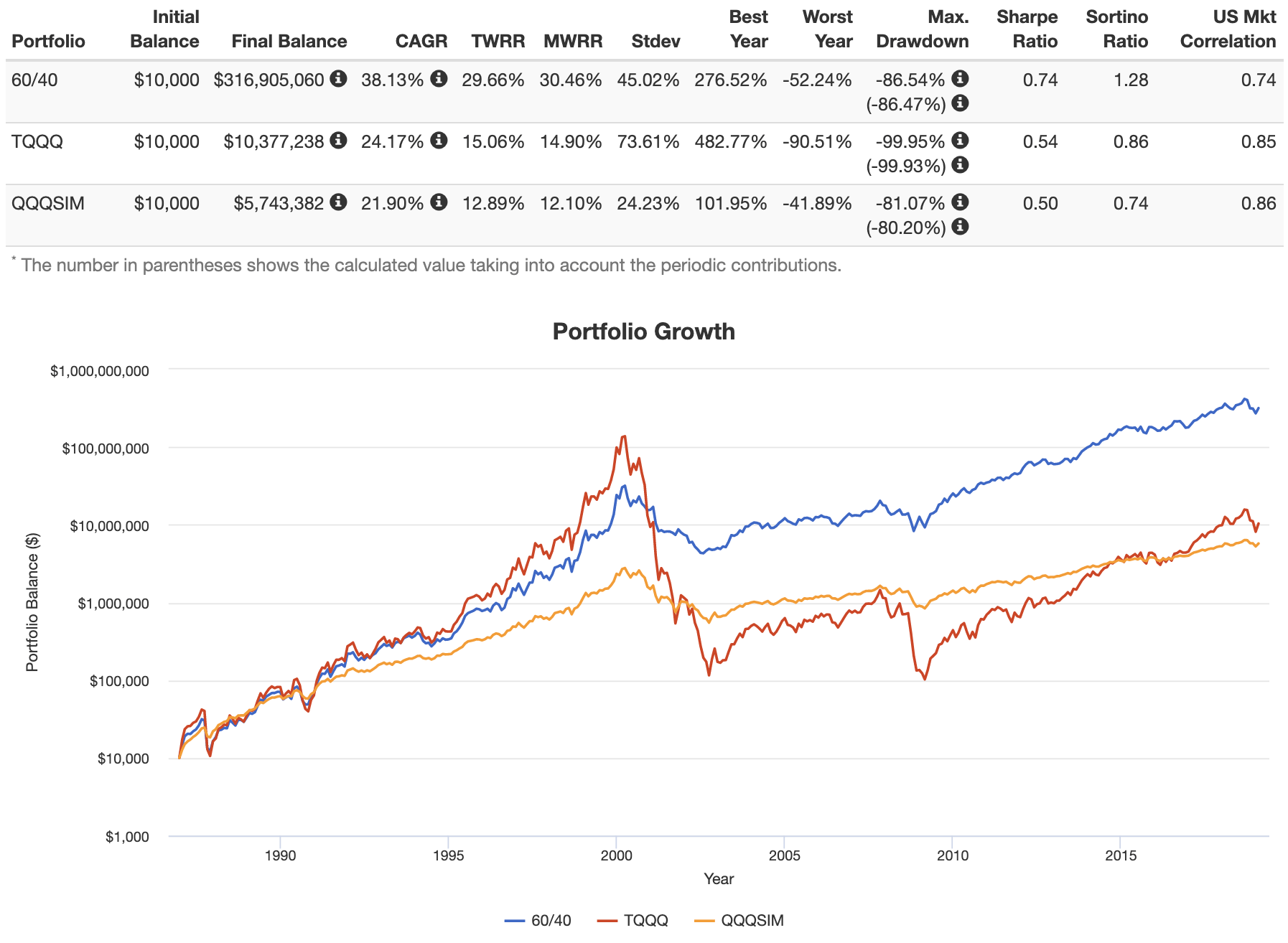

TQQQ ETF Is It A Good Investment for a Long Term Hold Strategy?

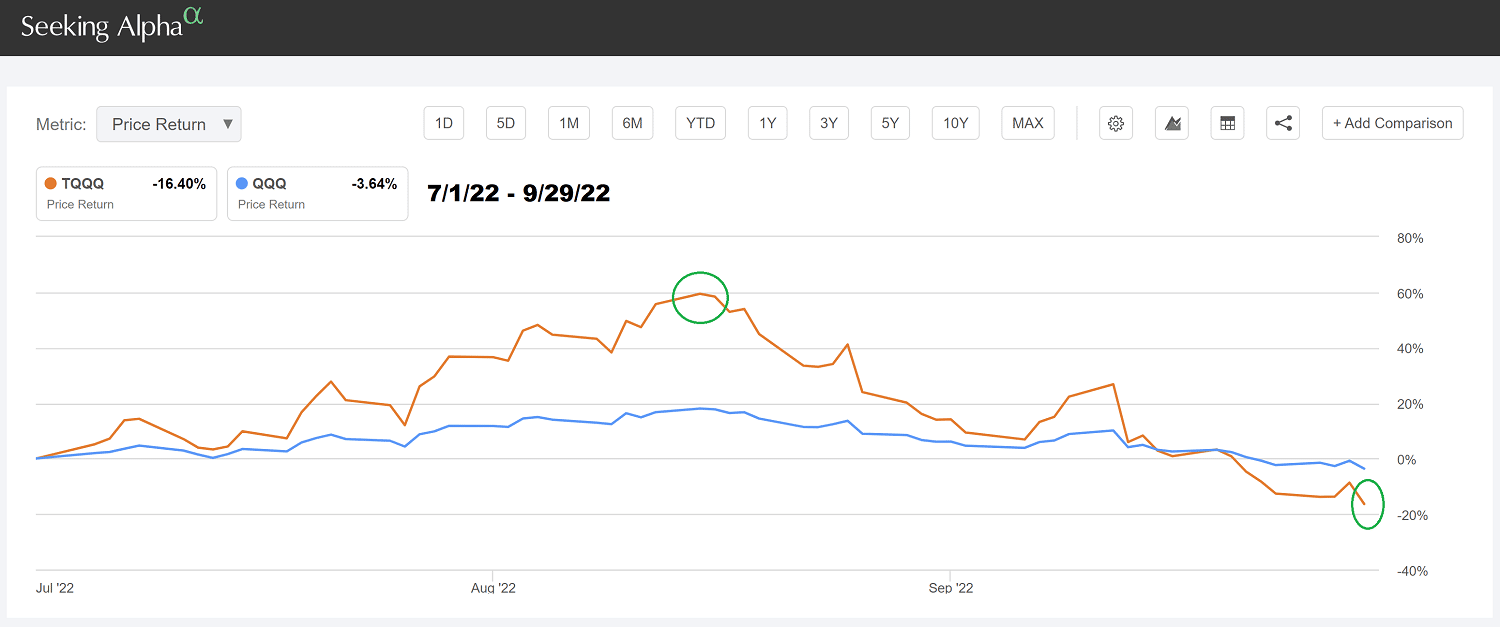

TQQQ ETF A Tool For Swing Traders Seeking Alpha

TQQQ ETF Is It A Good Investment for a Long Term Hold Strategy?

The Powerful Secret to TQQQ Investing Wall Strategies

Is TQQQ or QQQ ETF a Better Investment for You?

ETF Battles QQQ vs. VGT (12/20) ETF Portfolio Management

ProShares UltraPro QQQ ETF (TQQQ) TQQQ CHART

ARKK vs TQQQ vs QQQ for AMEXARKK by wendigooor — TradingView

Is TQQQ Stock Worth a Long Term Hold?

Is TQQQ Stock Worth a Long Term Hold?

Over The Past 10 Years, Qqq Has Had Annualized Average Returns Of 18.31% , Compared To 36.60% For Tqqq.

Web Compare Etfs Qqq And Tqqq On Performance, Aum, Flows, Holdings, Costs And Esg Ratings.

Bid Price And Ask Price.

07:00 08:00 09:00 10:00 11:00 12:00 13:00 58 59 60 61 62 63 Zoom 1D 1W 1M 3M 6M Ytd 1Y 3Y 5Y 10Y 15Y 20Y May 31, 2024 → May 31, 2024.

Related Post: