Triple Bottom Chart

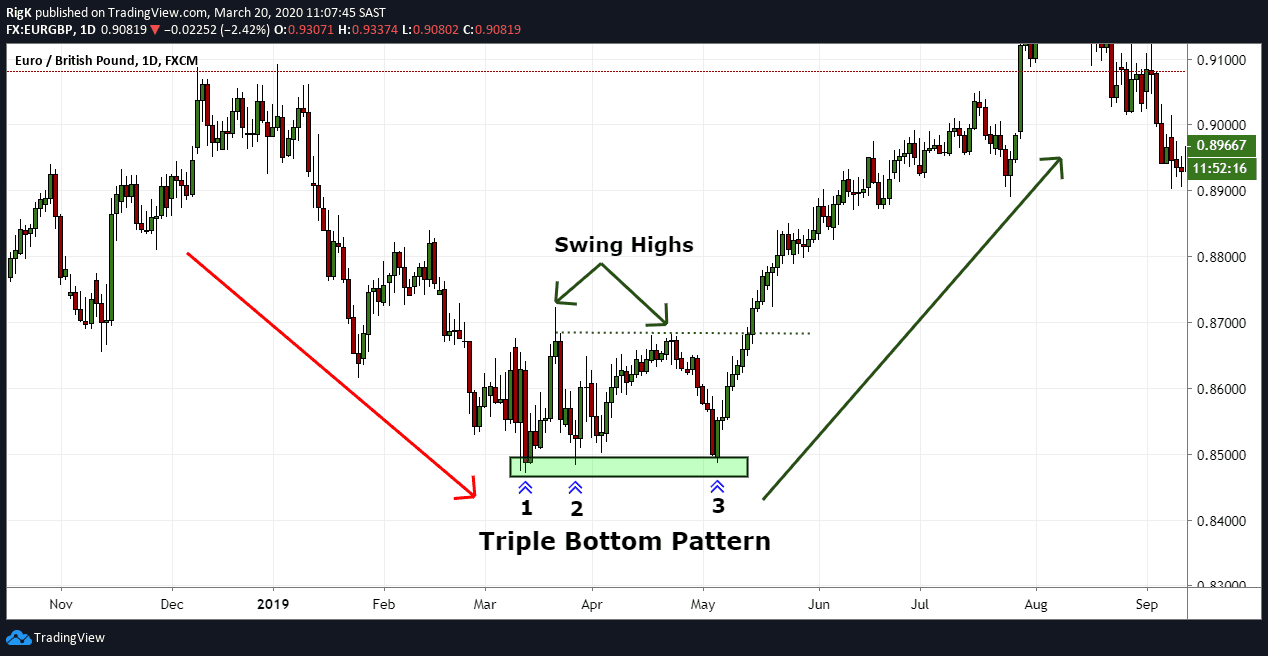

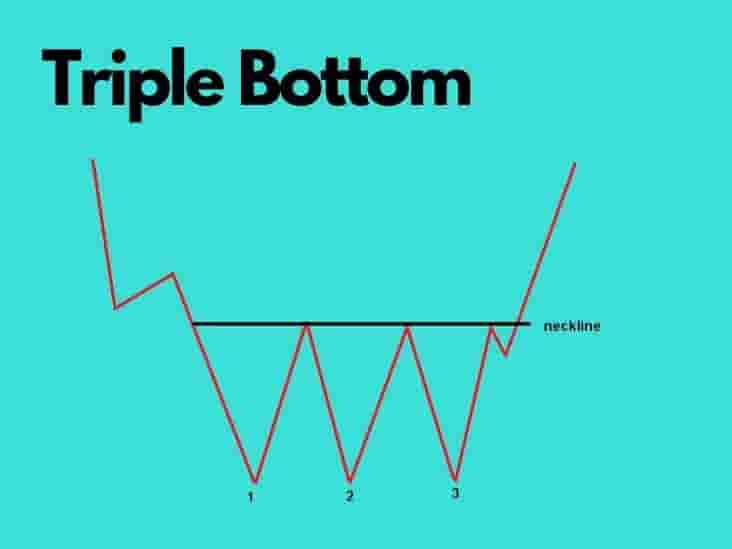

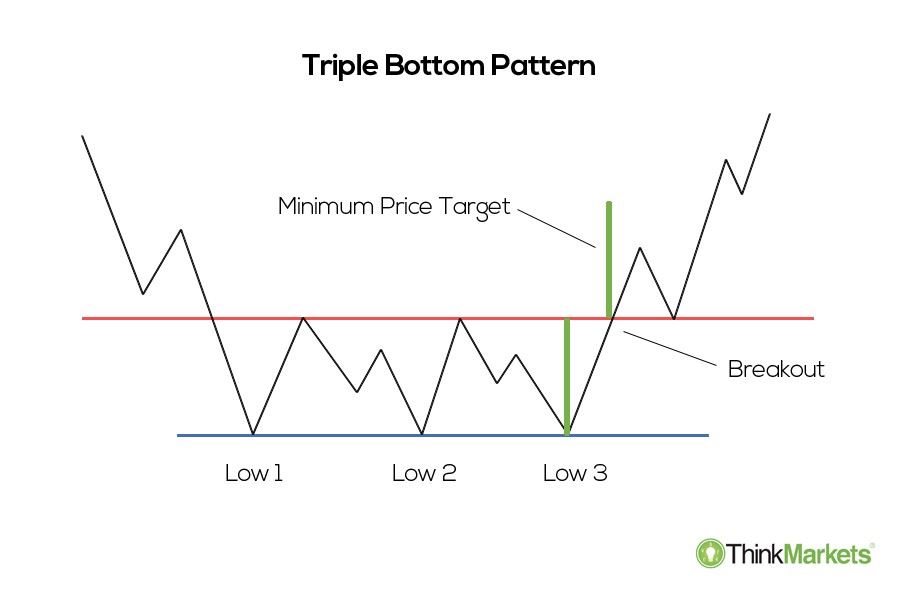

Triple Bottom Chart - It involves monitoring price action to find a distinct pattern before the price launches higher. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Typically, the pattern follows a prolonged downtrend where bears are controlling the trading market. The pattern appears on a price chart as three equal low levels followed by an uptrend that breaks through the. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Web the triple bottom is a bullish reversal chart pattern that could be an indication that sellers (bears) are losing control of a downtrend and that buyers (bulls) are taking over. Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price. It consists of 3 swing low levels in the price and it signals that a bearish. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. Much like its twin, the triple top pattern, it is considered one of the most reliable and accurate chart patterns and is fairly easy to identify on trading. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price. Web the triple bottom chart pattern is a technical analysis formation that occurs when the price of an asset creates three distinct troughs at. But what do triple bottom patterns look like? Web a triple bottom pattern is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears). These troughs are formed as a result of price action, where the asset’s price reaches a low point before bouncing back up. Web a triple bottom is a. These troughs are formed as a result of price action, where the asset’s price reaches a low point before bouncing back up. It involves monitoring price action to find a distinct pattern before the price launches higher. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a. Web the triple bottom chart pattern is a technical analysis trading strategy in which the trader attempts to identify a reversal point in the market. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Diese beiden formationen sind charakteristisch mit dem double top. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. Think of this pattern like a trusty ally that nudges you, suggesting, “the market’s tide might be turning.” It appears rarely, but it always warrants consideration, as it is. The characteristics are almost completely the same as the double bottom with the only difference that the support base of the pattern consists of not two but three bottoms with a temporary price recovery in between. Three troughs follow one another, indicating strong support. Diese beiden formationen sind charakteristisch mit dem double top / double bottom vergleichbar, besitzen jedoch drei. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. It consists of. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. It’s characterized by three equal lows followed by a breakout above the resistance level. It involves monitoring price action to find a distinct pattern before the price launches higher. It appears rarely, but it always. Three troughs follow one another, indicating strong support. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web the triple bottom chart pattern is a technical analysis formation that occurs when the price of an asset creates three distinct troughs at approximately the same level. But what do triple bottom patterns look like? The characteristics are almost completely the same as the double bottom with the only difference that the support base of the pattern consists of not two but three bottoms with a temporary price recovery in between. This is a sign of a tendency towards a reversal. Beim triple top sollten die höchstkurse wiederum auf einer höhe liegen, toleranz etwa 3 prozent. It’s characterized by three equal lows bouncing off support followed by the price action breaching resistance. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. Triple top und triple bottom. It consists of 3 swing low levels in the price and it signals that a bearish trend may be ending. Web the triple bottom chart pattern is used in technical analysis. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between them. For the triple bottom below, the support zone allows the price to bounce back three times. Diese beiden formationen sind charakteristisch mit dem double top / double bottom vergleichbar, besitzen jedoch drei hochs bzw.

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

Chart Pattern Triple Bottom — TradingView

Triple Bottom Pattern Explanation and Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Bottom_Definition_Jun_2020-01-38534512050d4a0a8e7cefc9ebb3509f.jpg)

What Is a Triple Bottom Chart in Technical Analysis?

Triple Bottom Chart Pattern Definition With Examples

How To Trade Triple Bottom Chart Pattern TradingAxe

The Triple Bottom Pattern is a bullish chart pattern. It occurs

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Chart Pattern Trading charts, Stock trading strategies

The Triple Bottom Candlestick Pattern ThinkMarkets AU

Web A Triple Bottom Is A Bullish Reversal Chart Pattern Found At The End Of A Bearish Trend And Signals A Shift In Momentum.

Web The Triple Bottom Pattern Offers A Second Chance For Traders Who Missed The Double Bottom Opportunity.

Typically, The Pattern Follows A Prolonged Downtrend Where Bears Are Controlling The Trading Market.

Web The Triple Bottom Is A Bullish Reversal Chart Pattern That Could Be An Indication That Sellers (Bears) Are Losing Control Of A Downtrend And That Buyers (Bulls) Are Taking Over.

Related Post: