Triple Top Chart Pattern

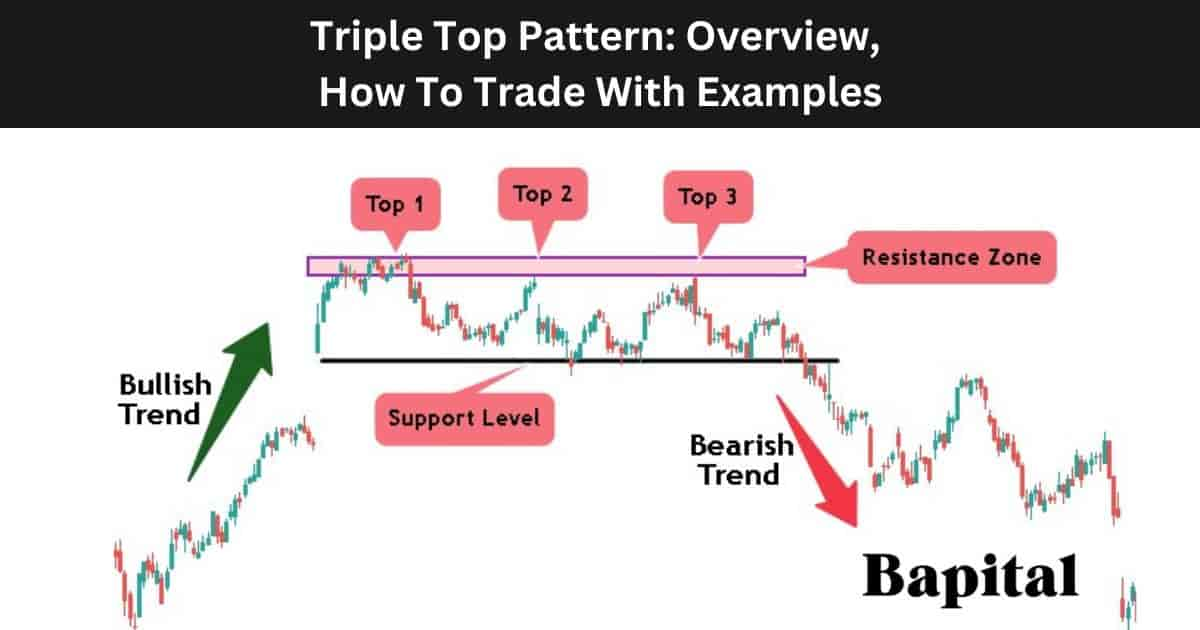

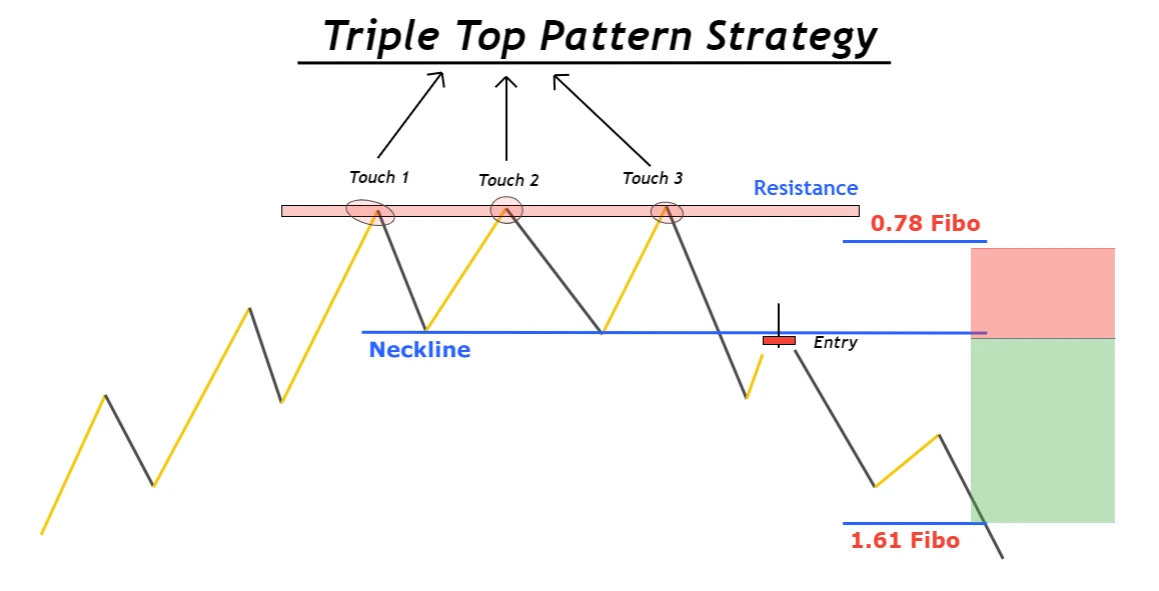

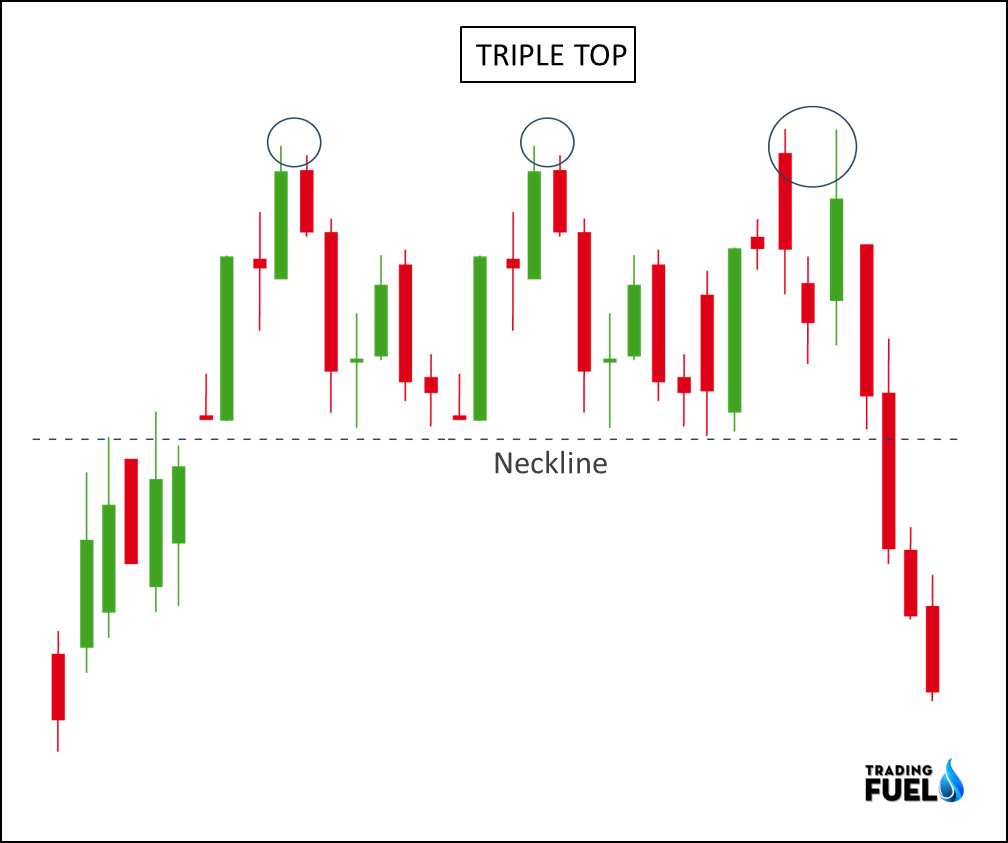

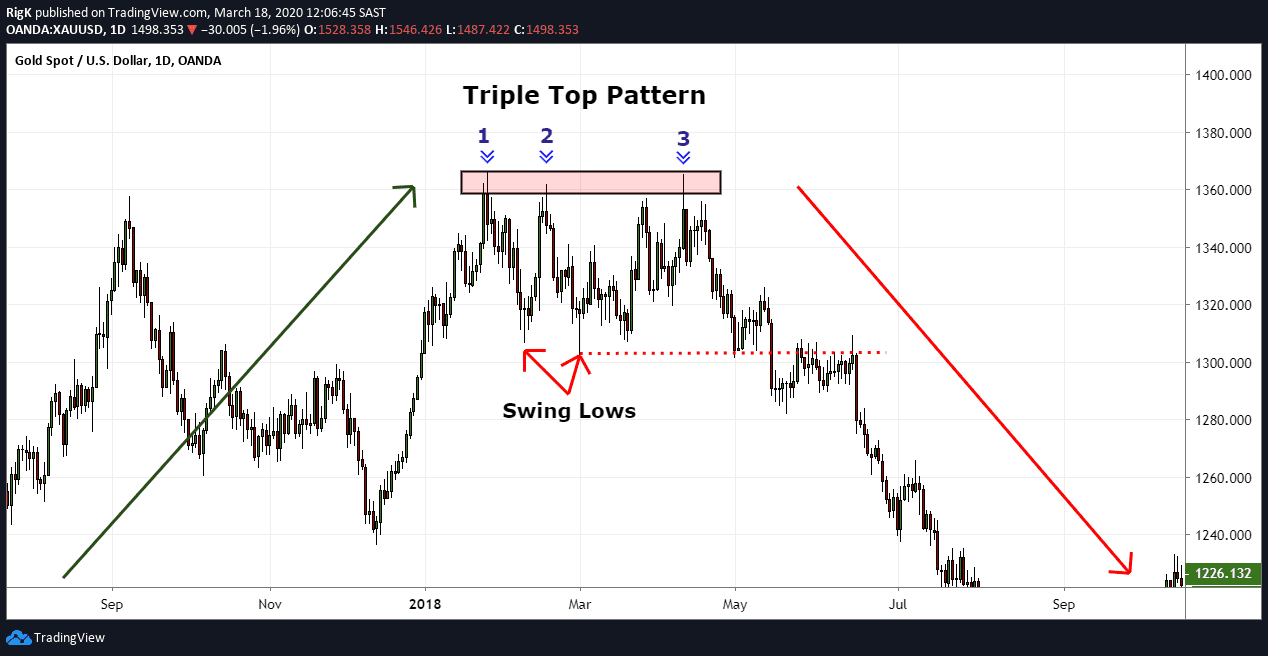

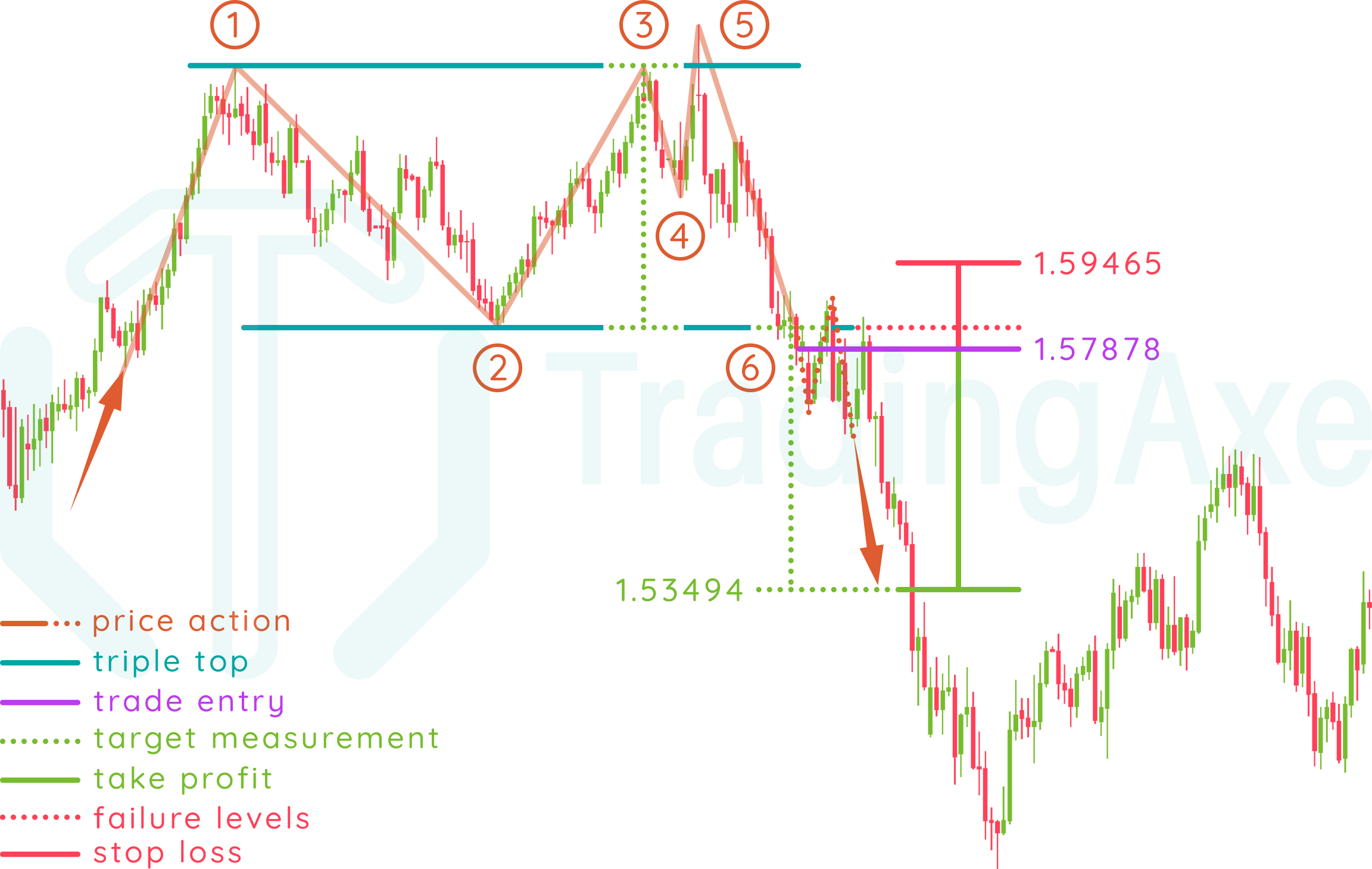

Triple Top Chart Pattern - Go short on a break below the support line. A triple top pattern is a bearish reversal signal that forms after an extended uptrend and consists of three swing high resistance prices and a support trendline. Thus, it’s commonly interpreted as a sign of a coming bearish trend. The first peak is formed after a strong uptrend and then retrace back to the neckline. Web classic triple top breakouts are five columns wide: A triple top pattern is a bearish reversal pattern that consists of three peaks or resistance levels that fail to break above the previous highs. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. See the structure, strengths, weaknesses and examples of this rare but powerful pattern. Go long on a break above the resistance line. Web learn what a triple top pattern is, how to identify it, and how to trade it in technical analysis. More sellers see that buyers are weak and unable to push. The first peak is formed after a strong uptrend and then retrace back to the neckline. Web learn what a triple top pattern is, how to identify it, and how to trade it in technical analysis. In this complete guide to the triple top pattern, you’ll learn the common. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. These patterns can mark reversal breakouts or continuation breakouts. A triple top pattern is a bearish reversal signal that forms after an extended uptrend and consists of three swing high resistance prices and a support trendline. A triple top pattern. Web a triple top is a bearish reversal chart pattern that signals that buyers are losing control to the sellers. Web learn how to identify and trade the triple top pattern, a bearish reversal signal that indicates buyers are losing momentum and sellers are gaining control. Web learn what a triple top pattern is, how to identify it, and how. The chart pattern is categorized as a bearish reversal pattern. See the structure, strengths, weaknesses and examples of this rare but powerful pattern. This pattern is formed with three peaks above a support level/neckline. Go long on a break above the resistance line. Price often rallies back to the support line which then acts as a resistance level. Find out the key components, formation criteria, volume indicator, and trading strategies for this pattern. This pattern is formed with three peaks above a support level/neckline. The chart pattern is categorized as a bearish reversal pattern. Web a triple top chart pattern is a bearish technical analysis formation often used in crypto trading and other financial markets. Web the triple. Web a triple top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. This pattern is formed with three peaks above a support level/neckline. Distinguishing between reversal and continuation depends on the prior move. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how. See the structure, strengths, weaknesses and examples of this rare but powerful pattern. Find out the key components, formation criteria, volume indicator, and trading strategies for this pattern. A triple top pattern is a bearish reversal pattern that consists of three peaks or resistance levels that fail to break above the previous highs. Web learn what a triple top pattern. Web a triple top chart pattern is a bearish technical analysis formation often used in crypto trading and other financial markets. Web a triple top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. Web learn how to identify and trade the triple top pattern, a bearish reversal chart pattern that emerges after a prolonged. Web learn what a triple top pattern is, how to identify it, and how to trade it in technical analysis. Web learn what a triple top pattern is, how it forms, and why it signals a bearish reversal. A triple top pattern is a bearish reversal signal that forms after an extended uptrend and consists of three swing high resistance. A triple top pattern is a bearish reversal pattern that consists of three peaks or resistance levels that fail to break above the previous highs. Go short on a break below the support line. Find out the key components, formation criteria, volume indicator, and trading strategies for this pattern. It signals the potential end of an uptrend and the beginning. The first peak is formed after a strong uptrend and then retrace back to the neckline. Web classic triple top breakouts are five columns wide: Find out how to trade this pattern, when it is likely to fail, and what common mistakes to avoid. Web the triple top pattern is a reversal chart pattern that is formed when the price of security hits the same resistance level three times before breaking down. A triple top pattern is a bearish reversal signal that forms after an extended uptrend and consists of three swing high resistance prices and a support trendline. Price often rallies back to the support line which then acts as a resistance level. Web learn what a triple top pattern is, how to identify it, and how to trade it. See examples, tips, and strategies for trading the triple top pattern with fibonacci levels and macd. Web learn what a triple top pattern is, how to identify it, and how to trade it in technical analysis. Web learn how to identify and trade the triple top pattern, a bearish reversal signal that indicates buyers are losing momentum and sellers are gaining control. A triple top pattern is a bearish reversal pattern that consists of three peaks or resistance levels that fail to break above the previous highs. These patterns can mark reversal breakouts or continuation breakouts. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Go long on a break above the resistance line. It signals the potential end of an uptrend and the beginning of a downtrend. See real chart examples of triple tops in stocks, forex and.

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

Triple Top Pattern Overview, How To Trade With Examples

Triple Top Pattern A Technical Analyst's Guide ForexBee

Chart Pattern Triple Top — TradingView

The Complete Guide to Triple Top Chart Pattern

The Complete Guide to Triple Top Chart Pattern

Double Top Pattern Definition How to Trade Double Tops & Bottoms

Triple Top Pattern A Guide by Experienced Traders

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

Triple Top Definition

How To Trade Triple Top Chart Pattern TradingAxe

Web Learn How To Identify And Use The Triple Top Pattern, A Bearish Reversal Chart Pattern That Occurs After An Uptrend And Tests The Highest Price Three Times.

The Pattern Holds Significant Importance In Digital Assets Due To Their Volatile Nature.

Web A Triple Top Chart Pattern Is A Bearish Reversal Chart Pattern That Is Formed After An Uptrend.

Find Out The Key Components, Formation Criteria, Volume Indicator, And Trading Strategies For This Pattern.

Related Post: