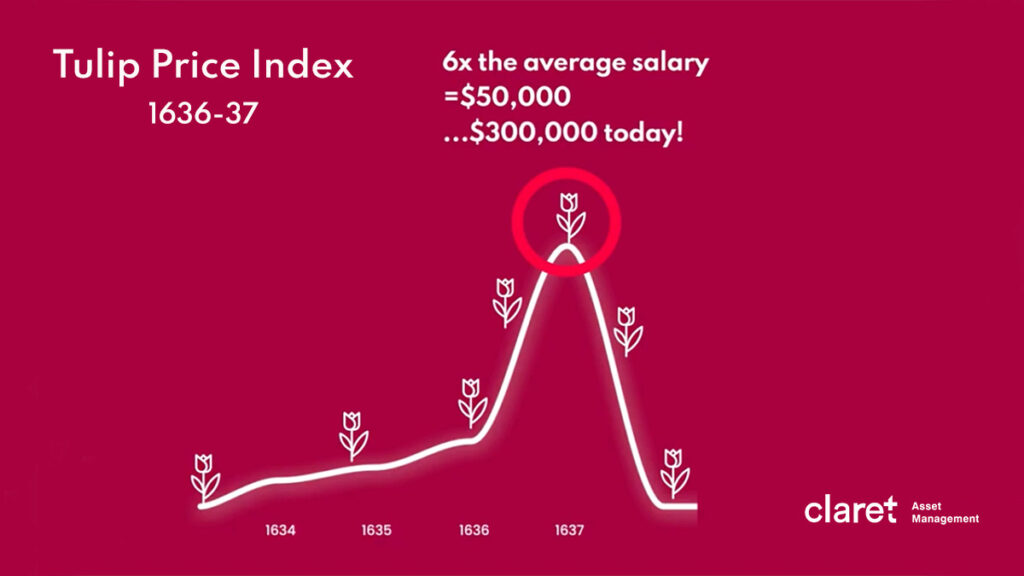

Tulip Bubble Price Chart

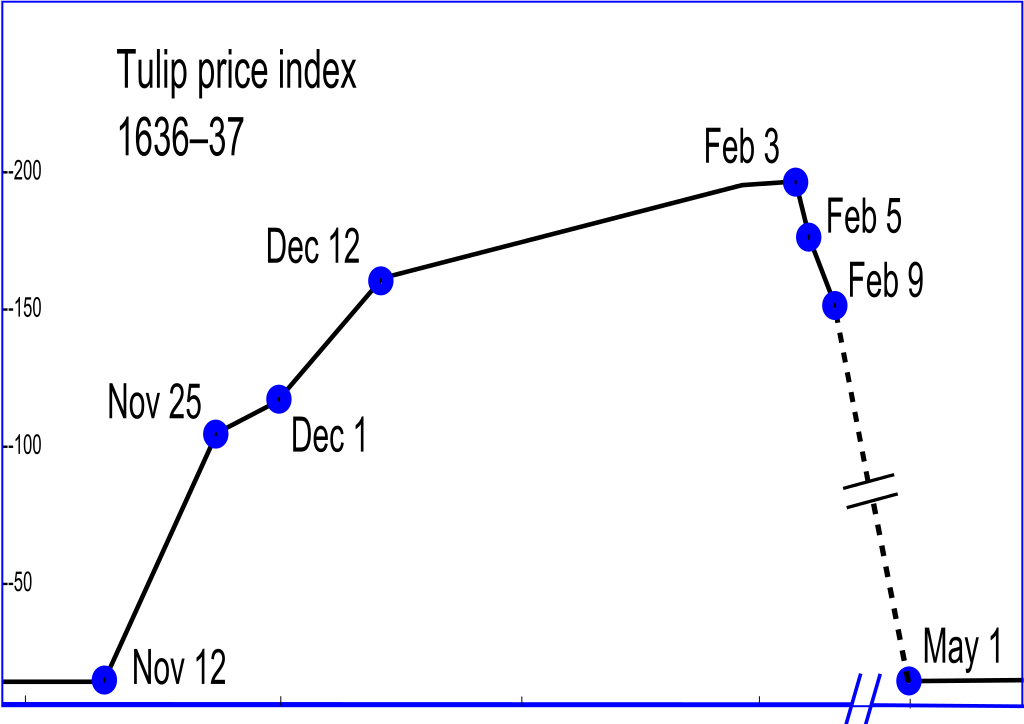

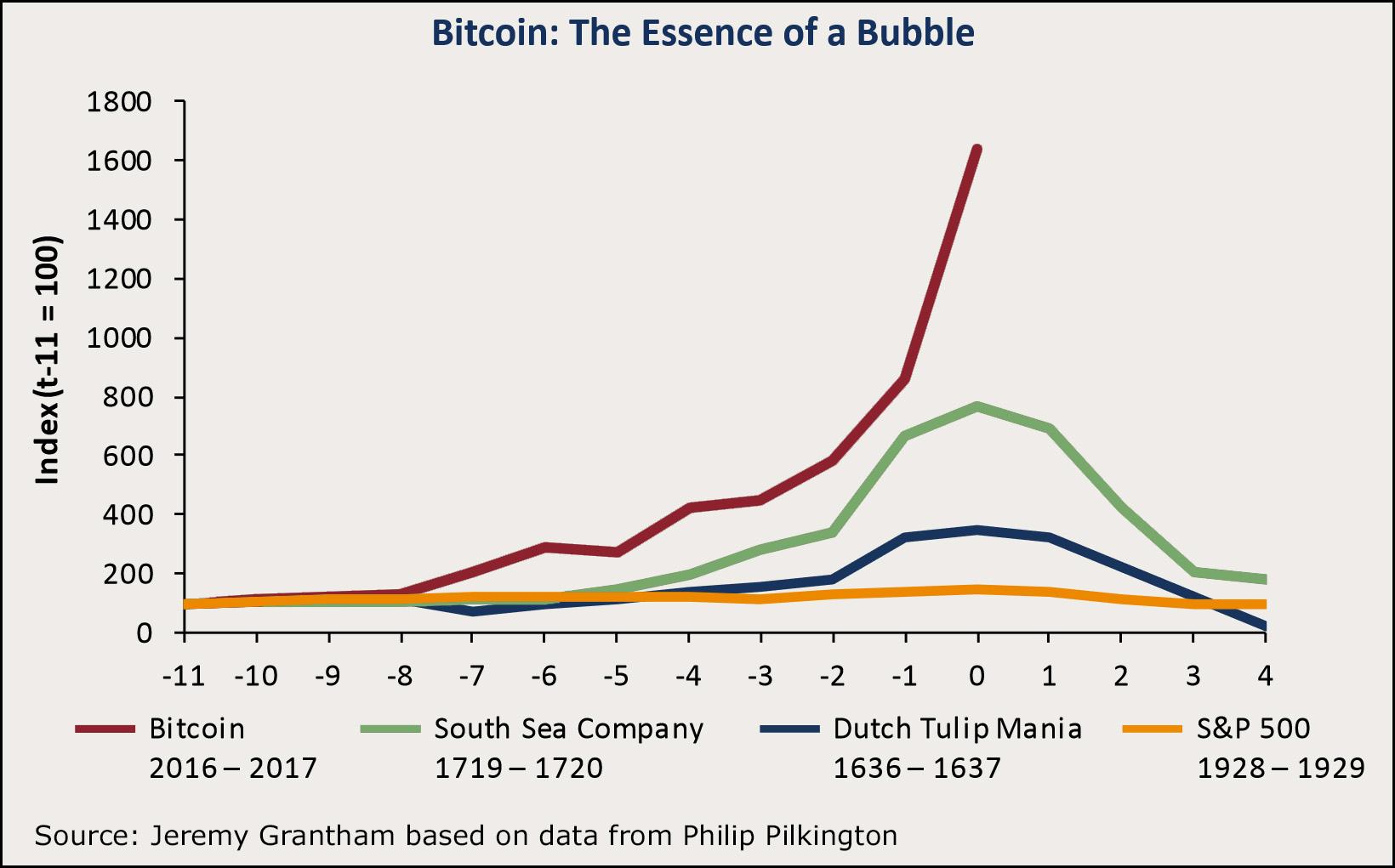

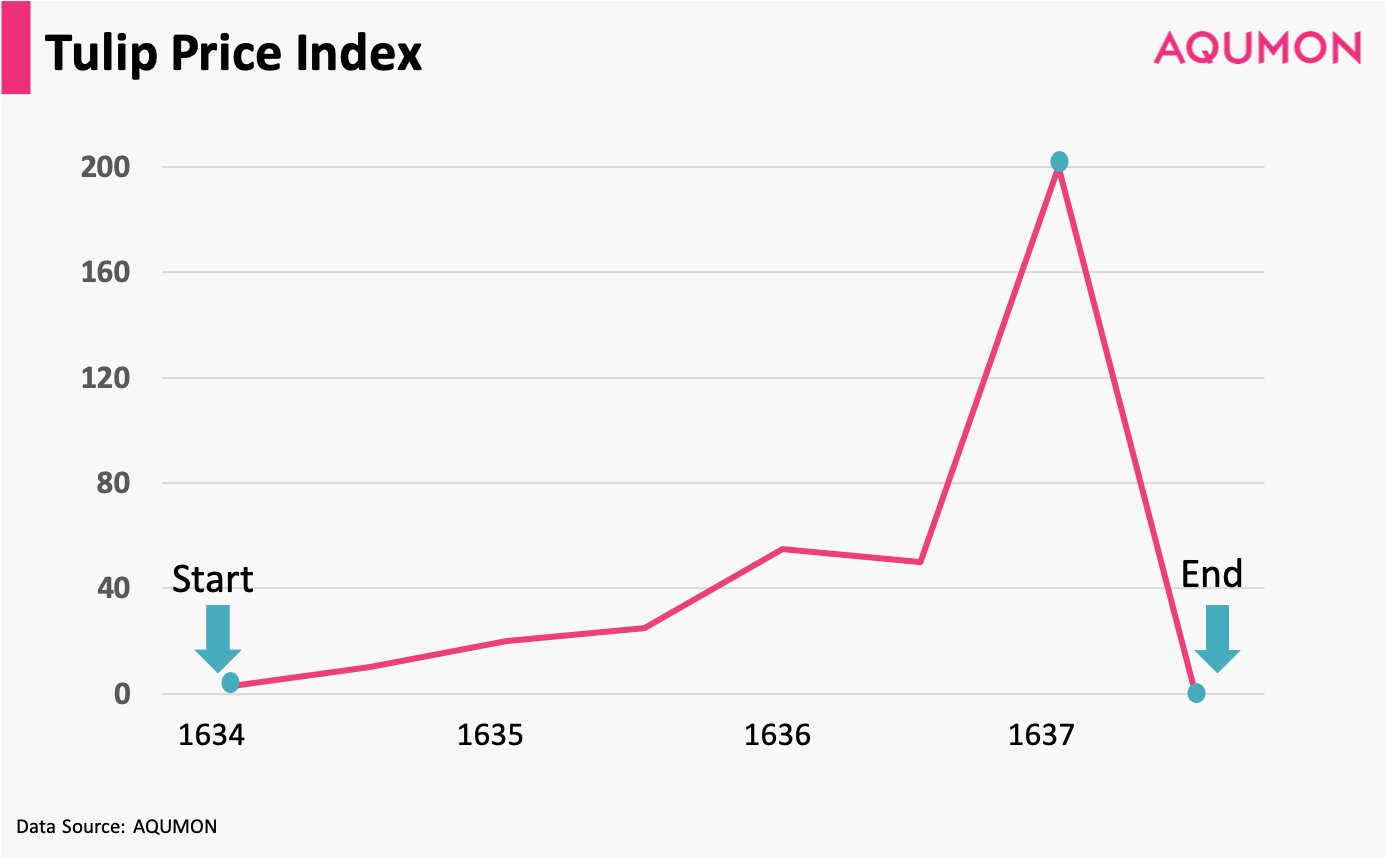

Tulip Bubble Price Chart - Web tulip mania is often cited as the classic example of a financial bubble: Web dutch tulip mania, also known as tulip speculation, tulip bubble, reveals the period when tulip bulb prices in the golden age of the netherlands between 1634 and 1637 rose to extraordinary levels and then collapsed. Web updated march 22, 2020. Tulips were introduced into europe from turkey shortly after 1550, and the delicately formed, vividly colored flowers became a popular if costly item. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. But months later, the bubble burst. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. Web by 1638 prices leveled off. Trading became increasingly more organized in these rare tulips, with companies established to grow, buy, and sell them. The major acceleration started in 1634 and then dramatically collapsed in february 1637. Web the tulip bubble chart is a classic depiction of speculative mania and its eventual unravelling. Web people draw many comparisons between the tulip bubble of the 1600s and the current bitcoin craze. This phenomenon turned the market into a speculative playground that eventually led to the. But months later, the bubble burst. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. Web tulip mania is often cited as the classic example of a financial bubble: Trading became increasingly more organized in these rare tulips, with companies established to grow,. Web by 1638 prices leveled off. Web this chart shows a comparison of price developments during the tulip mania in 1637 and the current bitcoin bonanza of 2017 When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect. Web tulip mania is often cited as the classic example. Web dutch tulip mania, also known as tulip speculation, tulip bubble, reveals the period when tulip bulb prices in the golden age of the netherlands between 1634 and 1637 rose to extraordinary levels and then collapsed. Web according to the bbc, in 1633 a single bulb of semper augustus was worth 5,500 guilders. And tulips figure prominently in many of. 4 years later in 1637, the sum had nearly doubled to 10,000 guilders. Web according to the bbc, in 1633 a single bulb of semper augustus was worth 5,500 guilders. Web dutch tulip mania, also known as tulip speculation, tulip bubble, reveals the period when tulip bulb prices in the golden age of the netherlands between 1634 and 1637 rose. Web the tulip bubble chart is a classic depiction of speculative mania and its eventual unravelling. Web tulipmania is the story of a major commodity bubble, which took place in the 17th century as dutch investors began to madly purchase tulips, pushing their prices to unprecedented highs. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. Web by 1638 prices leveled off. But accounts of the subsequent crash may be more fiction than fact. Tulips were introduced into europe from turkey shortly after 1550, and the delicately formed, vividly colored flowers became a. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. But accounts of the subsequent crash may be more fiction than fact. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. As the ascent. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. When the price of something goes up and up, not because of its. Tulips were introduced into europe from turkey shortly after 1550, and the delicately formed, vividly colored flowers became a popular if costly item. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. Web this chart shows a comparison of price developments during the tulip mania in 1637. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. 4 years later in 1637, the sum had nearly doubled to 10,000 guilders. As the ascent of the chart began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item and a status symbol. In the 17th century, history’s first speculative bubble popped. Tulips were introduced into europe from turkey shortly after 1550, and the delicately formed, vividly colored flowers became a popular if costly item. Web the dutch tulip bulb market bubble, also known as tulip mania, is a significant event in economic history and a historical case study illustrating the potential consequences of speculative market behavior and the. This phenomenon turned the market into a speculative playground that eventually led to the infamous bubble burst. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. Web according to the bbc, in 1633 a single bulb of semper augustus was worth 5,500 guilders. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. Web people draw many comparisons between the tulip bubble of the 1600s and the current bitcoin craze. But accounts of the subsequent crash may be more fiction than fact. Trading became increasingly more organized in these rare tulips, with companies established to grow, buy, and sell them. Web the dutch tulip bulb market bubble (or tulip mania) was a period in the dutch golden age during which contract prices for some of the tulip bulbs reached extraordinarily high levels and then dramatically collapsed in february 1637. Web by 1638 prices leveled off.

Is TSLA A 1,000 Stock Or A Tulip Mania Bubble? Robert McCarty

FileTulip price index1.svg Wikipedia

Tulip Price Index Tulip Mania 1630s Chart Data Visualization

Tulip Chart A Visual Reference of Charts Chart Master

Tulipmania First Major Financial Bubble AQUMON

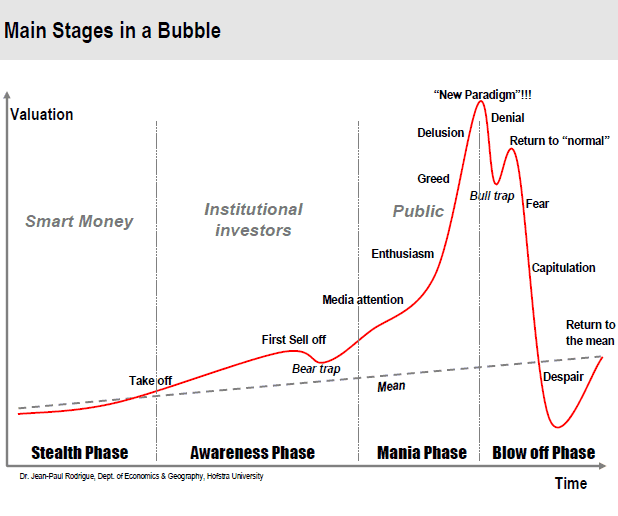

5 Stages of a Financial Bubble, From Birth to Bust » Claret

Tallenge Tulip Price Index Tulip Mania 1630s Chart Data

Price Of Tulips During Tulip Mania?N Amsterdam Tulip Museum

Bitcoin tulip bulb or another gold? Varchev Finance

The Index of Tulip Market during Tulip Bubble [10] Download

More Recently Some Modern Scholars Have Begun Reevaluate Long Held Assumptions Including The Idea That This Was Truly A Bubble.

Web Tulip Mania Is Often Cited As The Classic Example Of A Financial Bubble:

Web This Chart Shows A Comparison Of Price Developments During The Tulip Mania In 1637 And The Current Bitcoin Bonanza Of 2017

As Tulip Prices Shot Up By 1,000 Percent In The 1630S, Dutch Investors Scrambled To Buy Up Bulbs Still In The Ground.

Related Post: