Tulip Bulb Mania Chart

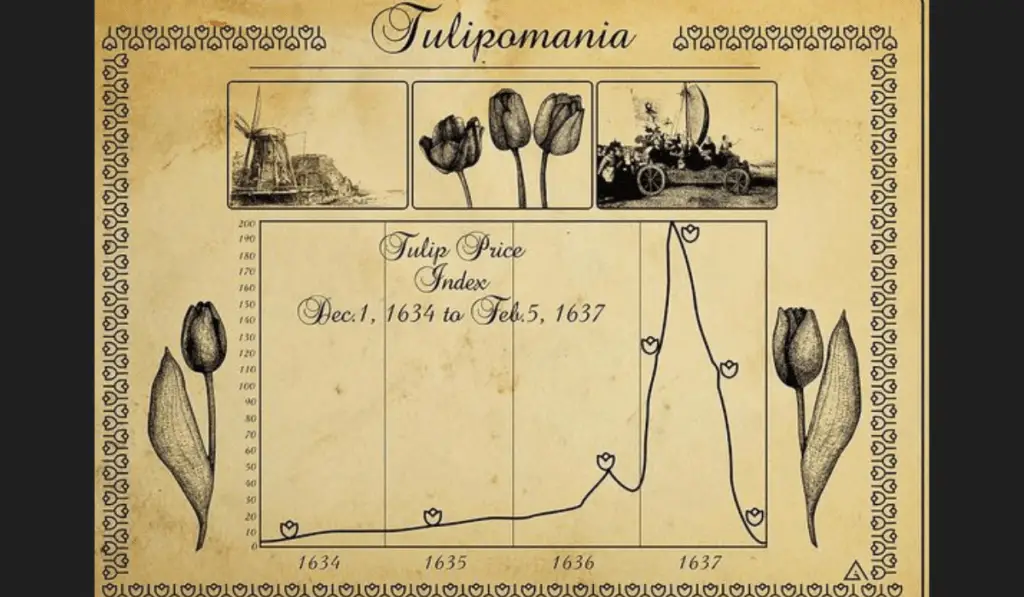

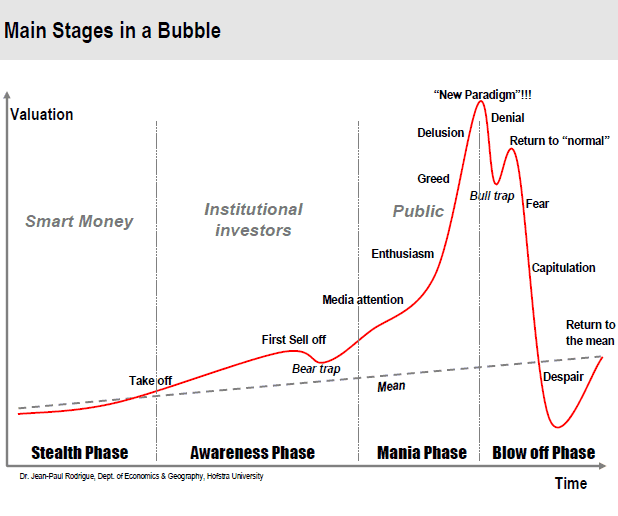

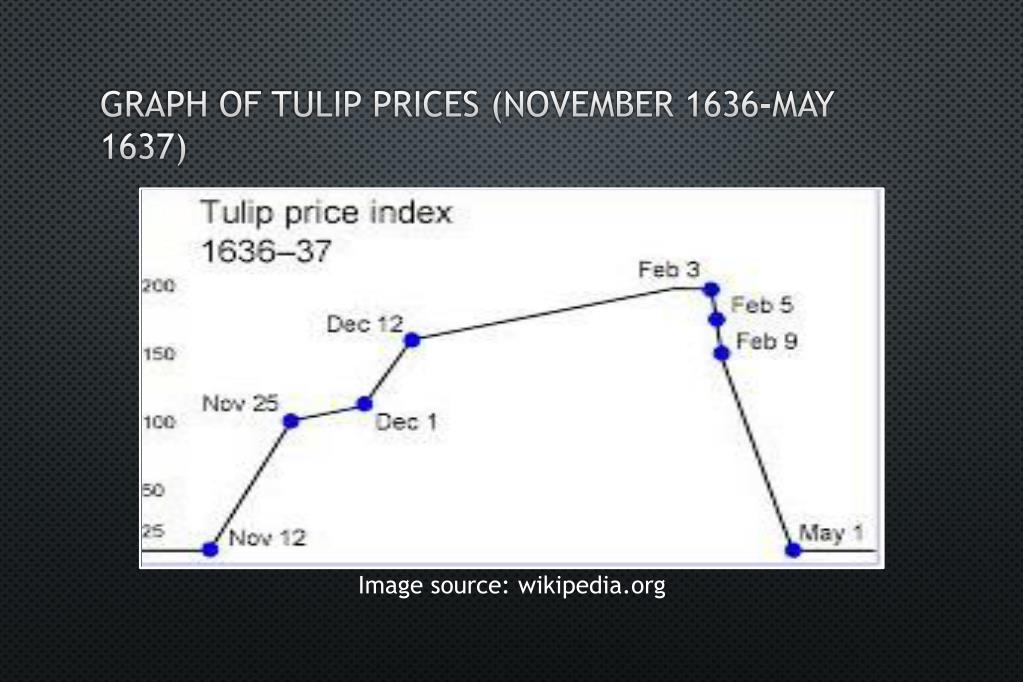

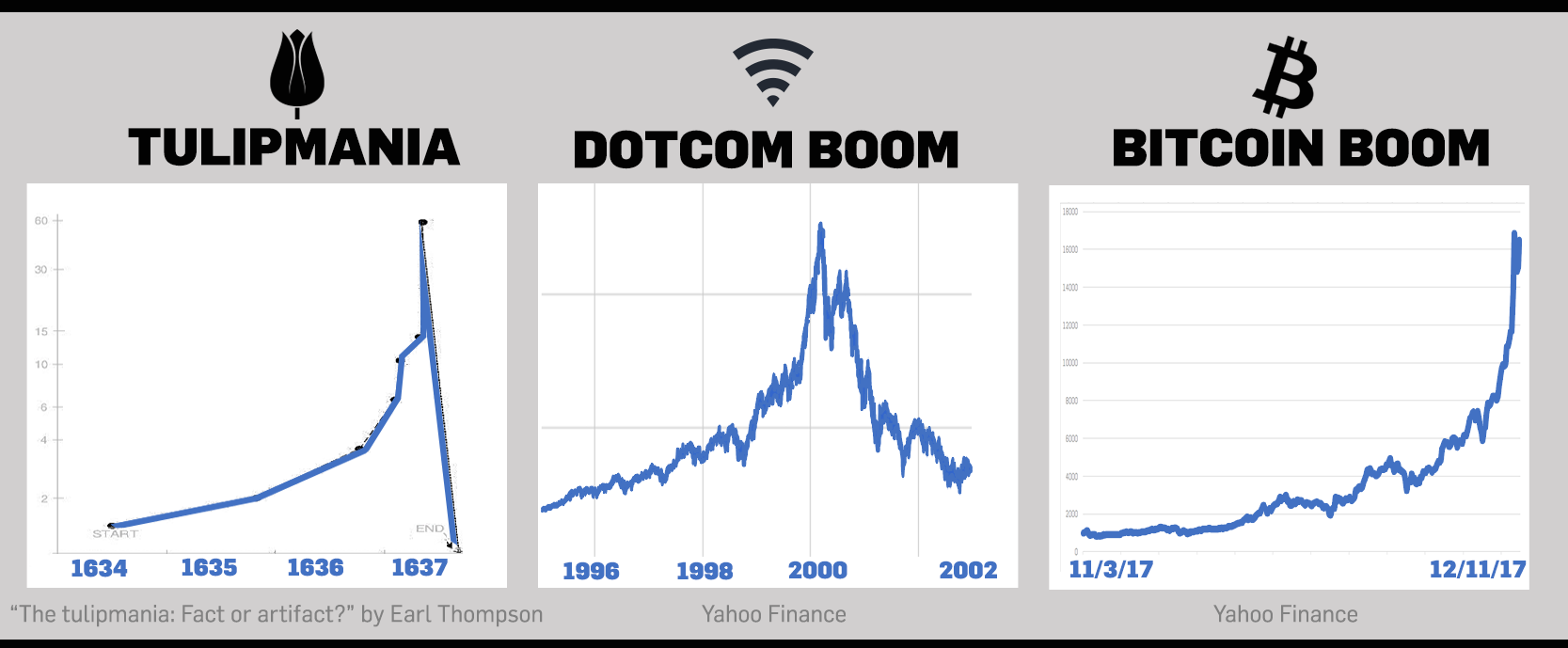

Tulip Bulb Mania Chart - Web tulip mania is often cited as the classic example of a financial bubble: Web tulip mania was a period during the 17th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. The values of this index were compiled by earl a. As the ascent of the chart began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item and a status symbol. With gains such as these, it is not hard to understand the mad rush to buy tulip bulbs at any cost. Web published march 18, 2020. Web two tons of butter. “many who, for a brief season, had emerged from the humbler walks of life,. Psychological biases lead to a massive upswing in the price of an asset or sector. Tulip mania is widely regarded as the first economic bubble, when the value of tulips rocketed up, then almost overnight came crashing down. Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time. The rarest tulip bulbs traded for as much as six times the average. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to.. “many who, for a brief season, had emerged from the humbler walks of life,. Investors lose track of rational expectations. A speculative market for the tulips grew and many dutchmen became tulip. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels. Web the. All that combined for just one, yes one, tulip bulb. By examining the tulip mania, historians and economists gain insights into the. Psychological biases lead to a massive upswing in the price of an asset or sector. As the ascent of the chart began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item. Tulip mania is widely regarded as the first economic bubble, when the value of tulips rocketed up, then almost overnight came crashing down. Web what was the dutch tulip bulb market bubble? A speculative market for the tulips grew and many dutchmen became tulip. Web two tons of butter. All that combined for just one, yes one, tulip bulb. Investors realize that they are holding an irrationally priced asset. Web tulip mania is often cited as the classic example of a financial bubble: Web this week's #tulipfact: All that combined for just one, yes one, tulip bulb. Web published march 18, 2020. Web by the height of the tulip and bulb craze in 1637, everyone had gotten involved in the trade, rich and poor, aristocrats and plebes, even children had joined the party. Tulips were introduced into europe from turkey shortly after 1550, and the delicately formed, vividly colored flowers became a popular if costly item. Web tulip mania is often cited. The major acceleration started in 1634 and then dramatically collapsed in february 1637. As the ascent of the chart began, the tulip, a simple flower, was transformed in the 17th century into a coveted luxury item and a status symbol. Let us know and we'll get back to you. Investors lose track of rational expectations. Tulip mania is widely regarded. Web by the height of the tulip and bulb craze in 1637, everyone had gotten involved in the trade, rich and poor, aristocrats and plebes, even children had joined the party. All that combined for just one, yes one, tulip bulb. This data visualization presents the phenomenon in modern financial terms. Tulip mania is widely regarded as the first economic. Web published march 18, 2020. Much of the trading was being done in bar rooms where alcohol was obviously involved. Web like many flowers, they can come in a variety of different colours: Web tulip mania is a model for the general cycle of asset bubbles: By examining the tulip mania, historians and economists gain insights into the. With gains such as these, it is not hard to understand the mad rush to buy tulip bulbs at any cost. Got a question or need something specific? When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. Investors lose track of rational expectations. As the ascent. When the price of something goes up and up, not because of its intrinsic value, but because people who buy it expect to. All that combined for just one, yes one, tulip bulb. Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time. In the 17th century, history’s first speculative bubble popped. By examining the tulip mania, historians and economists gain insights into the. Back then, apparently they were. The dutch came in contact with a brand new flower called the tulip. “many who, for a brief season, had emerged from the humbler walks of life,. Web this chart shows a comparison of price developments during the tulip mania in 1637 and the current bitcoin bonanza of 2017. The rarest tulip bulbs traded for as much as six times the average. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. Web the term tulip mania is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values. Much of the trading was being done in bar rooms where alcohol was obviously involved. Web this week's #tulipfact: With gains such as these, it is not hard to understand the mad rush to buy tulip bulbs at any cost. Web tulip mania is often cited as the classic example of a financial bubble:

The History of Tulip Bulb Mania

Tulipomania by Timeothy333 on DeviantArt

18+ Amazing Tulip Mania Facts You Will Need in School

Is TSLA A 1,000 Stock Or A Tulip Mania Bubble? Robert McCarty

Price Of Tulips During Tulip Mania?N Amsterdam Tulip Museum

PPT The Dutch Tulip Mania PowerPoint Presentation, free download ID

Current Litecoin Price Is Cryptocurrency Tulip Mania ArcoDive kursy

Tulipomania Poster Wall Street 2 Poster wall, Wall street, Wall painting

Entry 1 by BayroutteSdmf for I need some Graphic Design Tulipmania

Tulip Mania! Focus Planning Group

The Causes Of Tulip Mania Have Perhaps Been Distorted Over The Centuries, With Many Assuming It Was One Of The First Examples Of A Market Bubble Bursting.

As The Ascent Of The Chart Began, The Tulip, A Simple Flower, Was Transformed In The 17Th Century Into A Coveted Luxury Item And A Status Symbol.

Let Us Know And We'll Get Back To You.

Investors Lose Track Of Rational Expectations.

Related Post: