Tulip Crash Chart

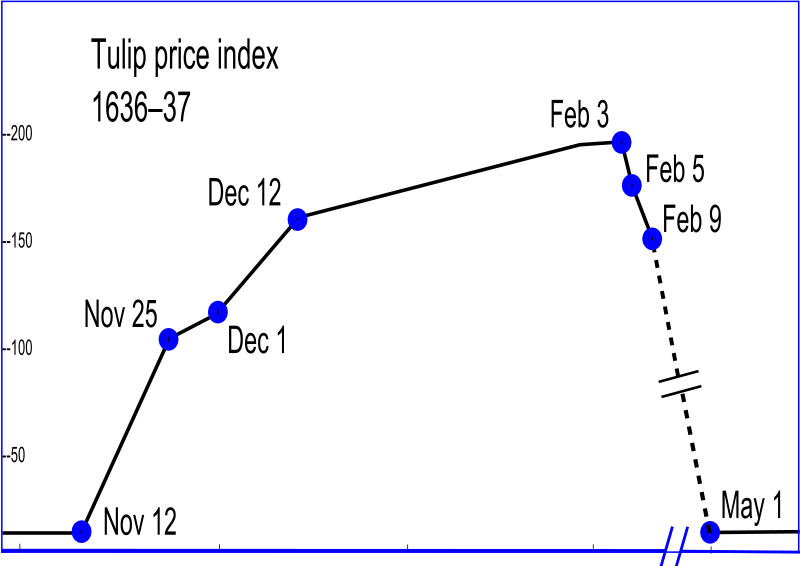

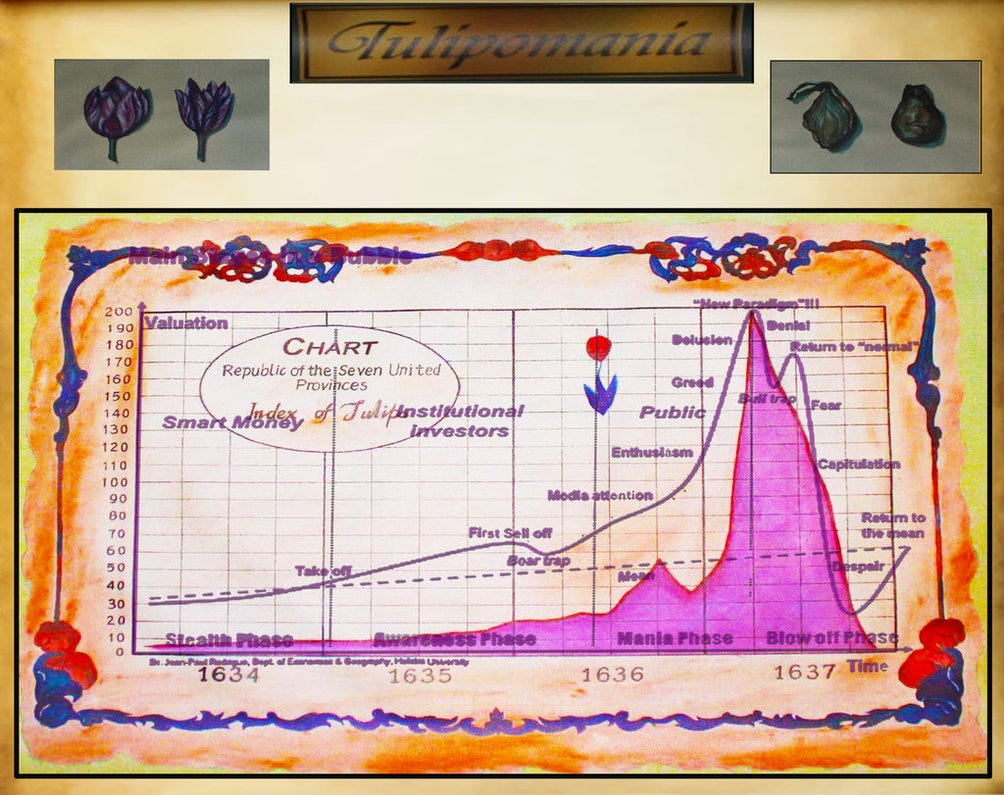

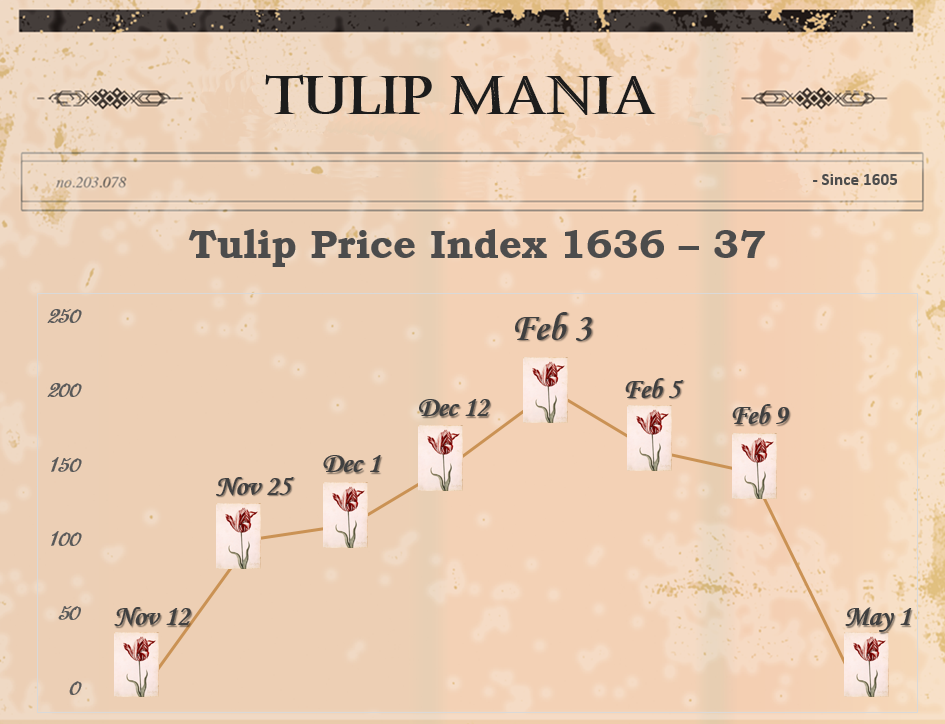

Tulip Crash Chart - Web from 1634 to 1637, an index of dutch tulip prices (see chart above). February 12, 2018 1:14am est. Tulip mania is often cited as the classic example of a financial bubble: Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached. Web the flowers that cost more than houses. Web the crash came early in 1637, when doubts arose as to whether prices would continue to increase. Our reframing of tulipmania provides a. Web tulip mania was a period during the 17 th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. Web within a few days, dutch tulip prices had fallen tenfold. Web this small, free exhibition charts the course over two centuries of the genre of dutch flower painting, which brueghel originated. Web on february 5, 1637, the flower market in the netherlands came crashing down, and the quick fortunes made by so many dutch citizens were lost forever. The dutch tulip bulb market bubble, known as tulipmania, emerged in the 17th century as a remarkable case of speculative frenzy. Tulpenmanie) was a period during the dutch golden age when contract prices. And tulips figure prominently in many of the 22. To start, the coin debasement crisis of the 1620s was followed by a period. Web the tulip bubble chart visually represents these stages, from the initial boom fueled by widespread participation to the inevitable panic that led to a crash. February 12, 2018 1:14am est. Tulpenmanie) was a period during the. It was the equivalent of more than 30. Web within a few days, dutch tulip prices had fallen tenfold. Web by the height of the tulip and bulb craze in 1637, everyone had gotten involved in the trade, rich and poor, aristocrats and plebes, even children had joined the party. But months later, the bubble. The event was designed to. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached. Web on february 5, 1637, the flower market in the netherlands came crashing down, and the quick fortunes made by so many dutch citizens were lost forever. February 12, 2018 1:14am est. It occurred in holland during. When the price of something goes up and up, not. As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time. Web the crash came. Web the crash came early in 1637, when doubts arose as to whether prices would continue to increase. When the price of something goes up and up, not. A number of factors contributed to the conditions that caused tulip mania. Like all bubbles, the dutch tulip bulb bubble continued to inflate beyond people’s wildest. Web from 1634 to 1637, an. When the price of something goes up and up, not. Like all bubbles, the dutch tulip bulb bubble continued to inflate beyond people’s wildest. The causes of tulip mania have. Almost overnight the price structure for tulips collapsed, sweeping away. Web within a few days, dutch tulip prices had fallen tenfold. February 12, 2018 1:14am est. Tulip mania is often cited as the classic example of a financial bubble: As tulip prices shot up by 1,000 percent in the 1630s, dutch investors scrambled to buy up bulbs still in the ground. Web according to history, tulip mania became common knowledge in 1841 when writer charles mackay published his book memoirs of. Web the crash came early in 1637, when doubts arose as to whether prices would continue to increase. Tulip mania is often cited as the classic example of a financial bubble: Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time. The causes of tulip mania. Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time. Almost overnight the price structure for tulips collapsed, sweeping away. A number of factors contributed to the conditions that caused tulip mania. Web from 1634 to 1637, an index of dutch tulip prices (see chart above).. Web updated march 22, 2020. A number of factors contributed to the conditions that caused tulip mania. Tulpenmanie) was a period during the dutch golden age when contract prices for some bulbs of the recently introduced and fashionable tulip reached. Web the climax of tulipmania was a legendary auction that took place in the town of alkmaar on feb. Web from 1634 to 1637, an index of dutch tulip prices (see chart above). Web according to history, tulip mania became common knowledge in 1841 when writer charles mackay published his book memoirs of extraordinary popular delusions and the. It was the equivalent of more than 30. Almost overnight the price structure for tulips collapsed, sweeping away. Web tulip mania was a period during the 17 th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. February 12, 2018 1:14am est. Web the plague and tulip mania. Web on february 5, 1637, the flower market in the netherlands came crashing down, and the quick fortunes made by so many dutch citizens were lost forever. It occurred in holland during the early to mid. Web within a few days, dutch tulip prices had fallen tenfold. Like all bubbles, the dutch tulip bulb bubble continued to inflate beyond people’s wildest. Web the dutch tulip bulb market bubble, also known as tulipmania, was one of the most famous market bubbles and crashes of all time.

Et krach, la tulipe histoire de la première bulle spéculative

Diario economico La crisis de los tulipanes

Tulip Price Index Tulip Mania 1630s Chart Data Visualization

Bitcoin chart vs Tulip mania chart vs Gold vs Beanie Baby craze vs

1637 Dutch Tulip Fever! Chart of peak prices versus chart of crash

Price Of Tulips During Tulip Mania?N Amsterdam Tulip Museum

The Index of Tulip Market during Tulip Bubble [10] Download

Inflation and Bubbles and Tulips Crash Course Economics 7 YouTube

Tulip Mania Beach Sheet for Sale by A Prints

MY MPCA Stock Market Crash Indicator

Tulip Mania Is Often Cited As The Classic Example Of A Financial Bubble:

Web The Dutch Tulip Bulb Market Bubble (Or Tulip Mania) Was A Period In The Dutch Golden Age During Which Contract Prices For Some Of The Tulip Bulbs Reached Extraordinarily High.

As Tulip Prices Shot Up By 1,000 Percent In The 1630S, Dutch Investors Scrambled To Buy Up Bulbs Still In The Ground.

The Event Was Designed To Raise Money For Children Recently Orphaned.

Related Post: