Visa Taxation Chart

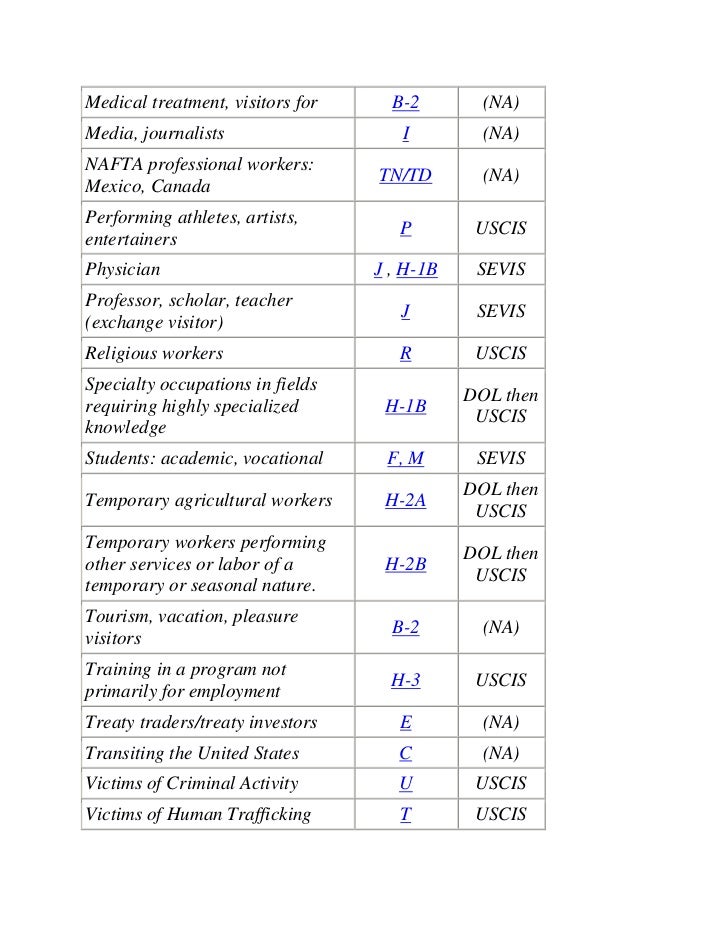

Visa Taxation Chart - This chart provides a summary of each. If you would like to learn more about the various visa categories, please use the resources list below. Tax benefits vary among types of u.s. Web visa annual income taxes for 2021 were $3.752b, a 28.32% increase from 2020. 1 yoy increase / (decrease) net revenues client incentives as a % of gross revenues operating. Web may 11, 2022, 1:06 am utc. Based on information contained in the code of. Tax purpose, a nonimmigrant or immigrant visa status under u.s. Web resident or nonresident alien decision chart. Tax residency status under u.s. Tax residency status under u.s. Web resident or nonresident alien decision chart. Compare v with other stocks. See the taxation of nonresident aliens page on the. Determine residency status for federal income tax purposes. Web resident or nonresident alien decision chart. Since 2018, us citizens and us domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million,. Includes prospective students with established intention to. Web the chart lists almost all nonimmigrant visa categories, with the exception of several not listed above.. Tax benefits vary among types of u.s. Since 2018, us citizens and us domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million,. If you would like to learn more about the various visa categories, please use the resources list below. Web we produce a range of. 1 yoy increase / (decrease) net revenues client incentives as a % of gross revenues operating. Compare v with other stocks. See the taxation of nonresident aliens page on the. Web 24 rows review tax information for aliens by visa type and immigration status. Web the chart lists almost all nonimmigrant visa categories, with the exception of several not listed. If you would like to learn more about the various visa categories, please use the resources list below. Web government chart of all visa types. Based on information contained in the code of. Tax purpose, a nonimmigrant or immigrant visa status under u.s. Noncitizens employed in the united states may have a u.s. Visa annual/quarterly income taxes history and growth rate from. Immigration law is different from u.s. Such income may be subject to taxation either on the basis of the graduated. Since 2018, us citizens and us domiciliaries have been subject to estate and gift taxation at a maximum tax rate of 40% with an exemption amount of $10 million,. Determine residency. Noncitizens employed in the united states may have a u.s. Includes prospective students with established intention to. Web if you are one of these individuals, it is essential to understand the us tax system and how it applies to different visa holders. Web we produce a range of tax tables to help you work out how much to withhold from. See the taxation of nonresident aliens page on the. Based on information contained in the code of. Immigration law is different from u.s. Such income may be subject to taxation either on the basis of the graduated. Us taxation can be complex, and your visa type can. Compare v with other stocks. Noncitizens employed in the united states may have a u.s. Web to view the reciprocity page for your country* of nationality, select your country*/area of authority from the list of countries on the left side menu. Immigration law is different from u.s. On the reciprocity page, select. Determine residency status for federal income tax purposes. Web the chart lists almost all nonimmigrant visa categories, with the exception of several not listed above. Web nonresident aliens are taxed only on income received from sources within the united states. Compare v with other stocks. Web general nonresident alien tax withholding and reporting schedules | business & financial services. Tax benefits vary among types of u.s. 1 yoy increase / (decrease) net revenues client incentives as a % of gross revenues operating. Web resident or nonresident alien decision chart. Web 24 rows review tax information for aliens by visa type and immigration status. Determine residency status for federal income tax purposes. Compare v with other stocks. Based on information contained in the code of. Web to view the reciprocity page for your country* of nationality, select your country*/area of authority from the list of countries on the left side menu. Web fiscal third quarter 2022 financial results ©2022 visa. Web government chart of all visa types. Web nonresident aliens are taxed only on income received from sources within the united states. Web may 11, 2022, 1:06 am utc. See the taxation of nonresident aliens page on the. This chart provides a summary of each. Web the visa classifications chart is a reference guide to the visa classifications issued by the immigration and naturalization service (ins). Web general nonresident alien tax withholding and reporting schedules | business & financial services.

What Are The Different Types Of Us Visas Visa Guides vrogue.co

Federal withholding calculator 2020 FloraidhJai

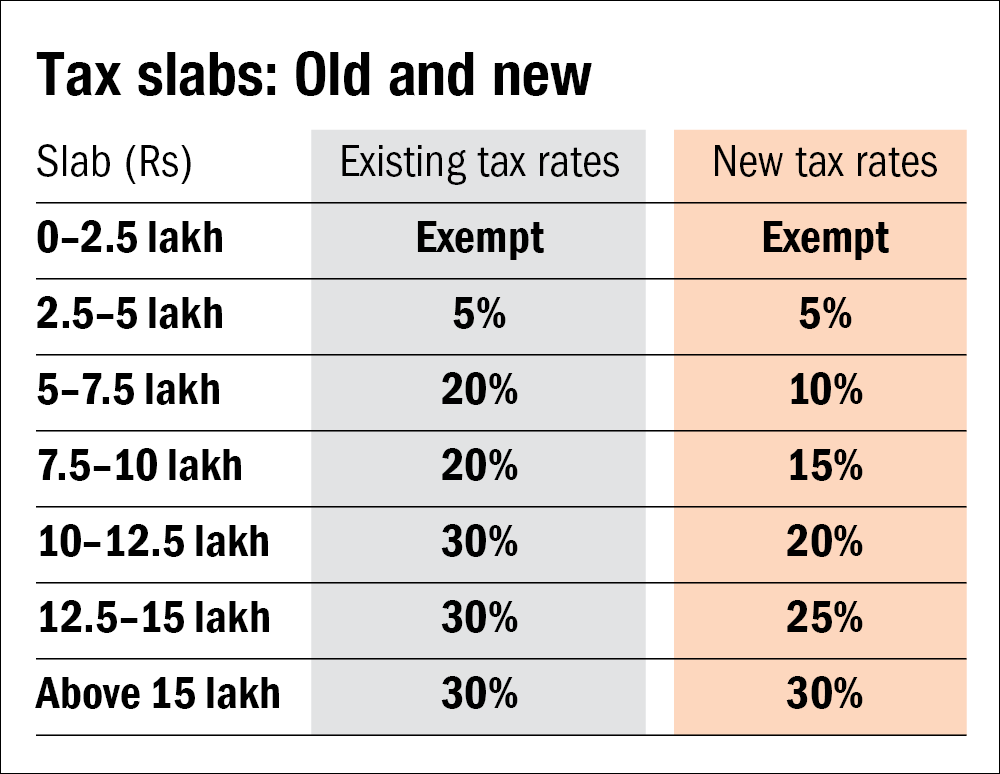

New Tax Regime Slab Rate For Ay 202425 Uefa Taryn Francyne

Living away from the tax man MacroBusiness

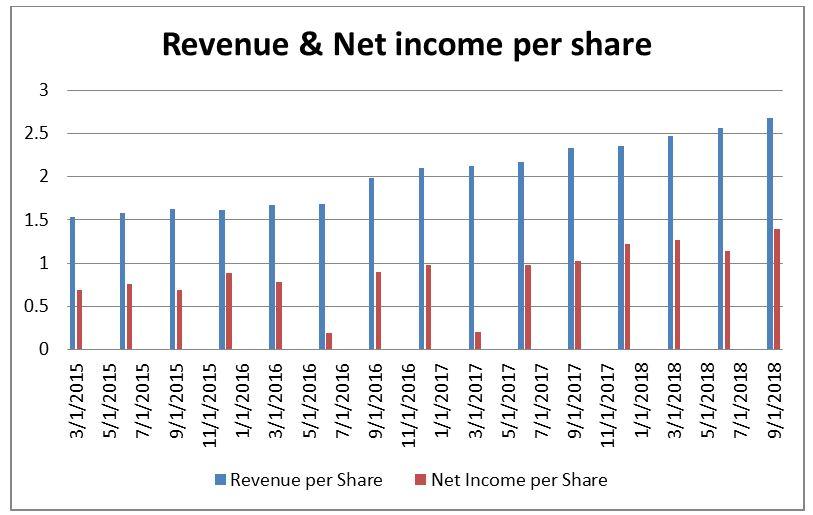

It Looks Prudent To Hold Visa Visa Inc. (NYSEV) Seeking Alpha

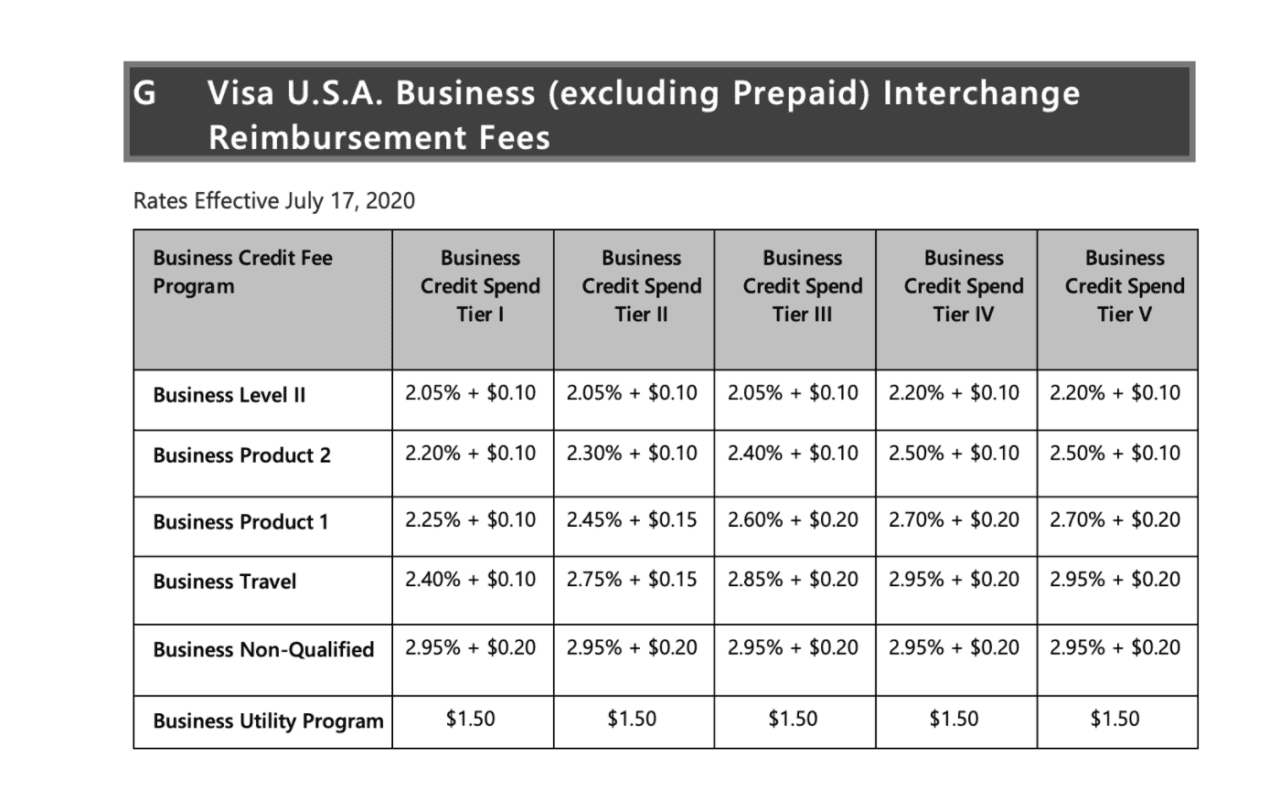

Visa Interchange Rates Increased July 2020 Merchant Cost Consulting

How “Digital Nomad” Visas Can Boost Local Economies

General Guide To Australian Permanent Resident Visa Through Skilled

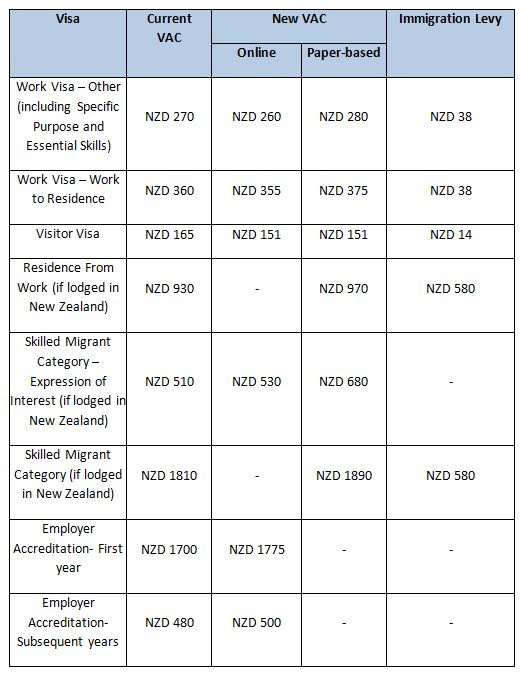

Visa Application Fees to Increase and Immigration Tax to be Introduced

US Visa Types Chart

Web We Produce A Range Of Tax Tables To Help You Work Out How Much To Withhold From Payments You Make To Your Employees Or Other Payees.

University Of California Payroll Coordination And Tax Services Visa Classifications Chart1.

Visa Annual/Quarterly Income Taxes History And Growth Rate From.

Tax Purpose, A Nonimmigrant Or Immigrant Visa Status Under U.s.

Related Post: