Wage Chart On Form Njw4

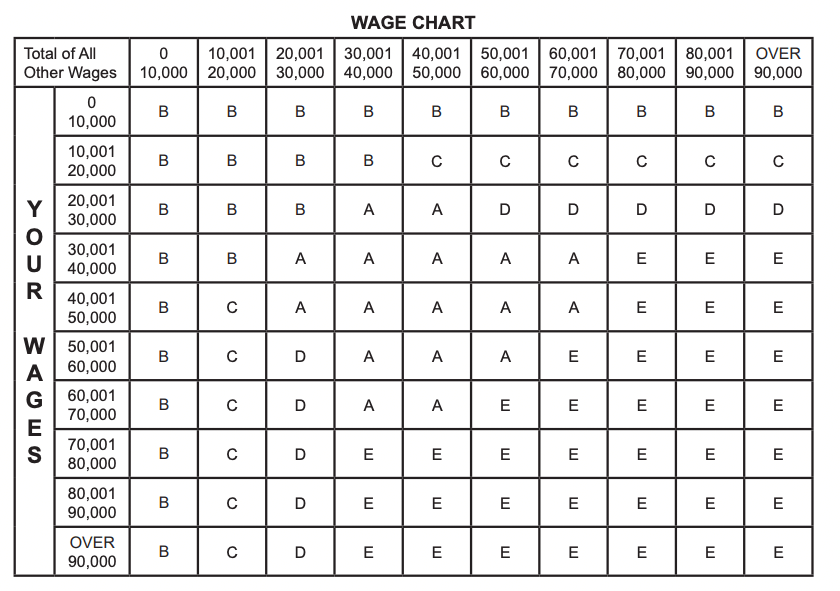

Wage Chart On Form Njw4 - Ex, marginal tax rate 10%. Web federal w4 changed so allowances are no longer a thing. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Under penalties of perjury, i certify that i am entitled to the number of withholding. If you employ new jersey residents working in new jersey, you must. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Annual payroll period (allowance $1,000) if the amount of taxable wages is: (see the rate tables on the reverse side to estimate your withholding. (see the rate tables on the reverse side to estimate your withholding. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Under penalties of perjury, i certify that i am entitled to the number of withholding. Web federal w4 changed so allowances are no longer a thing. If you have met. (see the rate tables on the reverse side to estimate your withholding. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. How to use the chart. Use the tax bracket calculator to find out what percent should be withheld to zero out. Its purpose is to determine the withholding rates you. Find the amount of the total for all other wages (including. How to use the chart. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. If you employ new jersey residents working in new jersey, you must. Use. This chart is designed to increase withholdings on your wages, if these wages will be taxed at a higher rate due to inclusion of other wages or income. Web federal w4 changed so allowances are no longer a thing. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater. Web federal w4 changed so allowances are no longer a thing. Find the amount of the total for all other wages (including. (see the rate tables on the reverse side to estimate your withholding. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Annual payroll period (allowance $1,000) if the amount. Web divide the annual new jersey tax withholding by 26 to obtain the biweekly new jersey tax withholding. (see the rate tables on the reverse side to estimate your withholding. Under penalties of perjury, i certify that i am entitled to the number of withholding. If you have met the conditions, enter exempt here. This chart is designed to increase. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. Find the amount of the total for all other wages (including. How to use the chart. (see the rate tables on the reverse side to estimate your withholding. If you employ new jersey residents working in new jersey, you must. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. How to use the chart. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works two jobs.. If you have met the conditions, enter exempt here. Web divide the annual new jersey tax withholding by 26 to obtain the biweekly new jersey tax withholding. How to use the chart. Find the amount of the total for all other wages (including. Its purpose is to determine the withholding rates you are subjected to, particularly if your household works. Find the amount of the total for all other wages (including. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,. If you employ new jersey residents working in new jersey, you. Ex, marginal tax rate 10%. Under penalties of perjury, i certify that i am entitled to the number of withholding. Find the amount of the total for all other wages (including. Web all wages and employee compensation paid to a resident working in new jersey is subject to withholding. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Web divide the annual new jersey tax withholding by 26 to obtain the biweekly new jersey tax withholding. Use the tax bracket calculator to find out what percent should be withheld to zero out. $ 384 $ 673 $ 769 $. Web federal w4 changed so allowances are no longer a thing. Web if you have indicated filing status #2, 4 or 5 on the above njw4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. $ 0 $ 384 $ 673 $ 769 $ 1,442 $ 9,615. (see the rate tables on the reverse side to estimate your withholding. Web w4 and your taxable income is greater than $50,000, you should strongly consider using the wage chart. Annual payroll period (allowance $1,000) if the amount of taxable wages is: If you have met the conditions, enter exempt here. Claim for refund of estimated gross income tax payment required on the sale of real property located in new jersey,.

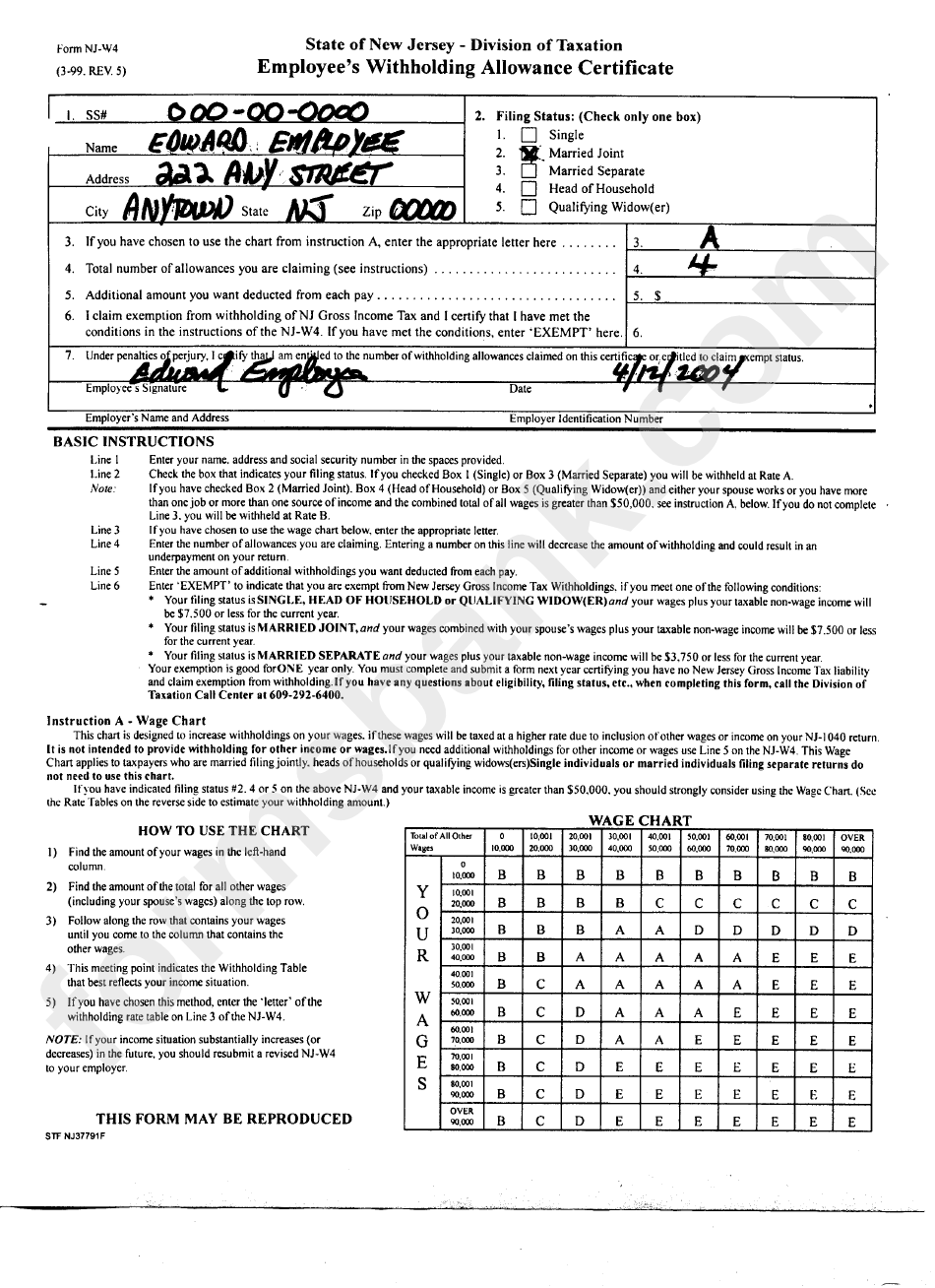

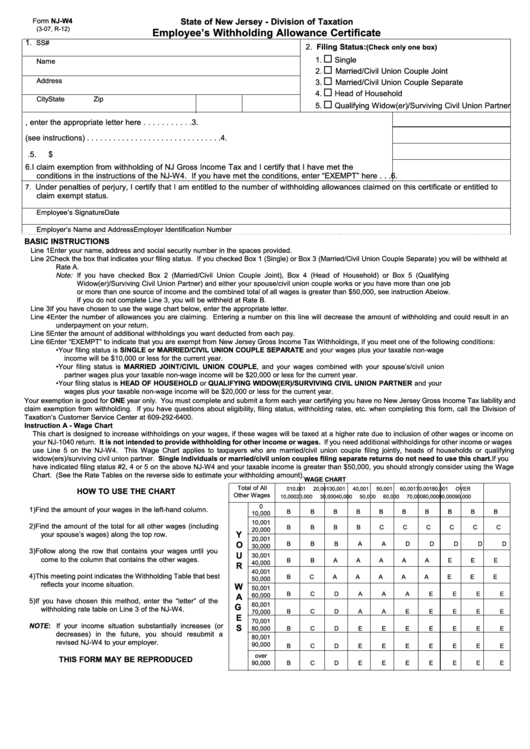

Form NjW4 Example Employee'S Withholding Allowance Certificate New

Fill Free fillable Njw4 Form NJ W4 WT 07 PDF form

Wage Chart On Form Njw4

Nj w4 Fill out & sign online DocHub

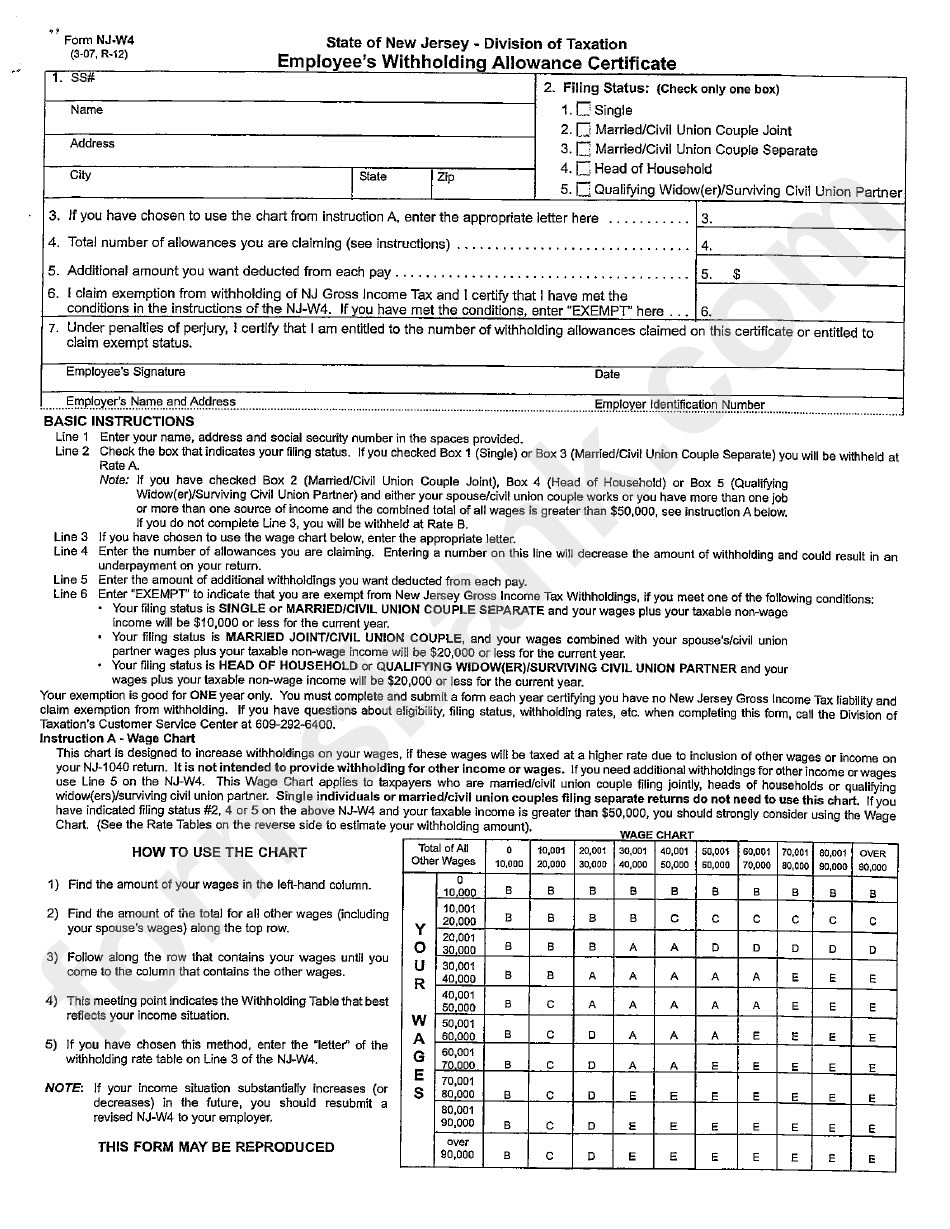

Form NjW4 Employee'S Withholding Allowance Certificate printable pdf

How to Fill Out New Jersey Withholding Form NJW4 in 2023 + FAQs

New Jersey W4 2024 Roze Wenona

Fillable Form NjW4 Employee'S Withholding Allowance Certificate

How Do I Fill out Form W4? StepbyStep Guide to Calculating Your

Employee's Withholding Allowance Certificate New Jersey Free Download

How To Use The Chart.

(See The Rate Tables On The Reverse Side To Estimate Your Withholding.

This Chart Is Designed To Increase Withholdings On Your Wages, If These Wages Will Be Taxed At A Higher Rate Due To Inclusion Of Other Wages Or Income.

If You Employ New Jersey Residents Working In New Jersey, You Must.

Related Post: