Delta Footprint Chart

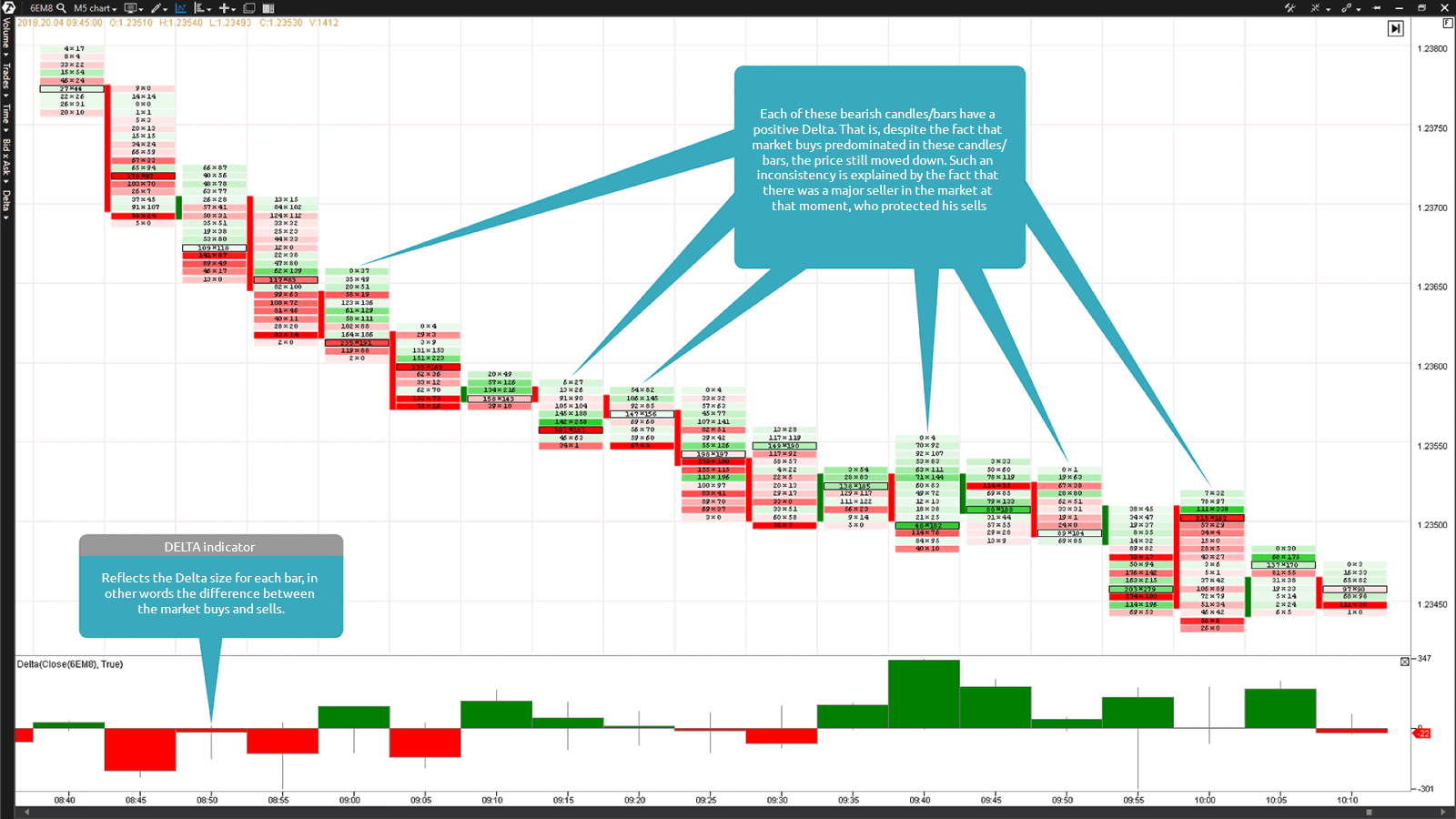

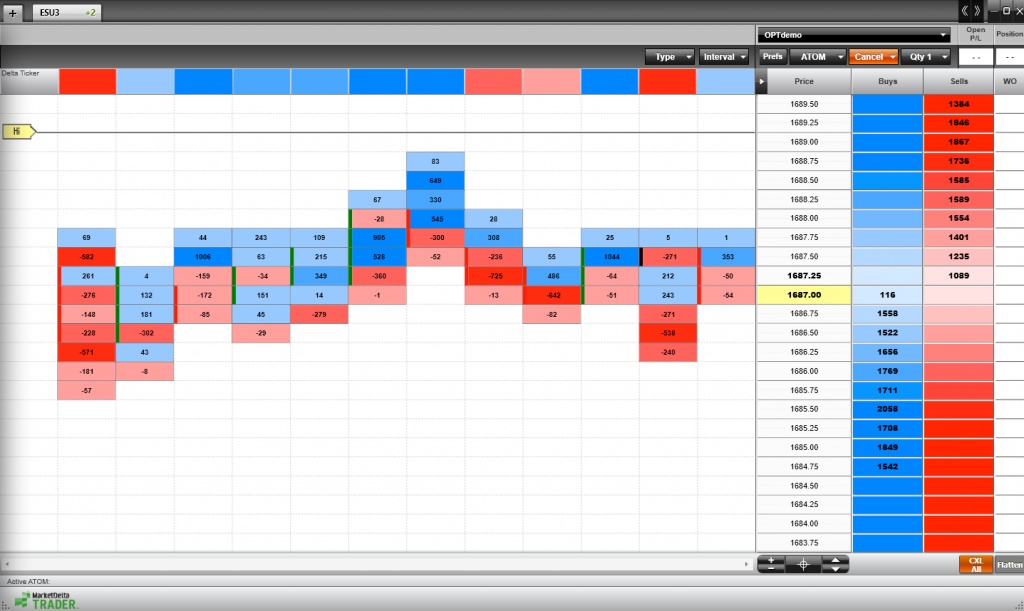

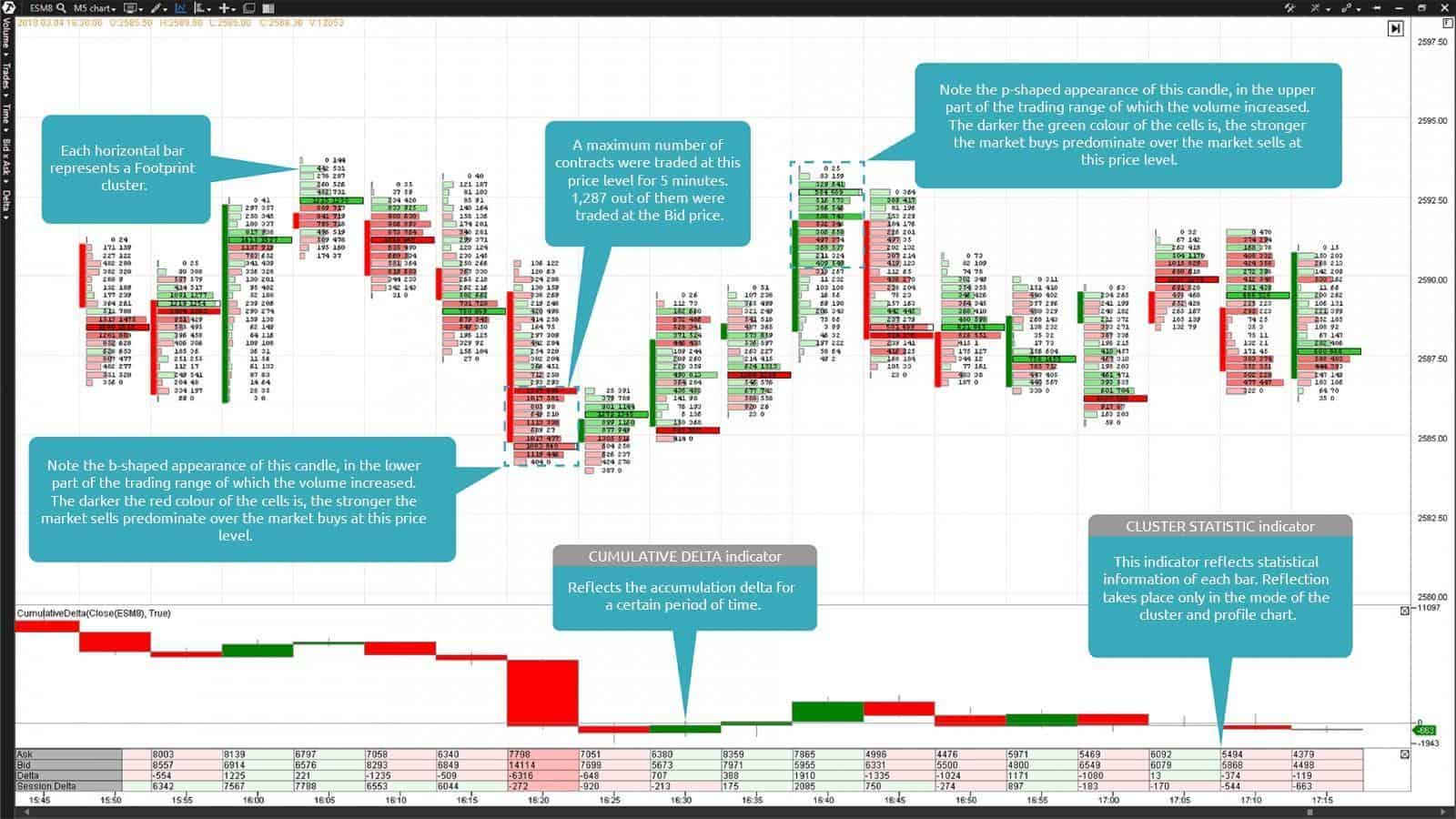

Delta Footprint Chart - Displays the net difference at each price between volume initiated by buyers and volume initiated by sellers. The delta is calculated as follows: The delta footprint displays positive or negative values. Web these patterns suggest a potential reversal in the current trend. Single, multiple, stacked, reverse, inverse, overzized, big consecutive and more. Volume delta is the difference between buying and selling pressure. Traders will see the delta data at every price level in such clusters. And, (3) delta volume footprint: Use this guide to learn more about the various ways to use the footprint® chart, market profile® and other tools included in marketdelta®. Web volume footprint is a powerful charting tool that visualizes the distribution of trading volume across several price levels for each candle on a specified timeframe, providing traders with additional information to help identify areas of. The delta footprint helps traders confirm that a price trend has. Web the tool has 3 modes, which display different volume data for the traded prices of each bar: A negative delta indicates aggressive selling and a larger number of sales at the bid. Rather than displaying market sells and market buys within each candlestick, the delta of the two. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: Web footprint charts provides information about traded contracts in high detail. Web the tool has 3 modes, which display different volume data for the traded prices of each bar: The #footprint indicator allows us to see accumulation and distribution of market volumes. We. The delta is calculated as follows: Volume delta measure the difference between buying and selling power. The result is more precise trade execution and a better understanding of where you should be trading. A footprint cell with a positive delta is coloured green and characterises a positive order flow, in the result of which buyers were more aggressive at a. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. The delta is calculated as follows: Web marketdelta® offers unique tools and analytics to empower the trader to see more, do more, and make more. All 4 of tradinglite's footprint styles, offer the ability to toggle ' delta mode '. They. Footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. The delta footprint helps traders confirm that a price trend has. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: This script can be used by any user.. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. The delta is calculated as follows: The #footprint indicator allows us to see accumulation and distribution of market volumes. Delta profile and the delta footprint. The delta footprint displays positive or negative values. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: Rather than displaying market sells and market buys within each candlestick, the delta of the two is instead displayed. Single, multiple, stacked, reverse, inverse, overzized, big consecutive and more. Web these patterns suggest a potential reversal in the current trend. Displays the net. We would also like to introduce you to our second forex tool. Volume delta measure the difference between buying and selling power. The delta is calculated as follows: The #footprint indicator allows us to see accumulation and distribution of market volumes. The footprint chart provides increased market transparency for active traders and delivers a discrete advantage over other charting methods. Rather than displaying market sells and market buys within each candlestick, the delta of the two is instead displayed. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. Single, multiple, stacked, reverse, inverse, overzized, big consecutive and more. Commonly the footprint term is used with the term order flow. Web. Web this article serves as an introduction to two ways of interpreting delta when daytrading futures instrukments: Footprint is a type of the chart where you can see sum of the traded volumes at a specified price for a certaing period. Web delta footprint charts are a great way to see absorption taking place in the order flow. Web data,. The delta footprint helps traders confirm that a price trend has. If the delta is positive, it’s a sign of more aggressive behavior by buyers, who purchased at the ask. Web volume footprint is a powerful charting tool that visualizes the distribution of trading volume across several price levels for each candle on a specified timeframe, providing traders with additional information to help identify areas of. A negative delta indicates aggressive selling and a larger number of sales at the bid. And if a buyer initiates a buy. Delta profile and the delta footprint. All 4 of tradinglite's footprint styles, offer the ability to toggle ' delta mode '. If an order is traded on the bid, it means a seller initiated the sale by “hitting the bid”. Web delta footprint charts are a great way to see absorption taking place in the order flow. Web the footprint chart reflects the positive and negative delta values inside each candle as it can be seen in chart 1. We would also like to introduce you to our second forex tool. This analysis is similar to how volume profile evaluates volume data from a portion of the chart. The delta footprint displays positive or negative values. Use this guide to learn more about the various ways to use the footprint® chart, market profile® and other tools included in marketdelta®. Web footprint charts provides information about traded contracts in high detail. Our footprint indicator has all the features orderflow traders need.

Delta and Cumulative Delta how could they help a day trader?

Webinar 2 Why Some Traders That Use The Market Delta Footprint Chart

FootPrint® Charting Introduction Market Delta Optimus Futures

Footprint Charts The Complete Trading Guide

Absorption of demand and supply in the footprint chart

Strategy of using the footprint through the example of a currency futures

The Ultimate Guide To Profiting From Footprint Charts

How to View Cumulative Delta on a Footprint Chart YouTube

Stock Market Analysis Delta Footprint Charts

Footprint charts in XTick software

Commonly The Footprint Term Is Used With The Term Order Flow.

Web The Tool Has 3 Modes, Which Display Different Volume Data For The Traded Prices Of Each Bar:

Single, Multiple, Stacked, Reverse, Inverse, Overzized, Big Consecutive And More.

The Result Is More Precise Trade Execution And A Better Understanding Of Where You Should Be Trading.

Related Post: