Triangle Pattern Chart

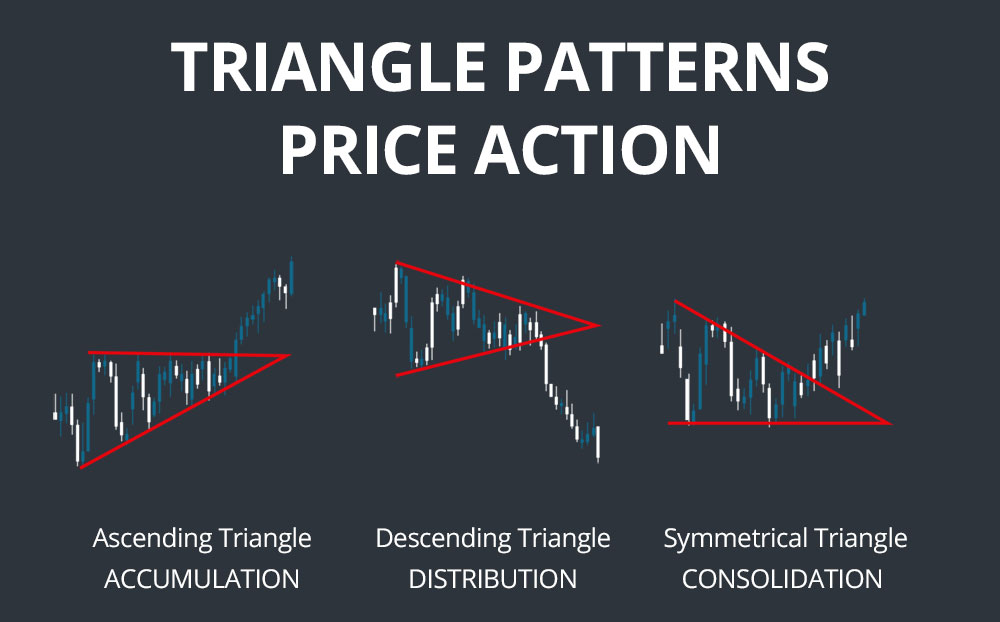

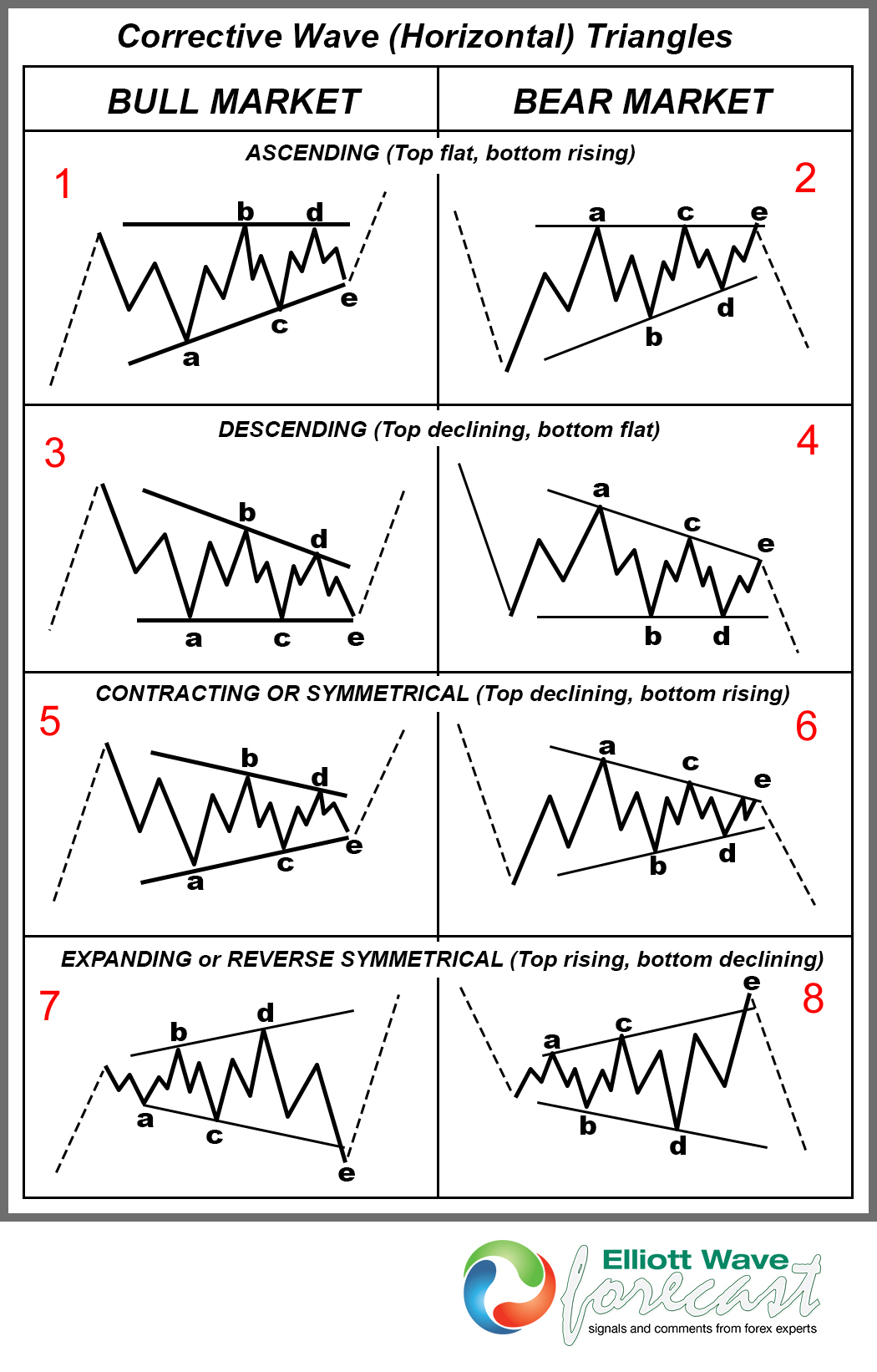

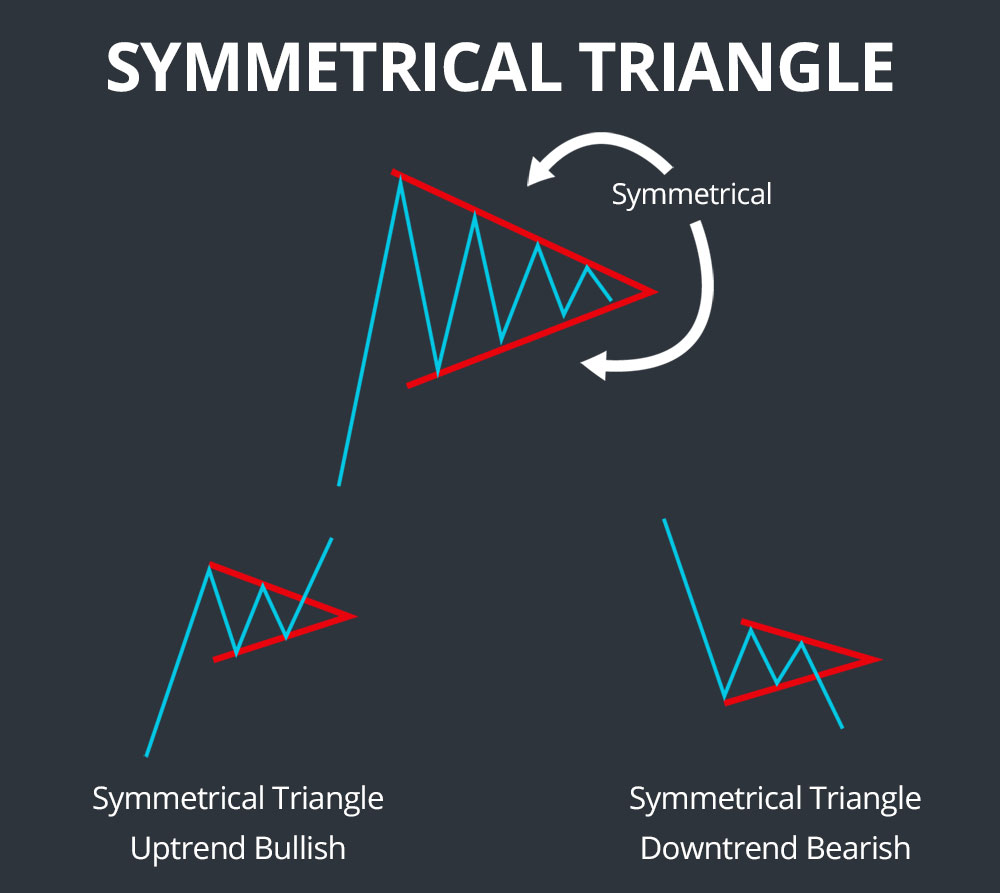

Triangle Pattern Chart - Web hello friends, stoked to finally start the tech analysis course! Web the following diagram shows the three basic types of triangle chart patterns: These chart patterns can indicate a trend reversal or signal the continuation of a bearish or bullish market. Web what are triangle chart patterns? This narrowing range is a visual representation of a battle between bulls and bears in the market. Triangles are similar to wedges and pennants and can be either a continuation pattern,. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a. Triangle chart patterns are usually identified by traders when a financial instrument’s trading range narrows after a downtrend or an uptrend. Web triangle chart pattern in technical analysis indicates the formation of a sideways market. We go into more detail about what they are and how. This narrowing range is a visual representation of a battle between bulls and bears in the market. Web triangles within technical analysis are chart patterns commonly found in the price charts of financially traded assets ( stocks, bonds, futures, etc.). Binance coin price is squeezed between the trendlines of an ascending triangle pattern. Triangle chart patterns, also known as bilateral. The various triangle chart patterns are popular technical analysis indicators used by traders of all types of assets and derivatives. Web what are triangle chart patterns? This provides clues on the likely breakout direction. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and. Spotting chart patterns is a popular activity amongst traders of all skill levels, and one of the easiest patterns to spot is. Web today, we'll explore all known triangle shapes: You need the premium tier to use all the features that i’m using. Determine if it’s a bullish triangle or a bearish triangle pattern. The pattern derives its name from. Web a symmetrical triangle also known as a coil is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Technical analysts and chartists seek to identify patterns to. Rising triangle chart pattern signal bullish continuations while a falling triangle is a bearish continuation pattern. We go into more detail about what they. This narrowing range is a visual representation of a battle between bulls and bears in the market. Symmetrical, ascending, descending and broadening triangles. Triangle pattern unfolds when the price breaks out from the range and continues in the direction of the prevailing trend. We go into more detail about what they are and how. The various triangle chart patterns are. A market where the buyers and sellers are in balance. If you still don’t have access to it, you can find out how to get grandfathered into the 60% off the premium annual tradingview plan forever here. Web the following diagram shows the three basic types of triangle chart patterns: The stock has recently broken out of an ascending triangle. Technical analysts and chartists seek to identify patterns to. These chart patterns can indicate a trend reversal or signal the continuation of a bearish or bullish market. This provides clues on the likely breakout direction. Updated on january 5, 2022. Web what is triangle chart pattern? This provides clues on the likely breakout direction. Probability of going up for 240 target. Determine if it’s a bullish triangle or a bearish triangle pattern. Web today, we'll explore all known triangle shapes: Triangles are similar to wedges and pennants and can be either a continuation pattern,. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. There are basically 3 types of triangles and they all point to price being in consolidation: Rising. Learn to identify the various triangle patterns that can appear on a chart and how you can use them in trading. Web a descending triangle is a chart pattern used in technical analysis created by drawing one trend line connecting a series of lower highs and a second horizontal trend line connecting a. Similar to wedges and pennants, triangle patterns. Triangles are similar to wedges and pennants and can be either a continuation pattern,. This provides clues on the likely breakout direction. Web triangle patterns are a chart pattern commonly identified by traders when a stock price’s trading range narrows following an uptrend or downtrend. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period. Web triangle chart pattern in technical analysis indicates the formation of a sideways market. The pattern derives its name from the fact that it is characterized by a contraction in price range and converging trend lines, thus giving it a triangular shape. If you still don’t have access to it, you can find out how to get grandfathered into the 60% off the premium annual tradingview plan forever here. Triangle chart patterns are usually identified by traders when a financial instrument’s trading range narrows after a downtrend or an uptrend. Web triangle chart patterns and day trading strategies. The triangle pattern, in its three forms, is one of the common stock patterns. The ascending, descending, and symmetrical triangles. The stock has recently broken out of an ascending triangle pattern on the weekly chart. Similar to wedges and pennants, triangle patterns can either be a continuation pattern or a reversal pattern. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a. Web what is a triangle chart pattern? Web a triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears.

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

In this blog, we will take a look at an example of a bearish

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns3_2-6eb5b82169aa45859c5696835f97244f.png)

Triangles A Short Study in Continuation Patterns

The Triangle Chart Pattern and Price Consolidation Opportunities

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Chart Patterns Complete Guide for Day Traders

Triangle Pattern Characteristics And How To Trade Effectively How To

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

Triangles A Short Study in Continuation Patterns

Web Triangle Chart Patterns Are Continuous Chart Patterns Drawn By Trendlines Depicting The Consolidation Phase And Breakout Giving A Clear Uptrend Or Downtrend Of A Security.

Triangle Chart Patterns, Also Known As Bilateral Chart Patterns, Are Formed When The Price Of A Security Moves Into A Narrower And Narrower Range Over Time.

Unlike Other Chart Patterns, Which Signal A Clear Directionality To The Forthcoming Price Movement, Triangle Patterns Can Anticipate Either A Continuation Of The Previous Trend Or A Reversal.

Web Today, We'll Explore All Known Triangle Shapes:

Related Post: